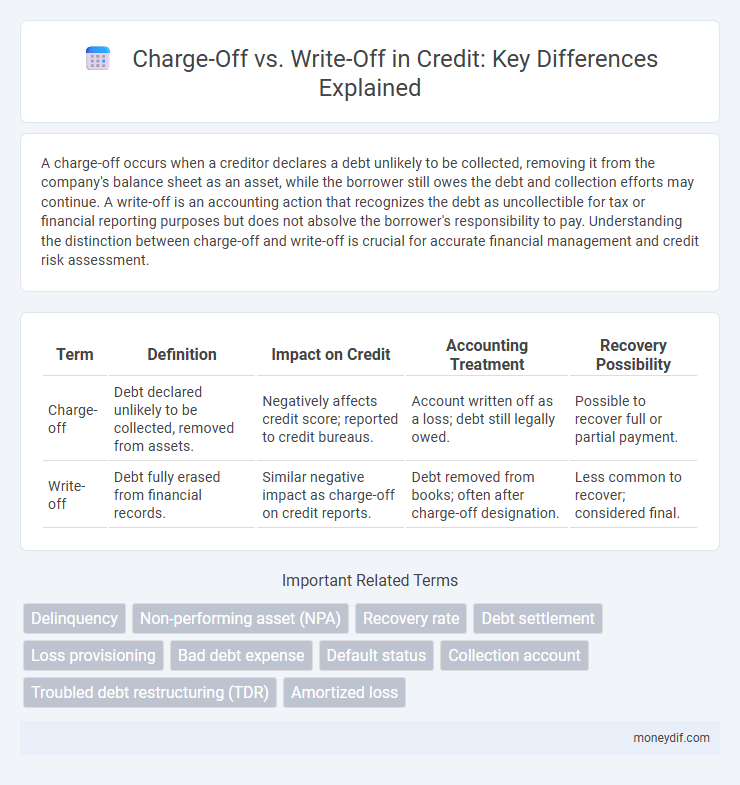

A charge-off occurs when a creditor declares a debt unlikely to be collected, removing it from the company's balance sheet as an asset, while the borrower still owes the debt and collection efforts may continue. A write-off is an accounting action that recognizes the debt as uncollectible for tax or financial reporting purposes but does not absolve the borrower's responsibility to pay. Understanding the distinction between charge-off and write-off is crucial for accurate financial management and credit risk assessment.

Table of Comparison

| Term | Definition | Impact on Credit | Accounting Treatment | Recovery Possibility |

|---|---|---|---|---|

| Charge-off | Debt declared unlikely to be collected, removed from assets. | Negatively affects credit score; reported to credit bureaus. | Account written off as a loss; debt still legally owed. | Possible to recover full or partial payment. |

| Write-off | Debt fully erased from financial records. | Similar negative impact as charge-off on credit reports. | Debt removed from books; often after charge-off designation. | Less common to recover; considered final. |

Understanding Charge-Offs and Write-Offs in Credit

Charge-offs in credit occur when a lender deems an outstanding debt unlikely to be collected, typically after 180 days of non-payment, marking the debt as a serious loss on their financial statements. Write-offs represent the formal accounting action of removing the charged-off debt from the lender's balance sheet, which does not absolve the borrower from repayment obligations. Both charge-offs and write-offs negatively impact a borrower's credit score and remain on credit reports for up to seven years, influencing future creditworthiness.

Key Differences Between Charge-Offs and Write-Offs

Charge-offs and write-offs both represent the acknowledgment of uncollectible debt, but charge-offs specifically refer to the formal declaration by a creditor that a debt is unlikely to be paid, often after 180 days of delinquency. Write-offs occur when the debt is removed from the creditor's balance sheet as an asset, indicating it is no longer considered an active receivable. The key difference lies in the accounting treatment: charge-offs impact the lender's profit and loss statement, while write-offs adjust the balance sheet to reflect loss realization.

How Charge-Offs Impact Your Credit Score

Charge-offs significantly damage your credit score by indicating that a lender has given up on collecting the debt, marking it as a serious delinquency on your credit report. This negative mark remains on your report for up to seven years, lowering your creditworthiness and increasing the difficulty of obtaining new credit. Lenders view charge-offs as a high-risk factor, leading to higher interest rates and less favorable loan terms.

Write-Offs: What They Mean for Borrowers and Lenders

Write-offs represent the formal recognition by lenders that a debt is unlikely to be collected, impacting borrowers by damaging their credit scores and limiting future credit access. For lenders, write-offs allow for tax deductions and the cleaning up of balance sheets, though the loss affects profitability. Understanding the distinction between write-offs and charge-offs is essential, as write-offs often follow charge-offs but specifically denote accounting removal of the debt.

Legal and Financial Implications of Charge-Offs

Charge-offs represent a creditor's declaration that a debt is unlikely to be collected, significantly impacting a borrower's credit score and remaining a adverse record for up to seven years under the FCRA. Legally, a charge-off does not eliminate the borrower's obligation to repay the debt, allowing creditors or collection agencies to pursue legal action for recovery. Financially, charged-off accounts may hinder access to new credit and increase borrowing costs due to decreased creditworthiness.

The Charge-Off Process: Step-by-Step Guide

The charge-off process begins when a creditor classifies a debt as unlikely to be collected after 180 days of delinquency, aligning with regulatory standards. This involves adjusting the account status in credit reports, impacting the debtor's credit score significantly. The write-off is an accounting action following charge-off, where the debt is removed from active receivables, but the obligation for repayment persists legally.

Write-Offs in Accounting: An Overview

Write-offs in accounting occur when a company officially recognizes that an asset, such as a receivable, is uncollectible and removes it from its balance sheet, reflecting a loss. This process helps maintain accurate financial statements by adjusting the asset's book value to zero, aligning with the matching principle in accounting. Write-offs differ from charge-offs in timing and reporting but both ultimately signify the same financial acknowledgment of uncollected debts.

How to Recover from a Charge-Off or Write-Off

Recovering from a charge-off or write-off involves first contacting the creditor to negotiate a payment plan or settlement, which can help rebuild your credit history over time. Prioritize making consistent payments and request a letter confirming the account status to ensure accurate credit reporting. Monitoring your credit reports regularly through agencies like Experian, Equifax, and TransUnion helps track improvements and dispute any inaccuracies.

Common Myths About Charge-Offs and Write-Offs

Charge-offs and write-offs are often misunderstood as identical credit events; however, a charge-off is a creditor's acknowledgment that a debt is unlikely to be collected, while a write-off is an accounting action removing the debt from the company's books. Many believe charge-offs erase debt, but they actually signify the creditor has given up on active collection efforts, and the debt still exists legally. Misconceptions also include thinking write-offs improve credit scores, when in reality, both can severely impact credit reports and future lending opportunities.

Preventing Charge-Offs and Write-Offs: Tips for Better Credit

Maintaining timely payments and monitoring credit reports regularly can significantly reduce the risk of charge-offs and write-offs on your credit account. Setting up automatic payments and creating a realistic budget helps avoid missed payments that lead to negative credit events. Communicating proactively with creditors during financial difficulties can also prevent accounts from being charged off or written off, preserving your credit score.

Important Terms

Delinquency

Delinquency refers to the failure to make timely payments on a debt, often signaling increased credit risk before a charge-off occurs, which is the creditor's formal acknowledgment that the debt is unlikely to be collected. A write-off happens when the charged-off debt is removed from the financial institution's balance sheet, typically after persistent delinquency, to reflect a loss.

Non-performing asset (NPA)

Non-performing assets (NPAs) transition from charge-off status, where the bank recognizes potential losses on delinquent loans, to write-off status, which involves removing the uncollectible loan balance from the bank's books to reflect actual loss.

Recovery rate

The recovery rate measures the percentage of charged-off debt amount successfully collected before it is fully written off as uncollectible.

Debt settlement

Debt settlement involves negotiating with creditors to reduce the total debt amount, often impacting whether a debt is classified as a charge-off or write-off on credit reports.

Loss provisioning

Loss provisioning allocates funds to cover estimated credit losses before charge-offs record actual uncollectible amounts and write-offs remove those debts from accounting records.

Bad debt expense

Bad debt expense represents the estimated uncollectible accounts receivable recognized in financial statements, while charge-off or write-off occurs when specific receivables are formally removed from the accounts after being deemed uncollectible.

Default status

Default status indicates the borrower has failed to meet debt obligations, often leading creditors to categorize the debt as a charge-off for accounting purposes before it may be legally written off.

Collection account

A collection account arises when a charge-off debt, declared uncollectible by the original creditor, is transferred or sold to a third-party agency for recovery, while a write-off represents the creditor's internal accounting action of declaring the debt as a loss without removing the obligation from the borrower.

Troubled debt restructuring (TDR)

Troubled debt restructuring (TDR) involves modifying loan terms due to borrower financial difficulty and may lead to a charge-off when the impaired portion is recognized, whereas a write-off represents the complete removal of the uncollectible loan balance from the lender's books.

Amortized loss

Amortized loss represents the gradual recognition of credit losses over time, bridging the timing difference between charge-offs--immediate removal of uncollectible loans--and write-offs, which finalize the accounting adjustment on defaulted assets.

charge-off vs write-off Infographic

moneydif.com

moneydif.com