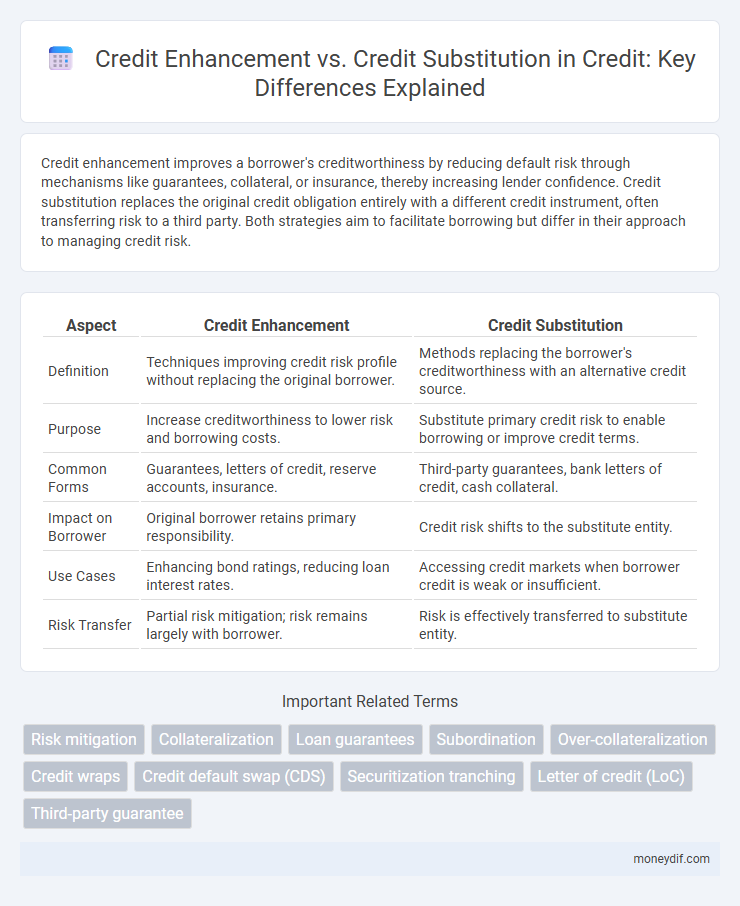

Credit enhancement improves a borrower's creditworthiness by reducing default risk through mechanisms like guarantees, collateral, or insurance, thereby increasing lender confidence. Credit substitution replaces the original credit obligation entirely with a different credit instrument, often transferring risk to a third party. Both strategies aim to facilitate borrowing but differ in their approach to managing credit risk.

Table of Comparison

| Aspect | Credit Enhancement | Credit Substitution |

|---|---|---|

| Definition | Techniques improving credit risk profile without replacing the original borrower. | Methods replacing the borrower's creditworthiness with an alternative credit source. |

| Purpose | Increase creditworthiness to lower risk and borrowing costs. | Substitute primary credit risk to enable borrowing or improve credit terms. |

| Common Forms | Guarantees, letters of credit, reserve accounts, insurance. | Third-party guarantees, bank letters of credit, cash collateral. |

| Impact on Borrower | Original borrower retains primary responsibility. | Credit risk shifts to the substitute entity. |

| Use Cases | Enhancing bond ratings, reducing loan interest rates. | Accessing credit markets when borrower credit is weak or insufficient. |

| Risk Transfer | Partial risk mitigation; risk remains largely with borrower. | Risk is effectively transferred to substitute entity. |

Understanding Credit Enhancement: Key Concepts

Credit enhancement improves creditworthiness by reducing default risk through mechanisms such as guarantees, insurance, or collateral, thereby increasing the likelihood of debt repayment. It differs from credit substitution, which replaces the original credit risk with another party's obligation, transferring the risk rather than mitigating it. Understanding credit enhancement involves recognizing its role in boosting borrower credit profiles and facilitating access to lower-cost financing.

What is Credit Substitution? An Overview

Credit substitution involves replacing the original obligor's credit risk with an alternative credit entity, often through guarantees or insurance, to improve perceived credit quality. Unlike credit enhancement, which strengthens the existing credit structure, credit substitution fundamentally shifts credit responsibility to a third party. This mechanism is commonly used in structured finance and securitization to facilitate better borrowing terms and reduce risk exposure.

Credit Enhancement vs. Credit Substitution: Core Differences

Credit enhancement improves the creditworthiness of a borrower or debt instrument by reducing the risk of default, often through guarantees, insurance, or collateral, thereby boosting investor confidence and lowering borrowing costs. Credit substitution involves replacing the original credit risk with another form of credit risk, such as when a stronger entity assumes the debt obligation, shifting but not necessarily reducing overall risk exposure. The core difference lies in credit enhancement's role in strengthening the existing credit profile, whereas credit substitution changes the responsible party or risk source without inherently increasing the credit quality.

Advantages of Credit Enhancement in Financial Transactions

Credit enhancement improves the creditworthiness of a financial transaction by reducing the risk for investors, resulting in better borrowing terms and lower interest rates. It provides greater confidence to lenders through mechanisms such as guarantees, insurance, or collateral, which directly support the underlying asset without altering its fundamental credit quality. This approach preserves the original credit structure while facilitating access to capital markets, distinguishing it from credit substitution that replaces the credit risk entirely.

Role of Credit Substitution in Risk Management

Credit substitution plays a critical role in risk management by transferring credit risk from one party to another through financial instruments like guarantees or credit derivatives. This process allows lenders to reduce their exposure to borrower default without altering the underlying credit quality of the asset, thereby preserving capital while maintaining credit availability. Compared to credit enhancement, which directly improves the creditworthiness of an obligation, credit substitution focuses on risk redistribution to achieve portfolio diversification and regulatory capital relief.

Impact on Credit Ratings: Enhancement vs. Substitution

Credit enhancement improves credit ratings by reducing the issuer's default risk, often through guarantees, collateral, or insurance, thereby boosting investor confidence and lowering borrowing costs. Credit substitution, while transferring risk to a substitute entity, may not always enhance credit ratings as the substitute's creditworthiness becomes critical, sometimes leading to limited or no rating improvement. Agencies assess credit enhancement more favorably because it directly strengthens the issuer's credit profile, whereas substitution relies heavily on the substitute's financial strength.

Common Techniques of Credit Enhancement

Common techniques of credit enhancement include collateralization, guarantees, and letters of credit, which improve the creditworthiness of a borrower without altering the underlying credit risk. Credit enhancement reduces the risk exposure for lenders by providing additional security or support, whereas credit substitution replaces the original credit obligation with a new credit instrument. Methods such as overcollateralization, third-party guarantees, and cash reserves are frequently used to increase the borrowing capacity and lower the cost of debt financing.

Popular Methods of Credit Substitution

Popular methods of credit substitution include guarantees, letters of credit, and insurance policies that transfer credit risk from the borrower to a third party. These techniques provide lenders with alternative assurance on loan repayment without altering the underlying credit quality of the borrower. Credit substitution mechanisms are widely used in structured finance and project financing to improve the credit profile of debt instruments.

Legal and Regulatory Considerations

Credit enhancement involves improving the credit profile of a financial transaction through legal mechanisms like guarantees or collateral, which comply with regulatory frameworks to reduce lender risk without altering the underlying credit obligations. Credit substitution replaces the original debtor's creditworthiness with another entity's, requiring strict adherence to regulatory guidelines to prevent risk misallocation and ensure transparency in financial reporting. Legal considerations emphasize enforceability of obligations and regulatory compliance, while regulatory bodies often scrutinize credit substitution transactions more rigorously due to potential systemic risk implications.

Choosing Between Credit Enhancement and Credit Substitution: Factors to Consider

Choosing between credit enhancement and credit substitution requires assessing the risk profile, cost implications, and regulatory requirements of the transaction. Credit enhancement improves the creditworthiness of the original obligation without altering the underlying borrower's credit risk, while credit substitution replaces the original debtor with a party of higher credit quality. Evaluating factors such as capital efficiency, impact on balance sheets, and investor perception informs the optimal choice between these two credit risk mitigation strategies.

Important Terms

Risk mitigation

Risk mitigation through credit enhancement involves improving a borrower's credit profile by adding guarantees, insurance, or collateral to reduce lender risk, while credit substitution replaces the borrower's creditworthiness entirely with a third party's credit, such as a bank guarantee or letter of credit, shifting default risk away from the original borrower. Credit enhancement typically supplements the underlying credit risk, whereas credit substitution creates a new credit exposure based on the substitute guarantor's financial strength.

Collateralization

Collateralization improves credit enhancement by providing tangible security to reduce lender risk, whereas credit substitution replaces the borrower's creditworthiness with another entity's guarantee.

Loan guarantees

Loan guarantees serve as a form of credit enhancement by improving the borrower's creditworthiness and reducing lender risk without replacing the underlying debt obligation, whereas credit substitution involves a third party assuming the borrower's repayment responsibility, effectively substituting the original credit risk. This distinction highlights how loan guarantees support financing by reinforcing credit profiles, while credit substitution transfers credit risk entirely to the guarantor.

Subordination

Subordination improves credit enhancement by prioritizing debt repayments to protect senior creditors, unlike credit substitution which involves replacing one credit with another, often transferring risk rather than mitigating it.

Over-collateralization

Over-collateralization enhances credit quality by providing excess collateral beyond the loan value, improving credit enhancement rather than serving as credit substitution.

Credit wraps

Credit wraps provide credit enhancement by improving the credit quality of a financial obligation without substituting the underlying credit risk of the original borrower.

Credit default swap (CDS)

A credit default swap (CDS) serves as credit enhancement by mitigating credit risk without replacing the underlying debt, whereas credit substitution involves using a CDS to replace the borrower's credit with the protection seller's creditworthiness.

Securitization tranching

Securitization tranching enhances credit quality by using credit enhancement techniques such as overcollateralization and reserve accounts to reduce risk, whereas credit substitution replaces the original credit risk with third-party guarantees or insurance.

Letter of credit (LoC)

A Letter of Credit (LoC) functions primarily as credit enhancement by improving the beneficiary's creditworthiness without replacing the underlying obligation, whereas credit substitution involves the LoC replacing the original debtor's credit risk with that of the issuing bank.

Third-party guarantee

Third-party guarantees provide credit enhancement by improving the creditworthiness of a borrower without replacing the original obligation, whereas credit substitution involves replacing the borrower's obligation with that of the guarantor.

credit enhancement vs credit substitution Infographic

moneydif.com

moneydif.com