Bankruptcy Chapter 7 involves liquidating non-exempt assets to repay creditors and typically discharges most unsecured debts quickly, making it suitable for individuals with limited income or complex debts. Bankruptcy Chapter 13 allows for a structured repayment plan over three to five years, enabling debtors to retain their assets while catching up on missed payments, ideal for those with steady income and significant secured debts. Choosing between Chapter 7 and Chapter 13 depends on income level, asset protection needs, and long-term financial goals.

Table of Comparison

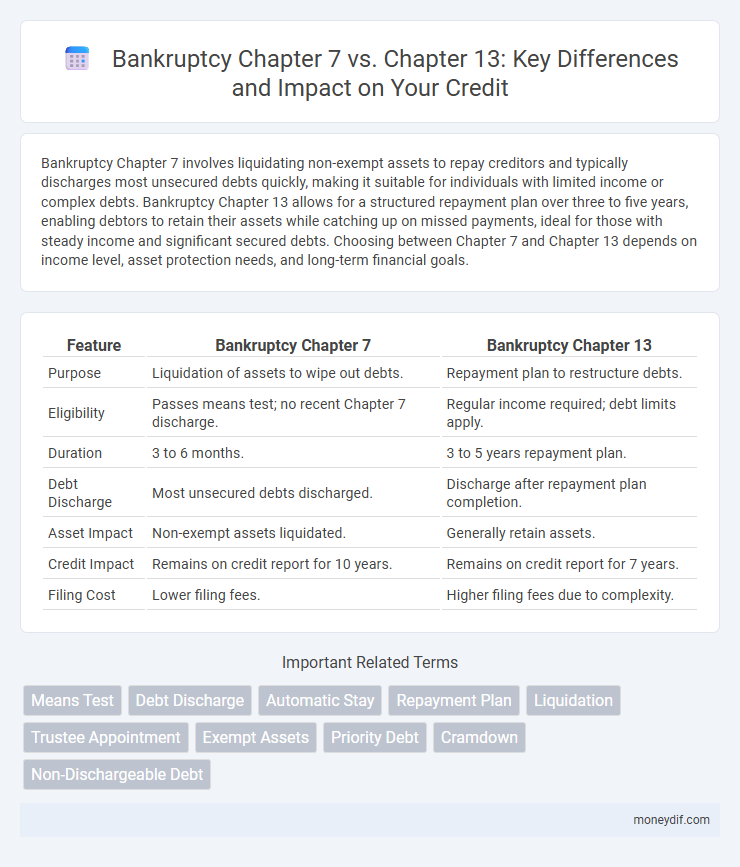

| Feature | Bankruptcy Chapter 7 | Bankruptcy Chapter 13 |

|---|---|---|

| Purpose | Liquidation of assets to wipe out debts. | Repayment plan to restructure debts. |

| Eligibility | Passes means test; no recent Chapter 7 discharge. | Regular income required; debt limits apply. |

| Duration | 3 to 6 months. | 3 to 5 years repayment plan. |

| Debt Discharge | Most unsecured debts discharged. | Discharge after repayment plan completion. |

| Asset Impact | Non-exempt assets liquidated. | Generally retain assets. |

| Credit Impact | Remains on credit report for 10 years. | Remains on credit report for 7 years. |

| Filing Cost | Lower filing fees. | Higher filing fees due to complexity. |

Understanding Bankruptcy: Chapter 7 vs Chapter 13

Bankruptcy Chapter 7 involves liquidation of non-exempt assets to pay creditors and typically closes cases within a few months, making it suitable for individuals with limited income and high unsecured debt. Bankruptcy Chapter 13 allows debtors to reorganize and repay debts over a three to five-year period, offering protection of assets and a structured repayment plan for those with steady income. Understanding the differences between Chapter 7 and Chapter 13 ensures debtors choose the best option based on income, assets, and debt type to optimize debt relief and financial recovery.

Key Differences Between Chapter 7 and Chapter 13 Bankruptcy

Chapter 7 bankruptcy involves liquidation of assets to repay creditors, typically resulting in the discharge of most unsecured debts within a few months. Chapter 13 bankruptcy focuses on reorganization, allowing debtors to create a repayment plan spread over three to five years while keeping their property. The key differences include asset liquidation in Chapter 7 versus debt repayment plans in Chapter 13, eligibility criteria based on income, and the impact on credit scores and financial recovery timelines.

Eligibility Requirements for Chapter 7 and Chapter 13

Chapter 7 bankruptcy eligibility requires passing the means test, which assesses your income against the median state income to determine if your debt qualifies for liquidation. Chapter 13 bankruptcy mandates having a regular income and unsecured debts below $465,275 and secured debts below $1,395,875, enabling structured repayment plans over three to five years. Both chapters require credit counseling completed within 180 days before filing to ensure informed decision-making.

Impact on Credit Score: Chapter 7 vs Chapter 13

Bankruptcy Chapter 7 typically causes a more significant immediate drop in credit scores compared to Chapter 13 because it involves liquidation of assets and is recorded on credit reports for up to 10 years. Chapter 13 bankruptcy, which entails a debt repayment plan over 3 to 5 years, tends to have a less severe impact on credit scores and may allow for earlier credit recovery. Creditors often view Chapter 13 more favorably since it demonstrates an active effort to repay debts, potentially improving credit scores faster after completion.

Debt Discharge: What Gets Wiped Out?

Bankruptcy Chapter 7 discharges most unsecured debts, including credit card balances, medical bills, and personal loans, effectively wiping out the debtor's obligation to repay these debts. Chapter 13, however, restructures debt repayment through a court-approved plan, allowing discharge of remaining unsecured debts only after consistent payments over three to five years. Secured debts like mortgages or car loans often remain unless surrendered or paid within the repayment plan in both types.

Costs and Fees Involved in Each Chapter

Bankruptcy Chapter 7 typically involves lower overall costs and fees, including a fixed court filing fee around $338 and trustee fees deducted from liquidated assets. Chapter 13 incurs higher costs, with court fees near $313 and additional legal fees averaging between $2,500 and $6,000 due to the extended repayment plan process. Chapter 13's monthly plan payments spread out over three to five years can significantly increase total expenses compared to the relatively quick resolution in Chapter 7.

Duration of Bankruptcy Process

Bankruptcy Chapter 7 typically lasts about 4 to 6 months, offering a quicker discharge of unsecured debts by liquidating non-exempt assets. Bankruptcy Chapter 13 extends over 3 to 5 years, allowing debtors to repay debts through a court-approved installment plan while retaining their property. The shorter duration of Chapter 7 contrasts with the longer, structured repayment period inherent in Chapter 13 bankruptcy cases.

Protecting Your Assets: Chapter 7 vs Chapter 13

Chapter 7 bankruptcy offers a faster path to debt discharge but typically requires liquidating non-exempt assets to repay creditors, which may risk losing valuable property. Chapter 13 allows debtors to keep their assets by creating a court-approved repayment plan over three to five years, making it ideal for protecting homes and vehicles while eliminating debt. Choosing between Chapter 7 and Chapter 13 depends on factors like asset protection, income level, and long-term financial goals.

Pros and Cons of Chapter 7 and Chapter 13

Bankruptcy Chapter 7 offers rapid debt discharge, ideal for individuals with limited income, but it may require liquidation of non-exempt assets, impacting personal property ownership. Chapter 13 enables debt restructuring through a 3- to 5-year repayment plan, preserving assets and stopping foreclosure, yet demands steady income and commitment to long-term payments. Choosing between Chapter 7 and Chapter 13 depends on financial stability, asset protection preferences, and the nature of outstanding debts.

Choosing the Right Bankruptcy Chapter for Your Situation

Choosing between Bankruptcy Chapter 7 and Chapter 13 depends on your income, debt type, and asset protection needs. Chapter 7 offers a quicker discharge of unsecured debts through liquidation, ideal for those with limited income and few assets to protect. Chapter 13 allows for debt reorganization with a repayment plan over three to five years, suitable for individuals with steady income aiming to keep valuable property like a home or car.

Important Terms

Means Test

The Means Test determines eligibility for Chapter 7 bankruptcy by assessing debtor income against state median levels to prevent abuse of liquidation bankruptcy options. In contrast, Chapter 13 bankruptcy allows debtors with higher incomes to restructure debts through a repayment plan without passing the Means Test.

Debt Discharge

Debt discharge in Bankruptcy Chapter 7 typically eliminates most unsecured debts quickly, providing a fresh financial start by liquidating non-exempt assets. In contrast, Bankruptcy Chapter 13 restructures debts into a repayment plan over three to five years, with partial discharge occurring upon successful completion of the plan.

Automatic Stay

The automatic stay in Bankruptcy Chapter 7 halts most creditor actions immediately after filing, providing debtor relief by stopping foreclosure, wage garnishments, and collection calls, but the stay is often short-lived due to asset liquidation. In contrast, Bankruptcy Chapter 13 imposes an automatic stay that not only stops creditor activities but also enables debtors to restructure debts over a 3 to 5-year repayment plan, offering greater protection and opportunity to retain assets.

Repayment Plan

Bankruptcy Chapter 7 involves liquidation with no repayment plan, allowing discharge of most debts within months, whereas Chapter 13 establishes a court-approved repayment plan over three to five years to gradually pay off debts. Chapter 13 protects assets from liquidation while offering a structured repayment schedule, making it suitable for individuals with regular income aiming to retain property.

Liquidation

Bankruptcy Chapter 7 involves the liquidation of non-exempt assets to repay creditors, resulting in a quicker discharge of debts, typically within four to six months. In contrast, Bankruptcy Chapter 13 allows debtors to keep their property by creating a repayment plan over three to five years, focusing on debt reorganization rather than asset liquidation.

Trustee Appointment

In Bankruptcy Chapter 7, a trustee is appointed by the court to liquidate non-exempt assets and distribute proceeds to creditors, whereas in Bankruptcy Chapter 13, a trustee oversees the debtor's repayment plan to creditors over three to five years. The Chapter 7 trustee primarily focuses on asset liquidation, while the Chapter 13 trustee facilitates debt reorganization and payment collection.

Exempt Assets

Exempt assets in Bankruptcy Chapter 7 typically include essential property such as a primary residence, vehicle, and personal belongings protected under federal or state exemption laws, allowing debtors to retain them during liquidation. In Bankruptcy Chapter 13, exempt assets are also protected, but the debtor proposes a repayment plan while maintaining possession of non-exempt assets subject to court approval.

Priority Debt

Priority debt, including tax obligations, child support, and certain wage claims, receives preferential treatment in both Chapter 7 and Chapter 13 bankruptcy filings. Chapter 7 typically discharges unsecured priority debts quickly through asset liquidation, while Chapter 13 incorporates these debts into a structured repayment plan over three to five years.

Cramdown

Cramdown in bankruptcy allows a debtor to reduce the secured amount on a lien to the collateral's current value, which is commonly applicable in Chapter 13 cases but generally not permitted in Chapter 7 liquidations. Chapter 13 enables debt reorganization with cramdown to adjust secured debts, while Chapter 7 involves asset liquidation without altering secured debt amounts through cramdown.

Non-Dischargeable Debt

Non-dischargeable debt in Bankruptcy Chapter 7 primarily includes certain taxes, student loans, child support, and recent luxury purchases, limiting debt elimination through liquidation. In contrast, Bankruptcy Chapter 13 allows repayment plans over three to five years for many debts but also excludes discharge of specific obligations like alimony, certain taxes, and criminal fines.

Bankruptcy Chapter 7 vs Bankruptcy Chapter 13 Infographic

moneydif.com

moneydif.com