A tradeline represents a specific credit account reported on a credit report, detailing the history and status of that account, whereas an account line broadly refers to the overall credit accounts listed on a report. Tradelines provide detailed information such as payment history, credit limit, and balance, which are critical for lenders assessing creditworthiness. Understanding the distinction helps in managing and improving credit profiles effectively.

Table of Comparison

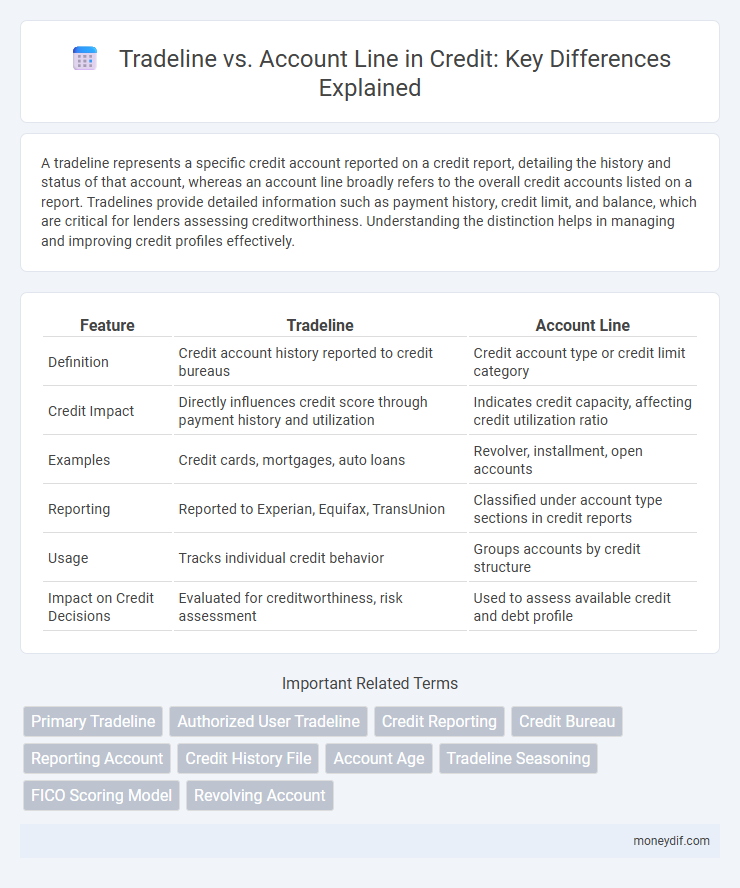

| Feature | Tradeline | Account Line |

|---|---|---|

| Definition | Credit account history reported to credit bureaus | Credit account type or credit limit category |

| Credit Impact | Directly influences credit score through payment history and utilization | Indicates credit capacity, affecting credit utilization ratio |

| Examples | Credit cards, mortgages, auto loans | Revolver, installment, open accounts |

| Reporting | Reported to Experian, Equifax, TransUnion | Classified under account type sections in credit reports |

| Usage | Tracks individual credit behavior | Groups accounts by credit structure |

| Impact on Credit Decisions | Evaluated for creditworthiness, risk assessment | Used to assess available credit and debt profile |

Understanding Tradelines and Account Lines

Tradelines represent the detailed credit information reported by lenders to credit bureaus, including account type, payment history, credit limits, and balances. Account lines refer to individual credit accounts listed on a credit report, each showing specific data such as date opened, credit utilization, and current status. Understanding how tradelines impact credit scores helps consumers manage their credit profiles effectively and improve creditworthiness.

Key Differences Between Tradelines and Account Lines

Tradelines represent individual credit accounts reported on a credit report, detailing payment history, credit limits, and account status, while account lines refer broadly to the types of credit extended, such as credit cards, mortgages, or installment loans. Key differences include that tradelines provide granular credit activity data essential for credit scoring models, whereas account lines categorize overall credit types impacting credit diversity analysis. Understanding these distinctions helps in credit management by highlighting how each element influences creditworthiness assessments and lending decisions.

How Tradelines Impact Credit Scores

Tradelines represent individual credit accounts listed on a credit report, directly influencing credit scores through payment history, credit utilization, and account age. Each tradeline's activity, including timely payments and balance levels, contributes to scoring models like FICO and VantageScore. The quality and diversity of tradelines enhance credit profiles, whereas negative marks or high utilization on any tradeline can lower credit scores significantly.

The Role of Account Lines in Credit Reporting

Account lines serve as the core components in credit reporting by detailing each credit account's status, payment history, and balance, which directly influence credit scores. Unlike tradelines that broadly represent credit accounts, account lines provide granular data essential for lenders assessing creditworthiness and risk. Accurate account lines ensure transparent credit profiles, enabling more precise risk evaluation and credit decision-making.

Types of Tradelines: Primary vs. Authorized User

Primary tradelines are credit accounts opened and managed by the main borrower, directly impacting their credit score and payment history. Authorized user tradelines allow another person to use the credit account without legal responsibility for repayments, providing potential credit benefits without affecting the primary account holder's obligations. Understanding the distinction between primary and authorized user tradelines is crucial for effective credit management and optimizing credit profiles.

Benefits of Managing Account Lines Effectively

Managing account lines effectively enhances credit utilization ratios by ensuring balances stay within optimal limits, which positively impacts credit scores. Accurate tracking of account lines helps prevent missed payments and reduces the risk of account delinquency, fostering better creditworthiness. Efficient management also allows for strategic allocation of credit limits, maximizing borrowing power while minimizing interest costs.

Tradeline Reporting: What Lenders See

Tradeline reporting provides lenders with detailed information about an individual's credit account, including account type, credit limit, payment history, and balance. Unlike general account lines, tradelines offer a comprehensive view of credit behavior, enabling lenders to assess risk and creditworthiness more accurately. This granular data directly impacts credit scoring models and influences lending decisions.

Risks of Purchasing Tradelines

Purchasing tradelines can expose consumers to risks such as potential fraud, inaccurate credit reporting, and possible account closures due to violations of credit bureau policies. These risks may damage credit scores instead of improving them and result in legal or financial consequences. It is important to carefully evaluate the legitimacy and impact of tradeline purchases compared to traditional account line management.

Building Credit: Tradeline Strategies vs. Account Line Management

Tradeline strategies involve adding authorized user accounts or new credit lines to boost credit history length and payment diversity, directly impacting credit scores. Account line management focuses on optimizing existing credit limits, reducing balances, and maintaining low credit utilization ratios to improve creditworthiness. Combining both approaches enhances credit building by expanding credit mix while effectively managing debt levels.

Frequently Asked Questions: Tradeline vs. Account Line

Tradelines refer to credit accounts reported on a credit report, detailing payment history, credit limit, and account status, while account lines represent the actual credit or loan accounts held by an individual. Frequently asked questions about tradelines vs. account lines often focus on how each impacts credit scores, with tradelines directly influencing creditworthiness through their payment and utilization history. Understanding the distinction helps consumers manage credit reports accurately and optimize their credit profiles for better lending outcomes.

Important Terms

Primary Tradeline

Primary tradelines represent the original credit accounts where the primary account holder's credit activity is reported, significantly impacting credit scores. Unlike account lines that may include secondary or authorized user accounts, primary tradelines provide direct credit responsibility data, offering more substantial influence on credit evaluation and lending decisions.

Authorized User Tradeline

An Authorized User Tradeline allows a non-primary user to benefit from a primary account holder's credit history, impacting the authorized user's credit score without legal responsibility for the debt. Unlike a standard Account Line, which a borrower fully owns and manages, an Authorized User Tradeline functions as a shared credit account, often used to build or improve credit profiles efficiently.

Credit Reporting

A tradeline refers to a detailed record of an individual credit account, including payment history, credit limit, and account status, while an account line represents the broader credit account itself on a credit report. Tradelines provide specific data points that influence credit scores, making them essential for accurate credit reporting and analysis.

Credit Bureau

Credit bureaus collect and report detailed tradeline data, which includes individual account lines reflecting credit card, mortgage, or loan activity. Each tradeline represents an account line with specific information such as payment history, credit limit, and current balance, crucial for accurate credit scoring and risk assessment.

Reporting Account

A Reporting Account in credit reporting refers to how creditors present tradelines, which are detailed records of individual credit accounts including payment history, balance, and credit limit, whereas an Account Line aggregates these details to summarize the overall status and impact on credit scores. Tradelines provide granular data essential for credit bureaus to assess risk, while the Account Line offers a consolidated view for credit analysis and reporting.

Credit History File

A Credit History File contains detailed records of an individual's credit activity, where tradelines represent specific credit accounts reported by lenders, each reflecting payment history, credit limits, and balances. Account lines are the individual entries within a tradeline that document the status and transactions of that specific credit account over time.

Account Age

Account age is a critical factor in credit scoring, reflecting the length of time an individual's credit accounts have been established, with older tradelines generally contributing positively to creditworthiness. Tradelines represent individual credit accounts reported to credit bureaus, while account lines encompass all active credit accounts, making the average age of these tradelines a key metric in evaluating overall account line age and credit history strength.

Tradeline Seasoning

Tradeline Seasoning enhances credit profiles by adding seasoned tradelines with established payment histories, distinguishing it from an account line, which represents individual credit accounts like credit cards or loans. This strategic use of seasoned tradelines improves credit scores by demonstrating consistent, long-term credit management compared to new or unseasoned account lines.

FICO Scoring Model

The FICO scoring model evaluates creditworthiness by analyzing tradelines, which are individual credit accounts reported to credit bureaus, while account lines refer to the broader category of credit accounts maintained by a borrower. Each tradeline's payment history, credit limit, and balance directly influence the credit score by reflecting the borrower's credit management on specific accounts.

Revolving Account

A Revolving Account is a type of credit account that allows cardholders to carry a balance from month to month, impacting credit utilization and payment history on the credit report. Unlike a simple Account Line, a Tradeline represents detailed reporting of that Revolving Account to credit bureaus, including credit limit, balance, and payment status, which directly influences credit scores.

Tradeline vs Account Line Infographic

moneydif.com

moneydif.com