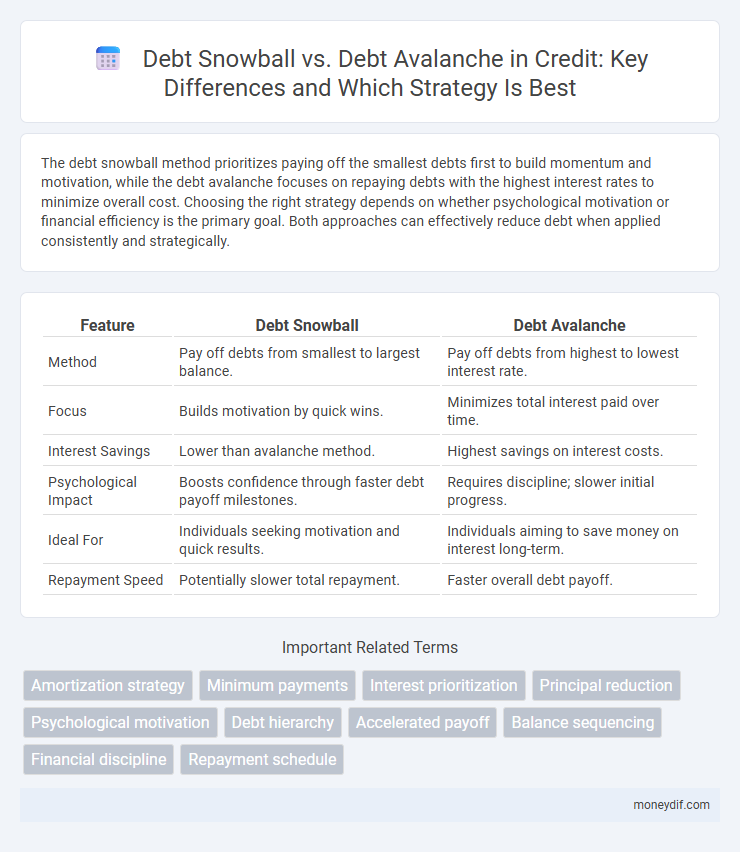

The debt snowball method prioritizes paying off the smallest debts first to build momentum and motivation, while the debt avalanche focuses on repaying debts with the highest interest rates to minimize overall cost. Choosing the right strategy depends on whether psychological motivation or financial efficiency is the primary goal. Both approaches can effectively reduce debt when applied consistently and strategically.

Table of Comparison

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Method | Pay off debts from smallest to largest balance. | Pay off debts from highest to lowest interest rate. |

| Focus | Builds motivation by quick wins. | Minimizes total interest paid over time. |

| Interest Savings | Lower than avalanche method. | Highest savings on interest costs. |

| Psychological Impact | Boosts confidence through faster debt payoff milestones. | Requires discipline; slower initial progress. |

| Ideal For | Individuals seeking motivation and quick results. | Individuals aiming to save money on interest long-term. |

| Repayment Speed | Potentially slower total repayment. | Faster overall debt payoff. |

Understanding Debt Snowball and Debt Avalanche Methods

The Debt Snowball method focuses on paying off the smallest debts first to build momentum and motivation, while the Debt Avalanche method targets debts with the highest interest rates to minimize overall interest paid. Both strategies require listing all debts, allocating extra funds to a chosen target debt, and making minimum payments on others, but differ in prioritization criteria. Understanding these methods enables individuals to select a repayment plan aligned with their financial goals and psychological preferences.

Key Differences Between Debt Snowball and Debt Avalanche

Debt snowball prioritizes paying off the smallest debts first to build momentum, whereas debt avalanche targets debts with the highest interest rates to minimize overall cost. Snowball offers psychological motivation through quick wins, while avalanche reduces total interest paid over time, leading to faster debt repayment. Choosing between them depends on whether behavioral motivation or financial efficiency is the priority.

Pros and Cons of the Debt Snowball Method

The Debt Snowball Method prioritizes paying off the smallest debts first, creating a psychological boost through quick wins that enhance motivation and commitment. This approach may not minimize overall interest paid compared to the Debt Avalanche Method, which targets high-interest debts first, potentially extending the repayment timeline and increasing total interest costs. The Debt Snowball's emphasis on behavioral momentum is ideal for individuals needing structured encouragement, while its main drawback is potentially higher total financial outlay over time.

Advantages and Disadvantages of the Debt Avalanche Method

The debt avalanche method prioritizes paying off debts with the highest interest rates first, which minimizes overall interest paid and shortens the debt repayment period. This approach is financially efficient but can be demotivating initially, as larger debts with high interest may take longer to eliminate compared to the smaller balances targeted in the snowball method. Its main disadvantage is the potential lack of psychological wins early on, which may affect consistency in maintaining debt repayment momentum.

Which Debt Repayment Strategy Pays Off Debt Faster?

The debt avalanche method pays off debt faster by prioritizing higher-interest balances, reducing overall interest costs significantly compared to the debt snowball, which targets smaller balances first to build motivation. According to financial experts, the avalanche strategy can save thousands in interest payments and shorten the repayment timeline. However, the debt snowball's psychological benefits may improve adherence, but purely from a cost and speed perspective, the debt avalanche is more efficient.

Impact on Credit Score: Snowball vs. Avalanche

The debt snowball method, by focusing on paying off the smallest balances first, can quickly reduce the number of outstanding accounts, potentially improving credit score factors like credit utilization and account status. The debt avalanche method targets high-interest debts first, which may lead to lower overall credit utilization faster when large balances are reduced, positively influencing credit scores through better debt-to-credit ratios. Both strategies help improve credit scores over time, but the snowball method often shows quicker changes in credit report entries while the avalanche method maximizes interest savings and long-term credit health.

Psychological Benefits of Debt Snowball

The Debt Snowball method emphasizes paying off smaller debts first, creating quick wins that boost motivation and build positive momentum. This psychological benefit encourages consistent repayment habits by providing frequent feelings of accomplishment, which can reduce stress and increase confidence in managing debt. Unlike the Debt Avalanche method, which focuses on minimizing interest costs, the Debt Snowball prioritizes behavioral triggers that sustain long-term financial discipline.

Financial Savings with Debt Avalanche

The debt avalanche method prioritizes paying off debts with the highest interest rates first, maximizing financial savings by reducing the total interest paid over time. This approach accelerates debt elimination more efficiently than the debt snowball method, which focuses on paying off smaller balances first. By minimizing interest accumulation, the debt avalanche strategy optimizes cash flow and shortens the overall debt repayment period.

How to Choose the Best Debt Repayment Strategy for You

Choosing the best debt repayment strategy depends on your financial behavior and goals; the debt snowball method targets smallest balances first to build motivation, while the debt avalanche method prioritizes higher interest rates to minimize overall cost. Assess your discipline with budgeting and preference for quick wins versus long-term savings to decide the most effective approach. Personalizing your plan by analyzing loan amounts, interest rates, and repayment timelines ensures optimal progress toward debt freedom.

Real-Life Success Stories: Debt Snowball vs. Debt Avalanche

Real-life success stories highlight that individuals using the debt snowball method often experience increased motivation by quickly eliminating smaller debts, which boosts confidence and encourages continued progress. Conversely, those who apply the debt avalanche strategy benefit from paying less interest over time, enabling faster overall debt repayment despite slower initial wins. Both approaches have proven effective in various case studies, depending on personal discipline, debt structure, and psychological preference.

Important Terms

Amortization strategy

The amortization strategy impacts debt repayment efficiency by determining how payments are allocated towards principal and interest, directly influencing the speed of debt payoff in methods like the debt snowball, which prioritizes smallest debts first for psychological motivation, versus the debt avalanche, which targets highest interest rates first to minimize total interest paid. By optimizing amortization schedules to align with the debt avalanche method, borrowers can achieve faster debt reduction and lower overall cost, while the debt snowball approach enhances commitment and reduces perceived financial burden.

Minimum payments

Minimum payments on debts prolong repayment timelines and increase interest costs, often undermining progress in both debt snowball and debt avalanche strategies. The debt snowball method prioritizes paying off smallest balances first to gain motivational momentum, while the debt avalanche targets highest interest rates to minimize total interest paid over time, both requiring consistent minimum payments on all debts to avoid penalties.

Interest prioritization

Interest prioritization significantly impacts debt repayment strategies, with the debt avalanche method targeting high-interest debts first to minimize total interest paid, while the debt snowball approach focuses on paying off smaller balances initially to build momentum. Selecting the optimal method depends on whether reducing interest costs or increasing psychological motivation is the priority for the debtor.

Principal reduction

Principal reduction accelerates debt payoff by lowering the outstanding balance, enhancing the effectiveness of both debt snowball and debt avalanche methods. While debt snowball focuses on paying off smaller balances first and debt avalanche targets high-interest debts, principal reduction directly decreases the total owed, resulting in faster interest savings and quicker debt elimination.

Psychological motivation

Psychological motivation plays a crucial role in the effectiveness of debt repayment methods like the debt snowball and debt avalanche; the snowball method boosts motivation by providing quick wins through paying off smaller debts first, while the avalanche method targets saving money on interest by prioritizing higher-interest debts. Choosing a strategy aligned with individual psychological preferences can significantly impact commitment and long-term financial success.

Debt hierarchy

Debt hierarchy prioritizes paying off debts based on specific criteria, such as interest rates in the debt avalanche method or balance size in the debt snowball method. The debt snowball focuses on eliminating smaller debts first to build momentum, while the debt avalanche targets high-interest debts to minimize overall interest paid.

Accelerated payoff

Accelerated payoff combines the structured approach of the debt snowball method, targeting smallest debts first for quick wins, with the debt avalanche strategy's focus on highest-interest debts to minimize total interest paid. This hybrid technique optimizes debt reduction by balancing psychological motivation and financial efficiency, reducing repayment time and overall cost.

Balance sequencing

Balance sequencing in debt repayment prioritizes targeting smaller balances first to build momentum and motivation, aligning with the debt snowball method, which accelerates psychological wins despite possibly higher interest costs. In contrast, the debt avalanche method sequences payments by highest interest rate, optimizing cost-efficiency and reducing total interest paid over time by minimizing high-interest balance durations.

Financial discipline

Financial discipline enhances effectiveness when using the debt snowball method by fostering motivation through paying off smaller debts first, while the debt avalanche technique emphasizes minimizing total interest paid by targeting high-interest debts initially; understanding personal spending habits and budgeting strategies plays a critical role in choosing the most financially advantageous approach. Consistent tracking of expenses combined with disciplined payment schedules accelerates debt reduction and improves credit scores, making either method successful for long-term financial stability.

Repayment schedule

A repayment schedule in the debt snowball method focuses on paying off debts from smallest to largest balance to build momentum, while the debt avalanche approach prioritizes debts with the highest interest rates first to minimize overall interest costs. Both strategies structure monthly payments strategically to accelerate debt elimination, with snowball emphasizing psychological motivation and avalanche optimizing financial savings.

Debt snowball vs debt avalanche Infographic

moneydif.com

moneydif.com