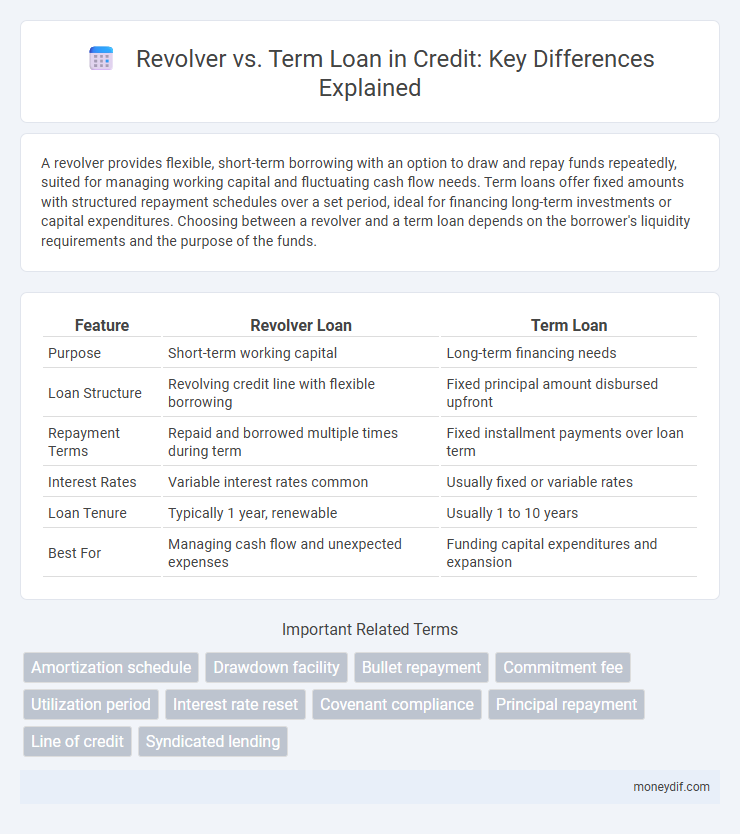

A revolver provides flexible, short-term borrowing with an option to draw and repay funds repeatedly, suited for managing working capital and fluctuating cash flow needs. Term loans offer fixed amounts with structured repayment schedules over a set period, ideal for financing long-term investments or capital expenditures. Choosing between a revolver and a term loan depends on the borrower's liquidity requirements and the purpose of the funds.

Table of Comparison

| Feature | Revolver Loan | Term Loan |

|---|---|---|

| Purpose | Short-term working capital | Long-term financing needs |

| Loan Structure | Revolving credit line with flexible borrowing | Fixed principal amount disbursed upfront |

| Repayment Terms | Repaid and borrowed multiple times during term | Fixed installment payments over loan term |

| Interest Rates | Variable interest rates common | Usually fixed or variable rates |

| Loan Tenure | Typically 1 year, renewable | Usually 1 to 10 years |

| Best For | Managing cash flow and unexpected expenses | Funding capital expenditures and expansion |

Introduction to Revolver and Term Loan

A revolver, or revolving credit facility, offers flexible borrowing with a credit limit that resets as principal is repaid, ideal for managing short-term liquidity needs. Term loans provide a fixed amount of capital disbursed upfront, repaid over a set schedule with interest, suitable for financing long-term investments. Both credit structures serve different strategic purposes in corporate finance depending on cash flow stability and capital expenditure requirements.

Key Differences Between Revolvers and Term Loans

Revolvers offer flexible borrowing up to a credit limit with interest paid only on the drawn amount, making them ideal for managing short-term cash flow needs. Term loans provide a fixed amount of capital repaid over a set schedule with a consistent interest rate, supporting longer-term financing objectives. Key differences include the revolving credit facility of revolvers versus the fixed principal repayment of term loans, impacting liquidity and cost structure.

Structure and Features of Revolving Credit Facilities

Revolving credit facilities offer flexible borrowing with a pre-approved credit limit that allows multiple withdrawals and repayments during the term, unlike term loans which provide a fixed amount disbursed upfront. The structure of revolvers includes periodic availability periods, interest calculated on the drawn amount, and commitment fees on undrawn balances. Features such as renewability, adjustable credit limits, and the option to repay and redraw funds enhance liquidity management for borrowers in revolving credit agreements.

Structure and Features of Term Loans

Term loans offer a fixed repayment schedule with predetermined interest rates, providing borrowers with predictable cash flow management. These loans typically have a defined maturity date and amortization period, ensuring systematic principal and interest payments over time. Unlike revolvers, term loans are structured for long-term financing needs, often used for capital expenditures or business expansion.

Eligibility Criteria for Revolver vs Term Loan

Eligibility criteria for a revolver typically require strong cash flow stability, a solid credit history, and a lower debt-to-equity ratio to ensure quick access to revolving credit lines. Term loans demand comprehensive financial documentation, including detailed income statements, collateral valuation, and a consistent repayment history to support longer maturities and fixed repayment schedules. Lenders prioritize the borrower's liquidity and creditworthiness differently, with revolvers favoring short-term financial flexibility and term loans emphasizing long-term financial strength.

Typical Use Cases: When to Choose Each Option

Revolvers are ideal for businesses requiring flexible access to working capital, managing seasonal cash flow fluctuations, or funding short-term operational needs. Term loans suit companies with specific, long-term investment plans such as purchasing equipment, expanding facilities, or refinancing existing debt. Choosing between a revolver and a term loan depends largely on the predictability of cash flows and the intended use of funds.

Interest Rates and Repayment Terms

Revolver loans typically have variable interest rates tied to benchmarks like LIBOR or SOFR, allowing borrowers flexibility in borrowing and repaying within the credit limit during the term. Term loans generally feature fixed interest rates with structured repayment schedules over a set period, providing predictability in cash flows and interest expenses. The choice between revolver and term loans depends on a company's cash flow stability and capital needs, as revolvers suit short-term liquidity management while term loans align with long-term financing objectives.

Pros and Cons of Revolver and Term Loan

Revolver credit facilities offer flexible borrowing and repayment options, making them ideal for managing short-term cash flow fluctuations but typically come with higher interest rates and variable terms. Term loans provide fixed repayment schedules and lower interest rates, suitable for long-term investments, yet they lack the flexibility to adjust borrowing amounts once the loan is disbursed. Choosing between a revolver and a term loan depends on the borrower's need for flexibility versus stability in their debt servicing plan.

Impact on Borrower’s Credit Profile

A revolver provides ongoing access to credit, enhancing liquidity and demonstrating flexible financial management on a borrower's credit profile. Term loans show a structured repayment schedule, reflecting a clear debt reduction plan that positively impacts creditworthiness over time. The combination of both can optimize credit utilization ratios and improve overall credit scoring by balancing revolving debt with fixed obligations.

How to Decide: Revolver vs Term Loan

Choosing between a revolver and a term loan depends on cash flow stability and funding needs; revolvers offer flexible, short-term borrowing ideal for managing working capital fluctuations, while term loans provide a lump sum with fixed repayment schedules suited for long-term investments. Credit officers assess factors like interest rates, borrowing duration, repayment capacity, and purpose to match loan structure with financial goals. Evaluating liquidity requirements and forecasted income streams ensures optimal capital structure and cost-effective credit utilization.

Important Terms

Amortization schedule

An amortization schedule for a term loan outlines fixed principal and interest payments over time, while a revolver typically features flexible borrowing and interest payments without a fixed amortization schedule.

Drawdown facility

A Drawdown facility in a revolver allows multiple flexible withdrawals up to a credit limit, whereas a term loan provides a fixed lump sum amount disbursed once with scheduled repayments.

Bullet repayment

Bullet repayment in term loans involves a single lump-sum payment at maturity, whereas revolvers typically require interest-only payments with flexible principal repayments throughout the loan term.

Commitment fee

Commitment fees for revolvers are typically charged on the unused portion of the credit line, whereas term loans generally do not involve commitment fees since the full amount is disbursed upfront.

Utilization period

The utilization period for revolver loans typically allows multiple draws and repayments within a set timeframe, whereas term loans require a lump-sum disbursement with fixed repayment schedules over the loan term.

Interest rate reset

Interest rate resets for revolvers typically occur based on short-term benchmark rates like LIBOR or SOFR, while term loans often have fixed or periodically adjusted rates aligned with longer-term market conditions.

Covenant compliance

Covenant compliance in revolver loans offers flexible borrowing limits tied to asset valuation, while term loans impose fixed repayment schedules and stricter financial covenants ensuring predictable leverage ratios.

Principal repayment

Principal repayment for revolving credit facilities typically occurs upon borrowing and repayment cycles with flexible amounts and timing, whereas term loans require fixed principal repayments on scheduled dates over the loan tenure.

Line of credit

A line of credit offers flexible, revolving access to funds up to a set limit, unlike a term loan which provides a fixed lump sum with scheduled repayments.

Syndicated lending

Syndicated revolving credit facilities offer flexible borrowing with variable drawdowns and repayments, while syndicated term loans provide fixed amounts with scheduled amortization over the loan term.

revolver vs term loan Infographic

moneydif.com

moneydif.com