A co-signer legally assumes responsibility for a loan, guaranteeing repayment if the primary borrower defaults, which can impact their credit score and financial obligations. An authorized user, however, is permitted to use the credit account but is not legally responsible for repayment, often benefiting from the primary user's positive credit history without direct accountability. Understanding these roles helps borrowers make informed decisions to build or protect their credit effectively.

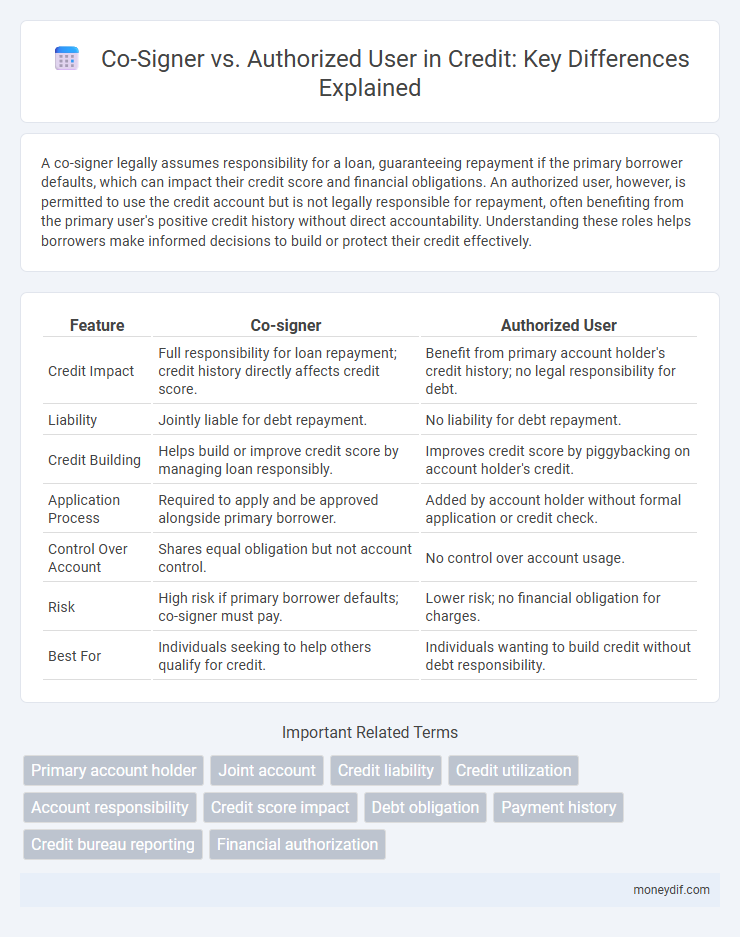

Table of Comparison

| Feature | Co-signer | Authorized User |

|---|---|---|

| Credit Impact | Full responsibility for loan repayment; credit history directly affects credit score. | Benefit from primary account holder's credit history; no legal responsibility for debt. |

| Liability | Jointly liable for debt repayment. | No liability for debt repayment. |

| Credit Building | Helps build or improve credit score by managing loan responsibly. | Improves credit score by piggybacking on account holder's credit. |

| Application Process | Required to apply and be approved alongside primary borrower. | Added by account holder without formal application or credit check. |

| Control Over Account | Shares equal obligation but not account control. | No control over account usage. |

| Risk | High risk if primary borrower defaults; co-signer must pay. | Lower risk; no financial obligation for charges. |

| Best For | Individuals seeking to help others qualify for credit. | Individuals wanting to build credit without debt responsibility. |

Understanding Co-Signers and Authorized Users

Co-signers are legally responsible for repaying a debt if the primary borrower defaults, significantly impacting their credit and financial liability. Authorized users gain permission to use a credit account without legal obligation to repay, often benefiting from improved credit history without direct debt responsibility. Understanding these distinctions is crucial for managing credit risk and building credit profiles effectively.

Key Differences Between Co-Signer and Authorized User Roles

A co-signer legally guarantees loan repayment and impacts their credit score directly, while an authorized user gains access to credit account benefits without financial responsibility or liability. Co-signers share equal obligation for debt, making missed payments affect their credit history, whereas authorized users benefit from the primary account holder's credit activity but do not share debt liability. The distinction between these roles significantly affects credit risk, responsibility, and credit score outcomes.

How Credit Scores Are Impacted

A co-signer's credit score is directly impacted by the loan or credit account because they share full legal responsibility for the debt, and any missed payments or defaults affect both parties' credit reports. An authorized user benefits by having the account and its positive payment history appear on their credit report without incurring liability for the debt. Lenders view co-signed accounts as joint obligations, which can increase debt-to-income ratios, while authorized users gain credit history boosts without the risk of increased debt.

Eligibility Requirements for Co-Signers vs Authorized Users

Co-signers must meet stringent creditworthiness criteria, including a strong credit score, steady income, and low debt-to-income ratio, as they share legal responsibility for the debt. Authorized users have no eligibility requirements beyond the primary account holder adding them to the account, with no legal obligation to repay the debt. The credit profile and income stability of co-signers are critical factors, while authorized users benefit from the account holder's credit history without undergoing qualification scrutiny.

Rights and Responsibilities Explained

A co-signer legally commits to repaying the debt if the primary borrower defaults, which impacts their credit report and could lead to collection actions. An authorized user gains permission to use the credit account but holds no legal responsibility for repayment, thereby avoiding direct liability for the debt. Both roles affect credit scores differently, with co-signers bearing full financial responsibility while authorized users benefit from account history without repayment obligations.

Pros and Cons of Becoming a Co-Signer

Becoming a co-signer can help someone with poor credit obtain a loan by leveraging the co-signer's stronger credit profile, potentially leading to better interest rates and loan approval. However, the co-signer assumes full legal responsibility for the debt, risking damage to their credit score if the primary borrower defaults or makes late payments. This arrangement also limits the co-signer's borrowing capacity since the loan appears on their credit report as an obligation.

Pros and Cons of Adding an Authorized User

Adding an authorized user to a credit account can improve their credit score by leveraging the primary account holder's positive payment history and credit utilization, which may help build credit without the responsibility of payments. However, the primary account holder assumes the risk of increased debt if the authorized user overspends, and some credit bureaus may not recognize authorized user accounts for credit building, limiting potential benefits. Unlike co-signers, authorized users have no legal obligation to repay, making it a lower-risk option for credit support but with less control over the authorized user's financial actions.

Potential Risks for Both Parties

A co-signer assumes full legal responsibility for the debt, risking credit damage if the primary borrower defaults, while an authorized user faces limited risk but also has no obligation to repay. The primary borrower benefits from using both, but co-signers may suffer from reduced credit availability due to debt appearing on their reports. Authorized users may see credit score impacts if the account behaves poorly, though their liability remains minimal.

When to Choose a Co-Signer or an Authorized User

Choose a co-signer when you need a reliable party to guarantee loan repayment, typically for large or secured loans where the primary borrower has insufficient credit history or income. An authorized user is ideal for someone looking to build credit by piggybacking on an established credit card account without assuming legal responsibility for repayments. Opt for a co-signer when loan approval or better terms depend on their credit, whereas an authorized user is best for gradually enhancing credit scores with minimal risk.

Frequently Asked Questions on Co-Signers and Authorized Users

A co-signer actively shares responsibility for a loan, impacting both parties' credit scores and requiring them to repay if the primary borrower defaults, whereas an authorized user is added to a credit account without legal responsibility for the debt. Frequently asked questions about co-signers often address the risks of credit damage and financial liability, while inquiries about authorized users focus on how their presence affects credit reports and the primary account holder's obligations. Understanding the distinctions between these roles is essential for managing credit risk and building credit history effectively.

Important Terms

Primary account holder

The primary account holder is responsible for all transactions and payments on the account, while a co-signer shares equal liability and credit impact, ensuring repayment if the primary defaults. An authorized user has permission to use the account but holds no financial responsibility or credit obligation.

Joint account

A joint account allows two or more individuals to equally share ownership, responsibility, and access to the account, whereas a co-signer guarantees the debt without having direct access to the account, and an authorized user merely has permission to use the account without legal responsibility for the debt. Unlike authorized users, both joint account holders and co-signers impact credit scores, but joint account holders share liability, while co-signers are liable only if the primary account holder defaults.

Credit liability

Credit liability for a co-signer involves full legal responsibility for loan repayment if the primary borrower defaults, directly impacting the co-signer's credit score and debt-to-income ratio. An authorized user has no legal obligation to repay the debt but benefits from positive credit history reporting on the primary account holder's activity, which can improve their credit profile without incurring liability.

Credit utilization

Credit utilization plays a critical role in credit scoring models, where a co-signer's credit utilization directly impacts both parties' credit profiles since they share equal responsibility for the debt. Authorized users benefit from the primary account holder's credit utilization rates improving their credit score without bearing financial liability, distinguishing their impact from that of co-signers.

Account responsibility

Account responsibility differs significantly between a co-signer and an authorized user; a co-signer shares full legal and financial liability for the account balance, whereas an authorized user has permission to use the account but is not legally responsible for repayment. Credit bureaus typically report activity for both co-signers and authorized users, but only the co-signer's credit is directly impacted by account delinquencies and payments.

Credit score impact

A co-signer's credit behavior directly affects the primary borrower's credit score because both parties share equal responsibility for the loan repayment, while an authorized user's credit score is influenced when the primary account holder maintains positive payment history without legal obligation to repay. Lenders typically view co-signers as equally liable, which can improve or damage credit scores based on repayment performance, whereas authorized users benefit from the primary account's good credit standing without the same risk.

Debt obligation

A debt obligation involving a co-signer means the co-signer is legally responsible for the full debt repayment if the primary borrower defaults, directly impacting their credit score and financial liability. An authorized user, however, is only permitted to use the credit account without legal responsibility for the debt, and their credit benefits depend on the primary account holder's payment behavior.

Payment history

Payment history of a primary borrower is positively impacted when a co-signer actively participates in loan repayments, as their credit responsibility is equally shared, enhancing creditworthiness. In contrast, an authorized user benefits from the primary account holder's payment history without assuming liability, which may improve credit scores but does not reflect personal credit responsibility.

Credit bureau reporting

Credit bureau reporting distinguishes co-signers and authorized users by attributing full responsibility for loan repayment to co-signers, directly impacting their credit scores, while authorized users benefit from credit history inclusion without liability. Co-signers' payment behaviors influence credit risk assessments, whereas authorized users' accounts affect credit utilization and history length without legal obligation.

Financial authorization

Financial authorization determines the extent of responsibility an individual has over a credit account, where a co-signer legally obligates full repayment and shares credit risk, while an authorized user simply gains account access without liability for the debt. Credit reporting agencies impact credit scores differently for co-signers who are equally accountable, contrasted with authorized users whose credit is primarily influenced by the primary account holder's payment behavior.

Co-signer vs authorized user Infographic

moneydif.com

moneydif.com