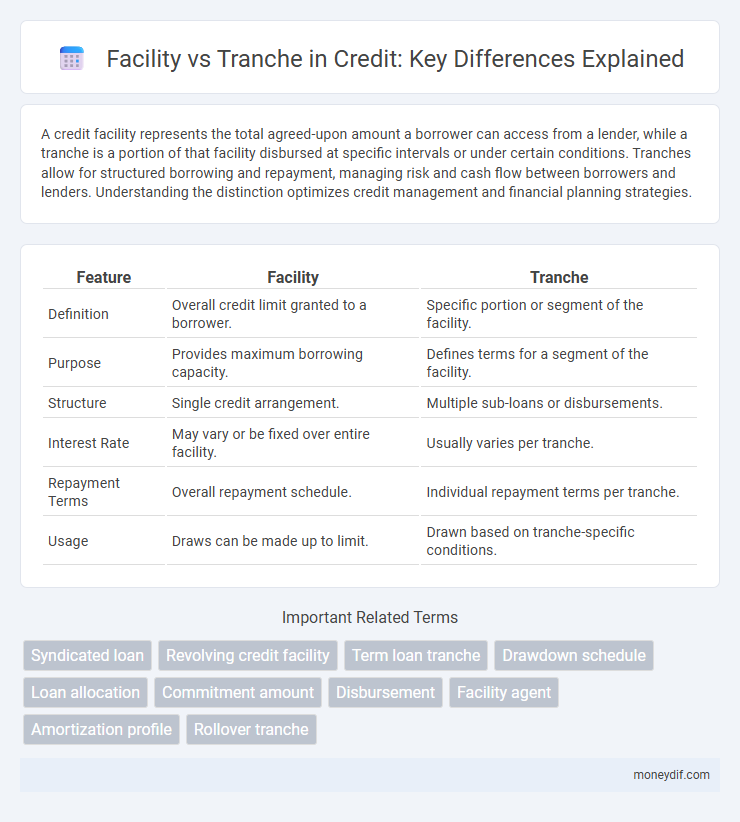

A credit facility represents the total agreed-upon amount a borrower can access from a lender, while a tranche is a portion of that facility disbursed at specific intervals or under certain conditions. Tranches allow for structured borrowing and repayment, managing risk and cash flow between borrowers and lenders. Understanding the distinction optimizes credit management and financial planning strategies.

Table of Comparison

| Feature | Facility | Tranche |

|---|---|---|

| Definition | Overall credit limit granted to a borrower. | Specific portion or segment of the facility. |

| Purpose | Provides maximum borrowing capacity. | Defines terms for a segment of the facility. |

| Structure | Single credit arrangement. | Multiple sub-loans or disbursements. |

| Interest Rate | May vary or be fixed over entire facility. | Usually varies per tranche. |

| Repayment Terms | Overall repayment schedule. | Individual repayment terms per tranche. |

| Usage | Draws can be made up to limit. | Drawn based on tranche-specific conditions. |

Understanding Credit Facilities and Tranches

A credit facility is a broad financial arrangement allowing a borrower to access funds up to a predetermined limit, while a tranche refers to a specific portion or segment of that facility with defined terms such as interest rates, maturity, or usage conditions. Tranches enable lenders and borrowers to structure financing in stages or layers, often aligned with project phases or risk profiles. Understanding the distinction between credit facilities and their tranches is crucial for managing repayment schedules and aligning credit risk with investment strategies.

Key Differences Between Facility and Tranche

A credit facility is a broad agreement providing a borrower with a maximum amount of funds available over a specified period, while a tranche refers to a specific portion or slice of that facility disbursed under defined terms. Facilities often encompass multiple tranches, each with distinct interest rates, maturities, or repayment schedules tailored to meet varying financing needs. Understanding the distinction helps in structuring credit arrangements effectively, optimizing risk distribution and cash flow management.

Facility Structures in Credit Agreements

In credit agreements, a facility represents the overall loan commitment provided by a lender to a borrower, outlining the maximum amount available for borrowing. Tranches are distinct portions or segments of the facility that may have different terms, maturity dates, or interest rates, allowing tailored withdrawal and repayment schedules. Facility structures enable lenders to manage risk and borrowers to access funds flexibly through multiple tranches under a single credit agreement.

What is a Credit Tranche?

A credit tranche refers to a segment or portion of a structured financial product, such as a loan or bond, that is divided based on risk level, maturity, or priority of repayment. Tranches allow investors to choose exposure according to their risk appetite, with senior tranches typically having lower risk and lower returns, while junior tranches carry higher risk and potential returns. This segmentation optimizes the allocation of credit risk and enhances funding flexibility within a credit facility.

Types of Credit Facilities

Credit facilities refer to the overall borrowing arrangements provided by financial institutions, while tranches represent segmented portions of these facilities, each with distinct terms and conditions. Types of credit facilities commonly include revolving credit lines, term loans, overdraft protections, and letters of credit, which can be divided into multiple tranches based on maturity dates, interest rates, or drawdown schedules. Understanding the differentiation between facility and tranche allows borrowers to tailor financing structures that optimize liquidity management and cost efficiency.

Role of Tranches in Loan Syndication

In loan syndication, tranches represent distinct portions of the total credit facility, each with specific terms, interest rates, and maturity profiles tailored to different investor preferences. Tranches enable lenders to diversify risk by segmenting the loan into multiple parts, facilitating structured financing and enhancing capital allocation efficiency. This segmentation also allows borrowers to access varied funding sources while managing repayment schedules effectively within the overall facility framework.

Advantages of Facilities Over Tranches

Facilities offer greater flexibility in credit management by allowing borrowers to access funds up to a predetermined limit without committing to multiple disbursements. They simplify administrative processes through consolidated documentation and streamline monitoring for lenders compared to managing multiple tranches separately. Facilities also enable faster funding availability, enhancing liquidity and responsiveness to borrower needs.

When to Use Tranches in Credit Deals

Tranches are used in credit deals to segment loans into portions with varying risk levels, maturities, or interest rates, enhancing portfolio diversification and risk management. Facility structures allocate the total credit amount under a single agreement, while tranches allow for staggered disbursement and conditional release of funds based on borrower performance or project milestones. Tranche utilization is common in syndicated loans, project financing, and structured credit facilities where flexibility and control over capital deployment are crucial.

Risk Management: Facility vs Tranche

In credit risk management, a facility represents the overall credit limit granted to a borrower, while a tranche refers to subdivisions within that facility, each with distinct terms, maturities, or risk profiles. Managing risk at the tranche level allows lenders to tailor credit exposure by segmenting repayment schedules, interest rates, and covenants, enhancing portfolio diversification and risk mitigation strategies. This granularity supports precise monitoring, enabling quicker identification of potential defaults and targeted interventions within the broader facility structure.

Choosing Between Facility and Tranche for Your Financing Needs

Selecting between a facility and a tranche depends on the structure and timing of your financing requirements. A credit facility offers a predetermined borrowing limit with flexible access, suitable for ongoing liquidity needs, while a tranche refers to a specific portion of financing disbursed at a particular time, ideal for staged project funding or phased capital deployment. Evaluating your cash flow patterns and project milestones helps determine whether a single facility or multiple tranches align better with your financial strategy.

Important Terms

Syndicated loan

A syndicated loan consists of multiple tranches, each representing a separate loan facility with distinct terms and conditions negotiated among participating lenders.

Revolving credit facility

A revolving credit facility provides a borrower with a maximum credit limit, while each tranche represents a distinct portion or installment of the total facility that can be drawn down separately.

Term loan tranche

A term loan tranche is a portion of the total loan facility, which represents the entire approved credit amount, divided into separate disbursements with specific terms and repayment schedules.

Drawdown schedule

The drawdown schedule specifies the timing and amounts of funds to be withdrawn from each tranche within a multi-tranche facility, ensuring coordinated cash flow management.

Loan allocation

Loan allocation is determined by assigning specific amounts to each facility based on its tranche structure, ensuring precise funding distribution within the overall credit arrangement.

Commitment amount

The commitment amount defines the total credit facility approved, while each tranche represents a portion of that facility disbursed under specific terms and conditions.

Disbursement

Disbursement refers to the actual release of funds from a facility, which is often divided into multiple tranches based on predefined conditions or milestones.

Facility agent

A facility agent manages the administrative and communication responsibilities between borrowers and lenders within a syndicated loan facility, coordinating multiple tranches to ensure accurate disbursement, repayment, and compliance with loan terms.

Amortization profile

The amortization profile of a facility outlines the repayment schedule and principal reduction for the entire loan, while each tranche within the facility may have distinct amortization terms and timelines tailored to specific disbursement conditions.

Rollover tranche

A rollover tranche refers to a portion of a financing facility that is extended or refinanced by creating a new tranche, allowing for continued or adjusted borrowing terms within the overall credit structure.

facility vs tranche Infographic

moneydif.com

moneydif.com