A first lien holds the highest priority in debt repayment, ensuring that the lender is compensated before any other creditors if the borrower defaults. In contrast, a second lien ranks below the first lien, meaning it is subordinate and only receives payment after the first lien is satisfied. This priority difference significantly affects the risk level and interest rates associated with each lien type.

Table of Comparison

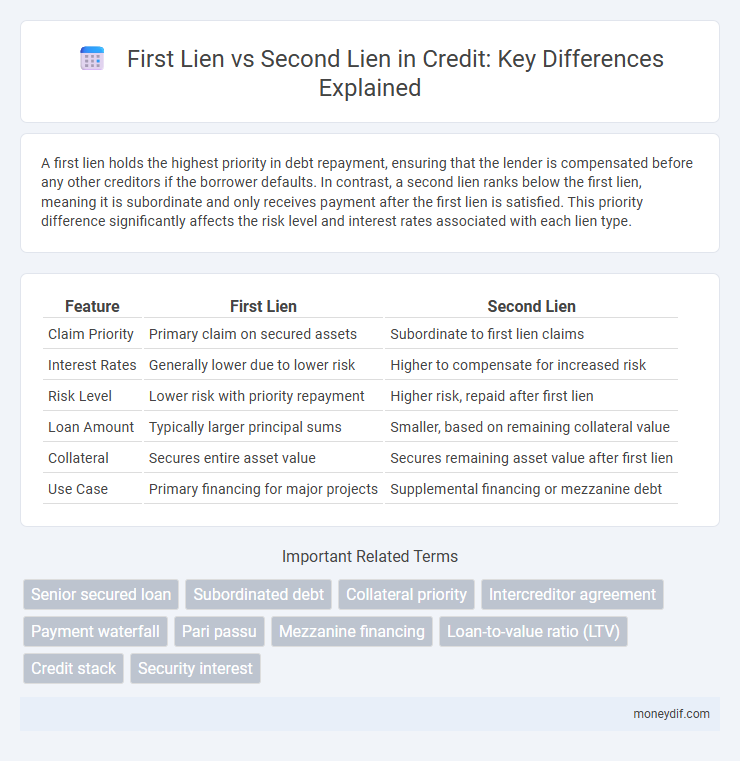

| Feature | First Lien | Second Lien |

|---|---|---|

| Claim Priority | Primary claim on secured assets | Subordinate to first lien claims |

| Interest Rates | Generally lower due to lower risk | Higher to compensate for increased risk |

| Risk Level | Lower risk with priority repayment | Higher risk, repaid after first lien |

| Loan Amount | Typically larger principal sums | Smaller, based on remaining collateral value |

| Collateral | Secures entire asset value | Secures remaining asset value after first lien |

| Use Case | Primary financing for major projects | Supplemental financing or mezzanine debt |

Understanding First Lien and Second Lien Loans

First lien loans hold the primary claim on a borrower's assets, granting lenders priority repayment in case of default, which reduces their risk and often results in lower interest rates. Second lien loans are subordinate to first lien loans, meaning they are repaid only after the first lien debt is fully satisfied, carrying higher risk and typically higher interest rates. Understanding the priority structure in lien positions is crucial for assessing credit risk and determining loan pricing.

Key Differences Between First Lien and Second Lien Credit

First lien credit holds the highest priority claim on collateral, ensuring repayment before second lien creditors in case of default. Second lien credit, subordinated to the first lien, carries higher risk and typically commands higher interest rates to compensate for this increased risk. The distinction impacts recovery rates, loan pricing, and borrower leverage capacity significantly.

Priority of Claims: First Lien vs Second Lien

First lien loans have the highest priority claim on a borrower's assets in the event of default or bankruptcy, ensuring they are repaid before any other creditors. Second lien loans are subordinate to first liens, meaning second lien holders are paid only after the first lien obligations are fully satisfied. This hierarchy affects recovery rates and risk assessment, making first lien debt typically less risky and lower cost compared to second lien debt.

Risk Factors: First Lien vs Second Lien Debt

First lien debt holds priority over second lien in claims on collateral during default, reducing risk exposure for first lien lenders. Second lien debt carries a higher risk due to its subordinate position, often resulting in higher interest rates to compensate for potential losses. Credit analysts emphasize collateral valuation, borrower creditworthiness, and market conditions to assess risk differences between first and second lien debt effectively.

Collateral Implications for First and Second Liens

First liens hold primary claim over collateral, granting lenders superior rights to seize and liquidate assets in the event of borrower default, ensuring higher recovery priority. Second liens are subordinate claims, meaning their collateral rights are secondary and typically only receive proceeds after first lien obligations are fully satisfied. This prioritization impacts loan pricing, risk assessment, and recovery strategies in credit agreements.

First Lien vs Second Lien: Impact on Interest Rates

First lien loans typically have lower interest rates compared to second lien loans due to their higher priority in the capital structure and reduced risk of loss in default scenarios. Second lien loans carry higher interest rates as compensation for increased risk, since they are subordinate to first lien debt and have lower recovery rates during bankruptcy. The interest rate spread between first and second liens reflects the risk premium lenders require for taking on subordinated claims.

Borrower Considerations for Choosing Lien Positions

Borrowers prioritize first lien loans for lower interest rates and stronger security due to senior claim on assets during default. Second lien loans offer higher financing flexibility and quicker access to capital but carry greater risk and cost because of subordinate priority. Evaluating cash flow stability, overall debt structure, and risk tolerance is essential when selecting lien positions to optimize borrowing costs and maintain control over financing terms.

Effects of Bankruptcy on First and Second Lien Holders

In bankruptcy, first lien holders have priority claims on the debtor's assets, allowing them to recover more value compared to second lien holders, whose claims are subordinate and paid only after first liens are satisfied. The recovery rate for second lien holders is typically lower, reflecting their increased risk and subordination in the capital structure. Bankruptcy proceedings often lead to renegotiation or restructuring of second lien debt, while first lien claims usually remain secured and enforceable, preserving creditor value.

Typical Use Cases for First Lien and Second Lien Financing

First lien financing is typically used for senior secured loans offering the lender the highest priority claim on assets, making it ideal for large-scale acquisitions and refinancing existing debt with lower risk profiles. Second lien financing often supports leveraged buyouts, growth capital, or recapitalizations where borrowers seek additional capital beyond first lien constraints despite higher interest rates and subordinate claims. Companies balance first and second lien debt to optimize capital structure, leveraging first lien for cost efficiency and second lien for flexible funding options.

Investor Perspectives: First Lien vs Second Lien Returns

First lien loans typically offer lower returns due to their senior claim on assets and higher security, attracting risk-averse investors seeking stable income. Second lien loans carry higher risk with subordinate repayment priority but compensate investors with elevated yields reflecting increased default risk exposure. Understanding the risk-return tradeoff is critical for credit investors when constructing diversified loan portfolios balancing security and return potential.

Important Terms

Senior secured loan

Senior secured loans with a first lien hold the highest priority claim on collateral and repayment in the event of borrower default, offering lower risk and typically lower interest rates. In contrast, second lien loans are subordinate to first liens, carry higher risk, and consequently demand higher yields to compensate for the increased credit exposure.

Subordinated debt

Subordinated debt ranks below first lien and second lien debts in the capital structure, meaning it carries higher risk and typically commands higher interest rates. While first lien debt has primary collateral claims and second lien holds secondary rights, subordinated debt is unsecured or backed by assets only after senior liens are fully satisfied.

Collateral priority

Collateral priority determines the order in which creditors are paid from the secured assets of a borrower, with the first lien holder having superior rights over the collateral compared to the second lien holder. In the event of default or liquidation, the first lien secures repayment before any funds are allocated to the second lien, significantly impacting recovery rates and risk assessments for lenders.

Intercreditor agreement

An intercreditor agreement establishes the rights and priorities between first lien and second lien creditors, defining the order of repayment and enforcement actions in default scenarios. This agreement mitigates conflicts by detailing control over collateral, standstill periods, and voting rights, ensuring clear hierarchies between senior secured debt and subordinated obligations.

Payment waterfall

Payment waterfall prioritizes allocations by distributing cash flows first to satisfy the first lien debt, ensuring senior creditors receive full repayment before any funds are allocated to second lien holders. This hierarchical structure protects first lien investors by reducing their risk exposure, while second lien debt bears higher risk but often commands higher interest rates.

Pari passu

Pari passu refers to the equal ranking and treatment of creditors, meaning first lien holders have primary claims with secured interests over specific assets, while second lien holders have subordinate claims that rank after the first lien in priority but often share similar terms regarding repayment. In cases of default or liquidation, the first lien creditors are paid in full before any distribution to second lien creditors, who rely on residual value and may face higher risk.

Mezzanine financing

Mezzanine financing typically ranks below first lien debt but above second lien debt in the capital structure, providing subordinate lenders with higher interest rates due to increased risk. First lien loans hold the highest priority claim on assets in default, while second lien loans and mezzanine financing absorb losses only after first lien creditors are fully repaid.

Loan-to-value ratio (LTV)

The loan-to-value ratio (LTV) measures the proportion of a property's value that is financed through a loan, with first lien loans typically having lower LTV ratios due to their primary claim on the collateral, while second lien loans often carry higher LTV ratios reflecting their subordinate position and increased risk. Lenders assess LTV in the context of first and second liens to determine risk exposure and set interest rates, with second lien loans generally facing stricter underwriting criteria and higher costs.

Credit stack

A credit stack consists of multiple layers of debt financing, where the first lien holds the highest priority claim on collateral and receives repayment before the second lien, which carries greater risk and typically commands higher interest rates. Understanding the hierarchy between first lien and second lien is crucial in structuring leverage and assessing credit risk in corporate or real estate financing.

Security interest

A first lien security interest holds primary claim over a debtor's collateral, ensuring priority in repayment over all subsequent liens. A second lien security interest is subordinate, receiving repayment only after the first lien is fully satisfied, increasing risk for second lienholders.

first lien vs second lien Infographic

moneydif.com

moneydif.com