Prime credit refers to borrowers with strong credit histories, low risk of default, and access to lower interest rates, while subprime credit involves higher-risk borrowers with weaker credit profiles who face higher interest rates and stricter lending conditions. Lenders often evaluate credit scores, income stability, and debt-to-income ratios to categorize applicants, influencing loan approval and terms. Understanding the differences between subprime and prime credit is essential for managing borrowing costs and financial planning.

Table of Comparison

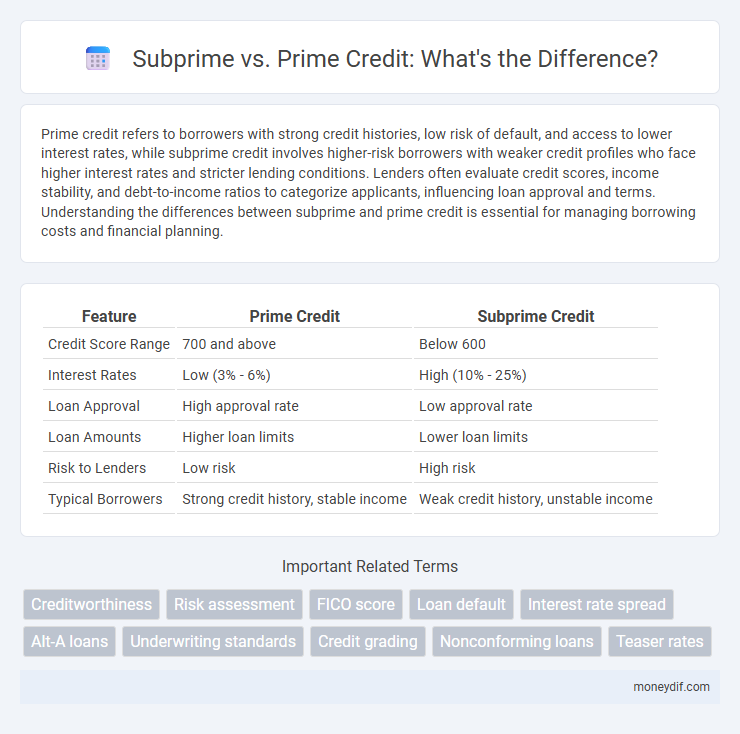

| Feature | Prime Credit | Subprime Credit |

|---|---|---|

| Credit Score Range | 700 and above | Below 600 |

| Interest Rates | Low (3% - 6%) | High (10% - 25%) |

| Loan Approval | High approval rate | Low approval rate |

| Loan Amounts | Higher loan limits | Lower loan limits |

| Risk to Lenders | Low risk | High risk |

| Typical Borrowers | Strong credit history, stable income | Weak credit history, unstable income |

Understanding Subprime and Prime Credit

Prime credit refers to borrowers with high credit scores, typically above 700, indicating a strong history of timely payments and low credit risk, which qualifies them for lower interest rates and favorable loan terms. Subprime credit involves borrowers with lower credit scores, often below 620, reflecting past credit challenges or limited credit history, resulting in higher interest rates and stricter loan conditions to offset increased risk. Understanding the distinctions between subprime and prime credit is crucial for lenders and borrowers to assess loan eligibility, risk factors, and debt management strategies effectively.

Key Differences Between Subprime and Prime Borrowers

Subprime borrowers typically have credit scores below 620 and higher default risk, resulting in elevated interest rates and stricter loan terms compared to prime borrowers with scores above 700. Prime borrowers benefit from better creditworthiness, lower interest rates, and more favorable repayment conditions due to their strong credit history and stable financial status. Lenders assess factors such as debt-to-income ratio and credit utilization to differentiate risk profiles between subprime and prime borrowers.

Credit Score Requirements: Subprime vs Prime

Credit score requirements distinguish subprime from prime borrowers, with prime typically requiring scores above 660, reflecting low credit risk. Subprime borrowers often fall below this threshold, usually scoring between 580 and 660, indicating higher risk and resulting in higher interest rates and less favorable loan terms. Lenders rely on these score ranges to assess creditworthiness and tailor loan offerings accordingly.

Loan Terms and Interest Rates Comparison

Subprime loans typically come with higher interest rates, ranging from 7% to 30%, compared to prime loans that usually offer rates between 3% and 7%, reflecting the increased risk associated with borrowers having lower credit scores. Loan terms for subprime credit often include stricter conditions, such as shorter repayment periods and higher fees, whereas prime borrowers benefit from more favorable terms, including longer repayment schedules and lower fees. Lenders price subprime loans to mitigate potential default risks, making costlier credit a significant factor in the subprime market.

Risk Factors in Subprime and Prime Lending

Subprime lending involves higher risk factors due to borrowers' low credit scores, unstable income, and higher debt-to-income ratios, increasing the likelihood of default. Prime lending targets borrowers with strong credit histories, stable employment, and low debt levels, resulting in lower credit risk and better loan performance. Interest rates and loan terms differ significantly, reflecting the varying risk profiles between subprime and prime borrowers.

Impact on Borrowers’ Financial Health

Subprime borrowers face higher interest rates compared to prime borrowers, resulting in increased monthly payments and greater financial strain. This elevated cost often leads to a higher risk of default and damaged credit scores among subprime borrowers. Prime borrowers benefit from lower rates, which supports better debt management and overall financial stability.

Lender Perspectives: Subprime vs Prime

Lenders view prime borrowers as low-risk, offering them lower interest rates and favorable credit terms due to strong credit scores and reliable payment histories. In contrast, subprime borrowers carry higher default risk, prompting lenders to charge elevated interest rates and impose stricter lending criteria to mitigate potential losses. Risk assessment models prioritize creditworthiness indicators, influencing loan approval rates and pricing strategies in prime versus subprime credit markets.

Common Types of Subprime and Prime Loans

Subprime loans typically include high-interest personal loans, credit cards, and adjustable-rate mortgages designed for borrowers with lower credit scores, reflecting higher default risk. Prime loans consist mainly of conventional fixed-rate mortgages, auto loans, and credit cards offered to borrowers with strong credit histories and stable income. Understanding the distinctions in loan types helps lenders assess credit risk and tailor interest rates accordingly.

Pros and Cons for Borrowers

Subprime credit offers access to loans for borrowers with low credit scores but comes with higher interest rates and stricter repayment terms, increasing overall borrowing costs. Prime credit provides lower interest rates and more favorable loan conditions due to higher creditworthiness, though qualification standards are tougher and may exclude riskier borrowers. Borrowers must weigh the immediate accessibility of subprime loans against the long-term financial benefits and reduced risk associated with prime credit.

How to Move from Subprime to Prime Credit

Improving credit from subprime to prime involves consistent on-time payments, reducing outstanding debt, and maintaining a low credit utilization ratio below 30%. Monitoring credit reports to dispute inaccuracies and diversifying credit types, such as installment loans and secured credit cards, also strengthen credit profiles. Establishing longer credit history and avoiding new credit inquiries boost credit scores, positioning borrowers for prime credit eligibility.

Important Terms

Creditworthiness

Creditworthiness assessment differentiates subprime borrowers with lower credit scores and higher default risk from prime borrowers who exhibit strong credit profiles and reliable repayment histories.

Risk assessment

Risk assessment in lending differentiates subprime borrowers by higher default probability and lower credit scores compared to prime borrowers with stronger creditworthiness and lower default risk.

FICO score

FICO scores below 620 typically classify borrowers as subprime, indicating higher credit risk, while scores above 700 generally denote prime borrowers with better creditworthiness and access to favorable loan terms.

Loan default

Loan default rates are significantly higher among subprime borrowers compared to prime borrowers due to weaker credit profiles and increased financial instability.

Interest rate spread

Interest rate spreads between subprime and prime loans often exceed 3-5 percentage points, reflecting higher default risk and credit costs associated with subprime borrowers.

Alt-A loans

Alt-A loans, positioned between prime and subprime, target borrowers with moderate credit risk by offering loans that are riskier than prime but less risky than subprime mortgages.

Underwriting standards

Underwriting standards for prime loans require higher credit scores and lower debt-to-income ratios, while subprime underwriting accepts lower credit scores and higher risk profiles to approve borrowers.

Credit grading

Credit grading categorizes borrowers into prime and subprime based on creditworthiness, with prime borrowers having higher credit scores and lower default risk, while subprime borrowers exhibit lower scores and higher risk.

Nonconforming loans

Nonconforming loans, often categorized as subprime due to lower creditworthiness and higher risk compared to prime loans, typically feature higher interest rates and less favorable terms reflecting increased default potential.

Teaser rates

Teaser rates, often higher risk due to subprime borrowers' lower credit scores, contrast with prime rates that reflect more stable, low-risk credit profiles.

subprime vs prime Infographic

moneydif.com

moneydif.com