Forbearance and deferment are two options for temporarily postponing loan payments, but they differ in key ways. Forbearance allows you to pause or reduce payments during financial hardship, often accruing interest on both subsidized and unsubsidized loans. Deferment typically applies to specific situations such as enrollment in school or active military duty and may allow subsidized loans to not accrue interest during the deferment period.

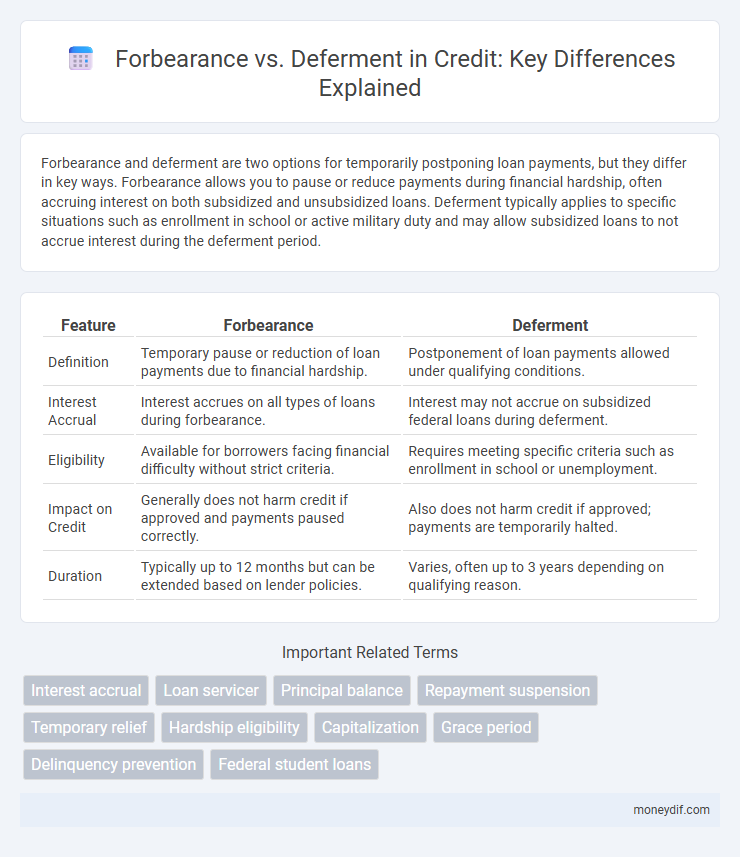

Table of Comparison

| Feature | Forbearance | Deferment |

|---|---|---|

| Definition | Temporary pause or reduction of loan payments due to financial hardship. | Postponement of loan payments allowed under qualifying conditions. |

| Interest Accrual | Interest accrues on all types of loans during forbearance. | Interest may not accrue on subsidized federal loans during deferment. |

| Eligibility | Available for borrowers facing financial difficulty without strict criteria. | Requires meeting specific criteria such as enrollment in school or unemployment. |

| Impact on Credit | Generally does not harm credit if approved and payments paused correctly. | Also does not harm credit if approved; payments are temporarily halted. |

| Duration | Typically up to 12 months but can be extended based on lender policies. | Varies, often up to 3 years depending on qualifying reason. |

Understanding Forbearance and Deferment in Credit

Forbearance and deferment are two credit relief options that temporarily pause or reduce loan payments during financial hardships. Forbearance allows borrowers to stop or lower payments, but interest typically continues to accrue, increasing the overall loan balance. Deferment also pauses payments, often without accruing interest on subsidized loans, making it a preferred option when eligible for federal student loans.

Key Differences Between Forbearance and Deferment

Forbearance allows temporary suspension or reduction of loan payments due to financial hardship, often without interest waivers on unsubsidized loans. Deferment also pauses loan payments but typically requires the borrower to meet specific criteria, such as enrollment in school or active military duty, and may provide interest subsidies on certain federal student loans. The key difference lies in eligibility conditions and how interest accrues during the suspension period, impacting overall loan cost.

When to Choose Forbearance Over Deferment

Forbearance is ideal when borrowers face temporary financial hardships but do not qualify for deferment, such as during periods of reduced income or medical emergencies. Unlike deferment, which often requires specific eligibility criteria like enrollment in school or active military service, forbearance provides broader relief by allowing payment pauses or reductions without strict qualification. Choosing forbearance over deferment helps maintain loan status and avoid default when immediate repayment is not feasible.

Pros and Cons of Forbearance

Forbearance allows temporary relief from loan payments by pausing or reducing monthly amounts, preserving credit standing but often leading to accrued interest that increases total repayment costs. It is beneficial for borrowers facing short-term financial hardships as it prevents default and credit damage but can extend the loan term and raise the overall balance due to unpaid interest capitalization. Unlike deferment, forbearance generally accrues interest on all loan types, making it less favorable for cost-conscious borrowers aiming to minimize debt growth.

Pros and Cons of Deferment

Deferment allows borrowers to temporarily pause or reduce loan payments, often beneficial for avoiding default during financial hardship or enrollment in school. Interest may continue to accrue on certain loan types during deferment, potentially increasing the total repayment amount. This option provides flexibility but can result in higher long-term costs compared to maintaining regular payments.

Eligibility Requirements for Forbearance and Deferment

Forbearance eligibility typically requires borrowers to demonstrate financial hardship, medical expenses, or military service, allowing temporary suspension or reduction of loan payments. Deferment eligibility is generally limited to specific situations such as enrollment in school at least half-time, active military duty, or economic hardship programs, where interest may not accrue on certain loan types during deferment. Both options require application through the loan servicer with supporting documentation to prove qualifying circumstances.

Impact on Credit Score: Forbearance vs. Deferment

Forbearance allows temporary suspension or reduction of loan payments but interest often continues to accrue, potentially increasing the overall loan balance and mildly impacting credit scores if reported. Deferment pauses both payments and interest accumulation on certain loans, generally presenting a neutral effect on credit scores when reported correctly. Timely communication with lenders during either option helps minimize negative credit implications and maintain creditworthiness.

How Interest Accumulates During Forbearance and Deferment

Interest accumulates differently during forbearance and deferment periods on credit accounts. In forbearance, interest continues to accrue on both subsidized and unsubsidized loans, increasing the total loan balance over time. In contrast, during deferment, interest typically does not accrue on subsidized loans but accrues on unsubsidized loans, affecting the overall cost depending on the loan type.

Application Process: Forbearance vs. Deferment

The forbearance application process typically requires borrowers to submit a detailed request to their loan servicer, demonstrating financial hardship or temporary inability to make payments, often supported by documentation such as income statements or medical records. Deferment applications usually involve submitting specific eligibility documentation, like enrollment verification for student deferments or unemployment proof, to qualify for paused payments without accruing interest on subsidized loans. Both processes require timely submission and approval by the loan servicer, but deferment approval often hinges on meeting precise criteria, whereas forbearance decisions are more discretionary.

Long-Term Financial Implications of Forbearance and Deferment

Forbearance and deferment both provide temporary relief from loan payments, but their long-term financial implications differ significantly. Interest typically accrues during forbearance, increasing the total amount owed and extending repayment duration, while deferment often allows interest to be waived on subsidized loans, minimizing additional costs. Borrowers should carefully evaluate how each option affects loan balance growth and overall repayment timelines to make informed decisions that protect long-term financial health.

Important Terms

Interest accrual

Interest accrual continues during forbearance periods, increasing the total loan balance, whereas interest may be temporarily suspended during deferment for qualifying federal student loans.

Loan servicer

Loan servicers manage borrower accounts by processing forbearance, which temporarily reduces or pauses payments due to financial hardship, and deferment, which delays payments while typically suspending interest accrual on certain federal student loans.

Principal balance

The principal balance remains unchanged during forbearance, whereas deferment may allow interest to capitalize, increasing the principal balance.

Repayment suspension

Repayment suspension options like forbearance and deferment temporarily stop or reduce loan payments, but forbearance may accrue interest on all loan types while deferment often allows interest to be waived on subsidized loans. Borrowers should evaluate eligibility criteria and long-term cost implications to choose between forbearance, which applies during financial hardship, or deferment, which usually requires specific qualifying circumstances such as enrollment in school or active military duty.

Temporary relief

Temporary relief options such as forbearance suspend or reduce loan payments without penalty, while deferment postpones payments and may also pause interest accrual on qualifying federal student loans.

Hardship eligibility

Hardship eligibility for forbearance allows temporary suspension or reduction of loan payments with accumulating interest, while deferment permits postponement without interest accrual on subsidized loans.

Capitalization

Capitalization of interest during forbearance increases the loan principal, whereas deferment often allows interest to remain unpaid without capitalization.

Grace period

A grace period provides temporary relief from loan payments, while forbearance allows suspension or reduction of payments due to financial hardship, and deferment postpones payments often based on qualifying criteria like enrollment status.

Delinquency prevention

Forbearance and deferment are key delinquency prevention tools that temporarily pause or reduce loan payments, helping borrowers avoid default by alleviating financial stress during hardship.

Federal student loans

Federal student loans offer both forbearance and deferment options to temporarily postpone or reduce payments, with deferment generally preferred because interest does not accrue on subsidized loans during this period. Forbearance allows borrowers facing financial hardship to pause payments but interest continues to accumulate on all loan types, potentially increasing the total repayment amount.

forbearance vs deferment Infographic

moneydif.com

moneydif.com