Loan syndication involves multiple lenders jointly providing a single loan to a borrower, sharing the risk and resources, while loan participation allows one lender to originate the loan and then sell portions of it to other investors to spread risk. Syndicated loans typically feature a lead arranger who negotiates terms and manages the process, whereas loan participation depends on the original lender maintaining the borrower relationship. Both methods help financial institutions diversify exposure and extend larger credit facilities to borrowers.

Table of Comparison

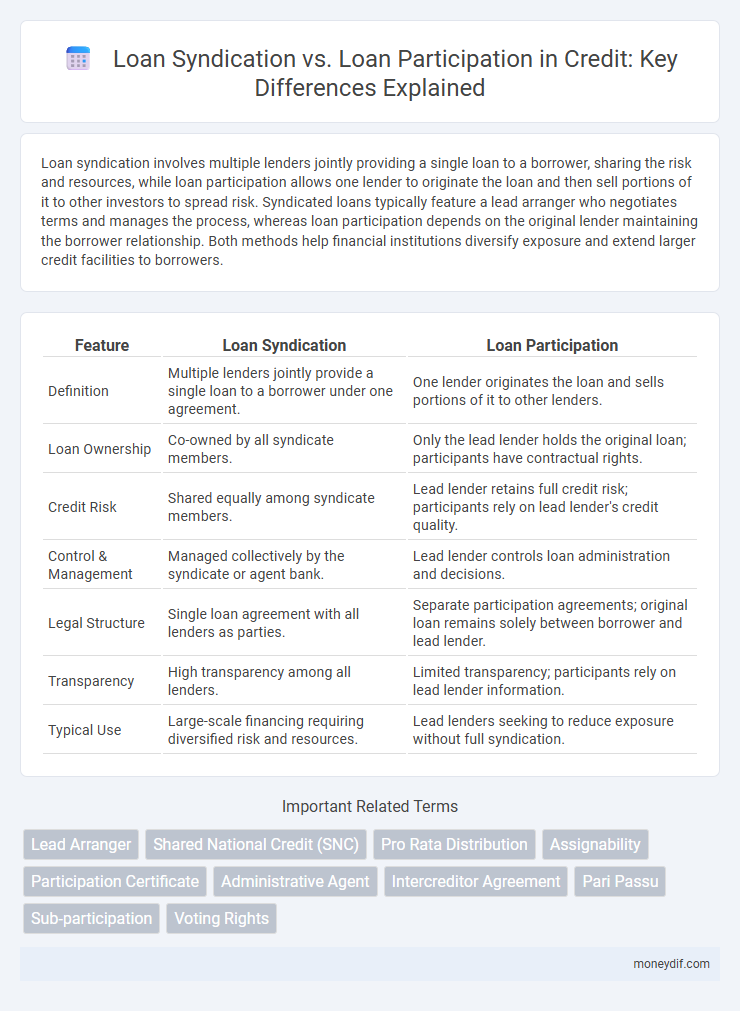

| Feature | Loan Syndication | Loan Participation |

|---|---|---|

| Definition | Multiple lenders jointly provide a single loan to a borrower under one agreement. | One lender originates the loan and sells portions of it to other lenders. |

| Loan Ownership | Co-owned by all syndicate members. | Only the lead lender holds the original loan; participants have contractual rights. |

| Credit Risk | Shared equally among syndicate members. | Lead lender retains full credit risk; participants rely on lead lender's credit quality. |

| Control & Management | Managed collectively by the syndicate or agent bank. | Lead lender controls loan administration and decisions. |

| Legal Structure | Single loan agreement with all lenders as parties. | Separate participation agreements; original loan remains solely between borrower and lead lender. |

| Transparency | High transparency among all lenders. | Limited transparency; participants rely on lead lender information. |

| Typical Use | Large-scale financing requiring diversified risk and resources. | Lead lenders seeking to reduce exposure without full syndication. |

Introduction to Loan Syndication and Loan Participation

Loan syndication involves multiple lenders collaborating to fund a single large loan, distributing risk while providing substantial capital to the borrower. Loan participation, by contrast, allows a lead lender to originate a loan and then sell portions of it to other investors, spreading credit exposure without direct borrower interaction from participants. Both mechanisms enhance lending capacity and risk management within the credit market, with syndication focusing on joint origination and participation emphasizing loan investment sharing.

Key Definitions: Syndicated vs Participated Loans

Syndicated loans involve a group of lenders jointly providing a large loan to a single borrower, sharing both risk and administrative responsibilities through a lead arranger. Participated loans occur when a primary lender originates the loan and then sells portions of the credit exposure to additional participants without transferring the loan's administration. Unlike loan participation, syndication facilitates collective decision-making and risk distribution among multiple lenders from the outset of the transaction.

Structural Differences Between Loan Syndication and Participation

Loan syndication involves a lead bank structuring, underwriting, and distributing portions of a large loan to multiple lenders, creating a contractual relationship directly between each lender and the borrower. In loan participation, the lead bank originates the entire loan and then sells participation interests to other lenders without establishing direct borrower-lender contracts for each participant. These structural differences affect risk distribution, legal responsibilities, and the level of control lenders have over loan administration.

Roles and Responsibilities of Lenders

In loan syndication, the lead lender structures and manages the loan while distributing portions to participant lenders, who primarily provide capital without direct involvement in loan administration. Participant lenders in loan participation assume credit risk proportionate to their share but rely on the lead lender for monitoring and servicing the loan. This delineation of roles ensures efficient risk distribution and centralized loan management.

Risk Sharing Mechanisms Explained

Loan syndication involves multiple lenders jointly providing a large loan to a single borrower, spreading credit risk equitably among participants based on their respective loan shares. Loan participation allows one lender to sell portions of an existing loan to other financial institutions, transferring credit risk while the original lender retains the loan servicing responsibilities. Both mechanisms enhance risk diversification by distributing exposure, but syndication typically involves more direct borrower-lender relationships, whereas participation focuses on liquidity and risk transfer among lenders.

Legal and Documentation Aspects

Loan syndication involves a lead lender coordinating with multiple lenders under a single loan agreement, which centralizes legal documentation and standardizes terms for all participants, ensuring uniform obligations and rights. Loan participation entails a primary lender extending portions of its loan to other lenders through separate agreements, requiring distinct documentation that often limits direct legal recourse by participants against the borrower. The legal framework in syndication emphasizes collective borrower-lender relationships with joint liability provisions, whereas participation agreements focus on contractual relationships primarily between the lead lender and participants.

Benefits of Loan Syndication

Loan syndication offers diversified risk distribution among multiple lenders, reducing individual exposure and enhancing credit capacity for large borrowers. It provides access to larger funding amounts and improved loan terms due to combined lender expertise and market reach. Enhanced borrower-lender relationships and streamlined administration are key advantages compared to loan participation.

Advantages of Loan Participation

Loan participation offers increased flexibility by allowing multiple lenders to share portions of a single loan, reducing individual exposure and diversifying risk efficiently. It enables smaller financial institutions to access larger, more lucrative loans otherwise exclusive to major banks. This method also streamlines administrative processes by designating a lead lender, simplifying communication and servicing for participants.

Common Use Cases and Industry Applications

Loan syndication commonly involves multiple lenders collaborating to fund large-scale projects such as infrastructure development, energy, and real estate, distributing risk across financial institutions. Loan participation typically serves secondary market purposes, enabling smaller banks to share portions of loans originated by lead banks in sectors like commercial real estate and corporate financing. Both structures optimize capital allocation and risk management in industries requiring substantial financing beyond individual lender capacity.

Choosing the Right Approach: Factors to Consider

Loan syndication involves multiple lenders jointly providing a loan to a single borrower, allowing risk sharing and larger financing amounts, whereas loan participation lets one lender originate the loan and sell portions of the credit to others, maintaining loan administration control. Key factors to consider when choosing between syndication and participation include the desired level of control over the loan, risk distribution preferences, borrower relationship management, and regulatory requirements. Assessing the size of the loan facility, complexity of the credit, and administrative capabilities will guide lenders in selecting the most appropriate financing structure to optimize portfolio diversification and credit exposure.

Important Terms

Lead Arranger

Lead arranger plays a crucial role in loan syndication by structuring, underwriting, and distributing the loan among multiple lenders to spread risk and ensure funding. Unlike loan participation where a lead lender sells portions of an existing loan to investors, the lead arranger actively organizes the initial loan agreement and terms for the syndicated credit facility.

Shared National Credit (SNC)

Shared National Credit (SNC) programs involve syndicated loans where multiple lenders jointly underwrite a single large loan, distributing credit risk among participants. Loan syndication differs from loan participation as syndication entails co-lenders sharing the same loan agreement, while loan participation involves a lead lender selling portions of a loan to other institutions without multiple direct agreements.

Pro Rata Distribution

Pro Rata Distribution in loan syndication refers to allocating loan repayments among syndicate members based on their share of the total loan commitment, ensuring proportional risk and return distribution. In contrast, loan participation involves a lead lender originating the loan and selling portions to participants without direct borrower relationships, where repayment flows through the lead lender, affecting the pro rata distribution dynamics.

Assignability

Assignability in loan syndication allows the original lender to transfer their interest in the entire loan facility to another party, maintaining the original loan agreement terms. In contrast, loan participation involves a lead lender selling portions of the loan exposure to participants without transferring the underlying borrower relationship or restructural consent rights.

Participation Certificate

A Participation Certificate represents an investor's share in a loan syndication, allowing multiple lenders to collectively finance a single borrower while sharing the associated risks and returns; it differs from loan participation where individual lenders purchase portions of an existing loan directly from the lead lender without creating a new loan agreement. Loan syndication typically involves an arranged syndicated loan with a coordinated structure, whereas loan participation is a secondary market activity transferring interests without altering the original loan terms.

Administrative Agent

An Administrative Agent manages the loan syndication process by coordinating communication between the syndicate lender group and the borrower, overseeing loan documentation, and ensuring compliance with terms. In contrast, loan participation involves a participant lender buying portions of an existing loan without direct management responsibility, leaving the Administrative Agent to solely administer the syndication.

Intercreditor Agreement

An Intercreditor Agreement governs the rights and priorities among multiple lenders involved in loan syndication, ensuring a clear hierarchy of claims and coordination during default or restructuring. In contrast, loan participation involves a primary lender selling portions of the loan to participants without changing the original lending relationship, often lacking a formal Intercreditor Agreement between participants.

Pari Passu

Pari passu ensures all lenders in a loan syndication share equal rights and repayment priority, preventing any creditor from gaining preferential treatment. In contrast, loan participation involves a lead lender selling portions of the loan to participants who do not hold direct contractual obligations, potentially creating varying risk exposures and priority levels among participants.

Sub-participation

Sub-participation involves a lender selling participation interests in a loan to one or more participants without transferring the loan agreement itself, commonly used in loan syndication to distribute risk among multiple financial institutions. Unlike loan participation, where the lead bank remains the lender of record, sub-participation often keeps the original lender's credit exposure off the participants' balance sheets, optimizing credit risk management.

Voting Rights

Voting rights in loan syndication typically grant lenders proportional influence over decisions affecting the loan terms, whereas loan participation often limits participants to economic benefits without direct voting power. Syndicated lenders collectively negotiate amendments and resolutions, while participants rely on the lead bank's voting authority, impacting control and risk management in syndicated lending structures.

loan syndication vs loan participation Infographic

moneydif.com

moneydif.com