A Credit Shelter Trust and a Bypass Trust both serve to maximize estate tax exemptions by sheltering assets for beneficiaries. The Credit Shelter Trust holds and protects assets up to the estate tax exemption amount, allowing the surviving spouse to access income without increasing the taxable estate. A Bypass Trust similarly avoids estate tax upon the second death by bypassing the surviving spouse's estate, ensuring that the trust assets pass to heirs tax-free.

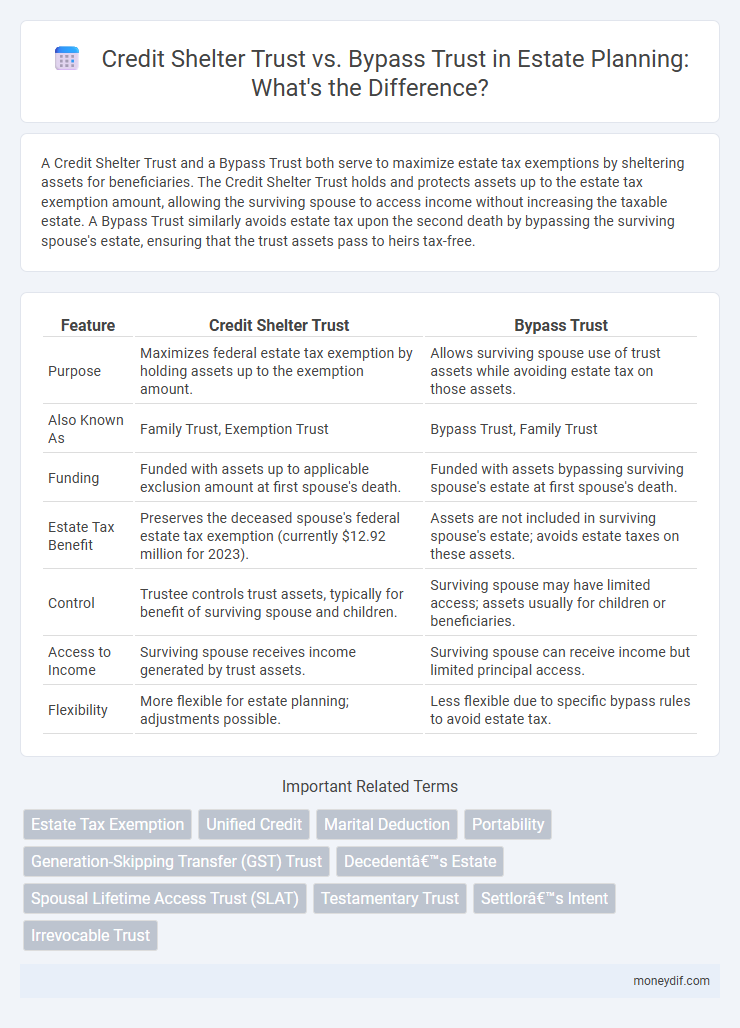

Table of Comparison

| Feature | Credit Shelter Trust | Bypass Trust |

|---|---|---|

| Purpose | Maximizes federal estate tax exemption by holding assets up to the exemption amount. | Allows surviving spouse use of trust assets while avoiding estate tax on those assets. |

| Also Known As | Family Trust, Exemption Trust | Bypass Trust, Family Trust |

| Funding | Funded with assets up to applicable exclusion amount at first spouse's death. | Funded with assets bypassing surviving spouse's estate at first spouse's death. |

| Estate Tax Benefit | Preserves the deceased spouse's federal estate tax exemption (currently $12.92 million for 2023). | Assets are not included in surviving spouse's estate; avoids estate taxes on these assets. |

| Control | Trustee controls trust assets, typically for benefit of surviving spouse and children. | Surviving spouse may have limited access; assets usually for children or beneficiaries. |

| Access to Income | Surviving spouse receives income generated by trust assets. | Surviving spouse can receive income but limited principal access. |

| Flexibility | More flexible for estate planning; adjustments possible. | Less flexible due to specific bypass rules to avoid estate tax. |

Understanding Credit Shelter Trusts

Credit shelter trusts, also known as bypass trusts, are estate planning tools designed to maximize the use of a deceased spouse's estate tax exemption by sheltering assets from estate taxes upon the second spouse's death. These trusts hold assets up to the federal estate tax exemption limit, allowing the surviving spouse to benefit from the trust income without increasing the taxable estate. Proper utilization of credit shelter trusts can significantly reduce estate tax liability while ensuring financial security for the surviving spouse.

What Is a Bypass Trust?

A bypass trust, also known as a credit shelter trust, is a legal arrangement used in estate planning to maximize federal estate tax exemptions for married couples. It allows a deceased spouse's assets to be transferred into the trust, bypassing the surviving spouse's taxable estate and thus reducing overall estate taxes. This trust ensures that assets up to the estate tax exemption limit can be preserved and passed to beneficiaries without incurring additional estate taxes.

Key Differences Between Credit Shelter and Bypass Trusts

Credit shelter trusts and bypass trusts both aim to minimize estate taxes by utilizing the estate tax exemption of the first spouse to die. The key difference lies in control and timing; credit shelter trusts typically allow the surviving spouse limited access to principal and income without disqualifying assets from the estate tax exemption, while bypass trusts provide beneficiaries, often children, direct future access to trust assets after the surviving spouse's death. These structural distinctions affect estate tax planning strategies, beneficiary rights, and asset protection outcomes.

How Credit Shelter Trusts Work

Credit shelter trusts work by allowing married couples to maximize their estate tax exemptions by placing assets up to the exemption limit into the trust upon the first spouse's death, ensuring those assets are shielded from estate taxes. The trust holds these assets for the surviving spouse's benefit without including them in the surviving spouse's taxable estate, thereby preserving the exemption amount for the couple's heirs. This strategy helps reduce overall estate taxes while providing income and principal access to the surviving spouse under the trust terms.

Purpose and Benefits of Bypass Trusts

Bypass trusts are estate planning tools designed to minimize estate taxes by utilizing the federal estate tax exemption of the first deceased spouse, effectively preserving assets for the surviving spouse and beneficiaries. These trusts safeguard the estate's value by preventing assets from being included in the surviving spouse's estate, thereby reducing overall tax liability upon their death. Benefits include enhanced control over asset distribution, protection from creditors, and ensuring long-term financial security for heirs.

Tax Implications: Credit Shelter vs Bypass Trust

Credit shelter trusts and bypass trusts both serve to minimize estate taxes by utilizing the decedent's estate tax exemption. A credit shelter trust allows the surviving spouse to benefit from the trust assets while sheltering the exempt amount from estate taxes upon the second death. In contrast, a bypass trust removes the assets from the surviving spouse's estate entirely, preventing those assets from being taxed again, thus maximizing tax savings for heirs.

Estate Planning Strategies Using Both Trusts

Credit shelter trusts and bypass trusts function to maximize estate tax exemptions by holding assets that pass tax-free to beneficiaries, often a surviving spouse and subsequently children. Utilizing both trusts in estate planning allows for strategic allocation of assets to minimize estate taxes while providing income and control for the surviving spouse without increasing the taxable estate. Combining these trusts ensures efficient transfer of wealth, preserves the marital deduction, and protects family assets from estate tax liabilities.

Eligibility and Setup Requirements

Credit shelter trusts and bypass trusts both protect estate tax exemptions, but eligibility for each depends on the marital status of the grantor; credit shelter trusts require a married couple where one spouse passes away, while bypass trusts specifically apply to bypassing estate tax upon the first spouse's death. Setup requirements for credit shelter trusts involve allocating the deceased spouse's estate tax exemption into the trust to preserve it for beneficiaries, whereas bypass trusts necessitate creating a separate irrevocable trust that holds assets up to the exemption limit to shelter them from estate taxes. Both trusts demand careful legal drafting to comply with IRS rules and maximize estate tax benefits for married couples.

Pros and Cons of Credit Shelter Trusts

Credit shelter trusts maximize estate tax exemptions by allowing a surviving spouse to utilize the deceased spouse's unused federal estate tax exclusion, preserving wealth for heirs. They offer asset protection from creditors and control over asset distribution but limit the surviving spouse's access to trust assets, potentially causing liquidity issues. Managing trust complexity and administrative costs are additional considerations when choosing a credit shelter trust.

Choosing the Right Trust for Your Estate Plan

A credit shelter trust leverages the federal estate tax exemption to maximize wealth transfer without incurring estate taxes, while a bypass trust primarily protects the surviving spouse's exemption and provides asset control. Choosing the right trust depends on factors such as the size of the estate, state tax laws, and the desired level of control over asset distribution. Incorporating a credit shelter trust is ideal for minimizing estate taxes in larger estates, whereas a bypass trust offers flexibility in managing assets and coordinating with a spouse's estate plan.

Important Terms

Estate Tax Exemption

Estate tax exemption allows individuals to transfer assets up to a specified limit without incurring federal estate taxes, making credit shelter trusts and bypass trusts effective tools to maximize this benefit. Both trusts utilize the estate tax exemption by placing the deceased spouse's exempted amount into a trust, preserving it for heirs while minimizing estate tax liability on the surviving spouse's estate.

Unified Credit

Unified Credit allows individuals to transfer a specific exemption amount from estate and gift taxes, enabling the effective use of Credit Shelter Trusts to maximize tax benefits without triggering estate taxes. Bypass Trusts, commonly funded by the unified credit, protect the unused exemption amount by holding assets separate from the surviving spouse's estate, thereby preserving wealth for heirs and minimizing tax liability.

Marital Deduction

The Marital Deduction allows unlimited transfers of assets to a surviving spouse free of federal estate tax, while a Credit Shelter Trust (CST) utilizes the deceased spouse's estate tax exemption to protect assets from taxation upon the surviving spouse's death. A Bypass Trust, often synonymous with a Credit Shelter Trust, functions to bypass the surviving spouse's estate, preserving the estate tax exemption for future generations and minimizing overall estate taxes.

Portability

Portability allows a surviving spouse to inherit the decedent's unused federal estate tax exemption, simplifying estate planning compared to a bypass trust, which requires complex drafting to maximize exemptions. Credit shelter trusts lock in the deceased spouse's exemption but lack portability's flexibility, making portability advantageous for easily transferring estate tax benefits without creating separate trusts.

Generation-Skipping Transfer (GST) Trust

A Generation-Skipping Transfer (GST) Trust is designed to skip the immediate next generation and transfer assets directly to grandchildren or later descendants, minimizing estate tax exposure across multiple generations. Unlike Credit Shelter or Bypass Trusts that primarily protect assets from estate tax between spouses, GST Trusts specifically address the GST tax by utilizing the GST tax exemption to preserve wealth over several generations.

Decedent’s Estate

A Decedent's Estate involves managing and distributing assets after death, where a Credit Shelter Trust and a Bypass Trust are estate planning tools designed to minimize estate taxes by utilizing the federal estate tax exemption. Both trusts allow survivors to inherit assets tax-free up to the exemption limit, but a Credit Shelter Trust holds assets up to the exemption for the surviving spouse's benefit without increasing the taxable estate, while a Bypass Trust bypasses the surviving spouse's estate to further reduce estate taxes for future beneficiaries.

Spousal Lifetime Access Trust (SLAT)

A Spousal Lifetime Access Trust (SLAT) enables one spouse to create an irrevocable trust for the benefit of the other, providing estate tax advantages and indirect access to trust assets, differing from a Credit Shelter Trust (CST) or Bypass Trust that primarily maximizes the estate tax exemption by preserving the decedent's exclusion amount for the surviving spouse. Unlike CSTs, which activate at death to shelter assets from estate taxes, SLATs are established during the grantor's lifetime for long-term wealth transfer, offering more flexible financial planning opportunities.

Testamentary Trust

A Testamentary Trust is a trust established through a will and activated upon the testator's death, often used to manage assets for beneficiaries; Credit Shelter Trusts and Bypass Trusts are specialized types designed to maximize estate tax exemptions by directing assets up to the federal estate tax exemption toward the trust. Credit Shelter Trusts protect the deceased spouse's exemption to shelter assets from estate taxes, while Bypass Trusts specifically bypass the surviving spouse's estate to reduce overall estate tax liability.

Settlor’s Intent

Settlor's intent is critical in distinguishing between Credit Shelter Trusts and Bypass Trusts, as it determines how estate assets are allocated to maximize tax exemptions and protect beneficiaries. Clear expression of the settlor's intent ensures proper funding of each trust type, optimizing the use of the federal estate tax exemption and preserving wealth for heirs.

Irrevocable Trust

An Irrevocable Trust is a legal arrangement that permanently transfers assets out of the grantor's estate, often used in Credit Shelter Trusts or Bypass Trusts to minimize estate taxes by sheltering the estate tax exemption. Both trust types function similarly by allowing the surviving spouse to benefit from the assets while ensuring that the remaining trust property bypasses the surviving spouse's estate, preserving the exemption for heirs.

Credit shelter trust vs Bypass trust Infographic

moneydif.com

moneydif.com