Hard inquiries occur when a lender reviews your credit report as part of a loan or credit application, potentially lowering your credit score temporarily. Soft inquiries happen when you or a company checks your credit report without your active application, such as for pre-approved offers, and do not affect your credit score. Understanding the difference helps manage credit health by minimizing unnecessary hard inquiries.

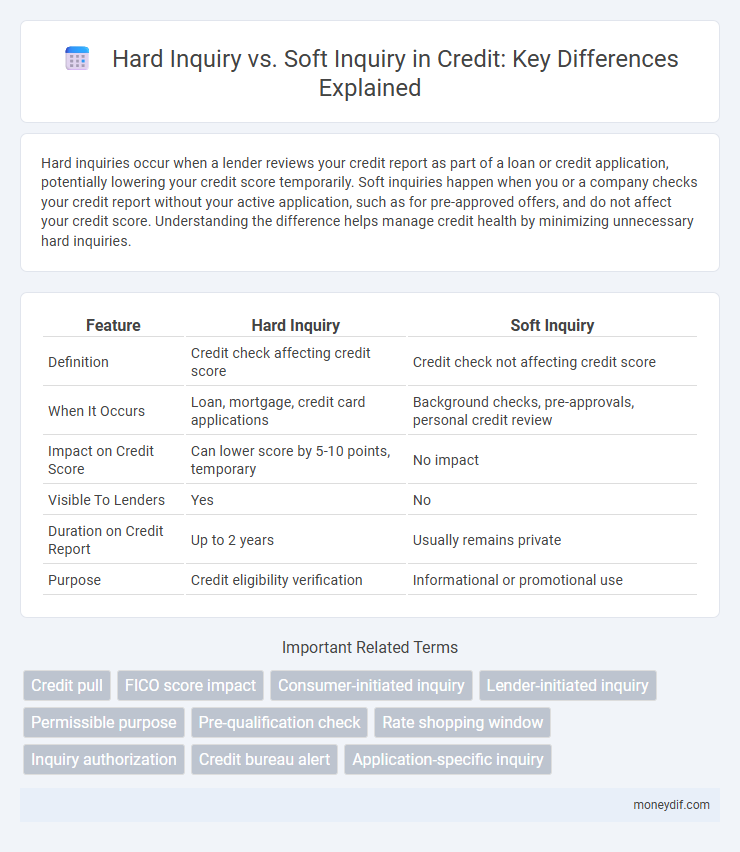

Table of Comparison

| Feature | Hard Inquiry | Soft Inquiry |

|---|---|---|

| Definition | Credit check affecting credit score | Credit check not affecting credit score |

| When It Occurs | Loan, mortgage, credit card applications | Background checks, pre-approvals, personal credit review |

| Impact on Credit Score | Can lower score by 5-10 points, temporary | No impact |

| Visible To Lenders | Yes | No |

| Duration on Credit Report | Up to 2 years | Usually remains private |

| Purpose | Credit eligibility verification | Informational or promotional use |

Understanding Hard and Soft Credit Inquiries

Hard credit inquiries occur when a lender or creditor reviews your credit report as part of a loan or credit application, potentially impacting your credit score. Soft credit inquiries, often initiated by you or companies for pre-approval offers, do not affect your credit rating and remain visible only to you. Differentiating between hard and soft inquiries is essential for managing credit health and understanding how various checks influence your creditworthiness.

What Triggers a Hard Inquiry?

Hard inquiries occur when a lender or creditor checks your credit report as part of a decision to extend credit, such as applying for a mortgage, auto loan, or credit card. These inquiries are triggered by your explicit consent during applications for new credit or when refinancing existing debt. Hard inquiries can slightly impact your credit score because they indicate potential new debt and increased credit risk.

Common Scenarios for Soft Inquiries

Soft inquiries commonly occur during pre-approval offers for credit cards or loans, where lenders assess potential risk without impacting credit scores. Employers conducting background checks and landlords verifying tenant credit also trigger soft inquiries, as they require a credit snapshot without affecting creditworthiness. Checking your own credit report or score through credit monitoring services is another frequent example of a soft inquiry.

Impact of Hard Inquiries on Credit Scores

Hard inquiries occur when a lender reviews your credit report for a lending decision, typically lowering your credit score by a few points temporarily. Multiple hard inquiries within a short period, such as 14 to 45 days, are often treated as a single inquiry for mortgage or auto loan applications, minimizing their combined impact on credit scores. Unlike hard inquiries, soft inquiries do not affect your credit score because they are made for background checks or pre-approved offers without your explicit application.

Do Soft Inquiries Affect Your Credit?

Soft inquiries do not affect your credit score because they are not linked to credit approval processes and only appear on your credit report visible to you. Examples include checking your own credit or pre-approved credit offers, ensuring no negative impact on your creditworthiness. Unlike hard inquiries, soft inquiries neither decrease credit scores nor influence lending decisions.

How Long Do Credit Inquiries Stay on Your Report?

Hard inquiries typically remain on your credit report for two years but only impact your credit score for up to one year, while soft inquiries do not affect your credit score and often stay on your report for up to two years without being visible to lenders. Monitoring the duration of these inquiries helps maintain an accurate understanding of credit health and can influence decisions when applying for new credit. Regularly reviewing your credit report ensures any unauthorized hard inquiries are identified and addressed promptly, protecting your credit profile.

Managing Hard and Soft Inquiries Effectively

Hard inquiries occur when lenders check your credit for loan approval, potentially lowering your credit score, while soft inquiries do not impact your score and are often used for background checks or pre-approvals. Managing hard inquiries involves spacing out credit applications to minimize score impact and only applying when necessary, whereas monitoring soft inquiries regularly helps detect unauthorized activity without affecting your credit health. Using credit monitoring tools allows you to track both inquiry types, ensuring accurate reporting and better control over your credit profile.

Examples of Hard vs Soft Credit Checks

Hard inquiries occur when lenders review your credit report for decisions on loans, credit cards, or mortgages, such as applying for a new credit card or an auto loan. Soft inquiries happen during background checks, pre-approved credit offers, or personal credit monitoring, like employers reviewing credit reports or individuals checking their own credit scores. Understanding the impact of these inquiries is crucial since hard inquiries can temporarily lower credit scores, whereas soft inquiries have no effect.

How to Monitor Credit Inquiries

Monitoring credit inquiries involves regularly checking your credit report from major credit bureaus such as Experian, Equifax, and TransUnion to identify both hard and soft inquiries. Use free services like AnnualCreditReport.com to obtain your reports and set up alerts with credit monitoring tools to track new inquiries in real time. Keeping an eye on credit inquiries helps detect unauthorized hard pulls that can impact your credit score and ensures that soft inquiries remain for informational purposes only.

Tips to Minimize Credit Score Impact

Limit hard inquiries by applying for credit sparingly and only when necessary since each hard inquiry can lower your credit score by a few points temporarily. Monitor your credit report regularly to spot unauthorized hard inquiries and dispute them promptly, protecting your score from unnecessary damage. Use soft inquiries for pre-qualification checks or personal credit review, as they do not affect your credit score and help minimize negative impacts.

Important Terms

Credit pull

Hard inquiries occur when a lender or creditor requests your credit report for lending decisions, potentially lowering your credit score by a few points and staying on your report for up to two years. Soft inquiries, often initiated by you or for pre-approved offers, do not affect your credit score and remain visible only to you on your credit report.

FICO score impact

A hard inquiry on a credit report, typically triggered by applications for loans, credit cards, or mortgages, can slightly reduce a FICO score by a few points and remain on the report for up to two years. Conversely, soft inquiries, such as personal credit checks or pre-approved offers, do not affect the FICO score and are only visible to the consumer, not potential lenders.

Consumer-initiated inquiry

Consumer-initiated inquiries occur when individuals request their own credit reports, generating soft inquiries that do not impact credit scores, whereas hard inquiries result from lender-initiated requests for credit approval and can slightly lower credit scores. Understanding the distinction between hard inquiry versus soft inquiry is crucial for managing credit health and ensuring responsible financial behavior.

Lender-initiated inquiry

Lender-initiated inquiries, classified as hard inquiries, occur when a lender checks a borrower's credit report as part of a loan application process, potentially impacting the credit score. Soft inquiries, by contrast, are made without the borrower's active application and do not affect credit scores, often used for pre-approval or background checks.

Permissible purpose

Permissible purpose refers to the legitimate reasons allowed by the Fair Credit Reporting Act (FCRA) for accessing a consumer's credit report, impacting whether a hard inquiry or soft inquiry is generated. Hard inquiries occur during credit applications requiring consumer authorization, potentially affecting credit scores, while soft inquiries are often for pre-qualification or background checks and do not impact credit ratings.

Pre-qualification check

Pre-qualification checks typically involve a soft inquiry, which does not impact the applicant's credit score, whereas hard inquiries occur during formal credit applications and can slightly lower the credit score due to their detailed review of credit reports. Understanding the distinction between hard and soft inquiries is essential for managing credit health and ensuring optimal approval chances.

Rate shopping window

The rate shopping window is a designated period, typically 14 to 45 days, during which multiple credit inquiries for the same type of loan are treated as a single hard inquiry by credit scoring models, minimizing the impact on credit scores. Hard inquiries occur when lenders check credit for loan underwriting, slightly lowering scores, while soft inquiries, such as pre-approvals or personal credit checks, do not affect credit scores within or outside the rate shopping window.

Inquiry authorization

Inquiry authorization determines whether a credit check results in a hard inquiry, impacting credit scores, or a soft inquiry, which does not affect credit ratings. Hard inquiries occur with explicit consumer permission during applications for credit cards, loans, or mortgages, while soft inquiries happen during background checks or pre-approved offers without impacting creditworthiness.

Credit bureau alert

A credit bureau alert notifies consumers of hard inquiries, which occur when a lender checks credit for loan approval, potentially lowering credit scores due to multiple such inquiries in a short period. Soft inquiries, including checks made by companies for pre-approved offers or personal credit reviews, do not impact credit scores and are only visible to the individual consumer.

Application-specific inquiry

An application-specific inquiry, also known as a hard inquiry, occurs when a lender reviews a consumer's credit report as part of a loan or credit application process, potentially lowering the credit score by a few points. Soft inquiries, in contrast, occur without the consumer's application, such as during background checks or pre-approved credit offers, and do not impact credit scores.

Hard inquiry vs Soft inquiry Infographic

moneydif.com

moneydif.com