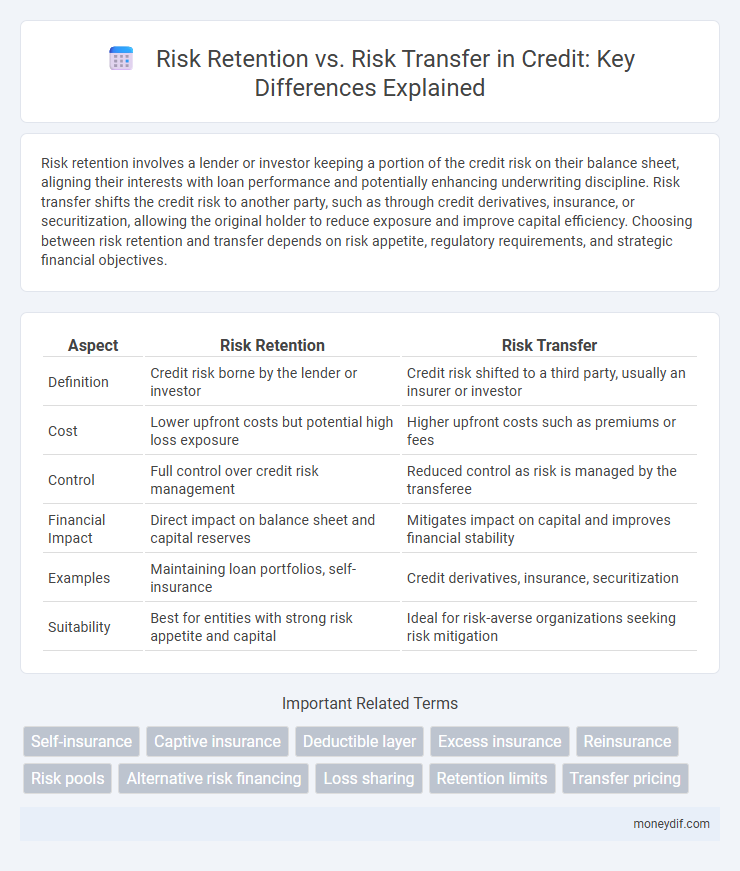

Risk retention involves a lender or investor keeping a portion of the credit risk on their balance sheet, aligning their interests with loan performance and potentially enhancing underwriting discipline. Risk transfer shifts the credit risk to another party, such as through credit derivatives, insurance, or securitization, allowing the original holder to reduce exposure and improve capital efficiency. Choosing between risk retention and transfer depends on risk appetite, regulatory requirements, and strategic financial objectives.

Table of Comparison

| Aspect | Risk Retention | Risk Transfer |

|---|---|---|

| Definition | Credit risk borne by the lender or investor | Credit risk shifted to a third party, usually an insurer or investor |

| Cost | Lower upfront costs but potential high loss exposure | Higher upfront costs such as premiums or fees |

| Control | Full control over credit risk management | Reduced control as risk is managed by the transferee |

| Financial Impact | Direct impact on balance sheet and capital reserves | Mitigates impact on capital and improves financial stability |

| Examples | Maintaining loan portfolios, self-insurance | Credit derivatives, insurance, securitization |

| Suitability | Best for entities with strong risk appetite and capital | Ideal for risk-averse organizations seeking risk mitigation |

Understanding Risk Retention and Risk Transfer in Credit

Risk retention in credit involves a lender or investor maintaining a portion of the credit risk on their balance sheet, ensuring alignment of interests and incentivizing thorough credit assessment. Risk transfer shifts credit risk to third parties, such as through credit derivatives or insurance products, allowing institutions to mitigate potential losses and improve capital efficiency. Effective management of risk retention and transfer strategies enhances portfolio resilience and regulatory compliance in lending practices.

Key Differences Between Risk Retention and Risk Transfer

Risk retention involves a party assuming the financial responsibility for potential losses, whereas risk transfer shifts that burden to a third party, such as an insurer. The key differences lie in control and cost management: risk retention offers greater control over risk handling but requires sufficient capital reserves, while risk transfer reduces direct exposure by paying premiums to mitigate risk. Organizations balance these strategies based on risk appetite, financial capacity, and regulatory requirements to optimize credit risk management.

Benefits of Risk Retention in Credit Management

Risk retention in credit management allows institutions to maintain greater control over credit portfolios, improving decision-making through direct exposure to risk outcomes. It enhances the ability to accurately price credit risk by leveraging proprietary data and models, leading to more tailored credit products and competitive advantage. Retaining risk also aligns incentives between lenders and borrowers, fostering stronger relationships and potentially reducing default rates over time.

Advantages of Risk Transfer in Credit Strategies

Risk transfer in credit strategies significantly reduces exposure to potential defaults by shifting the credit risk to third parties such as insurers or capital markets, enhancing financial stability. This approach improves capital allocation efficiency by freeing up regulatory capital, allowing institutions to undertake additional lending or investment activities. Moreover, risk transfer mechanisms like credit derivatives or securitization provide flexibility and diversification, mitigating concentration risk in credit portfolios.

Factors Influencing the Choice: Retain or Transfer Credit Risk

Credit risk management decisions hinge on factors such as the lender's risk appetite, capital requirements, and regulatory constraints. The borrower's creditworthiness, loan portfolio diversification, and economic conditions also critically impact whether institutions choose to retain or transfer credit risk. Market availability of credit derivatives, cost of risk transfer, and potential impact on financial statements further shape the strategic approach to managing credit exposure.

Common Methods of Credit Risk Retention

Common methods of credit risk retention include securitization with a required subordinated tranche, where originators retain a portion of the credit risk to align interests with investors. Another prevalent technique is the use of recourse agreements, allowing lenders to retain liability for credit losses on transferred assets. Additionally, loan syndication often involves shared credit risk retention among participating lenders to mitigate individual exposure.

Popular Approaches to Credit Risk Transfer

Popular approaches to credit risk transfer include securitization, credit derivatives such as credit default swaps (CDS), and loan sales. Securitization pools various loans into tradable securities, dispersing risk among investors, while CDS provide protection against credit events by allowing risk holders to transfer exposure to counterparties. Loan sales directly transfer credit risk by selling debt obligations to third parties, enabling originators to manage capital requirements and improve liquidity.

Impact on Financial Stability: Risk Retention vs Risk Transfer

Risk retention enhances financial stability by aligning the interests of creditors and borrowers, reducing moral hazard and encouraging prudent lending practices. In contrast, risk transfer can increase systemic risk by dispersing credit exposures among multiple parties, potentially obscuring the true risk levels and leading to greater vulnerability during economic downturns. Effective balance between risk retention and risk transfer is crucial for maintaining resilience in the credit market and preventing cascading financial failures.

Regulatory Considerations in Credit Risk Management

Regulatory considerations in credit risk management emphasize strict adherence to risk retention rules, mandating financial institutions to hold a defined percentage of credit risk to align interests with borrowers and investors. Risk transfer mechanisms, such as credit derivatives or securitization, must comply with Basel III and Dodd-Frank Act requirements, ensuring transparency and minimizing systemic risk. Regulatory frameworks demand comprehensive risk assessment and reporting to prevent regulatory arbitrage and maintain capital adequacy ratios effectively.

Best Practices for Balancing Risk Retention and Risk Transfer in Credit

Effective risk management in credit involves identifying an optimal balance between risk retention and risk transfer to enhance portfolio resilience. Employing data-driven credit scoring models and maintaining adequate capital reserves can improve risk retention strategies, while utilizing credit derivatives and insurance products facilitates risk transfer to third parties. Regular portfolio stress testing and monitoring help adjust risk retention thresholds and transfer mechanisms dynamically based on market conditions and credit performance metrics.

Important Terms

Self-insurance

Self-insurance involves risk retention by deliberately assuming potential losses internally rather than transferring them to an external insurer through risk transfer.

Captive insurance

Captive insurance enables businesses to optimize risk retention by self-insuring specific exposures while balancing risk transfer through reinsurance to manage financial uncertainty effectively.

Deductible layer

The deductible layer represents the amount of risk an insured retains before risk transfer to the insurer begins, influencing the balance between risk retention and risk transfer strategies.

Excess insurance

Excess insurance provides additional coverage above a primary policy, facilitating risk transfer by limiting the insurer's exposure while encouraging policyholders to retain initial losses up to a specified retention limit.

Reinsurance

Reinsurance strategically balances risk retention and risk transfer by allowing insurers to cede portions of risk to reinsurers, optimizing capital management and enhancing financial stability.

Risk pools

Risk pools aggregate risks from multiple participants to lower individual exposure, optimizing the balance between risk retention and risk transfer strategies.

Alternative risk financing

Alternative risk financing empowers organizations to balance risk retention and risk transfer by utilizing self-funding mechanisms, captive insurance, and risk pooling strategies to optimize financial resilience and cost efficiency.

Loss sharing

Loss sharing balances financial exposure by distributing risks between risk retention, where entities keep potential losses, and risk transfer, where losses are passed to third parties such as insurers.

Retention limits

Retention limits define the maximum amount of risk an insurer retains before transferring excess risk to reinsurers, balancing risk retention and risk transfer strategies for optimal financial protection.

Transfer pricing

Transfer pricing strategies must carefully balance risk retention and risk transfer to ensure compliance with tax regulations and optimize the allocation of financial risks among related entities.

risk retention vs risk transfer Infographic

moneydif.com

moneydif.com