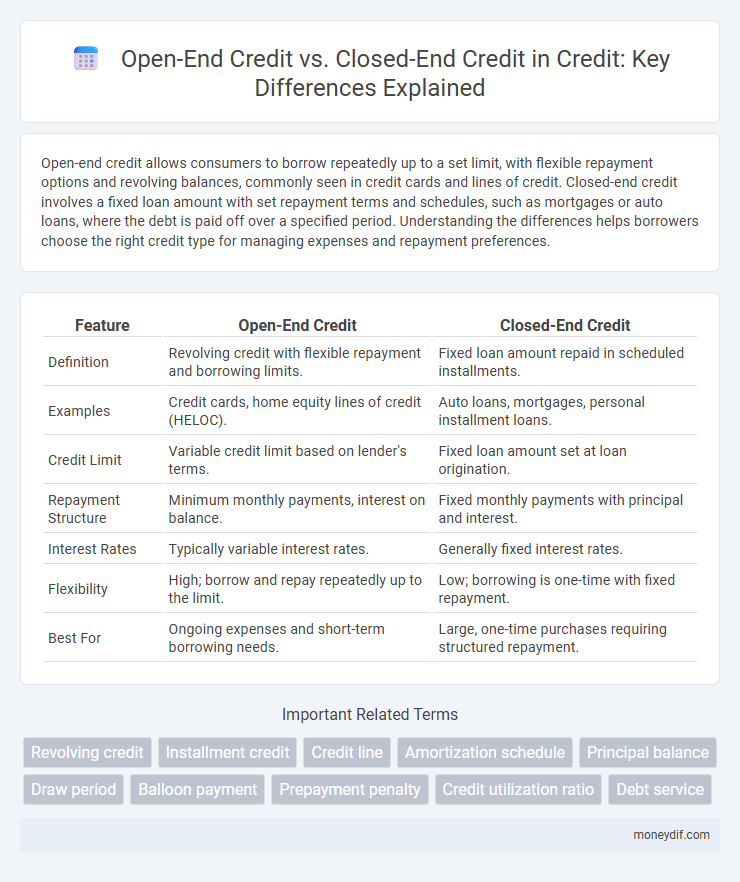

Open-end credit allows consumers to borrow repeatedly up to a set limit, with flexible repayment options and revolving balances, commonly seen in credit cards and lines of credit. Closed-end credit involves a fixed loan amount with set repayment terms and schedules, such as mortgages or auto loans, where the debt is paid off over a specified period. Understanding the differences helps borrowers choose the right credit type for managing expenses and repayment preferences.

Table of Comparison

| Feature | Open-End Credit | Closed-End Credit |

|---|---|---|

| Definition | Revolving credit with flexible repayment and borrowing limits. | Fixed loan amount repaid in scheduled installments. |

| Examples | Credit cards, home equity lines of credit (HELOC). | Auto loans, mortgages, personal installment loans. |

| Credit Limit | Variable credit limit based on lender's terms. | Fixed loan amount set at loan origination. |

| Repayment Structure | Minimum monthly payments, interest on balance. | Fixed monthly payments with principal and interest. |

| Interest Rates | Typically variable interest rates. | Generally fixed interest rates. |

| Flexibility | High; borrow and repay repeatedly up to the limit. | Low; borrowing is one-time with fixed repayment. |

| Best For | Ongoing expenses and short-term borrowing needs. | Large, one-time purchases requiring structured repayment. |

Understanding Open-End Credit

Open-end credit allows borrowers to access a revolving line of credit up to a predetermined limit, enabling repeated borrowing and repayment cycles without reapplying for credit. This type of credit includes credit cards and home equity lines of credit, offering flexibility in borrowing amounts and payment schedules. Understanding the variable interest rates and minimum payment requirements associated with open-end credit is essential for effective financial management.

Defining Closed-End Credit

Closed-end credit refers to a type of loan with a fixed amount that borrowers must repay in regular installments over a specified period, such as mortgages, auto loans, and personal loans. The borrower receives the full loan amount upfront and agrees to a predetermined repayment schedule, which includes principal and interest, ensuring predictable payment terms. Unlike open-end credit, closed-end credit does not allow additional borrowing once the initial loan is disbursed, emphasizing structured repayment and financial planning.

Key Differences Between Open-End and Closed-End Credit

Open-end credit, such as credit cards, allows borrowers to repeatedly access a revolving credit line up to a set limit without reapplying, while closed-end credit involves a one-time loan amount with fixed payments, like a mortgage or auto loan. Interest rates on open-end credit can be variable and fluctuate based on credit card terms, whereas closed-end credit typically features fixed or pre-determined interest rates over the loan term. Open-end credit offers flexibility and ongoing borrowing capacity, contrasting with closed-end credit's structured repayment schedule and fixed loan duration.

Common Examples of Open-End Credit

Common examples of open-end credit include credit cards, home equity lines of credit (HELOCs), and store charge accounts, all of which allow borrowers to repeatedly access funds up to a predetermined credit limit. These credit types enable flexible repayment schedules and revolving balances, contrasting with the fixed amounts and fixed repayment terms of closed-end credit such as auto loans and mortgages. Open-end credit is widely used for ongoing expenses due to its convenience and ability to accommodate fluctuating borrowing needs.

Typical Uses of Closed-End Credit

Closed-end credit is commonly used for major purchases such as automobiles, real estate, and home improvements, where borrowers receive a lump sum and repay it over a fixed term. Mortgage loans and auto loans exemplify closed-end credit due to their structured payment schedules and defined loan amount. This type of credit provides predictability and often lower interest rates compared to open-end credit, making it suitable for large, planned expenses.

Advantages of Open-End Credit

Open-end credit offers flexibility by allowing borrowers to repeatedly access funds up to a preset limit without reapplying each time, making it ideal for ongoing expenses and emergencies. It enables users to manage cash flow efficiently through revolving balances and minimum payments, often accompanied by lower interest rates compared to closed-end credit. The convenience of timely access and potential rewards programs enhance the overall financial control and satisfaction associated with open-end credit.

Benefits of Closed-End Credit

Closed-end credit offers predictable repayment schedules and fixed interest rates, providing borrowers with clear financial obligations and reducing the risk of accumulating unexpected debt. This credit type is ideal for large purchases like mortgages or auto loans, as it fosters disciplined budgeting through set term lengths. Lenders favor closed-end credit due to its structured repayment plan, which lowers default risk and often results in lower interest rates for consumers.

Risks Associated with Open-End Credit

Open-end credit, such as credit cards, entails higher risks due to the potential for accumulating uncontrolled debt and variable interest rates that can increase repayment burdens. Borrowers may face compounding interest on outstanding balances, leading to extended debt periods and reduced financial flexibility. Unlike closed-end credit, which has fixed payments and terms, open-end credit requires vigilant management to avoid cycles of borrowing and increased risk of credit score damage.

Potential Drawbacks of Closed-End Credit

Closed-end credit often comes with rigid repayment schedules that can strain borrowers' financial flexibility and increase the risk of default. High penalties for late payments and limited options for early payoff can escalate the overall cost of borrowing. The fixed nature of closed-end credit limits the borrower's ability to adjust access to new funds, unlike open-end credit which offers revolving access based on credit limits.

Choosing Between Open-End and Closed-End Credit

Selecting between open-end and closed-end credit depends on your borrowing needs and repayment flexibility. Open-end credit, such as credit cards, allows repeated borrowing up to a set limit and offers ongoing access to funds with variable payments, ideal for managing fluctuating expenses. Closed-end credit, like auto loans or mortgages, provides a fixed loan amount with a set repayment schedule, suited for large, one-time purchases requiring structured payments.

Important Terms

Revolving credit

Revolving credit allows borrowers to access a preset credit limit repeatedly as they repay outstanding balances, unlike closed-end credit which involves a fixed loan amount paid in installments over a set term. Common examples of revolving credit include credit cards and home equity lines of credit, whereas closed-end credit examples encompass auto loans and mortgages.

Installment credit

Installment credit allows borrowers to repay a fixed amount over a set period, distinguishing it as a closed-end credit with predefined terms and a scheduled payoff date. In contrast, open-end credit, such as credit cards, offers revolving borrowing limits without fixed repayment schedules, allowing continuous borrowing and repayment flexibility.

Credit line

Credit lines are typically associated with open-end credit, allowing borrowers to access funds repeatedly up to a set limit and make flexible payments over time, unlike closed-end credit which provides a fixed loan amount that must be repaid in full by a specified date. Open-end credit products include credit cards and home equity lines of credit (HELOCs), offering ongoing borrowing options, whereas closed-end credit includes auto loans and mortgages with predetermined repayment schedules.

Amortization schedule

An amortization schedule for open-end credit, such as credit cards, varies due to fluctuating balances and payment amounts, whereas closed-end credit, like auto loans or mortgages, features a fixed amortization schedule with consistent payments reducing both principal and interest over a set term. Understanding the differences in amortization schedules helps borrowers manage repayment strategies effectively for varying credit types.

Principal balance

Principal balance represents the original amount borrowed that remains unpaid, influencing interest calculations for both open-end and closed-end credit. In open-end credit, the principal balance fluctuates as cardholders borrow and repay repeatedly, while in closed-end credit, the principal balance steadily decreases with fixed periodic payments until fully repaid.

Draw period

The draw period in open-end credit, such as home equity lines of credit (HELOCs), allows borrowers to withdraw funds up to a set limit and make interest-only payments, contrasting with closed-end credit where the entire loan amount is disbursed upfront and repaid in fixed installments over a fixed term. Open-end credit offers flexibility during the draw period, whereas closed-end credit requires structured repayment without additional borrowing after the initial disbursement.

Balloon payment

A balloon payment is a large, lump-sum payment due at the end of a loan term, commonly associated with closed-end credit where the borrower repays a fixed amount over time followed by a final substantial payment. Open-end credit typically involves revolving balances without balloon payments, allowing borrowers to pay variable amounts without a predetermined large final installment.

Prepayment penalty

A prepayment penalty is a fee charged to borrowers who pay off their loans early, more commonly associated with closed-end credit such as mortgages and auto loans, since these loans have fixed terms and principal amounts. Open-end credit accounts, like credit cards and home equity lines of credit (HELOCs), typically do not impose prepayment penalties due to their revolving, flexible balance structures.

Credit utilization ratio

Credit utilization ratio measures the percentage of available open-end credit, such as credit cards and lines of credit, that a borrower is currently using, directly impacting credit scores by reflecting short-term borrowing behavior. Closed-end credit, including installment loans like mortgages and auto loans, does not affect credit utilization ratio but influences credit profiles through payment history and loan term adherence.

Debt service

Debt service for open-end credit, such as credit cards and lines of credit, typically varies with outstanding balances and interest rates, leading to fluctuating monthly payments. Closed-end credit, including auto loans and mortgages, features fixed repayment schedules with consistent principal and interest payments over the loan term, ensuring predictable debt service costs.

open-end credit vs closed-end credit Infographic

moneydif.com

moneydif.com