Non-performing loans (NPLs) are loans on which borrowers have failed to make scheduled payments for a significant period, indicating a high risk of default. Restructured loans, by contrast, involve modifications to the original loan terms, such as reduced interest rates or extended repayment periods, aimed at improving the borrower's ability to repay. The key difference lies in the borrower's repayment status: NPLs represent deteriorated credit quality, while restructured loans reflect attempts to rehabilitate troubled debt.

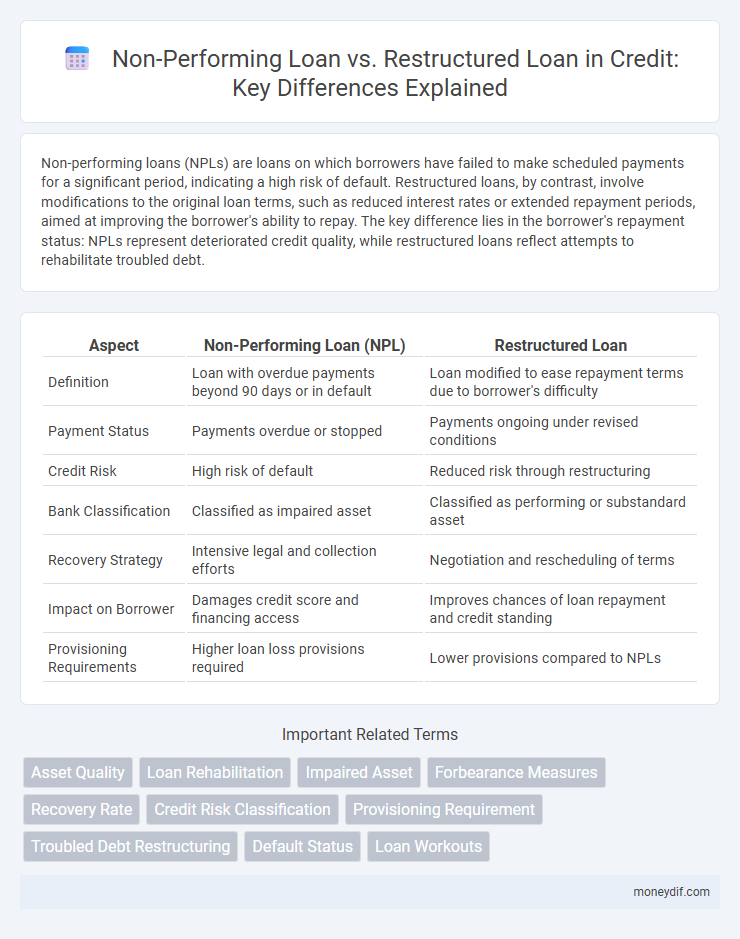

Table of Comparison

| Aspect | Non-Performing Loan (NPL) | Restructured Loan |

|---|---|---|

| Definition | Loan with overdue payments beyond 90 days or in default | Loan modified to ease repayment terms due to borrower's difficulty |

| Payment Status | Payments overdue or stopped | Payments ongoing under revised conditions |

| Credit Risk | High risk of default | Reduced risk through restructuring |

| Bank Classification | Classified as impaired asset | Classified as performing or substandard asset |

| Recovery Strategy | Intensive legal and collection efforts | Negotiation and rescheduling of terms |

| Impact on Borrower | Damages credit score and financing access | Improves chances of loan repayment and credit standing |

| Provisioning Requirements | Higher loan loss provisions required | Lower provisions compared to NPLs |

Definition of Non-Performing Loans

Non-performing loans (NPLs) are credit facilities where the borrower has failed to make scheduled interest or principal payments for a period typically exceeding 90 days, indicating significant credit risk and potential default. Restructured loans, by contrast, involve modified terms agreed upon by the lender and borrower to improve repayment prospects and avoid classification as non-performing. The definition of NPLs is critical for financial institutions to assess asset quality, allocate provisions, and maintain regulatory compliance under banking supervision frameworks.

What Are Restructured Loans?

Restructured loans are credit agreements modified by lenders to provide more flexible repayment terms for borrowers experiencing financial difficulties, aiming to prevent default and reduce non-performing loans (NPLs) on balance sheets. Common restructuring measures include extending the loan tenure, reducing interest rates, or adjusting the principal amount, thereby improving the borrower's ability to meet obligations. Restructured loans remain classified as performing assets if the borrower adheres to the revised terms, distinguishing them from non-performing loans that represent defaults or impaired credit.

Key Differences: NPL vs Restructured Loan

Non-performing loans (NPLs) are loans in default or close to default, typically classified as overdue for 90 days or more, reflecting a borrower's inability to meet original repayment terms. Restructured loans involve modifying the original loan agreement--such as extending repayment periods or reducing interest rates--to improve the borrower's ability to repay and avoid classification as NPL. The key difference lies in status; NPLs indicate financial distress or default, while restructured loans represent proactive adjustments aimed at loan recovery and risk mitigation.

Causes of Non-Performing Loans

Non-performing loans (NPLs) arise from borrowers' inability to meet original loan terms due to factors such as economic downturns, poor credit assessment, and business failures. Restructured loans involve modifying repayment schedules to prevent loans from becoming non-performing by improving borrower cash flow. Understanding the causes of NPLs enables financial institutions to implement effective risk management and minimize credit losses.

Criteria for Loan Restructuring

Loan restructuring criteria typically include borrower's financial distress, repayment capacity, and potential for recovery, essential for converting non-performing loans into viable assets. Financial institutions assess factors such as the borrower's credit history, current cash flow, and collateral value to determine eligibility for restructuring. Clear documentation of revised payment terms, interest rates, and timeline modifications ensures transparency and regulatory compliance in loan restructuring processes.

Impact on Bank Balance Sheets

Non-performing loans (NPLs) directly reduce asset quality by increasing loan loss provisions, leading to lower bank profitability and weakened capital ratios. Restructured loans, while temporarily off the NPL list, carry higher credit risk and often require ongoing monitoring, affecting risk-weighted assets and regulatory capital. Both NPLs and restructured loans strain bank balance sheets by limiting lending capacity and increasing potential write-offs.

Regulatory Framework for NPLs and Restructured Loans

The regulatory framework for non-performing loans (NPLs) mandates specific provisioning requirements and asset classification criteria to ensure financial institutions maintain adequate capital buffers against potential losses. Restructured loans, while still under close regulatory scrutiny, often benefit from tailored guidelines allowing temporary relief measures such as extended repayment terms or reduced interest rates to enhance borrower recovery prospects. Compliance with these regulations aims to stabilize the banking sector by mitigating systemic risks associated with loan defaults and improving the quality of the loan portfolio.

Risk Assessment: Non-Performing vs Restructured Loans

Non-performing loans (NPLs) pose a higher credit risk due to prolonged default and uncertain recovery prospects, often signaling severe borrower distress. Restructured loans, while indicating financial difficulty, reflect negotiated terms aimed at improving repayment capacity and reducing default risk. Accurate risk assessment requires analyzing loan status, repayment history, and restructuring terms to distinguish between potential recovery and probable loss exposure.

Recovery Strategies for NPLs

Non-performing loans (NPLs) require tailored recovery strategies focused on asset valuation, borrower engagement, and legal enforcement to mitigate credit losses effectively. Restructured loans involve modifying loan terms to improve the borrower's repayment capacity, often including interest rate adjustments, extended tenors, or principal haircuts, enhancing the likelihood of recovery. Implementing proactive monitoring and early warning systems accelerates intervention, minimizing loan default risks and optimizing recovery outcomes.

Future Trends in Loan Restructuring

Future trends in loan restructuring indicate a growing preference for proactive management of non-performing loans (NPLs) through tailored restructuring plans that enhance recoverability and borrower viability. Advancements in digital analytics and AI-driven credit risk assessment tools are enabling lenders to identify potential NPLs early and implement customized repayment solutions that mitigate losses. Regulatory frameworks are evolving to encourage transparent communication and standardized restructuring practices, promoting financial stability and improved asset quality across banking portfolios.

Important Terms

Asset Quality

Asset quality reflects the overall health of a loan portfolio, with non-performing loans (NPLs) indicating debt obligations that are in default or close to default, while restructured loans represent modifications made to accommodate borrowers facing financial difficulties. A high ratio of NPLs signals deteriorating asset quality, whereas restructured loans may temporarily improve classification but carry underlying credit risk that requires close monitoring.

Loan Rehabilitation

Loan rehabilitation is a process that enables borrowers with non-performing loans to restore loan status to current by making a series of agreed payments, distinguishing it from loan restructuring which modifies the original loan terms to improve repayment feasibility. While non-performing loans indicate default or overdue status, restructured loans adjust terms such as interest rates, repayment schedules, or principal amounts to prevent default and facilitate recovery.

Impaired Asset

Impaired assets include both non-performing loans (NPLs) and restructured loans, where NPLs are loans on which borrowers have failed to make scheduled payments for 90 days or more, indicating a higher risk of default. Restructured loans, while still impaired, involve modified terms such as reduced interest rates or extended maturities to improve the borrower's repayment capacity and potentially avoid classification as non-performing.

Forbearance Measures

Forbearance measures in the context of non-performing loans (NPLs) involve temporary concessions such as reduced interest rates or extended repayment schedules to prevent default and facilitate recovery, while restructured loans often signify a formal modification of original terms to improve borrower repayment ability and classification from NPL to performing status. Effective forbearance can reduce the volume of NPLs by allowing borrowers to regain financial stability, whereas restructured loans require ongoing monitoring to ensure sustained performance and mitigate credit risk.

Recovery Rate

The recovery rate is a critical metric in assessing the effectiveness of debt restructuring strategies, typically higher for restructured loans than non-performing loans (NPLs) due to negotiated repayment plans that improve cash flow and reduce default risk. NPLs often exhibit lower recovery rates because of prolonged default periods and increased legal and administrative costs associated with loan enforcement and asset liquidation.

Credit Risk Classification

Credit risk classification differentiates non-performing loans (NPLs), which represent loans in default or close to default, from restructured loans that have modified terms to avoid default but may carry higher risk levels. This distinction is crucial for accurate risk assessment, provisioning, and regulatory compliance in banking and financial institutions.

Provisioning Requirement

Provisioning requirement for non-performing loans (NPLs) typically demands higher capital reserves due to increased default risk compared to restructured loans, which are loans modified to improve repayment likelihood and may qualify for lower provisioning under regulatory frameworks. Accurate classification between NPLs and restructured loans ensures compliant provisioning levels, impacting bank stability and financial reporting accuracy.

Troubled Debt Restructuring

Troubled Debt Restructuring (TDR) involves modifying the terms of a loan to provide relief to borrowers facing financial difficulties, often converting non-performing loans (NPLs) into restructured loans with revised payment schedules or interest rates. Effective TDR can reduce the classification of loans as NPLs by improving borrower repayment capacity and enhancing asset quality for financial institutions.

Default Status

Default status indicates that a non-performing loan (NPL) has missed scheduled repayments for a specified period, typically 90 days, signaling financial distress and elevated credit risk. Restructured loans, while modified to improve repayment terms and avoid default, may still be classified as non-performing if they fail to meet restructured payment obligations.

Loan Workouts

Loan workouts focus on modifying the terms of a non-performing loan to avoid default and recover value, often transforming it into a restructured loan with adjusted payment schedules, interest rates, or principal reductions. Restructured loans typically exhibit improved performance metrics compared to non-performing loans by restoring the borrower's ability to meet financial obligations under revised conditions.

non-performing loan vs restructured loan Infographic

moneydif.com

moneydif.com