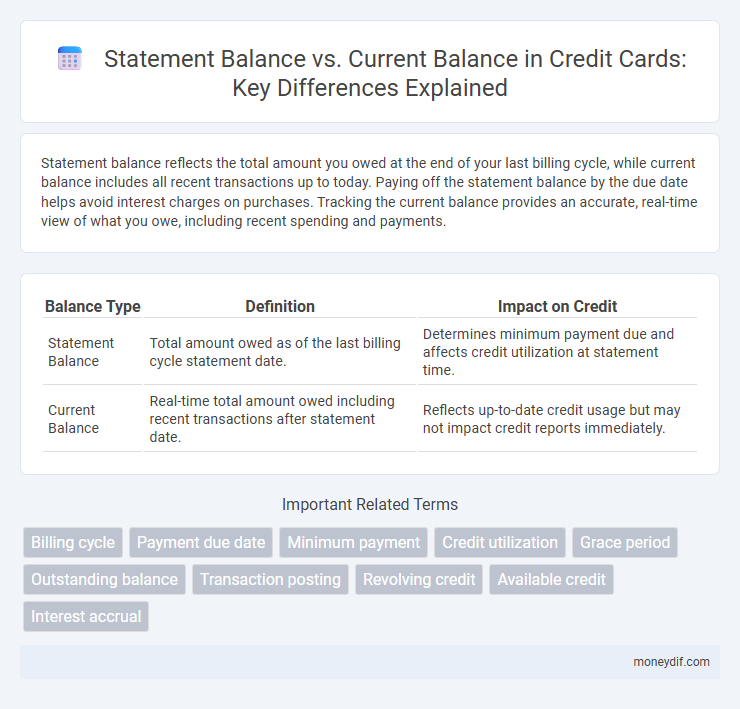

Statement balance reflects the total amount you owed at the end of your last billing cycle, while current balance includes all recent transactions up to today. Paying off the statement balance by the due date helps avoid interest charges on purchases. Tracking the current balance provides an accurate, real-time view of what you owe, including recent spending and payments.

Table of Comparison

| Balance Type | Definition | Impact on Credit |

|---|---|---|

| Statement Balance | Total amount owed as of the last billing cycle statement date. | Determines minimum payment due and affects credit utilization at statement time. |

| Current Balance | Real-time total amount owed including recent transactions after statement date. | Reflects up-to-date credit usage but may not impact credit reports immediately. |

Understanding Statement Balance vs. Current Balance

Understanding statement balance versus current balance is crucial for effective credit management, as the statement balance reflects the total amount owed at the end of a billing cycle, while the current balance includes all recent transactions up to the present date. Paying the statement balance in full by the due date helps avoid interest charges and maintain a good credit score, whereas the current balance provides a real-time snapshot of your outstanding debt. Monitoring both balances supports accurate budgeting and prevents overspending on credit accounts.

Key Differences Between Statement Balance and Current Balance

Statement balance represents the total amount owed on a credit card at the end of the billing cycle, while the current balance reflects real-time debt including recent purchases, payments, and fees. The statement balance is used to calculate the minimum payment due and avoid interest charges if paid in full by the due date, whereas the current balance fluctuates daily based on all posted transactions. Understanding these distinctions helps consumers manage payments effectively and maintain a positive credit score.

How Statement Balance Is Calculated

The statement balance is calculated by summing all posted transactions, including purchases, payments, fees, and interest, within a specific billing cycle. It excludes any pending or unposted charges that have not yet been finalized by the credit card issuer. This balance represents the amount due by the payment due date to avoid interest charges.

What Determines Your Current Balance

Your current balance reflects all recent transactions, including purchases, payments, fees, and pending charges that have not yet posted to your account. It fluctuates throughout the billing cycle as new activity occurs and provides an up-to-date snapshot of the money you owe. This figure is essential for managing credit usage and avoiding interest, since it differs from the statement balance, which only shows the amount due at the end of the last billing period.

Impact of Payments on Both Balances

Payments reduce the current balance immediately by decreasing the total amount owed on a credit account, while the statement balance reflects the amount owed at the end of the billing cycle, unaffected by recent payments. Clearing the statement balance in full by the due date avoids interest charges and maintains a positive credit score. Understanding the timing of payments and their impact on both balances helps consumers manage debt effectively and optimize credit utilization ratios.

Why Statement Balance Matters for Credit Card Users

Statement balance represents the total amount owed at the end of a billing cycle, crucial for credit card users to avoid interest charges by paying it in full. Current balance reflects ongoing transactions and can fluctuate daily, but paying only the current balance may lead to missed payments or interest if the statement balance isn't cleared. Understanding the statement balance helps maintain good credit utilization rates and improves credit scores by ensuring timely and complete payments.

Effects of Statement vs. Current Balance on Credit Scores

Statement balance reflects the total amount owed at the end of the billing cycle, while current balance shows the real-time debt on a credit account. Credit scoring models typically use the statement balance reported to credit bureaus, impacting credit utilization ratios and ultimately credit scores. Maintaining a low statement balance relative to credit limits helps improve credit scores, whereas a high current balance may not immediately affect scores if it is paid down before the statement date.

Choosing Which Balance to Pay: Pros and Cons

Paying the statement balance in full each month avoids interest charges and helps maintain a positive credit score by showing responsible credit use. Opting to pay the current balance ensures all recent transactions are covered, preventing any new charges from accumulating interest but may require more funds upfront. Choosing between the two depends on managing cash flow and avoiding interest while keeping credit utilization low for optimal credit health.

Managing Due Dates: Statement vs. Current Balance

Effectively managing due dates requires understanding the difference between statement balance and current balance on credit accounts. The statement balance reflects the amount owed at the end of the billing cycle, which must be paid by the due date to avoid interest charges, while the current balance includes all recent transactions up to the present moment. Monitoring both balances helps ensure timely payments and prevents missed due dates or unexpected fees.

Common Misconceptions About Balances on Credit Cards

Statement balance represents the total amount owed at the end of the billing cycle, while current balance reflects real-time charges, including recent transactions and payments. Many users mistakenly believe paying the current balance avoids interest, but interest typically applies if the statement balance is not paid in full by the due date. Understanding the difference helps prevent unexpected fees and maintain a healthy credit score.

Important Terms

Billing cycle

The billing cycle determines the period during which transactions are recorded, impacting the statement balance that reflects charges up to the cycle's end, while the current balance includes all recent transactions, including those made after the statement date. Understanding the distinction between statement balance and current balance is crucial for timely payments and avoiding interest charges.

Payment due date

The payment due date is the deadline by which the statement balance must be paid to avoid interest charges, while the current balance reflects real-time spending and may exceed the statement balance. Paying only the statement balance by the due date ensures accounts remain in good standing, but paying the current balance helps prevent accumulating additional interest.

Minimum payment

Minimum payment is a fixed percentage or amount set by credit card issuers, calculated based on the statement balance, which represents the total charges due by the billing cycle's end. The current balance includes all recent transactions and pending payments, so paying only the minimum on the statement balance may not cover new charges, potentially leading to interest accumulation and extended debt repayment.

Credit utilization

Credit utilization is calculated by dividing the current balance on a credit card by the credit limit, showing how much of the available credit is being used in real-time. Unlike the statement balance, which reflects what you owed at the end of the billing cycle, the current balance impacts your credit utilization ratio and can affect your credit score if it is high.

Grace period

The grace period allows cardholders to avoid interest charges when they pay their statement balance in full by the due date, rather than just the current balance which includes recent transactions. Understanding the difference between statement balance and current balance is crucial for managing credit card payments effectively and maintaining a healthy credit score.

Outstanding balance

The outstanding balance reflects the total amount owed on a credit account, which can differ from the statement balance that shows what was due at the end of the last billing cycle. Current balance includes all recent transactions and payments, providing a real-time snapshot of the debt, whereas the statement balance represents the fixed amount billed on the last statement.

Transaction posting

Transaction posting impacts the statement balance by including all transactions processed during the billing cycle, while the current balance reflects real-time activity, including recent transactions not yet posted. Understanding the difference between statement balance and current balance is essential for accurate financial tracking and avoiding overdraft fees.

Revolving credit

Revolving credit allows borrowers to carry a balance from month to month, with the statement balance representing the amount owed at the end of the billing cycle while the current balance reflects real-time charges and payments made thereafter. Paying the statement balance in full by the due date avoids interest charges, whereas carrying a current balance beyond the billing cycle accrues finance charges based on the outstanding amount.

Available credit

Available credit is calculated by subtracting the statement balance and any pending transactions from the total credit limit, reflecting the real-time spending capacity. Unlike the statement balance, which represents the amount owed at the end of the billing cycle, the current balance includes all recent purchases and payments, directly impacting the available credit.

Interest accrual

Interest accrual on credit cards is typically calculated based on the statement balance rather than the current balance, meaning interest is charged on the amount owed at the end of the billing cycle. Paying the current balance in full before the due date can prevent interest charges since it reflects recent transactions and payments not yet included in the statement balance.

Statement balance vs current balance Infographic

moneydif.com

moneydif.com