Amortization reduces the value of an intangible asset over a defined period, reflecting its consumption or usage in financial statements. Accretion increases the carrying amount of a liability, such as a discounted bond or asset retirement obligation, to its future settlement value. Understanding the differences between amortization and accretion is essential for accurate financial reporting and asset management.

Table of Comparison

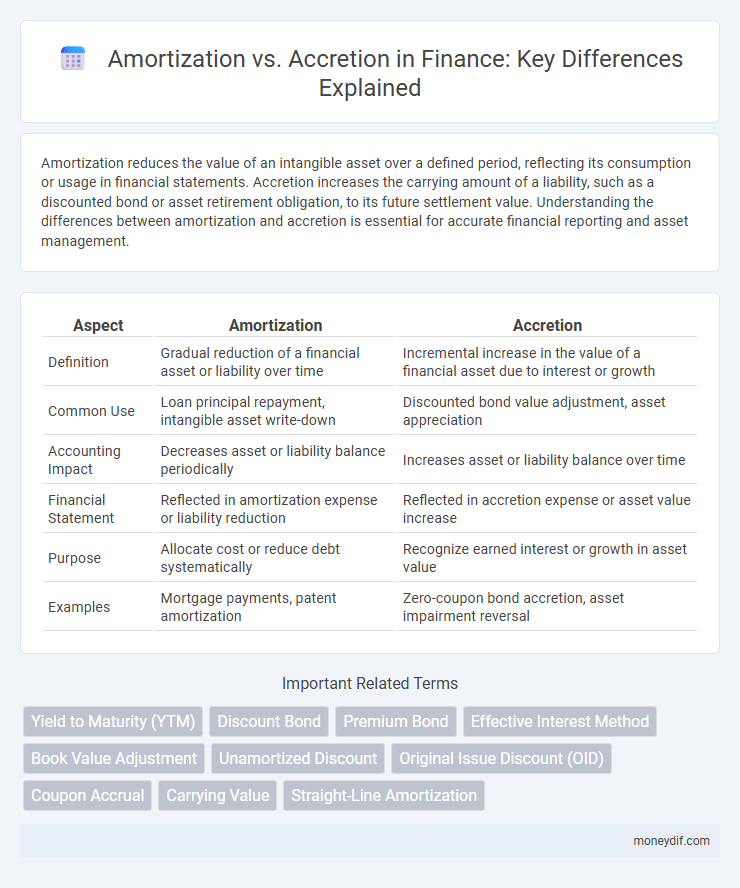

| Aspect | Amortization | Accretion |

|---|---|---|

| Definition | Gradual reduction of a financial asset or liability over time | Incremental increase in the value of a financial asset due to interest or growth |

| Common Use | Loan principal repayment, intangible asset write-down | Discounted bond value adjustment, asset appreciation |

| Accounting Impact | Decreases asset or liability balance periodically | Increases asset or liability balance over time |

| Financial Statement | Reflected in amortization expense or liability reduction | Reflected in accretion expense or asset value increase |

| Purpose | Allocate cost or reduce debt systematically | Recognize earned interest or growth in asset value |

| Examples | Mortgage payments, patent amortization | Zero-coupon bond accretion, asset impairment reversal |

Introduction to Amortization and Accretion

Amortization refers to the gradual reduction of a debt or intangible asset's value over a specified period through regular payments or systematic write-offs. Accretion involves the incremental increase in the value of a financial asset or liability, often seen with zero-coupon bonds where the bond's value grows as it approaches maturity. Both concepts are essential for accurate financial reporting and valuation in accounting and investment analysis.

Key Differences Between Amortization and Accretion

Amortization involves systematically reducing the book value of an intangible asset or loan principal over a set period, reflecting periodic expense recognition. Accretion, in contrast, refers to the gradual increase in the value of a financial instrument or liability, such as zero-coupon bonds or asset retirement obligations, driven by the passage of time and interest accumulation. The key difference lies in amortization's expense allocation process versus accretion's growth in asset or liability value due to interest or market adjustments.

Understanding Amortization in Finance

Amortization in finance refers to the gradual reduction of a debt or intangible asset's book value through scheduled, periodic payments over a specified time frame. It applies to loans, where each payment covers interest and principal, gradually decreasing the outstanding balance, and to intangible assets like patents, spreading the asset's cost evenly over its useful life. Understanding amortization helps in accurate financial reporting, budgeting, and assessing the true cost or value of financial instruments over time.

What is Accretion and How Does It Work?

Accretion in finance refers to the gradual increase in the value of a financial asset over time, often associated with bonds purchased at a discount or with asset-backed securities. It works by systematically adding the unrealized gains to the asset's book value, reflecting its appreciation until maturity or sale. This process ensures accurate representation of the asset's market value and income in financial statements.

Importance of Amortization in Loan Repayment

Amortization is crucial in loan repayment as it systematically reduces the principal balance through scheduled payments, ensuring predictable cash flow management for borrowers. This process minimizes interest expense over the loan term by applying payments toward both principal and interest, leading to full debt retirement at maturity. In contrast, accretion mainly applies to bond valuation, highlighting amortization's specific importance in managing loan obligations effectively.

Accretion in Bond Investments and Accounting

Accretion in bond investments refers to the gradual increase in the bond's book value as it approaches maturity, typically applied to bonds purchased at a discount. This accounting process systematically adjusts the bond's carrying amount upward, reflecting interest income earned over time, which directly impacts financial statements and investor returns. Unlike amortization, which spreads out a premium, accretion emphasizes the incremental value gain from original discounted cost to maturity value, enhancing precision in bond valuation and income recognition.

Real-World Applications of Amortization

Amortization in finance refers to the systematic allocation of the cost of an intangible asset or loan principal repayment over a specific period, reflecting its declining value or outstanding balance. Real-world applications include loan amortization schedules used by banks to determine periodic payments that cover both principal and interest, and intangible asset amortization for financial reporting and tax purposes. This process ensures accurate financial statements and aids businesses in managing cash flow effectively by spreading costs evenly across accounting periods.

Practical Examples of Accretion in Finance

Accretion in finance occurs when the value of a financial asset, such as a bond purchased at a discount, gradually increases to its face value over time through periodic adjustments. For example, zero-coupon bonds accrete value as interest income is recognized and added to the bond's carrying amount until maturity. Another practical case is accreting swaps, where the notional principal grows over time, reflecting increasing financial exposure and corresponding interest income recognition.

Amortization vs Accretion: Impact on Financial Statements

Amortization reduces the carrying value of intangible assets over time, directly decreasing net income due to systematic expense recognition on the income statement. Accretion increases the carrying amount of liabilities or asset retirement obligations, reflecting the passage of time and raising expenses on the income statement. Both processes affect the balance sheet by adjusting asset or liability values, influencing financial ratios and stakeholders' assessment of a company's financial health.

Choosing the Right Method: Amortization or Accretion?

Choosing the right method between amortization and accretion depends on the financial instrument and its accounting treatment; amortization applies to the gradual reduction of intangible assets or loan principal, while accretion reflects the periodic increase in the value of a discounted liability or asset. Accurate selection requires analyzing the asset's or liability's nature, expected cash flows, and regulatory standards such as GAAP or IFRS. Effective use of amortization or accretion ensures precise financial reporting and compliance with accounting principles.

Important Terms

Yield to Maturity (YTM)

Yield to Maturity (YTM) accurately reflects the internal rate of return on a bond by incorporating both amortization of premiums and accretion of discounts over the bond's life.

Discount Bond

A discount bond's price increases to its face value over time through accretion, reflecting the gradual recognition of interest income, while amortization pertains to systematically reducing bond premium or discount in accounting.

Premium Bond

Premium bonds experience amortization as their premium decreases over time, whereas accretion applies when discount bonds increase in value toward maturity.

Effective Interest Method

The Effective Interest Method allocates interest expense by amortizing bond premiums and accreting bond discounts over the bond's life to reflect the carrying amount accurately.

Book Value Adjustment

Book value adjustment reflects the systematic amortization of intangible assets or the accretion of liabilities to align carrying values with their fair values over time.

Unamortized Discount

Unamortized discount represents the portion of a bond discount not yet expensed, requiring amortization to systematically reduce the discount on debt instruments or accretion to increase the carrying value of discounted liabilities over time.

Original Issue Discount (OID)

Original Issue Discount (OID) involves amortization as the systematic allocation of bond discount over time, while accretion reflects the gradual increase in bond value toward maturity.

Coupon Accrual

Coupon accrual represents the periodic interest income earned on a bond, impacting amortization by systematically reducing bond premium or accretion by increasing bond discount over the bond's life.

Carrying Value

Carrying value reflects the net amount of an asset or liability after amortization reduces premiums and accretion increases discounts over time, aligning book value with the asset's or liability's effective interest.

Straight-Line Amortization

Straight-line amortization evenly spreads the reduction of an asset's book value over its useful life, contrasting with accretion which gradually increases the asset's carrying amount to reflect accrued interest or discounts.

Amortization vs Accretion Infographic

moneydif.com

moneydif.com