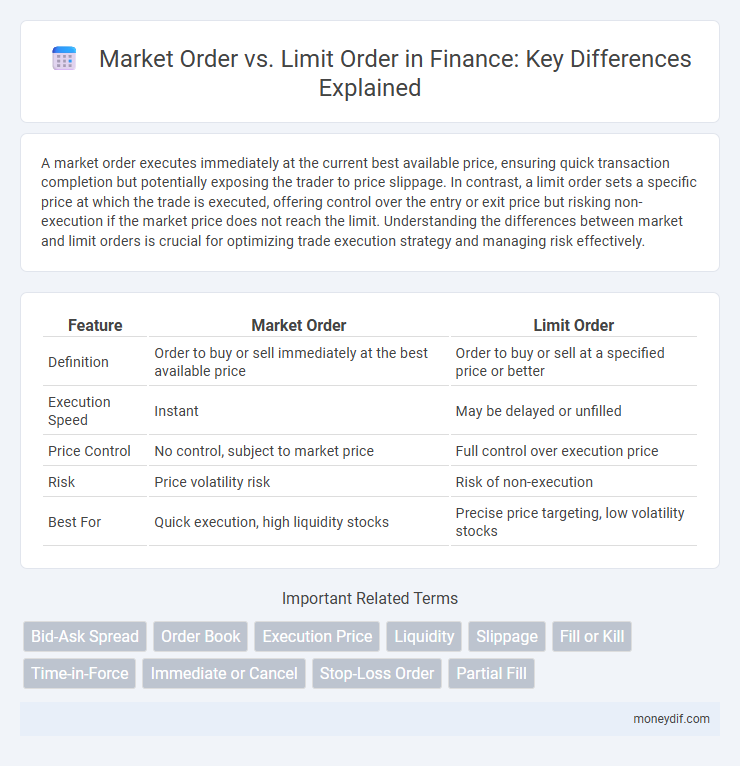

A market order executes immediately at the current best available price, ensuring quick transaction completion but potentially exposing the trader to price slippage. In contrast, a limit order sets a specific price at which the trade is executed, offering control over the entry or exit price but risking non-execution if the market price does not reach the limit. Understanding the differences between market and limit orders is crucial for optimizing trade execution strategy and managing risk effectively.

Table of Comparison

| Feature | Market Order | Limit Order |

|---|---|---|

| Definition | Order to buy or sell immediately at the best available price | Order to buy or sell at a specified price or better |

| Execution Speed | Instant | May be delayed or unfilled |

| Price Control | No control, subject to market price | Full control over execution price |

| Risk | Price volatility risk | Risk of non-execution |

| Best For | Quick execution, high liquidity stocks | Precise price targeting, low volatility stocks |

Understanding Market Orders: Definition and Key Features

Market orders execute trades immediately at the best available current price, ensuring quick transaction completion. They prioritize speed over price control, making them ideal for highly liquid markets or urgent trades. Key features include guaranteed execution but possible price slippage in volatile conditions.

What Is a Limit Order? Detailed Explanation

A limit order is a type of trade order used in financial markets to buy or sell a security at a specified price or better. Traders use limit orders to control the execution price, ensuring they do not pay more or receive less than their predetermined price, unlike market orders which execute immediately at current market prices. Limit orders provide price precision and protection from volatility but may not execute if the market price does not reach the set limit.

How Market Orders Work in Financial Trading

Market orders execute immediately at the best available price, ensuring rapid transaction completion in volatile markets. Traders use market orders to prioritize speed over price certainty, accepting potential slippage due to price fluctuations. This order type is essential for entering or exiting positions quickly, especially during high liquidity periods.

Step-by-Step Process of Placing a Limit Order

Placing a limit order involves specifying the maximum price you are willing to pay for a security or the minimum price at which you wish to sell, ensuring transactions occur only at your desired price or better. Begin by selecting the stock or asset and choosing "limit order" in your trading platform, then input the exact price limit and the total number of shares or contracts you intend to trade. Confirm the order details and submit, after which the order remains active until executed at the specified limit price or canceled, providing precise control over trade execution compared to market orders.

Market Order vs Limit Order: Core Differences

Market orders execute immediately at the current best available price, ensuring rapid transaction completion but with potential price slippage in volatile markets. Limit orders specify the maximum or minimum price at which to buy or sell, providing price control but without guaranteed execution if the market doesn't reach the limit price. Understanding these core differences is crucial for optimizing trade strategies based on urgency, price sensitivity, and market conditions.

Pros and Cons of Using Market Orders

Market orders guarantee immediate execution at the current market price, providing liquidity and speed essential for timely trades. The primary drawback is price uncertainty, as market orders may execute at unfavorable prices during high volatility or low liquidity. Traders prioritize market orders for quick entry or exit, but risk slippage compared to limit orders that specify exact prices.

Advantages and Disadvantages of Limit Orders

Limit orders provide precise price control by allowing traders to specify the maximum purchase or minimum sale price, which helps in avoiding unfavorable execution prices in volatile markets. This type of order ensures the trade is executed only at the specified price or better, reducing slippage risk common with market orders, but it also carries the disadvantage of potentially missing out on trades if the market price does not reach the limit set. Limit orders may also result in slower execution times, which can be detrimental in fast-moving markets where immediate execution is critical.

When to Use Market Orders in Finance

Market orders are ideal when investors prioritize immediate execution over price precision, especially in highly liquid markets where prices fluctuate minimally. They ensure prompt transaction completion by accepting the current market price, making them suitable for entering or exiting positions quickly during volatile trading sessions. Traders use market orders when speed is critical to capitalize on real-time opportunities or to prevent losses from rapid price movements.

Ideal Scenarios for Utilizing Limit Orders

Limit orders are ideal in volatile markets where precise entry or exit prices are crucial to control trading costs and avoid slippage. They work best when an investor targets a specific price level, such as buying dips or securing profits at a predetermined resistance point. Utilizing limit orders ensures execution only at favorable prices, benefiting long-term strategic trading and risk management.

Choosing Between Market and Limit Orders: Which Is Better?

Market orders prioritize immediate execution, making them suitable for traders seeking quick transactions at current prices, whereas limit orders enable price control by specifying a maximum or minimum acceptable price, ideal for those aiming to avoid slippage. The choice depends on trading goals: market orders offer speed and certainty of execution, while limit orders provide price precision but risk non-execution. Evaluating factors such as market volatility, liquidity, and urgency assists investors in selecting the optimal order type to balance execution certainty and price control.

Important Terms

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask), where market orders execute immediately at the best available price within the spread while limit orders specify a price ceiling or floor, potentially narrowing the spread but risking non-execution.

Order Book

An order book displays real-time buy and sell orders for a specific financial asset, showing limit orders with specified prices at various levels, while market orders execute immediately at the best available price. Understanding the order book depth helps traders assess liquidity and potential price movements between aggressive market orders and passive limit orders.

Execution Price

Execution price for a market order is determined by the best available price at the time of order placement, ensuring immediate transaction but with potential price fluctuations. In contrast, a limit order sets a specific execution price, only completing the trade if the market reaches that predetermined level, offering price control but no guarantee of fulfillment.

Liquidity

Liquidity significantly affects the execution speed and price stability between market and limit orders; market orders prioritize immediate execution by accepting current prices, often incurring slippage in low-liquidity environments, while limit orders provide price control but risk non-execution in volatile markets. High liquidity enhances market order efficiency and reduces bid-ask spreads, whereas limit orders benefit from abundant liquidity by increasing the likelihood of matching without adverse price movement.

Slippage

Slippage occurs when a market order executes at a significantly different price than expected, whereas a limit order controls execution price but may not fill if the market price does not reach the specified limit.

Fill or Kill

Fill or Kill (FOK) is a specialized order type that requires the entire order quantity to be executed immediately at a specified limit price or better, otherwise, it is canceled entirely, contrasting with Market Orders which prioritize immediate execution regardless of price. Limit Orders, including FOK, control transaction prices by setting explicit price boundaries, preventing unwanted slippage common in Market Orders that execute at the best available price without guarantees on execution price.

Time-in-Force

Time-in-Force specifies the duration an order remains active before execution or expiration, crucial in differentiating market orders--executed immediately at current prices--from limit orders, which execute only at a specified price or better within the designated time frame. Common Time-in-Force options include GTC (Good-Til-Canceled), IOC (Immediate-Or-Cancel), and FOK (Fill-Or-Kill), impacting execution strategies and order fulfillment certainty.

Immediate or Cancel

Immediate or Cancel (IOC) orders execute all or part of a market or limit order immediately, canceling any unfilled portion. Unlike standard market orders that prioritize immediate execution regardless of price, IOC orders ensure rapid execution while limiting exposure to price changes by canceling unfilled quantities instantly.

Stop-Loss Order

A stop-loss order triggers a market order once the stop price is reached, ensuring immediate execution but potentially at a less favorable price during high volatility, whereas a stop-limit order converts to a limit order, providing price control but risking non-execution if the limit price is not met. This distinction impacts risk management strategies by balancing the certainty of execution with desired price thresholds in dynamic market conditions.

Partial Fill

A partial fill occurs when only a portion of a market or limit order is executed due to insufficient available liquidity at the specified price. Market orders prioritize immediate execution, often resulting in partial fills during volatile conditions, while limit orders fill only at the set price or better, increasing the likelihood of partial fills if the order size exceeds available volume.

market order vs limit order Infographic

moneydif.com

moneydif.com