Delta hedging involves adjusting a portfolio to remain neutral against small price movements in the underlying asset by offsetting delta risk, while gamma hedging targets the curvature or acceleration of price changes to manage the risk of delta itself shifting. Effective delta hedging minimizes losses from directional price changes, whereas gamma hedging stabilizes the portfolio against large or rapid price fluctuations. Combining both strategies enhances risk management by controlling first and second-order sensitivities in options trading.

Table of Comparison

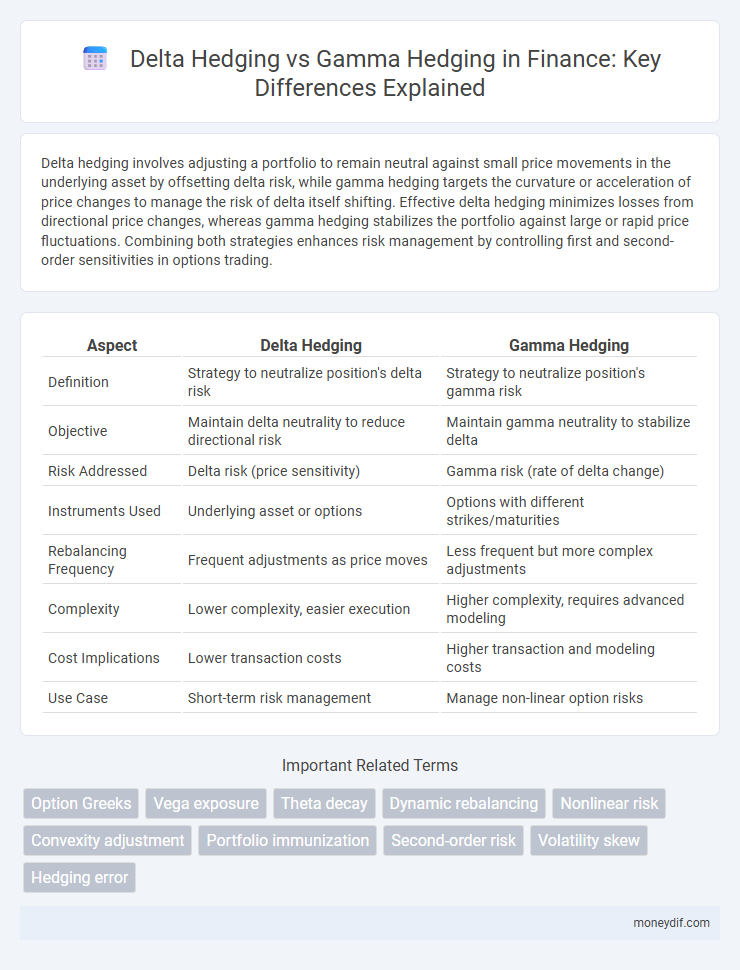

| Aspect | Delta Hedging | Gamma Hedging |

|---|---|---|

| Definition | Strategy to neutralize position's delta risk | Strategy to neutralize position's gamma risk |

| Objective | Maintain delta neutrality to reduce directional risk | Maintain gamma neutrality to stabilize delta |

| Risk Addressed | Delta risk (price sensitivity) | Gamma risk (rate of delta change) |

| Instruments Used | Underlying asset or options | Options with different strikes/maturities |

| Rebalancing Frequency | Frequent adjustments as price moves | Less frequent but more complex adjustments |

| Complexity | Lower complexity, easier execution | Higher complexity, requires advanced modeling |

| Cost Implications | Lower transaction costs | Higher transaction and modeling costs |

| Use Case | Short-term risk management | Manage non-linear option risks |

Introduction to Delta and Gamma Hedging

Delta hedging involves managing the risk of price movements in an underlying asset by offsetting the delta, which measures the sensitivity of an option's price to changes in the asset's price. Gamma hedging addresses the risk of changes in delta itself by neutralizing the gamma, the rate of change of delta relative to the underlying asset price. Both strategies aim to minimize directional risk, with delta hedging focusing on first-order price changes and gamma hedging targeting the curvature or acceleration of those changes.

Understanding Delta Hedging in Financial Markets

Delta hedging in financial markets involves managing the sensitivity of an option's price to changes in the underlying asset's price, aiming to maintain a neutral position by offsetting the delta risk. Traders adjust their portfolio by buying or selling the underlying asset to keep the delta close to zero, thereby minimizing directional risk. This strategy helps stabilize profits and limits losses as the market price fluctuates, contrasting with gamma hedging, which focuses on managing the rate of change of delta itself.

What is Gamma Hedging?

Gamma hedging is a risk management strategy used in options trading to neutralize the gamma exposure of a portfolio, aiming to stabilize the delta and reduce sensitivity to underlying asset price movements. By adjusting the positions in options and underlying assets, traders maintain a delta-neutral stance, minimizing the impact of second-order price changes. This technique is crucial for managing the non-linear risk inherent in options portfolios, especially when large price swings or volatility shifts occur.

Key Differences Between Delta and Gamma Hedging

Delta hedging focuses on neutralizing the portfolio's sensitivity to small price changes in the underlying asset by adjusting positions to maintain a delta of zero, while gamma hedging targets the rate of change of delta itself, managing the curvature or convexity of the portfolio's value relative to underlying price movements. Delta hedging is typically implemented through buying or selling the underlying asset to offset delta exposure, whereas gamma hedging often involves trading additional options to control how delta changes as the underlying price moves. The key difference lies in delta hedging maintaining first-order price risk neutrality, while gamma hedging addresses second-order risk, providing protection against larger or rapid price fluctuations.

Advantages and Limitations of Delta Hedging

Delta hedging offers the advantage of reducing directional risk by neutralizing the portfolio's exposure to small price movements in the underlying asset, making it essential for options traders managing short-term price fluctuations. However, its limitation lies in its sensitivity to gamma, as delta hedging requires frequent adjustments when the underlying asset experiences significant volatility or large price changes, leading to higher transaction costs. Delta hedging effectively manages first-order price risk but fails to address curvature risks, necessitating complementary strategies like gamma hedging for more comprehensive risk management.

Benefits and Drawbacks of Gamma Hedging

Gamma hedging offers enhanced risk management by stabilizing the portfolio's sensitivity to underlying asset price movements, reducing the risk associated with large market swings. This strategy helps maintain a more consistent delta, thereby improving the accuracy of hedging over time, but it requires frequent rebalancing and incurs higher transaction costs. Despite increased complexity and operational demands, gamma hedging effectively minimizes the impact of volatility, making it valuable for portfolios with significant exposure to options.

Practical Examples: Delta vs. Gamma Hedging

Delta hedging involves adjusting a portfolio's position to remain neutral against small price changes in the underlying asset, such as continuously buying or selling shares to offset delta risk in options trading. Gamma hedging, on the other hand, aims to manage the curvature risk by neutralizing changes in delta, often requiring additional hedges with multiple options to stabilize the portfolio against large price movements. For example, a trader holding a call option might delta hedge by shorting shares as price rises, while simultaneously using a gamma hedge by purchasing other options to reduce sensitivity to large market swings.

Risk Management Implications in Hedging Strategies

Delta hedging manages directional risk by maintaining a portfolio's sensitivity to underlying asset price movements at zero, thus minimizing exposure to small price changes. Gamma hedging addresses the curvature risk by stabilizing delta itself, reducing the impact of large price swings and improving hedge effectiveness in volatile markets. Incorporating both delta and gamma hedging enhances risk management by balancing immediate price sensitivity with protection against nonlinear risks in options portfolios.

Cost Considerations: Delta Hedging vs. Gamma Hedging

Delta hedging typically incurs lower immediate transaction costs since it only involves offsetting directional risk by adjusting positions in the underlying asset. Gamma hedging requires more frequent rebalancing to manage curvature risk, leading to higher cumulative trading expenses and potentially increased market impact costs. The choice between delta and gamma hedging strategies hinges on balancing cost efficiency with risk mitigation precision over the hedge's time horizon.

Choosing the Right Hedging Strategy: Factors to Consider

Choosing the right hedging strategy between delta hedging and gamma hedging depends on the portfolio's risk tolerance, volatility expectations, and time horizon. Delta hedging manages directional price risk by neutralizing the portfolio's exposure to small price movements, ideal for stable or low-volatility environments. Gamma hedging addresses changes in delta caused by large price swings, providing protection against higher volatility but requiring more frequent adjustments and higher transaction costs.

Important Terms

Option Greeks

Delta hedging focuses on neutralizing the portfolio's sensitivity to underlying price changes by adjusting positions based on delta, the first-order derivative of the option's price relative to the underlying asset. Gamma hedging manages the rate of change of delta itself, using gamma--the second-order derivative--to maintain a stable delta and protect against large swings in underlying asset prices, ultimately ensuring a more dynamic risk management approach.

Vega exposure

Vega exposure measures sensitivity to volatility changes and requires delta-neutral positions through delta hedging, while gamma hedging stabilizes the delta itself to manage the changing sensitivity in option portfolios.

Theta decay

Theta decay represents the time-related erosion of an option's value, which is a critical consideration in delta hedging strategies that focus on neutralizing price movements but may incur losses due to time decay. Gamma hedging adjusts the hedge dynamically to maintain delta neutrality, mitigating risk from price fluctuations and indirectly managing the adverse effects of theta decay by reducing frequent re-hedging costs.

Dynamic rebalancing

Dynamic rebalancing in options trading involves continuously adjusting the hedge ratio to maintain a delta-neutral position, minimizing exposure to small price movements. Gamma hedging complements this by managing the rate of change of delta, reducing the risk of large price swings and improving overall portfolio sensitivity to underlying asset fluctuations.

Nonlinear risk

Nonlinear risk arises in delta hedging due to the changing sensitivity of an option's price to the underlying asset, causing imperfect hedge performance as the underlying moves. Gamma hedging mitigates this risk by adjusting positions to account for the convexity of the option's value, enhancing hedge accuracy and reducing exposure to large price fluctuations.

Convexity adjustment

Convexity adjustment accounts for the nonlinear relationship between option prices and underlying asset movements, making gamma hedging essential for managing the curvature risk that delta hedging alone cannot address. Effective convexity adjustment enhances hedging accuracy by incorporating gamma sensitivities, reducing exposure to large price swings in the underlying asset.

Portfolio immunization

Portfolio immunization involves strategies to shield bond portfolios from interest rate fluctuations, primarily through duration matching to minimize sensitivity to small rate changes, aligning with delta hedging that manages first-order price risks. Gamma hedging complements this by addressing convexity or second-order risks, adjusting the portfolio to handle larger or nonlinear interest rate movements, thus enhancing the immunization effectiveness against volatility.

Second-order risk

Second-order risk in options trading arises from gamma exposure, making gamma hedging essential to manage portfolio sensitivity beyond delta hedging's linear adjustments.

Volatility skew

Volatility skew reflects the variation in implied volatility across options with different strike prices and is crucial in managing risk through delta and gamma hedging techniques. Delta hedging adjusts positions to remain neutral to small price movements, while gamma hedging focuses on controlling the rate of change of delta, both requiring adjustments influenced by observed volatility skew to optimize option pricing and risk exposure.

Hedging error

Hedging error occurs when the actual portfolio changes deviate from the expected risk-neutral adjustments, often arising in delta hedging due to non-linear price movements not captured by first-order Greeks. Gamma hedging mitigates this error by incorporating the second-order sensitivity of option prices, stabilizing the hedge against underlying asset price fluctuations and reducing the residual risk inherent in delta-only strategies.

delta hedging vs gamma hedging Infographic

moneydif.com

moneydif.com