A buyback involves a company repurchasing its shares directly from the open market to reduce outstanding stock and boost shareholder value. A tender offer is a more targeted approach where the company proposes to buy shares at a specific price, often at a premium, from existing shareholders within a set timeframe. Understanding the strategic use of buybacks versus tender offers helps investors assess the impact on stock price, ownership dilution, and corporate control.

Table of Comparison

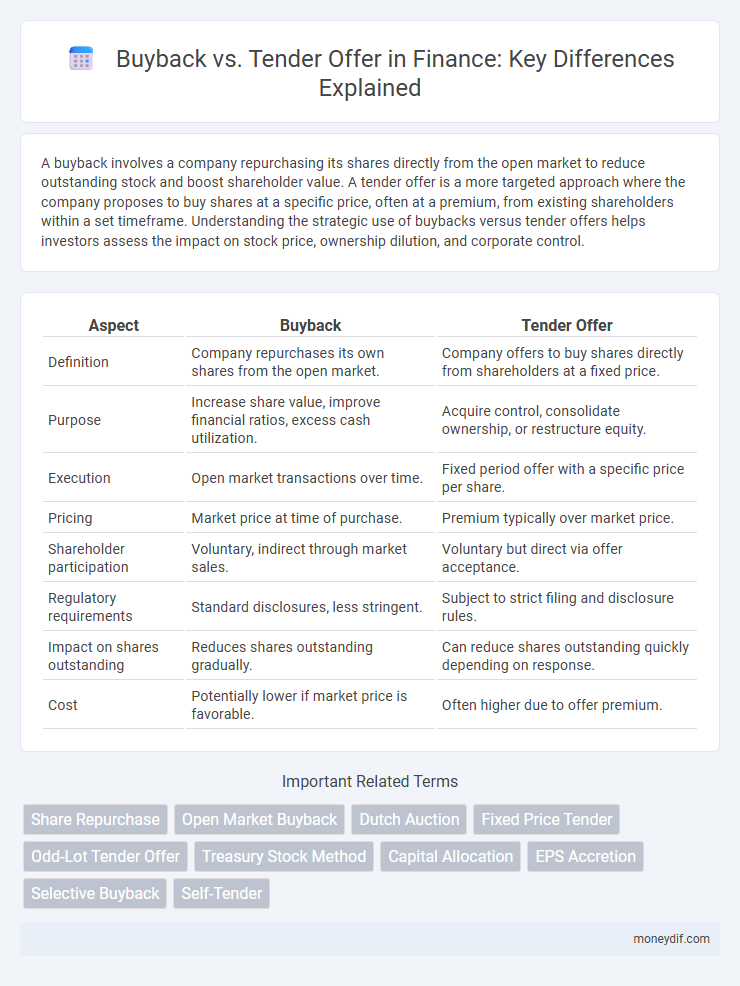

| Aspect | Buyback | Tender Offer |

|---|---|---|

| Definition | Company repurchases its own shares from the open market. | Company offers to buy shares directly from shareholders at a fixed price. |

| Purpose | Increase share value, improve financial ratios, excess cash utilization. | Acquire control, consolidate ownership, or restructure equity. |

| Execution | Open market transactions over time. | Fixed period offer with a specific price per share. |

| Pricing | Market price at time of purchase. | Premium typically over market price. |

| Shareholder participation | Voluntary, indirect through market sales. | Voluntary but direct via offer acceptance. |

| Regulatory requirements | Standard disclosures, less stringent. | Subject to strict filing and disclosure rules. |

| Impact on shares outstanding | Reduces shares outstanding gradually. | Can reduce shares outstanding quickly depending on response. |

| Cost | Potentially lower if market price is favorable. | Often higher due to offer premium. |

Understanding Buybacks and Tender Offers

A buyback occurs when a company repurchases its own shares from the open market, aiming to reduce outstanding shares and increase shareholder value. A tender offer involves the company directly inviting shareholders to sell their shares at a specified price, often at a premium, within a limited time frame. Understanding the difference between buybacks and tender offers is crucial for investors to assess the impact on stock liquidity and market perception.

Key Differences Between Buybacks and Tender Offers

Buybacks involve a company repurchasing its own shares from the open market at prevailing prices, enhancing shareholder value by reducing outstanding shares and potentially boosting earnings per share. Tender offers are a targeted approach where a company or investor proposes to buy a specific number of shares directly from existing shareholders at a premium to the market price, often used to gain control or influence. The key differences lie in the method of repurchase, pricing strategy, and purpose, with buybacks being more flexible and market-driven, while tender offers are structured, price-specific, and often strategic.

Motivations Behind Share Buybacks

Share buybacks are primarily driven by the desire to return excess cash to shareholders, signal confidence in the company's future prospects, and enhance key financial metrics such as earnings per share (EPS). Companies may also pursue buybacks to counteract dilution from employee stock options or to adjust their capital structure by increasing leverage. Tender offers, as a subset of buybacks, often target larger blocks of shares and are motivated by strategic goals like gaining greater shareholder control or executing substantial capital reallocation.

Why Companies Opt for Tender Offers

Companies opt for tender offers because they provide a controlled and transparent method to repurchase shares directly from shareholders at a premium, which can efficiently reduce outstanding stock and improve earnings per share. Tender offers allow firms to set a fixed price and quantity, streamlining the buyback process and signaling confidence in the company's valuation. This targeted approach helps maximize shareholder value and supports strategic capital structure management.

Impact on Shareholder Value

Buybacks typically increase shareholder value by reducing the number of outstanding shares, which can lead to higher earnings per share and stock price appreciation. Tender offers often provide shareholders with a premium over the market price, offering immediate liquidity and potential gains. The choice between buyback and tender offer depends on the company's cash position, market conditions, and shareholder preferences for long-term value versus short-term returns.

Regulatory Framework for Buybacks and Tender Offers

The regulatory framework for buybacks requires companies to comply with specific guidelines such as filing disclosures with securities regulators and adhering to limits on purchase volumes and timing to prevent market manipulation. Tender offers involve stricter regulatory oversight, including mandatory tender offer procedures under securities laws, detailed disclosures to shareholders, and adherence to fairness rules to protect minority investors. Both mechanisms are subject to compliance with the Securities Exchange Act and relevant regulations enforced by authorities like the SEC to ensure transparency and market integrity.

Tax Implications for Investors

Buybacks typically result in capital gains tax liabilities only when investors sell their shares, allowing deferral of taxes until the point of sale. Tender offers may trigger immediate tax consequences because investors often receive cash payments directly after tendering shares, potentially resulting in short-term or long-term capital gains based on holding period. Understanding the differential tax treatment of these corporate actions is crucial for investors to optimize after-tax returns and plan their investment strategy effectively.

Case Studies: Successful Buybacks vs Tender Offers

Case studies reveal that successful buybacks, such as Apple's $90 billion repurchase program, often boost stock prices by signaling confidence in intrinsic value and improving earnings per share. In contrast, tender offers like Oracle's $10 billion acquisition of Sun Microsystems demonstrate strategic control acquisition and shareholder value realization through premium pricing. Data indicates buybacks generally enhance long-term shareholder returns, while tender offers prioritize immediate liquidity and control shifts.

Risks and Drawbacks of Each Method

Buybacks can lead to stock price manipulation concerns and may deplete company cash reserves, risking financial flexibility. Tender offers pose risks of overpayment and shareholder dissatisfaction if the offer price undervalues the stock, potentially harming long-term shareholder value. Both methods carry reputational risks that can impact investor confidence and market perception.

Strategic Considerations for Corporates

Corporates pursue buybacks to enhance shareholder value by reducing outstanding shares and signaling confidence in their financial health, often optimizing capital structure and earnings per share. Tender offers serve as strategic tools for acquiring a significant portion of shares quickly, enabling targeted ownership consolidation or defense against hostile takeovers. Both approaches require careful assessment of market conditions, cost implications, and regulatory compliance to align with long-term corporate objectives.

Important Terms

Share Repurchase

Share repurchases can be executed through buybacks, where companies repurchase shares on the open market, or tender offers, which involve offering to buy shares directly from shareholders at a specified price above market value.

Open Market Buyback

Open Market Buybacks allow companies to repurchase shares gradually at market prices, differing from Tender Offers which propose a fixed price for a bulk purchase within a set timeframe.

Dutch Auction

A Dutch auction enables companies to repurchase shares by specifying a price range, allowing shareholders to tender shares at desired prices, contrasting with fixed-price tender offers that set a single repurchase price.

Fixed Price Tender

A Fixed Price Tender involves a company offering to buy back shares at a predetermined price, providing shareholders a clear, fixed value as opposed to a Tender Offer which may involve negotiated or variable pricing.

Odd-Lot Tender Offer

Odd-lot tender offers enable companies to repurchase small-block shares at a premium, providing an alternative to standard buybacks and full tender offers by targeting shareholders with less than a normal trading unit to reduce odd-lot holdings and improve share liquidity.

Treasury Stock Method

The Treasury Stock Method calculates potential dilution from in-the-money options and convertible securities, affecting share count differently in buybacks, where companies repurchase shares on the open market, versus tender offers, which involve direct bids to shareholders.

Capital Allocation

Capital allocation strategies prioritize buybacks for flexible market-driven repurchases while tender offers target large, fixed-price share repurchases to optimize shareholder value.

EPS Accretion

EPS accretion from buybacks typically arises due to share count reduction at market price, while tender offers can provide more targeted and potentially accretive repurchases depending on the premium paid and acquisition method.

Selective Buyback

Selective buyback allows companies to repurchase specific shares from targeted shareholders, contrasting with tender offers where companies invite all shareholders to sell shares at a fixed price.

Self-Tender

Self-tender offers involve a company repurchasing its own shares directly from shareholders, contrasting with buybacks which may occur through open market purchases or negotiated transactions.

Buyback vs Tender Offer Infographic

moneydif.com

moneydif.com