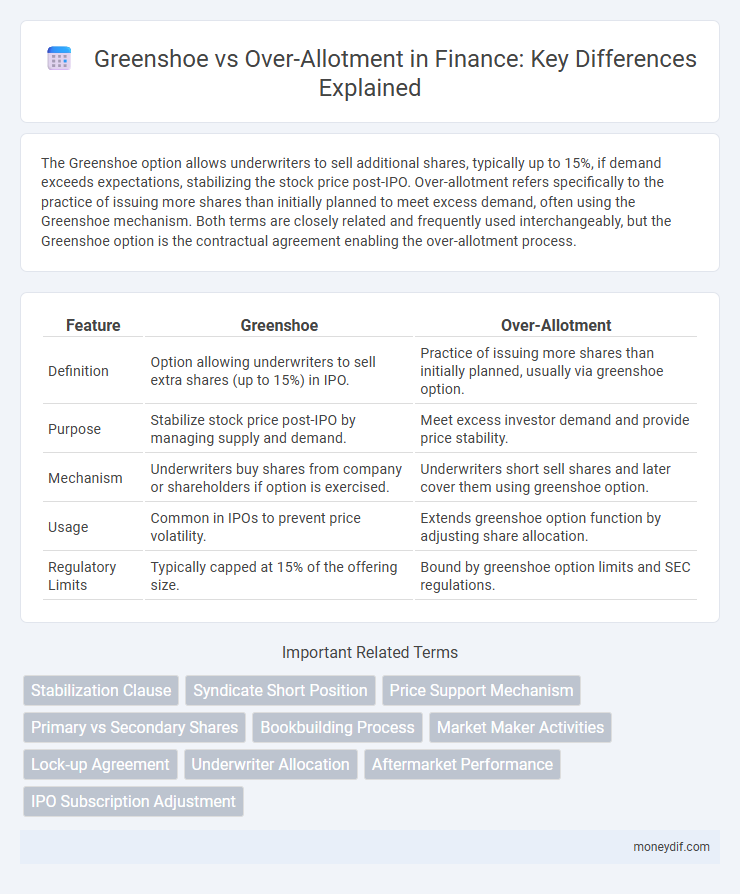

The Greenshoe option allows underwriters to sell additional shares, typically up to 15%, if demand exceeds expectations, stabilizing the stock price post-IPO. Over-allotment refers specifically to the practice of issuing more shares than initially planned to meet excess demand, often using the Greenshoe mechanism. Both terms are closely related and frequently used interchangeably, but the Greenshoe option is the contractual agreement enabling the over-allotment process.

Table of Comparison

| Feature | Greenshoe | Over-Allotment |

|---|---|---|

| Definition | Option allowing underwriters to sell extra shares (up to 15%) in IPO. | Practice of issuing more shares than initially planned, usually via greenshoe option. |

| Purpose | Stabilize stock price post-IPO by managing supply and demand. | Meet excess investor demand and provide price stability. |

| Mechanism | Underwriters buy shares from company or shareholders if option is exercised. | Underwriters short sell shares and later cover them using greenshoe option. |

| Usage | Common in IPOs to prevent price volatility. | Extends greenshoe option function by adjusting share allocation. |

| Regulatory Limits | Typically capped at 15% of the offering size. | Bound by greenshoe option limits and SEC regulations. |

Introduction to Greenshoe and Over-allotment in Finance

Greenshoe and over-allotment options are mechanisms used in initial public offerings (IPOs) to stabilize the stock price post-listing by allowing underwriters to sell additional shares beyond the original allotment. The Greenshoe option specifically permits underwriters to purchase up to 15% more shares from the issuing company, providing flexibility to manage excess demand and reduce volatility. Over-allotment enables the creation of a temporary short position, which underwriters cover by exercising the Greenshoe, aligning supply with market demand and supporting price stability.

Defining the Greenshoe Option: Mechanism and Purpose

The Greenshoe option, also known as an over-allotment option, allows underwriters to sell more shares than initially planned, typically up to 15% above the offering size, to stabilize the stock price post-IPO. This mechanism helps mitigate price volatility by enabling underwriters to buy back shares if market demand is weak, ensuring a smoother aftermarket performance. Its primary purpose is to protect both issuers and investors by maintaining price stability during the critical initial trading period.

What is Over-allotment? Key Concepts Explained

Over-allotment refers to the practice where underwriters sell more shares than initially planned during an equity offering, usually up to 15% above the original amount, to stabilize the stock price. This mechanism allows underwriters to cover excess demand by exercising a greenshoe option, offering additional shares to investors if necessary. Over-allotment helps maintain market stability and investor confidence by preventing sharp price drops post-IPO or follow-on offering.

The Role of Greenshoe in IPOs and Secondary Offerings

The Greenshoe option plays a crucial role in stabilizing prices during IPOs and secondary offerings by allowing underwriters to sell additional shares, typically up to 15% more than the original allocation. This mechanism helps to absorb excess demand, preventing significant price volatility and supporting post-offering market stability. By enabling timely share buybacks if the stock price dips, the Greenshoe ensures a smoother transition into public trading and protects investor interests.

Over-allotment Process: How Does It Work?

The over-allotment process, commonly known as the greenshoe option, allows underwriters to sell additional shares beyond the original offering size to stabilize the stock price post-IPO. This mechanism grants underwriters up to 15% more shares, which they can purchase from shareholders if demand exceeds expectations. By exercising the greenshoe, underwriters manage price volatility and provide liquidity, ensuring a smoother market debut for the issuing company.

Similarities Between Greenshoe and Over-allotment

Greenshoe and over-allotment options both serve as mechanisms in initial public offerings (IPOs) to stabilize share prices by allowing underwriters to sell more shares than initially planned. Each method helps manage excess demand and reduce volatility by permitting the purchase of additional shares, typically up to 15% of the original offering size. Both strategies enhance market confidence and liquidity while protecting against share price fluctuations post-IPO.

Key Differences: Greenshoe vs. Over-allotment

The Greenshoe option is a specific type of over-allotment provision allowing underwriters to sell up to 15% more shares than initially planned to stabilize post-IPO prices. Over-allotment broadly refers to any instance where more shares are allocated than the original offering size, potentially causing dilution if exercised. Key differences lie in the Greenshoe's predefined cap and price stabilization goal versus general over-allotment's broader application without guaranteed share buyback.

Advantages and Risks of Using Greenshoe

The Greenshoe option, a reserved allotment of up to 15% additional shares in an IPO, allows underwriters to stabilize the stock price by offsetting excess demand, thereby reducing volatility and enhancing investor confidence. Its advantages include managing market fluctuations and preventing sharp price declines post-offering, which supports a successful capital raise. Risks involve potential dilution of existing shareholders if the option is exercised and the possibility of misjudging market appetite, leading to over-allotment and subsequent price pressure.

Impact of Over-allotment on Investors and Issuers

Over-allotment, often implemented through a greenshoe option, allows issuers to sell additional shares beyond the initial offering, stabilizing stock prices during volatile market conditions. This mechanism benefits investors by reducing price volatility and providing greater market liquidity shortly after the IPO. For issuers, over-allotment can enhance capital raised without diluting existing shareholders excessively, while supporting a successful market debut.

Real-world Examples and Case Studies: Greenshoe vs. Over-allotment

The Greenshoe option, widely used in IPOs such as Alibaba's $25 billion offering, allows underwriters to stabilize share prices by purchasing up to 15% additional shares, whereas over-allotment refers specifically to the sale of this extra allocation to meet excess demand. In Spotify's direct listing, no Greenshoe was utilized, highlighting a key difference where over-allotment facilitates price support, while direct listings rely on market liquidity. Case studies like Facebook's IPO demonstrate how Greenshoe provisions helped mitigate volatility by enabling underwriters to buy back shares during early trading instability, a feature absent in simple over-allotment frameworks.

Important Terms

Stabilization Clause

The Stabilization Clause in equity underwriting agreements helps maintain the stock price by authorizing the underwriter to purchase additional shares through a Greenshoe option, which allows overallotment beyond the initial offering size. This clause mitigates price volatility by enabling underwriters to stabilize the market after an IPO, ensuring the shares do not fall below the offering price while managing supply-demand dynamics effectively.

Syndicate Short Position

A Syndicate Short Position arises when underwriters sell more shares than allotted in an offering, often linked to the Greenshoe option, which allows them to buy back up to 15% extra shares to stabilize prices. The Over-allotment is the practice of initially allocating additional shares beyond the offering size, enabling syndicates to cover short positions and manage market demand efficiently.

Price Support Mechanism

Price support mechanisms stabilize stock prices during initial public offerings by preventing sharp declines through strategic buying or underwriting actions; Greenshoe options allow underwriters to sell more shares than initially planned to meet excess demand, while over-allotment refers to the actual issuance of these additional shares to support price levels. Both strategies help maintain market confidence and reduce volatility by managing supply and demand dynamics effectively.

Primary vs Secondary Shares

Primary shares represent new stock issued by a company during an initial public offering (IPO), while secondary shares are existing shares sold by current shareholders. The Greenshoe option relates to overallotment in IPOs, allowing underwriters to sell extra shares (up to 15% more), stabilizing the stock price by covering excess demand through primary or secondary shares.

Bookbuilding Process

The bookbuilding process involves gathering investor demand to set an initial public offering (IPO) price, where the greenshoe option allows underwriters to sell up to 15% more shares than initially planned to stabilize the stock price. Unlike the broader over-allotment mechanism that covers any excess demand beyond primary shares, the greenshoe specifically permits market support by buying back shares to prevent price drops after the IPO.

Market Maker Activities

Market maker activities regarding Greenshoe and Over-allotment options involve stabilizing stock prices during IPOs by exercising the Greenshoe option to buy up to 15% additional shares, preventing excessive volatility. These mechanisms enable market makers to manage supply and demand effectively, supporting price stabilization and liquidity in the aftermarket trading phase.

Lock-up Agreement

A Lock-up Agreement restricts insiders from selling shares for a specified period after an IPO, stabilizing stock price and preventing early sell-offs; it often complements Greenshoe options, which allow underwriters to purchase additional shares to cover over-allotments and maintain market stability. Over-allotment shares sold during the IPO can be bought back using the Greenshoe, with the Lock-up Agreement ensuring controlled insider share sales while underwriters manage share supply.

Underwriter Allocation

Underwriter allocation balances risk and demand by distributing shares during the greenshoe option, allowing over-allotment up to 15% to stabilize post-IPO prices.

Aftermarket Performance

Aftermarket performance of a Greenshoe option typically stabilizes stock prices post-IPO by allowing underwriters to buy back shares and support market demand, whereas an over-allotment issue increases the supply of shares temporarily, potentially impacting volatility. Both mechanisms are strategically employed to manage share price fluctuations, enhance liquidity, and ensure a smoother transition in the secondary market.

IPO Subscription Adjustment

IPO subscription adjustment involves balancing demand and supply through mechanisms like the greenshoe option, which allows underwriters to sell additional shares up to 15% more than the original offering to stabilize stock price. Over-allotment refers to the initial sale of these extra shares, enabling price support and preventing excessive volatility during the IPO's early trading days.

Greenshoe vs Over-allotment Infographic

moneydif.com

moneydif.com