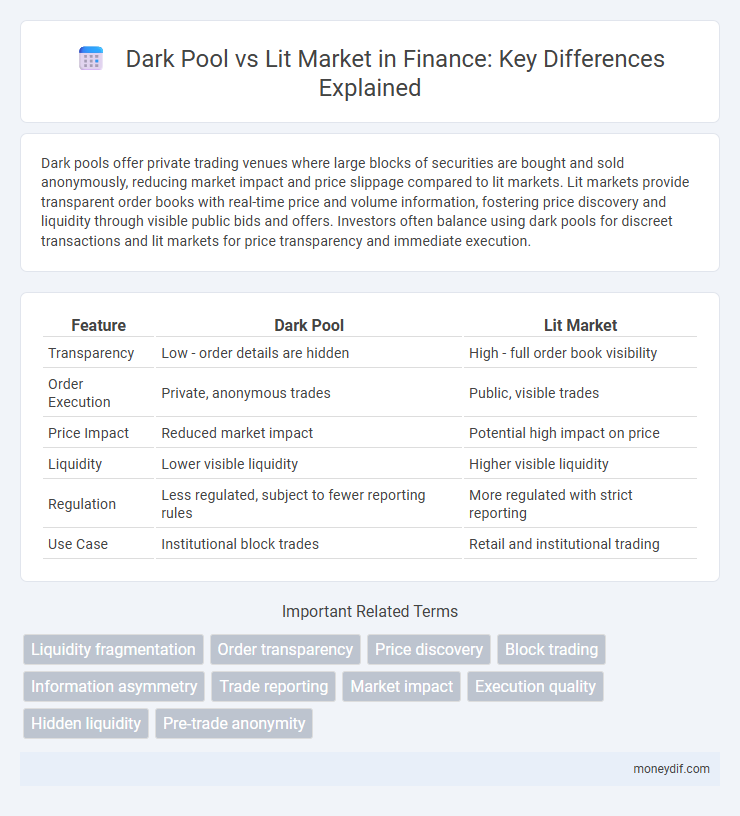

Dark pools offer private trading venues where large blocks of securities are bought and sold anonymously, reducing market impact and price slippage compared to lit markets. Lit markets provide transparent order books with real-time price and volume information, fostering price discovery and liquidity through visible public bids and offers. Investors often balance using dark pools for discreet transactions and lit markets for price transparency and immediate execution.

Table of Comparison

| Feature | Dark Pool | Lit Market |

|---|---|---|

| Transparency | Low - order details are hidden | High - full order book visibility |

| Order Execution | Private, anonymous trades | Public, visible trades |

| Price Impact | Reduced market impact | Potential high impact on price |

| Liquidity | Lower visible liquidity | Higher visible liquidity |

| Regulation | Less regulated, subject to fewer reporting rules | More regulated with strict reporting |

| Use Case | Institutional block trades | Retail and institutional trading |

Introduction to Dark Pools and Lit Markets

Dark pools are private trading venues where large institutional investors execute substantial orders without exposing their intentions to the public market, reducing market impact and information leakage. Lit markets, or public exchanges like NYSE and NASDAQ, display order books and trade prices transparently, providing price discovery and liquidity for all participants. Understanding the trade-offs between dark pools' anonymity and lit markets' transparency is crucial for effective trade execution and market efficiency.

Key Differences Between Dark Pools and Lit Markets

Dark pools are private trading venues where buy and sell orders are not publicly displayed, enabling large investors to execute sizable trades with minimal market impact, while lit markets offer transparent order books with real-time bid and ask prices accessible to all participants. Price discovery is more efficient in lit markets due to visible order flow and liquidity, whereas dark pools provide anonymity but may contribute to fragmented market liquidity. Regulatory scrutiny differs as lit markets are subject to stringent transparency requirements, whereas dark pools operate under lighter regulations, raising concerns about fairness and market integrity.

How Dark Pools Operate

Dark pools operate as private trading venues where large orders are executed anonymously to minimize market impact and prevent price fluctuations. These alternative trading systems match buy and sell orders without displaying the order book publicly, thus providing institutional investors with discretion and reduced information leakage. By facilitating block trades off-exchange, dark pools help maintain market stability and reduce transaction costs compared to lit markets.

How Lit Markets Function

Lit markets function as transparent trading venues where order books are publicly visible, allowing investors to see bid and ask prices in real-time. This transparency promotes price discovery and market efficiency by enabling participants to react instantly to supply and demand changes. High liquidity and continuous order matching in lit markets facilitate fair price formation for equities and other securities.

Advantages of Trading in Dark Pools

Dark pools provide institutional investors with the advantage of executing large trades anonymously, reducing market impact and minimizing price slippage. These private trading venues offer enhanced liquidity by aggregating sizable orders away from public exchanges, preserving confidentiality and preventing information leakage. The lack of pre-trade transparency in dark pools allows traders to avoid signaling costs, improving execution quality and facilitating strategic order placement.

Benefits of Trading in Lit Markets

Lit markets offer full transparency with real-time bid and ask prices, enabling investors to make informed decisions based on visible market depth and volume. Higher liquidity in lit markets increases the likelihood of order execution at desired prices, reducing slippage and enhancing price discovery efficiency. Regulatory oversight in lit markets also ensures fair trading practices, fostering investor confidence and market integrity.

Risks and Challenges in Dark Pools

Dark pools present significant risks due to their lack of transparency, which can lead to increased market manipulation and reduced price discovery compared to lit markets. The opacity of dark pools poses challenges in monitoring large trades, potentially resulting in information asymmetry and adverse selection for investors. Regulatory scrutiny intensifies as dark pools may facilitate unfair trading practices, increasing systemic risk within financial markets.

Transparency and Regulation Comparison

Dark pools operate with limited transparency, allowing large institutional investors to trade privately without immediate public disclosure, contrasting sharply with lit markets where order books and trade data are fully visible to all participants. Regulatory oversight of dark pools is often less stringent, emphasizing trade secrecy and anonymity, whereas lit markets adhere to stricter regulations promoting transparency, fair access, and real-time reporting to prevent market manipulation. This difference in transparency and regulatory frameworks affects price discovery, liquidity, and the overall fairness perceived by retail investors and market regulators.

Impact on Market Liquidity and Price Discovery

Dark pools reduce market transparency by executing large trades off-exchange, which can hinder price discovery and obscure true market liquidity. Lit markets, with visible order books and real-time pricing, enhance liquidity by allowing participants to assess supply and demand openly, promoting more accurate price discovery. The balance between dark pool anonymity and lit market transparency critically influences overall market efficiency and investor confidence.

Choosing the Right Venue: Dark Pool vs Lit Market

Choosing the right trading venue between dark pools and lit markets depends on trade size, transparency preferences, and market impact considerations. Dark pools offer anonymity and reduced market impact for institutional investors executing large block trades, while lit markets provide greater price discovery and liquidity with visible order books. Evaluating factors like order size, urgency, and volatility helps determine the optimal balance between confidentiality and execution efficiency.

Important Terms

Liquidity fragmentation

Liquidity fragmentation occurs when trading volume is dispersed across multiple venues, diminishing overall market transparency and price discovery efficiency. Dark pools contribute to this fragmentation by executing large orders privately, reducing visible liquidity in lit markets and potentially impacting bid-ask spreads and market impact costs.

Order transparency

Order transparency significantly differs between dark pools and lit markets, with lit markets offering real-time visibility of order books and trade prices, enhancing price discovery and market fairness. Dark pools limit order transparency by allowing large trades to be executed anonymously, reducing market impact but potentially increasing information asymmetry and reducing overall market liquidity.

Price discovery

Price discovery occurs as transparent lit markets provide public order flow and real-time bid-ask data, enabling accurate valuation of assets. Dark pools, by contrast, obscure trade sizes and prices, potentially delaying public price signals and impacting market efficiency in determining true market value.

Block trading

Block trading allows large-volume transactions to be executed discreetly, often leveraging dark pools to minimize market impact and price slippage. Unlike lit markets, where trade orders are visible in the public order book, dark pools provide anonymity, enabling institutional investors to buy or sell significant blocks of shares without revealing their intentions to the broader market.

Information asymmetry

Information asymmetry in financial markets occurs when one party has access to better or more timely information than others, creating an imbalance in trading decisions. Dark pools exacerbate this asymmetry by allowing large trades to be executed privately without revealing order details to the public lit market, often leading to price discrepancies and reduced market transparency.

Trade reporting

Trade reporting regulations mandate timely disclosure of transactions in lit markets, while dark pools offer limited transparency to protect large block trades from market impact.

Market impact

Dark pools significantly affect market impact by enabling large institutional trades to occur with minimal price disruption, as these private venues conceal order size and reduce information leakage compared to lit markets. In contrast, lit markets display order books publicly, increasing transparency but also exposing large trades to front-running and higher market impact costs.

Execution quality

Execution quality in dark pools often benefits from reduced market impact and price improvement due to hidden order placement, while lit markets offer higher transparency and immediate price discovery but may expose trades to greater price slippage and front-running risks. Studies indicate that institutional investors achieve better average execution prices in dark pools for large block trades, whereas retail investors tend to experience superior execution quality in lit markets due to tighter spreads and visible liquidity.

Hidden liquidity

Hidden liquidity represents unadvertised buy or sell interest that is visible in dark pools but not displayed in lit markets. Dark pools enable large institutional investors to execute substantial trades anonymously, minimizing market impact and price slippage compared to the transparent order books of lit markets.

Pre-trade anonymity

Pre-trade anonymity in dark pools enables institutional investors to execute large orders without revealing their intentions, minimizing market impact and information leakage compared to lit markets where order details are publicly visible. This confidentiality advantage helps maintain price stability and reduces adverse selection risks inherent in transparent order books.

dark pool vs lit market Infographic

moneydif.com

moneydif.com