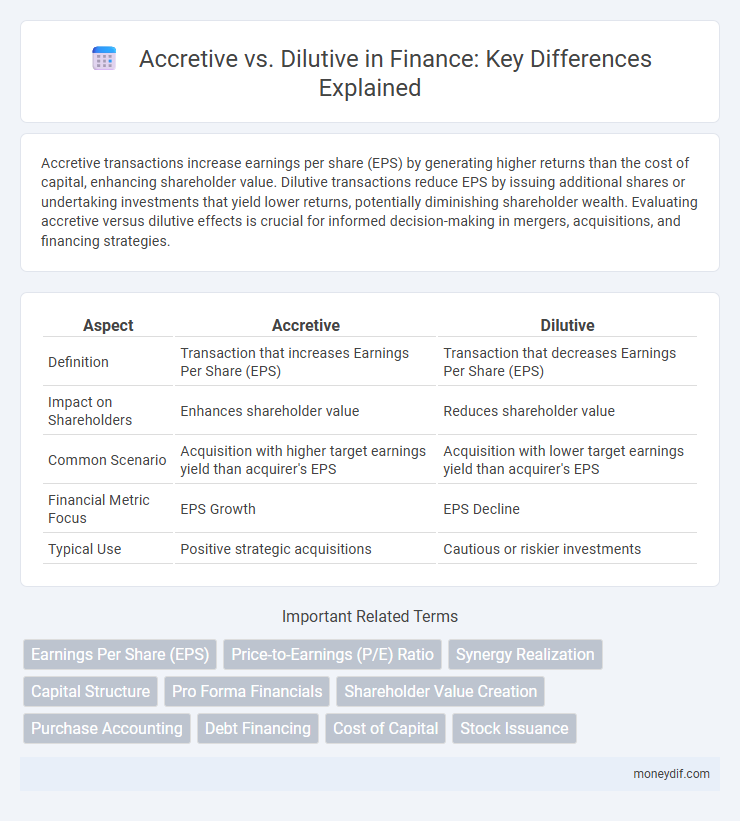

Accretive transactions increase earnings per share (EPS) by generating higher returns than the cost of capital, enhancing shareholder value. Dilutive transactions reduce EPS by issuing additional shares or undertaking investments that yield lower returns, potentially diminishing shareholder wealth. Evaluating accretive versus dilutive effects is crucial for informed decision-making in mergers, acquisitions, and financing strategies.

Table of Comparison

| Aspect | Accretive | Dilutive |

|---|---|---|

| Definition | Transaction that increases Earnings Per Share (EPS) | Transaction that decreases Earnings Per Share (EPS) |

| Impact on Shareholders | Enhances shareholder value | Reduces shareholder value |

| Common Scenario | Acquisition with higher target earnings yield than acquirer's EPS | Acquisition with lower target earnings yield than acquirer's EPS |

| Financial Metric Focus | EPS Growth | EPS Decline |

| Typical Use | Positive strategic acquisitions | Cautious or riskier investments |

Understanding Accretive and Dilutive Transactions

Accretive transactions increase a company's earnings per share (EPS), enhancing shareholder value by generating higher profits relative to the cost of acquisition. Dilutive transactions decrease EPS, often resulting from issuing new shares or acquiring assets that underperform relative to the acquisition cost. Understanding the impact of accretive versus dilutive deals is critical for evaluating mergers, acquisitions, and capital-raising strategies to ensure long-term financial growth.

Key Differences Between Accretive and Dilutive Deals

Accretive deals increase a company's earnings per share (EPS) by adding more value than the cost of acquiring the assets or business, often boosting shareholder value immediately. Dilutive deals reduce EPS because the acquisition costs or shares issued outweigh the incremental earnings generated, leading to a decrease in per-share profitability. Key differences include impact on EPS, effects on shareholder value, and the underlying financial metrics such as price-to-earnings (P/E) ratios and acquisition premiums.

How to Calculate Accretion and Dilution

Calculate accretion by dividing the pro forma earnings per share (EPS) after a merger or acquisition by the standalone EPS before the transaction; if the ratio exceeds 1, the deal is accretive. For dilution, the pro forma EPS is lower than the standalone EPS, resulting in a ratio less than 1. Key inputs include net income projections, share counts, purchase price, and costs associated with the transaction to determine the impact on shareholder value.

Impact of Mergers and Acquisitions on EPS

Mergers and acquisitions can significantly impact earnings per share (EPS) by either being accretive or dilutive. Accretive transactions increase EPS by generating higher combined earnings relative to the number of shares outstanding, often through cost synergies, revenue growth, or improved capital structure. Dilutive transactions reduce EPS when the acquisition's cost exceeds its earnings contribution or leads to share issuance, diluting existing shareholder value.

Factors Influencing Accretion or Dilution

Factors influencing accretion or dilution include the relative earnings per share (EPS) of the target and acquiring companies, transaction structure, and financing method. Stock issuance typically causes dilution if the acquirer's EPS is lower than the target's, while cash deals tend to be accretive due to no change in share count. Synergies, integration costs, and market conditions also play critical roles in determining the net impact on EPS.

Strategic Considerations for Accretive M&A

Accretive M&A transactions enhance earnings per share (EPS) by acquiring companies with higher earnings yield relative to the acquirer's cost of capital, thereby increasing shareholder value. Strategic considerations for accretive deals include rigorous target evaluation, synergy realization, and financing methods that preserve or improve the acquirer's capital structure. Prioritizing accretive acquisitions can accelerate growth, improve market positioning, and strengthen financial performance metrics critical to investor confidence.

Risks Associated with Dilutive Transactions

Dilutive transactions pose significant risks by decreasing existing shareholders' earnings per share (EPS) and ownership percentage, potentially undermining investor confidence. These transactions often result from issuing new equity or convertible securities that dilute the value of current shares, impacting stock price and market perception. Companies must carefully assess dilution effects to avoid adverse financial and strategic consequences in capital structure management.

Real-World Examples: Accretive vs Dilutive Deals

Accretive deals increase a company's earnings per share (EPS), often seen in acquisitions where the purchase price is lower than the earnings generated by the acquired business, such as Facebook's acquisition of Instagram. Dilutive deals decrease EPS, commonly occurring when companies issue new shares to finance an acquisition without immediate proportional earnings growth, like Amazon's acquisition of Whole Foods. Financial analysts evaluate these transactions by comparing the transaction's impact on EPS to assess shareholder value implications.

Investor Perspectives on Accretion and Dilution

Investors evaluate accretive and dilutive transactions to assess the impact on earnings per share (EPS) and overall shareholder value. Accretive deals increase EPS by generating higher returns than the cost of capital, often signaling financial strength and growth potential. Dilutive deals reduce EPS, raising concerns about overpayment or inadequate future earnings, which may affect stock price and investor confidence.

Best Practices for Evaluating Deal Outcomes

Accretive deals increase earnings per share (EPS) post-transaction, while dilutive deals reduce EPS, making EPS impact analysis crucial for evaluating deal outcomes. Best practices include conducting thorough financial modeling with sensitivity analysis on key variables such as purchase price, synergies, and integration costs to forecast accretion or dilution accurately. Additionally, assessing the strategic fit, long-term cash flow generation, and potential market reactions ensures a comprehensive evaluation beyond just EPS metrics.

Important Terms

Earnings Per Share (EPS)

Accretive earnings per share (EPS) occurs when a company's acquisition increases EPS, while dilutive EPS results when an acquisition decreases EPS, impacting shareholder value and investment decisions.

Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio measures a company's current share price relative to its per-share earnings, crucial for assessing whether an acquisition is accretive or dilutive to shareholder value. An accretive transaction typically occurs when the acquiring company's P/E ratio exceeds the target's, increasing earnings per share (EPS), whereas a dilutive deal results when the acquirer's P/E is lower, potentially decreasing EPS post-merger.

Synergy Realization

Synergy realization occurs when the combined value of merged entities exceeds their individual valuations, driving accretive outcomes by enhancing earnings per share (EPS) and operational efficiencies. Conversely, failure to achieve expected synergies can result in dilutive effects, where the merger decreases EPS and shareholder value due to integration challenges or overestimated benefits.

Capital Structure

Capital structure impacts whether an acquisition is accretive or dilutive by influencing the cost of capital and earnings per share (EPS) from debt and equity financing. A well-balanced mix of debt and equity in the capital structure can enhance accretive deals by minimizing EPS dilution and maximizing shareholder value.

Pro Forma Financials

Pro forma financials project the potential impact of mergers or acquisitions on a company's earnings per share (EPS), distinguishing whether the transaction is accretive, increasing EPS, or dilutive, decreasing EPS. These financial statements help investors analyze future profitability by excluding one-time items and focusing on ongoing operational performance.

Shareholder Value Creation

Shareholder value creation is significantly influenced by whether a transaction is accretive or dilutive to earnings per share (EPS); accretive transactions increase EPS and enhance investor returns, while dilutive transactions reduce EPS and can decrease shareholder wealth. Companies aim for accretive deals by carefully evaluating acquisition costs, synergies, and integration strategies to boost overall market valuation and long-term growth prospects.

Purchase Accounting

Purchase accounting involves recording acquired assets and liabilities at their fair market values, directly impacting earnings per share (EPS) analysis. An acquisition is accretive if the post-acquisition EPS increases due to higher net income or favorable purchase price allocation, whereas it is dilutive if the EPS decreases because of acquisition-related costs or overvaluation of assets.

Debt Financing

Debt financing can be accretive when the interest cost is lower than the acquired company's earnings yield, thereby increasing earnings per share, whereas it becomes dilutive if the cost of debt outweighs those earnings, reducing shareholder value.

Cost of Capital

The cost of capital directly influences whether an acquisition is accretive or dilutive by comparing the acquiree's return on investment against the acquirer's weighted average cost of capital (WACC); if the acquiree's return exceeds the WACC, the acquisition is accretive, increasing earnings per share (EPS). Conversely, when the acquiree's return falls below the WACC, the transaction is dilutive, leading to a decrease in EPS and potentially lower shareholder value.

Stock Issuance

Stock issuance can be classified as accretive or dilutive based on its impact on earnings per share (EPS); accretive issuance increases EPS by raising capital without proportionally increasing shares, while dilutive issuance lowers EPS due to a higher share count outweighing earnings growth. Evaluating the price-to-earnings (P/E) ratio before and after issuance helps determine whether the new equity issuance will enhance shareholder value or dilute ownership.

accretive vs dilutive Infographic

moneydif.com

moneydif.com