Securitization involves pooling various financial assets to create securities that can be sold to investors, increasing liquidity and risk distribution. Tranching further divides these securities into different layers or "tranches" based on risk and return profiles, allowing investors to choose according to their risk appetite. This structured finance technique enhances capital efficiency by tailoring investment products to diverse investor needs.

Table of Comparison

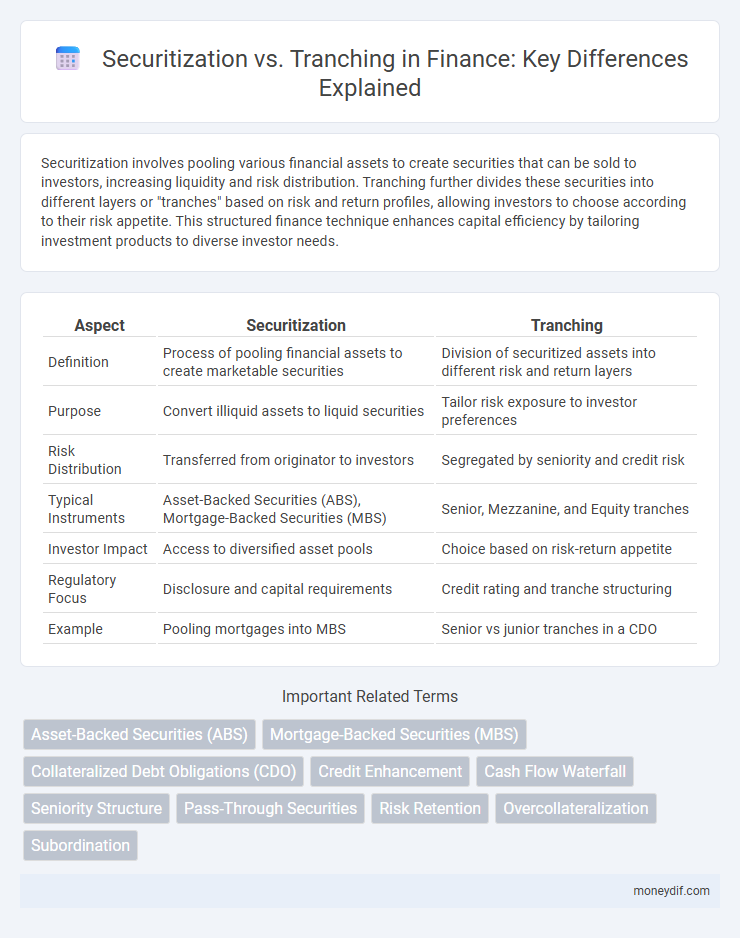

| Aspect | Securitization | Tranching |

|---|---|---|

| Definition | Process of pooling financial assets to create marketable securities | Division of securitized assets into different risk and return layers |

| Purpose | Convert illiquid assets to liquid securities | Tailor risk exposure to investor preferences |

| Risk Distribution | Transferred from originator to investors | Segregated by seniority and credit risk |

| Typical Instruments | Asset-Backed Securities (ABS), Mortgage-Backed Securities (MBS) | Senior, Mezzanine, and Equity tranches |

| Investor Impact | Access to diversified asset pools | Choice based on risk-return appetite |

| Regulatory Focus | Disclosure and capital requirements | Credit rating and tranche structuring |

| Example | Pooling mortgages into MBS | Senior vs junior tranches in a CDO |

Introduction to Securitization and Tranching

Securitization involves pooling various financial assets, such as loans or receivables, to create marketable securities, thereby transferring risk from originators to investors. Tranching structures these securities into different layers based on risk and return profiles, allowing investors to select tranches aligned with their risk appetite. This process enhances liquidity and diversifies risk, making securitization a critical tool in modern finance for capital market efficiency.

Defining Securitization in Modern Finance

Securitization in modern finance involves pooling various financial assets, such as mortgages or loans, and transforming them into marketable securities to distribute risk and enhance liquidity. This process enables originators to transfer asset risk to diverse investors while generating capital for new lending. Unlike tranching, which segments a security into different risk layers, securitization encompasses the initial packaging and issuance of asset-backed securities in the financial markets.

What is Tranching? Key Concepts

Tranching is a financial process used in securitization to divide pooled assets into segments or "tranches" with varying risk levels, priorities, and returns. Each tranche is structured to cater to different investor risk appetites, often classified as senior, mezzanine, and equity tranches, with senior tranches receiving priority in payments. This segmentation enhances capital efficiency by aligning asset-backed securities with tailored investment profiles and credit ratings.

Core Differences: Securitization vs Tranching

Securitization involves pooling various financial assets, such as loans or receivables, and converting them into marketable securities, transferring credit risk away from the originator. Tranching is the process of dividing these securitized assets into different slices or tranches, each with distinct risk levels, maturities, and returns to cater to diverse investor preferences. The core difference lies in securitization being the overall packaging of assets, while tranching is the segmentation of this package into risk-prioritized classes.

Process Flow: From Securitization to Tranch Creation

Securitization begins with pooling financial assets like loans or receivables and transferring them to a special purpose vehicle (SPV) to isolate credit risk. The SPV then structures the cash flows from these assets into distinct tranches, each with varying risk levels, maturities, and payment priorities to appeal to different investor profiles. This tranch creation process enhances liquidity and risk management by distributing asset-backed securities according to investors' risk tolerance and return expectations.

Benefits and Risks of Securitization

Securitization enhances liquidity by converting illiquid assets into tradable securities, enabling originators to transfer risk and diversify funding sources. It offers investors tailored risk-return profiles through different tranches, matching varying risk appetites. However, securitization carries risks including credit risk misestimation, reduced transparency, and potential market instability during economic downturns.

Tranching: Risk Allocation and Investor Appeal

Tranching divides a pooled asset into distinct layers, each with varying risk and return profiles, enabling targeted risk allocation tailored to investor preferences. Senior tranches carry lower risk and receive priority on cash flows, attracting risk-averse investors, while junior tranches offer higher yields but absorb initial losses, appealing to those with greater risk tolerance. This structural segmentation enhances investor appeal by aligning exposure to credit risk with individual investment strategies and regulatory capital requirements.

Real-World Applications and Case Studies

Securitization transforms illiquid assets into marketable securities, enabling financial institutions to manage risk and improve liquidity, as seen in mortgage-backed securities during the 2000s housing market. Tranching divides these securities into layers with varying risk and return profiles, attracting diverse investor groups as demonstrated by collateralized debt obligations (CDOs) in both pre- and post-crisis financial markets. Real-world applications reveal how securitization and tranching facilitate capital flow and risk distribution, critical for structured finance and investment strategies.

Regulatory Landscape: Securitization and Tranching

Securitization involves pooling financial assets and issuing securities backed by these assets, subject to regulatory frameworks such as Basel III and risk retention rules designed to enhance transparency and risk management. Tranching, a process within securitization, segments securities into different risk levels and maturities, requiring adherence to regulations like the Dodd-Frank Act to ensure investor protection and market stability. Regulatory bodies emphasize disclosure, capital requirements, and risk retention to mitigate systemic risk and promote accountability in both securitization and tranching activities.

Future Trends in Asset Securitization and Tranching

Future trends in asset securitization and tranching emphasize increased automation through blockchain technology, enhancing transparency and efficiency in transaction processing. Artificial intelligence-driven analytics will optimize tranche structuring by better assessing credit risk and investor demand. Regulatory frameworks are expected to evolve, promoting standardized disclosures to improve market stability and investor confidence.

Important Terms

Asset-Backed Securities (ABS)

Asset-Backed Securities (ABS) are financial instruments created through the securitization process, where pools of underlying assets such as loans or receivables are transformed into tradable securities. Tranching divides these ABS into different risk and return segments, enabling investors to choose from various levels of credit exposure and maturity profiles.

Mortgage-Backed Securities (MBS)

Mortgage-Backed Securities (MBS) are created through securitization, a process that pools mortgage loans and transforms them into marketable securities. Tranching divides these MBS into different risk and return segments, allowing investors to choose securities that match their risk appetite and investment horizon.

Collateralized Debt Obligations (CDO)

Collateralized Debt Obligations (CDOs) are complex financial instruments created through securitization, which pools various debt assets to generate new securities; the cash flows from these assets are then divided into tranches with varying risk and return profiles to appeal to different investor preferences. The tranching process enhances risk distribution by prioritizing payment waterfalls and credit enhancements, allowing investors to selectively absorb default risks based on their risk appetite and investment horizon.

Credit Enhancement

Credit enhancement improves the credit risk profile of securitized assets by reducing potential losses and increasing investor confidence. Unlike tranching, which divides a securitization pool into layers with varying risk and return, credit enhancement provides external or internal safeguards such as overcollateralization, reserve funds, or third-party guarantees to protect senior tranches from defaults.

Cash Flow Waterfall

Cash flow waterfall structures prioritize payment distribution in securitization by directing cash flows through sequential tranches based on seniority and risk, ensuring senior tranche investors receive payments before subordinated tranches. This mechanism enhances credit enhancement and investor confidence by systematically allocating principal and interest payments according to tranche hierarchy.

Seniority Structure

Seniority structure in securitization defines the priority order of debt repayment, where senior tranches have the highest claim on cash flows and lowest risk, while subordinate tranches absorb losses first. This hierarchical arrangement influences tranche ratings, investor risk exposure, and yield spreads within the securitized debt framework.

Pass-Through Securities

Pass-through securities represent cash flows from underlying asset pools directly passed to investors, contrasting with tranching that segments these flows into layers with distinct risk and return profiles. Securitization synthesizes asset pools into pass-through securities, while tranching modifies risk distribution by creating senior, mezzanine, and equity tranches to cater to diverse investor appetites.

Risk Retention

Risk retention mandates require securitizers to hold a portion of the credit risk to align interests with investors, enhancing transparency and collateral quality in securitization transactions. Unlike tranching, which structurally divides cash flows and risk across multiple layers of securities, risk retention focuses on the originator's ongoing exposure and accountability to credit performance.

Overcollateralization

Overcollateralization enhances securitization by providing excess collateral beyond the issued securities' value, which reduces credit risk and supports higher credit ratings. Tranching divides the securitized pool into layers with varying risk and return profiles, allowing investors to select based on risk tolerance, while overcollateralization acts as a credit enhancement benefiting all tranches.

Subordination

Subordination in securitization refers to the hierarchy of debt repayments where junior tranches absorb losses before senior tranches, enhancing the credit quality of senior securities. Tranching divides the securitized assets into multiple layers with varying risk and return profiles, allowing investors to choose exposure based on their risk tolerance and investment objectives.

securitization vs tranching Infographic

moneydif.com

moneydif.com