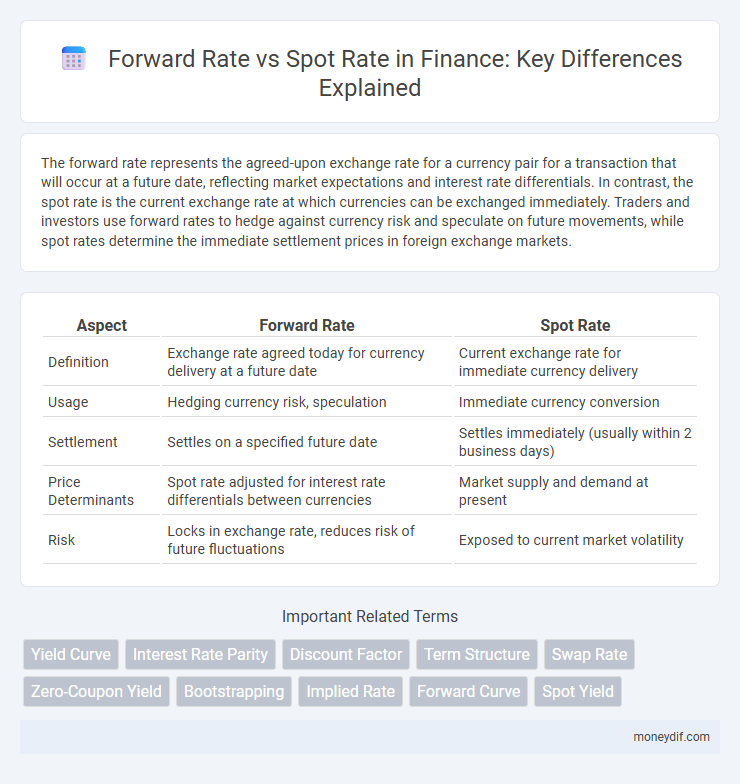

The forward rate represents the agreed-upon exchange rate for a currency pair for a transaction that will occur at a future date, reflecting market expectations and interest rate differentials. In contrast, the spot rate is the current exchange rate at which currencies can be exchanged immediately. Traders and investors use forward rates to hedge against currency risk and speculate on future movements, while spot rates determine the immediate settlement prices in foreign exchange markets.

Table of Comparison

| Aspect | Forward Rate | Spot Rate |

|---|---|---|

| Definition | Exchange rate agreed today for currency delivery at a future date | Current exchange rate for immediate currency delivery |

| Usage | Hedging currency risk, speculation | Immediate currency conversion |

| Settlement | Settles on a specified future date | Settles immediately (usually within 2 business days) |

| Price Determinants | Spot rate adjusted for interest rate differentials between currencies | Market supply and demand at present |

| Risk | Locks in exchange rate, reduces risk of future fluctuations | Exposed to current market volatility |

Understanding Forward Rate and Spot Rate

The forward rate represents the agreed-upon interest rate or exchange rate for a financial transaction that will occur at a future date, reflecting market expectations and interest rate differentials. The spot rate, on the other hand, is the current exchange or interest rate for immediate settlement and serves as the baseline for determining forward rates. Analyzing the relationship between forward and spot rates helps investors assess future market conditions, hedge against risks, and make informed financial decisions.

Key Differences Between Forward Rate and Spot Rate

Forward rate is the agreed-upon exchange rate for a currency transaction that will occur at a future date, reflecting market expectations and interest rate differentials. Spot rate is the current exchange rate at which currencies can be exchanged immediately, determined by real-time supply and demand in the foreign exchange market. Key differences include timing, as forward rates apply to future transactions while spot rates apply to immediate trades, and pricing mechanisms, where forward rates incorporate interest rate parity and spot rates reflect current market conditions.

Importance of Forward Rates in Financial Markets

Forward rates are essential in financial markets as they provide valuable information about the market's expectations of future interest rates, aiding investors and institutions in hedging and investment decisions. These rates help in pricing derivatives, managing interest rate risk, and establishing arbitrage strategies by linking current spot rates with anticipated future rates. Accurate forward rate predictions enable efficient capital allocation and contribute to market stability by reflecting collective market sentiment about future economic conditions.

How Spot Rates Are Determined

Spot rates are determined by the current supply and demand dynamics in the foreign exchange market, reflecting the immediate price at which currencies can be exchanged. Factors such as interest rate differentials, inflation expectations, geopolitical events, and central bank interventions directly impact spot rate fluctuations. Market liquidity and economic indicators also play crucial roles in shaping the prevailing spot exchange rate.

Calculating Forward Rates: Methods and Formulas

Forward rates are calculated using spot rates through the no-arbitrage condition, ensuring that investing over multiple periods yields the same return as locking in a forward contract. The typical formula derives the forward rate \( f_{t,T} \) between times \( t \) and \( T \) by solving \( (1+s_T)^T = (1+s_t)^t \times (1+f_{t,T})^{T-t} \), where \( s_t \) and \( s_T \) are the spot rates for maturities \( t \) and \( T \) respectively. This method leverages current spot rates to determine expectations of future interest rates embedded in forward contracts, essential for pricing derivative securities and managing interest rate risk.

Practical Applications of Spot and Forward Rates

Spot rates enable immediate currency conversion or asset valuation, critical for settling current transactions and accounting accuracy. Forward rates facilitate hedging against future exchange rate fluctuations, allowing businesses to lock in prices and manage financial risk in cross-border contracts. Both rates are essential in optimizing cash flow management and strategic financial planning within multinational corporations.

Factors Influencing Forward and Spot Rates

Forward rates and spot rates are influenced by interest rate differentials, inflation expectations, and geopolitical stability between countries. Market demand and supply dynamics in the foreign exchange market directly impact spot rates, while forward rates also incorporate anticipated future economic conditions and interest rate parity. Central bank policies, trade balances, and capital flows further shape both forward and spot exchange rates, affecting currency valuation.

Role in Managing Currency and Interest Rate Risk

Forward rates allow businesses and investors to hedge against future currency and interest rate fluctuations by locking in prices today, thereby reducing uncertainty in cash flows. Spot rates reflect current market prices, serving as benchmarks for immediate transactions but exposing entities to potential volatility. Utilizing forward rates for risk management enables precise budgeting and protection from adverse movements in exchange or borrowing costs.

Forward Rate vs Spot Rate: Impact on Investment Decisions

Forward rate and spot rate significantly influence investment decisions by indicating future expectations of interest rates and currency values. The forward rate, derived from the spot rate and interest rate differentials, provides insight into anticipated market conditions, allowing investors to hedge risks or capitalize on expected changes. Spot rates reflect the current market price for immediate transactions, serving as a baseline for assessing the profitability and timing of investments.

Limitations and Risks Associated with Forward and Spot Rates

Forward rates and spot rates both carry limitations and risks in financial transactions, including exposure to market volatility and potential forecasting errors. Forward rates, while useful for hedging future exchange rate risk, may not always accurately predict actual spot rates at contract maturity, leading to basis risk. Spot rates reflect current market conditions but can result in unfavorable exchange rates due to short-term fluctuations and liquidity constraints.

Important Terms

Yield Curve

The yield curve graphically represents the relationship between spot rates and maturities, while forward rates derived from it indicate expected future interest rates. Comparing forward rates to corresponding spot rates helps investors assess market expectations for interest rate movements and potential arbitrage opportunities.

Interest Rate Parity

Interest Rate Parity (IRP) establishes a theoretical relationship between the forward exchange rate and the spot exchange rate based on differences in interest rates between two countries. According to IRP, the forward rate adjusts to offset the interest rate differential, ensuring no arbitrage opportunities exist from borrowing in one currency and investing in another.

Discount Factor

The discount factor reflects the present value of a future amount and is inversely related to interest rates derived from spot and forward rates; it is calculated by exponentiating the negative product of the rate and the time period. Forward rates, implied by spot rates, indicate expected future short-term rates, and the discount factor based on forward rates adjusts the valuation of cash flows occurring at different times, ensuring consistency between spot and forward markets.

Term Structure

The term structure of interest rates illustrates the relationship between forward rates and spot rates across different maturities, reflecting market expectations of future interest rate movements. Forward rates derived from the term structure serve as implied future spot rates, helping investors price bonds and manage interest rate risk efficiently.

Swap Rate

The swap rate reflects the fixed interest rate agreed upon in an interest rate swap, typically derived from the forward rate rather than the current spot rate, as it incorporates market expectations of future interest rates over the swap's tenor. This rate aligns more closely with the forward rate curve, representing the market consensus on future funding costs, while the spot rate depicts the immediate borrowing cost.

Zero-Coupon Yield

Zero-coupon yield serves as a fundamental indicator in bond valuation, derived from discounting the bond's future cash flows to their present value using spot rates. Forward rates, inferred from spot rates, represent expected future interest rates and help investors assess the term structure of interest rates by comparing today's zero-coupon yields with implied future yields.

Bootstrapping

Bootstrapping constructs a zero-coupon yield curve by iteratively solving for spot rates using observed forward rates derived from coupon-bearing bonds. This method enables accurate extraction of spot rates from forward rates, ensuring consistency between forward rate expectations and spot rate discounting for precise valuation and risk management.

Implied Rate

Implied rate is the interest rate derived from the relationship between forward rates and spot rates, reflecting the expected future interest rate implied by current market prices.

Forward Curve

Forward curve represents the expected future prices or interest rates of an asset, derived from forward rates that reflect market expectations beyond the current spot rate. The comparison between forward rates and spot rates reveals market sentiment on interest rate changes, inflation, and risk premia over different time horizons.

Spot Yield

Spot yield reflects the return on a zero-coupon bond at a specific maturity, while the forward rate represents the implied future interest rate between two periods derived from current spot rates.

forward rate vs spot rate Infographic

moneydif.com

moneydif.com