The capital stack represents the hierarchy of financing sources including equity, mezzanine debt, and senior debt, each with varying risk and return profiles. The waterfall outlines the specific order in which cash flows and returns are distributed to investors, prioritizing senior debt payments before mezzanine and equity holders. Understanding both concepts is essential for structuring investments and managing risk in real estate and private equity transactions.

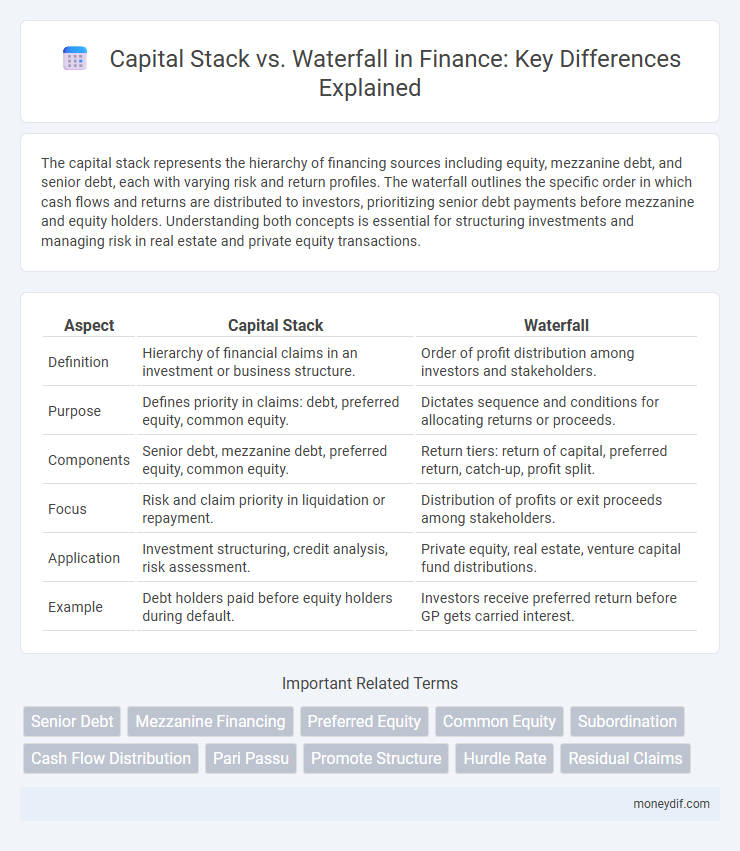

Table of Comparison

| Aspect | Capital Stack | Waterfall |

|---|---|---|

| Definition | Hierarchy of financial claims in an investment or business structure. | Order of profit distribution among investors and stakeholders. |

| Purpose | Defines priority in claims: debt, preferred equity, common equity. | Dictates sequence and conditions for allocating returns or proceeds. |

| Components | Senior debt, mezzanine debt, preferred equity, common equity. | Return tiers: return of capital, preferred return, catch-up, profit split. |

| Focus | Risk and claim priority in liquidation or repayment. | Distribution of profits or exit proceeds among stakeholders. |

| Application | Investment structuring, credit analysis, risk assessment. | Private equity, real estate, venture capital fund distributions. |

| Example | Debt holders paid before equity holders during default. | Investors receive preferred return before GP gets carried interest. |

Understanding the Capital Stack in Finance

The capital stack represents the hierarchy of financing layers in a project or company, including equity, mezzanine debt, and senior debt, each with distinct risk and return profiles. Understanding the capital stack is critical for investors and lenders to assess their position in terms of repayment priority and potential losses during financial distress. This structure directly influences the waterfall distribution, which dictates the order and manner in which cash flows and proceeds are allocated among stakeholders.

What is a Waterfall Structure?

A waterfall structure in finance delineates the sequential distribution of returns among investors based on their priority in the capital stack, ensuring senior debt holders receive payments before subordinated debt and equity investors. This tiered model allocates cash flow according to predefined rules, protecting higher-priority stakeholders while incentivizing lower-tier investors with potential upside after senior obligations are met. Understanding the waterfall structure is essential for evaluating risk and return profiles in complex financing arrangements and syndicated investments.

Key Differences: Capital Stack vs Waterfall

The capital stack represents the hierarchy of funding sources in a real estate or investment deal, prioritizing claims from senior debt to equity, while the waterfall outlines the distribution of profits among stakeholders based on predetermined tiers. Key differences include the capital stack defining the order of investment risk and return, whereas the waterfall determines the sequence and proportion of cash flow allocation and profit sharing. Understanding these distinctions is crucial for investors to assess risk exposure and expected returns in structured finance deals.

Components of the Capital Stack Explained

The capital stack consists of multiple layers of financing, including common equity, preferred equity, mezzanine debt, and senior debt, each with varying risk and return profiles. Senior debt holds the highest repayment priority, followed by mezzanine debt which often carries higher interest rates due to increased risk, then preferred equity which offers fixed dividends before common equity. Common equity sits at the bottom of the stack, bearing the highest risk but also the greatest potential for upside returns in a company's capital structure.

How Waterfall Models Distribute Returns

Waterfall models distribute returns in a hierarchical structure, prioritizing the repayment of capital and preferred returns to senior investors before allocating profits to junior stakeholders. This method ensures that different tranches within the capital stack receive returns according to predefined tiers, reflecting their risk and reward profiles. By systematically cascading cash flows through these tiers, the waterfall model aligns investor incentives and accurately reflects the risk-return dynamics within a capital stack.

Importance of Priority in Capital Stack

Priority in the capital stack is critical for determining the order of payments and risk exposure among different investors in a financing structure. Senior debt holders receive payments first, minimizing their risk, while equity investors are last in line but have the highest return potential. Understanding this hierarchy ensures proper structuring of waterfall distributions and aligns investor expectations with their risk and return profiles.

Waterfall Structures: Types and Tiers

Waterfall structures in finance refer to the priority order in which capital distributions are made to investors, typically organized into multiple tiers such as return of capital, preferred returns, and profit splits. Common types include pari passu, where distributions are shared equally, and tiered waterfalls, which prioritize senior investors before subordinated classes. Understanding the tiers within waterfall models is essential for structuring equity investments and aligning risk-reward preferences among stakeholders.

Impacts on Investor Risk and Return

Capital stack delineates the hierarchy of claims on a company's assets, directly influencing investor risk and return by prioritizing senior debt over mezzanine and equity positions, which typically bear higher returns alongside increased risk. Waterfall structures specify the order and conditions under which cash flows are distributed, affecting investor returns by detailing when and how different capital stack layers receive payouts, thereby defining potential gains and exposure to losses. Understanding both frameworks enables investors to assess risk profiles accurately and predict return expectations based on position priority and distribution mechanisms.

Practical Examples: Capital Stack vs Waterfall

The capital stack represents the hierarchy of funding sources in a real estate or business investment, typically comprising senior debt, mezzanine debt, preferred equity, and common equity, each with different risk and return profiles. The waterfall structure dictates the order in which cash flows or proceeds are distributed among stakeholders, prioritizing repayments to senior debt holders before allocating returns to mezzanine lenders and equity investors. For example, in a commercial real estate project, proceeds from property sales first repay senior debt, then pay mezzanine debt, and finally distribute remaining profits to preferred and common equity holders, illustrating how both the capital stack and waterfall work together to define financial priorities and returns.

Choosing the Right Structure for Investments

Choosing the right capital stack and waterfall structure is critical for optimizing investment returns and managing risk in finance. Capital stack defines the hierarchy of debt and equity claims, while the waterfall determines the order of cash flow distribution among investors. Understanding investor priorities and project cash flow patterns ensures alignment between financial goals and payout sequences, maximizing value and minimizing conflicts.

Important Terms

Senior Debt

Senior debt holds the highest claim in the capital stack and receives priority in the waterfall distribution, ensuring repayment before mezzanine and equity investors.

Mezzanine Financing

Mezzanine financing occupies a subordinate position in the capital stack, providing higher returns than senior debt but ranking below equity in the waterfall distribution hierarchy.

Preferred Equity

Preferred equity holds priority in the capital stack by receiving fixed returns before common equity distributions in the waterfall structure.

Common Equity

Common Equity represents the residual ownership interest in a company, positioned lowest in the capital stack and receiving distributions only after all debts and preferred equity are fully paid in the waterfall structure. This tier carries the highest risk and potential return, reflecting its subordinated claim in both liquidation and profit distribution scenarios.

Subordination

Subordination in capital stack structures dictates the priority of claims on assets and cash flows, where equity holders are subordinate to debt holders, affecting the waterfall distribution sequence. This hierarchy ensures senior debt is paid first, followed by mezzanine and preferred equity, with common equity receiving residual proceeds last.

Cash Flow Distribution

Cash flow distribution in the context of capital stack versus waterfall structures determines the order and priority of payments to investors based on their position within the capital hierarchy, ensuring senior debt holders receive cash flows before mezzanine and equity investors. The waterfall mechanism allocates proceeds sequentially, aligning returns with risk levels and capital contributions to optimize investor returns and capital efficiency.

Pari Passu

Pari passu refers to the equal ranking of investors within the capital stack where distributions are made proportionally in the waterfall without preference or subordination.

Promote Structure

Promote structure aligns equity incentives by prioritizing investor returns through a capital stack hierarchy before distributing carried interest according to a predefined waterfall model.

Hurdle Rate

The hurdle rate is a critical benchmark in private equity capital stacks, representing the minimum preferred return investors must receive before sponsors participate in profit sharing under the waterfall structure. It ensures that limited partners achieve a targeted return threshold, aligning incentives and dictating the sequence in which cash flows are distributed through the capital stack.

Residual Claims

Residual claims represent the rights of equity holders to the remaining assets after all debt obligations in the capital stack are satisfied according to the waterfall distribution.

Capital stack vs Waterfall Infographic

moneydif.com

moneydif.com