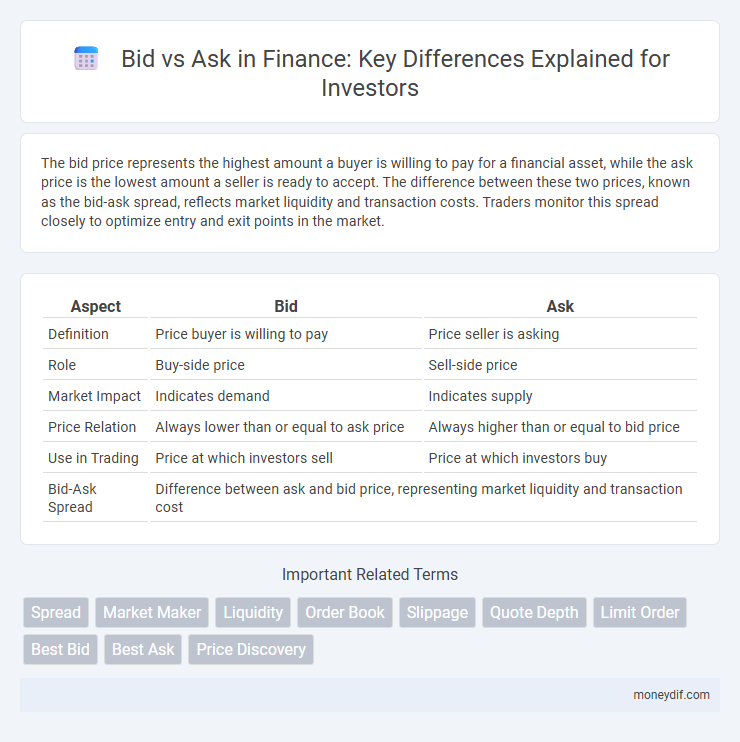

The bid price represents the highest amount a buyer is willing to pay for a financial asset, while the ask price is the lowest amount a seller is ready to accept. The difference between these two prices, known as the bid-ask spread, reflects market liquidity and transaction costs. Traders monitor this spread closely to optimize entry and exit points in the market.

Table of Comparison

| Aspect | Bid | Ask |

|---|---|---|

| Definition | Price buyer is willing to pay | Price seller is asking |

| Role | Buy-side price | Sell-side price |

| Market Impact | Indicates demand | Indicates supply |

| Price Relation | Always lower than or equal to ask price | Always higher than or equal to bid price |

| Use in Trading | Price at which investors sell | Price at which investors buy |

| Bid-Ask Spread | Difference between ask and bid price, representing market liquidity and transaction cost | |

Understanding Bid and Ask Prices

Bid price represents the highest price a buyer is willing to pay for a security, while the ask price indicates the lowest price a seller is willing to accept. The difference between these two prices is known as the bid-ask spread, which reflects market liquidity and transaction costs. Understanding bid and ask prices is essential for traders to execute orders effectively and gauge market sentiment.

The Importance of the Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, serving as a key indicator of market liquidity and transaction costs. Narrow spreads typically signify high liquidity and efficient markets, while wider spreads indicate lower liquidity and higher trading costs, impacting investor decisions. Understanding the bid-ask spread is crucial for optimizing trade execution and assessing market conditions in financial instruments.

How Bid and Ask Influence Market Liquidity

Bid and ask prices directly impact market liquidity by determining the ease with which assets can be bought or sold. Narrow bid-ask spreads typically indicate high liquidity, allowing traders to execute transactions quickly with minimal price impact. Wider spreads suggest lower liquidity, increasing transaction costs and potentially causing price volatility.

Factors Affecting Bid-Ask Spread

Bid-ask spreads are influenced by factors such as market liquidity, trading volume, and volatility, where higher liquidity and volume typically narrow the spread, while increased volatility widens it. Asset type and market maker competition also play critical roles, with highly traded securities like large-cap stocks exhibiting tighter spreads compared to thinly traded or illiquid assets. Information asymmetry and transaction costs further impact the bid-ask spread, as markets with less transparency and higher operational costs tend to have wider spreads.

Bid vs Ask: Impact on Trading Costs

Bid vs Ask prices directly influence trading costs by determining the spread investors pay when executing orders. A narrower bid-ask spread reduces the cost of buying and selling securities, enhancing market liquidity and efficiency. Traders frequently monitor these spreads to optimize entry and exit points, minimizing transaction expenses.

Role of Market Makers in Bid-Ask Dynamics

Market makers play a crucial role in bid-ask dynamics by continuously providing liquidity and ensuring smoother price discovery in financial markets. They quote both bid prices, at which they are willing to buy assets, and ask prices, at which they are ready to sell, facilitating transactions between buyers and sellers. Their ability to absorb imbalances between supply and demand stabilizes price fluctuations and narrows the bid-ask spread, enhancing market efficiency.

Bid Price Strategies for Buyers

Bid price strategies for buyers involve setting competitive bids just below the current ask price to maximize potential profit while increasing the likelihood of order execution. Buyers often analyze market depth and historical bid-ask spreads to time entries for better positioning against sellers. Employing limit orders at strategic bid prices can control purchase costs and optimize investment returns in volatile markets.

Ask Price Strategies for Sellers

Sellers leverage ask price strategies by setting competitive ask prices just above the bid to attract buyers while maximizing profit margins. Dynamic pricing models and real-time market data enable sellers to adjust ask prices based on demand fluctuations, liquidity, and order book depth. Effective ask price strategy enhances sell order execution speed and optimizes revenue in volatile financial markets.

Real-World Examples of Bid and Ask

In the stock market, the bid price represents the highest price a buyer is willing to pay for shares, while the ask price is the lowest price a seller is willing to accept. For instance, if Apple Inc. shares are quoted with a bid of $145.20 and an ask of $145.50, traders know buyers seek to purchase at $145.20, and sellers offer shares starting at $145.50, defining the bid-ask spread. Understanding these real-world bid and ask prices helps investors evaluate market liquidity and execute trades efficiently.

Bid-Ask Spread in Different Financial Markets

The bid-ask spread varies significantly across financial markets, reflecting differences in liquidity, volatility, and market structure. Equity markets typically feature narrower spreads due to high trading volumes and competition among market makers, while spreads in bond and forex markets can be wider because of lower liquidity or higher risk. Understanding these variations helps traders optimize transaction costs and improve pricing efficiency strategies.

Important Terms

Spread

The spread represents the difference between the highest bid price and the lowest ask price in a financial market, indicating market liquidity and transaction costs.

Market Maker

Market makers provide liquidity by continuously posting competitive bid and ask prices, profiting from the spread between the buy (bid) and sell (ask) quotes.

Liquidity

Liquidity in financial markets is determined by the narrowness of the bid-ask spread and the volume of buy and sell orders available at those prices.

Order Book

The Order Book displays real-time Bid and Ask prices, representing buyers' willingness to purchase at specific prices and sellers' willingness to sell, crucial for market liquidity and price discovery.

Slippage

Slippage occurs when the executed price differs from the bid or ask price due to market volatility or low liquidity during order execution.

Quote Depth

Quote Depth measures the volume of buy (bid) and sell (ask) orders at various price levels, indicating market liquidity and potential price movement.

Limit Order

A limit order sets a specific price to buy at the bid or sell at the ask, ensuring execution only at the predetermined price or better.

Best Bid

The best bid represents the highest price a buyer is willing to pay, contrasting with the best ask which is the lowest price a seller is willing to accept in financial markets.

Best Ask

Best Ask represents the lowest price a seller is willing to accept in the market, contrasting with the Best Bid, which is the highest price a buyer is willing to pay.

Price Discovery

Price discovery occurs through the continuous interaction of bid prices, representing buyers' willingness to pay, and ask prices, reflecting sellers' minimum acceptable amounts, ultimately determining the transaction price in financial markets.

Bid vs Ask Infographic

moneydif.com

moneydif.com