Pari passu debt holders share equal rights to repayment and have the same priority in the event of borrower default, ensuring simultaneous distribution of assets. Subordinated debt ranks below pari passu and senior debt, which means its holders are paid only after higher-ranking creditors have been fully satisfied. Understanding the distinction between pari passu and subordinated debt is crucial for assessing risk exposure and structuring financing deals effectively.

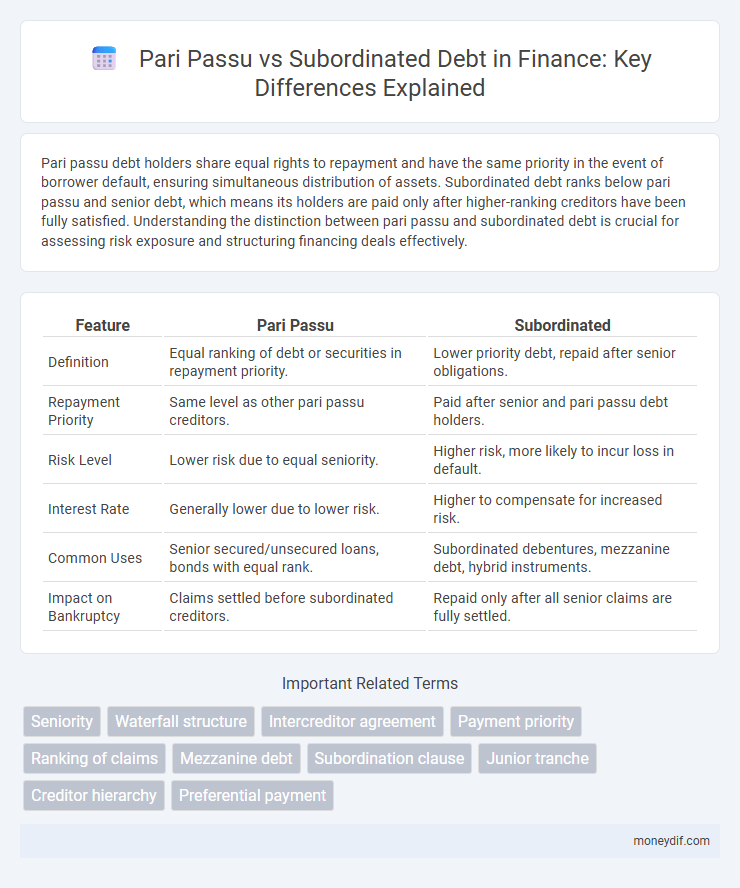

Table of Comparison

| Feature | Pari Passu | Subordinated |

|---|---|---|

| Definition | Equal ranking of debt or securities in repayment priority. | Lower priority debt, repaid after senior obligations. |

| Repayment Priority | Same level as other pari passu creditors. | Paid after senior and pari passu debt holders. |

| Risk Level | Lower risk due to equal seniority. | Higher risk, more likely to incur loss in default. |

| Interest Rate | Generally lower due to lower risk. | Higher to compensate for increased risk. |

| Common Uses | Senior secured/unsecured loans, bonds with equal rank. | Subordinated debentures, mezzanine debt, hybrid instruments. |

| Impact on Bankruptcy | Claims settled before subordinated creditors. | Repaid only after all senior claims are fully settled. |

Defining Pari Passu and Subordinated Debt

Pari passu debt refers to loans or securities that share equal rights to repayment without any preference in priority during liquidation or restructuring, meaning all creditors are treated equally. Subordinated debt ranks below senior debt in the capital structure, implying that it will only be repaid after all senior obligations have been satisfied. This hierarchy significantly affects risk, recovery rates, and interest rates, with subordinated debt typically offering higher yields due to increased risk exposure.

Key Differences between Pari Passu and Subordinated Claims

Pari passu claims share equal priority in the repayment hierarchy, ensuring creditors receive payments proportionally according to their claim size. Subordinated claims rank below pari passu claims in priority and are repaid only after senior obligations are fully satisfied. This hierarchy directly impacts recovery rates and risk profiles for investors in debt instruments.

Priority of Payment in Insolvency

Pari passu debt holders share equal priority in receiving payments during insolvency, ensuring proportional distribution of assets simultaneously among them. Subordinated debt, however, ranks lower in the hierarchy, receiving payment only after all senior and pari passu creditors have been fully satisfied. This prioritization critically influences risk assessment and recovery rates in financial restructurings and bankruptcies.

Legal Framework Governing Debt Hierarchies

Pari passu debt ranks equally in the legal framework, ensuring creditors have proportional claims on assets without preference, while subordinated debt is contractually lower in priority and repaid only after senior claims are satisfied. The legal hierarchy is governed by insolvency laws, bankruptcy codes, and specific covenants within debt agreements that clearly define repayment order and enforcement rights. Jurisdictions differ in their treatment of pari passu clauses and subordination agreements, impacting creditor recoveries and restructuring outcomes.

Risk Assessment: Pari Passu vs Subordinated Instruments

Pari passu instruments share equal priority in claim hierarchy during default, reducing exposure to recovery risk compared to subordinated instruments, which bear higher risk due to lower repayment priority. Risk assessment favors pari passu structures for conservative portfolios seeking stable capital recovery and liquidity. Subordinated instruments typically offer higher yield compensation for increased credit risk and potential loss severity.

Impact on Investor Returns

Pari passu debt ranks equally with other debt in claims on assets and earnings, ensuring investors receive payments simultaneously without priority, which typically results in lower risk and steadier returns. Subordinated debt carries a lower priority in the capital structure, meaning investors face higher risk due to later payment order, but potentially enjoy higher returns through elevated interest rates as compensation. The choice between pari passu and subordinated instruments directly impacts investor risk exposure and expected yield outcomes.

Common Examples in Financial Markets

Common examples of pari passu arrangements in financial markets include unsecured bonds and syndicated loans, where creditors share equal ranking in claims. Subordinated debt commonly appears in mezzanine financing and junior bonds, positioned below senior creditors in repayment priority. These distinctions impact risk assessment, influencing interest rates and investor preferences in capital structures.

Role in Corporate Capital Structure

Pari passu debt ranks equally in the corporate capital structure, ensuring all holders share the same priority for repayment during liquidation events, which reduces risk exposure for creditors. Subordinated debt stands below senior obligations, absorbing losses first and offering higher yields to investors due to increased risk, thus acting as a buffer that protects senior creditors. Understanding the distinction between pari passu and subordinated debt is crucial for assessing credit risk and optimizing capital cost strategies in corporate finance.

Implications for Lenders and Bondholders

Pari passu debt ranks equally among lenders and bondholders, ensuring proportional repayment during default without priority, which reduces credit risk and increases recovery certainty. Subordinated debt carries lower priority, meaning lenders and bondholders absorb losses after senior creditors are paid, resulting in higher risk but often higher yields to compensate. Understanding these ranking implications is critical for assessing investment risk, structuring loan agreements, and pricing bonds within credit markets.

Choosing between Pari Passu and Subordinated Debt

Choosing between pari passu and subordinated debt depends on risk tolerance and capital structure strategy. Pari passu debt holds equal ranking with other senior obligations, offering lower risk and higher claim priority during liquidation. Subordinated debt ranks below senior debt, carrying higher risk but typically providing higher yields to compensate investors for the added risk exposure.

Important Terms

Seniority

Seniority determines a debt's repayment priority where pari passu creditors share equal rank while subordinated creditors have lower repayment priority in bankruptcy cases.

Waterfall structure

In a waterfall structure, pari passu investors receive distributions simultaneously and equally, while subordinated investors are paid only after senior tranches have been fully satisfied.

Intercreditor agreement

An intercreditor agreement defines the rights and priorities between pari passu creditors, who share equal ranking in debt claims, and subordinated creditors, whose claims rank below those of senior lenders. This agreement governs enforcement rights, payment waterfalls, and voting powers to avoid conflicts during borrower default or restructuring.

Payment priority

Payment priority determines the order in which creditors receive funds during debt repayment, with pari passu debts sharing equal ranking and distribution simultaneously, while subordinated debts rank lower and are paid only after senior obligations are fully satisfied. Understanding the distinction between pari passu and subordinated obligations is critical for assessing credit risk and recovery prospects in insolvency scenarios.

Ranking of claims

Pari passu claims rank equally without priority, while subordinated claims rank lower and are paid only after senior claims are settled.

Mezzanine debt

Mezzanine debt occupies a hybrid position between senior secured debt and equity, often structured as subordinated debt with higher yields to compensate for increased risk. In capital structure hierarchy, mezzanine debt ranks pari passu with other subordinated lenders, meaning it shares equal payment priority but stands behind senior creditors during liquidation or default events.

Subordination clause

A subordination clause legally establishes the priority ranking of debt claims, ensuring pari passu debts share equal repayment rights while subordinated debts rank below and are repaid only after senior obligations are fulfilled.

Junior tranche

The junior tranche in structured finance refers to the lowest priority segment in the capital structure, absorbing losses before the senior tranche, making it subordinated rather than pari passu with other tranches. It offers higher yields due to increased risk, as payment and principal recovery occur only after senior and pari passu tranches are fully satisfied.

Creditor hierarchy

Creditor hierarchy determines the priority of claims in bankruptcy, where pari passu creditors share equal ranking and receive proportional payments simultaneously, while subordinated creditors rank lower and are paid only after senior creditors have been fully satisfied. This structured prioritization impacts recovery rates, legal risk, and negotiation leverage during restructuring or liquidation processes.

Preferential payment

Preferential payment refers to claims that must be paid before others in insolvency, ranking higher than subordinated debts but below secured creditors, while pari passu denotes equal ranking among creditors with no priority. Understanding the distinction between preferential payments and subordinated claims is crucial for accurately determining creditor hierarchy and distribution in bankruptcy proceedings.

Pari passu vs Subordinated Infographic

moneydif.com

moneydif.com