Cross-currency swaps involve exchanging principal and interest payments in different currencies, mitigating currency and interest rate risk simultaneously, while interest rate swaps solely exchange interest payments on a single currency principal, targeting interest rate risk management. Cross-currency swaps are often used by multinational corporations and financial institutions for hedging foreign exchange exposure, whereas interest rate swaps are common for managing interest rate exposure on loans or bonds. The choice depends on the specific risk profile and the nature of underlying cash flows or liabilities.

Table of Comparison

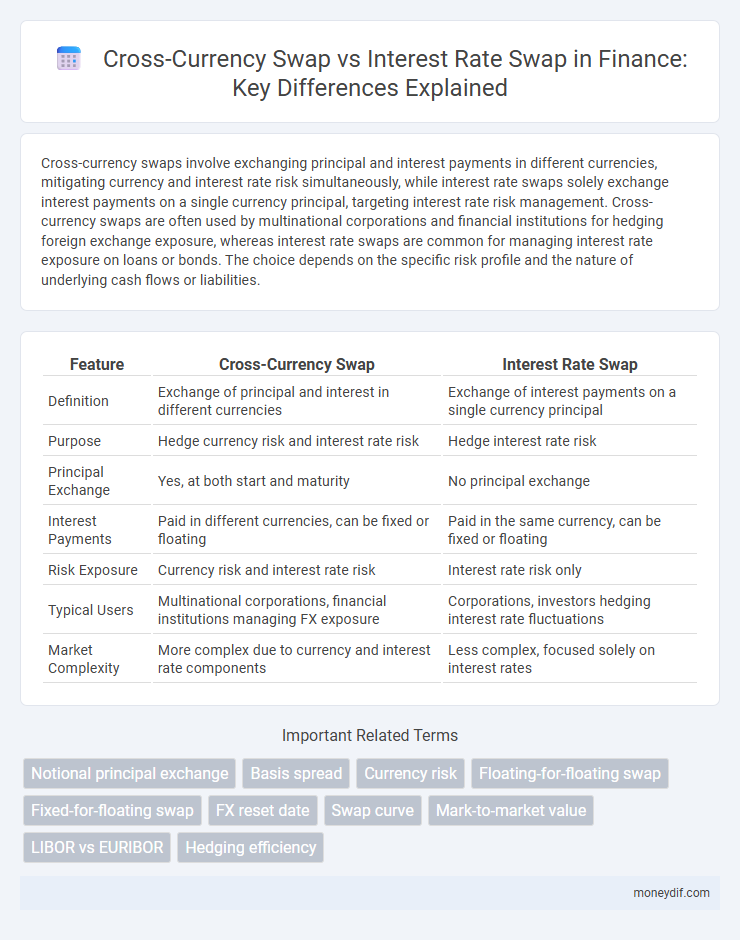

| Feature | Cross-Currency Swap | Interest Rate Swap |

|---|---|---|

| Definition | Exchange of principal and interest in different currencies | Exchange of interest payments on a single currency principal |

| Purpose | Hedge currency risk and interest rate risk | Hedge interest rate risk |

| Principal Exchange | Yes, at both start and maturity | No principal exchange |

| Interest Payments | Paid in different currencies, can be fixed or floating | Paid in the same currency, can be fixed or floating |

| Risk Exposure | Currency risk and interest rate risk | Interest rate risk only |

| Typical Users | Multinational corporations, financial institutions managing FX exposure | Corporations, investors hedging interest rate fluctuations |

| Market Complexity | More complex due to currency and interest rate components | Less complex, focused solely on interest rates |

Introduction to Cross-Currency Swaps and Interest Rate Swaps

Cross-currency swaps involve exchanging principal and interest payments in different currencies, mitigating foreign exchange risk and interest rate exposure simultaneously. Interest rate swaps, on the other hand, typically exchange fixed interest rate payments for floating rate payments within the same currency to manage interest rate risk. Both derivatives play a crucial role in corporate finance and risk management by providing tailored solutions for hedging interest rate fluctuations and currency mismatches.

Fundamental Differences Between Cross-Currency and Interest Rate Swaps

Cross-currency swaps involve exchanging principal and interest payments in two different currencies, effectively managing both currency risk and interest rate risk, while interest rate swaps only exchange interest payments based on a single currency, focusing solely on interest rate risk management. Fundamental differences include the involvement of exchange rate risk in cross-currency swaps, which requires dealing with foreign exchange markets, and the typically more complex valuation process compared to interest rate swaps. Cross-currency swaps often serve multinational corporations for hedging foreign currency debt, whereas interest rate swaps are widely used to convert fixed-rate debt to floating-rate debt or vice versa within the same currency.

How Cross-Currency Swaps Work

Cross-currency swaps involve exchanging principal and interest payments in different currencies between two parties, allowing firms to manage foreign exchange risk and access cheaper financing. The parties agree on fixed or floating interest rates in their respective currencies and swap these payments over the contract's life, with principal amounts typically exchanged both at initiation and maturity. This mechanism differs from interest rate swaps, which only exchange interest rate payments without involving principal or currency exchange.

How Interest Rate Swaps Function

Interest rate swaps function by exchanging fixed interest rate payments for floating rate payments between two parties, typically linked to a benchmark like LIBOR or SOFR, to manage interest rate exposure or reduce borrowing costs. These derivatives do not involve exchanging principal amounts, unlike cross-currency swaps which swap both principal and interest in different currencies. The cash flows are calculated on a notional principal which remains unchanged throughout the swap's life, facilitating risk management for institutions facing variable interest rate fluctuations.

Key Use Cases for Cross-Currency Swaps

Cross-currency swaps are primarily used by multinational corporations to hedge foreign exchange risk when managing debt issued in multiple currencies, ensuring predictable cash flows despite currency fluctuations. They enable companies to obtain financing in a foreign currency at more favorable interest rates without directly accessing foreign capital markets. These swaps are also crucial for managing exposure to both interest rate differentials and exchange rate volatility simultaneously, unlike interest rate swaps which only address interest rate risk in a single currency.

Common Applications of Interest Rate Swaps

Interest rate swaps are primarily used to manage exposure to fluctuations in interest rates by exchanging fixed-rate payments for floating-rate payments, helping companies stabilize cash flows and reduce borrowing costs. Corporations often utilize interest rate swaps to convert variable-rate debt to fixed rates, ensuring predictable interest expenses in volatile markets. These swaps also facilitate portfolio diversification and risk management strategies for institutional investors by adjusting the interest rate profile of assets and liabilities without altering the principal amount.

Risk Factors Associated with Each Swap Type

Cross-currency swaps expose parties to both interest rate risk and foreign exchange risk due to the involvement of multiple currencies, making currency fluctuations a primary risk factor. Interest rate swaps primarily carry interest rate risk, as they involve exchanging fixed and floating interest payments within the same currency, minimizing currency exposure. Credit risk affects both swap types but intensified in cross-currency swaps because of the complexities in settlement across different currencies and jurisdictions.

Pricing and Valuation Comparison

Cross-currency swaps involve exchanging principal and interest payments in different currencies, requiring valuation models to account for foreign exchange rates, interest rate differentials, and basis spreads, making pricing more complex than interest rate swaps. Interest rate swaps focus solely on exchanging fixed and floating interest payments within the same currency, simplifying discounting and valuation using the domestic yield curve. The presence of currency risk and the need for multiple yield curves in cross-currency swaps typically lead to higher bid-ask spreads and more intricate sensitivity analyses compared to the more straightforward valuation of interest rate swaps.

Regulatory and Accounting Considerations

Cross-currency swaps require adherence to multiple jurisdictions' regulatory frameworks, including compliance with Dodd-Frank in the U.S. and EMIR in Europe, which impacts reporting and margin requirements. Interest rate swaps primarily face regulatory scrutiny related to interest rate risk and derivatives clearing mandates under similar regulations but within a single currency framework, simplifying cross-border compliance. Accounting treatment for cross-currency swaps involves hedge accounting complexities due to foreign exchange risk, while interest rate swaps focus predominantly on fair value measurement and interest rate risk exposure under IFRS 9 and ASC 815 standards.

Choosing Between a Cross-Currency Swap and an Interest Rate Swap

Choosing between a cross-currency swap and an interest rate swap depends on the specific financial objectives and currency exposure of a company. Cross-currency swaps are ideal for firms needing to hedge both interest rate risk and foreign exchange risk simultaneously, involving principal and interest payments in different currencies. Interest rate swaps, by contrast, primarily manage interest rate risk within a single currency, making them suitable for companies focused on modifying fixed or floating rate debt without currency exchange concerns.

Important Terms

Notional principal exchange

Notional principal exchange in cross-currency swaps involves swapping principal amounts in different currencies at the start and maturity, minimizing foreign exchange risk, unlike interest rate swaps where notional amounts are typically not exchanged, focusing instead on interest payments based on a fixed or floating rate. This fundamental difference affects cash flow management and counterparty credit exposure in cross-currency swaps compared to interest rate swaps.

Basis spread

Basis spread in cross-currency swaps reflects the difference between the interest rates of two currencies, accounting for credit and liquidity risks beyond standard interest rate swap spreads. This spread crucially impacts hedging costs and pricing by measuring the deviation from covered interest rate parity in cross-currency funding.

Currency risk

Currency risk in cross-currency swaps arises from fluctuations in exchange rates when exchanging principal and interest payments in different currencies, unlike interest rate swaps which primarily expose parties to interest rate volatility without direct foreign exchange risk. Cross-currency swaps mitigate currency risk by locking in exchange rates, while interest rate swaps focus solely on managing interest rate exposure in a single currency.

Floating-for-floating swap

Floating-for-floating swaps involve exchanging variable interest rate payments between two parties, commonly seen in cross-currency swaps where the principal and interest in different currencies are swapped based on floating rates. Unlike interest rate swaps that typically exchange fixed for floating rates within the same currency, cross-currency swaps hedge both interest rate and currency risk by swapping floating rates across different currencies.

Fixed-for-floating swap

Fixed-for-floating swaps involve exchanging fixed interest payments for floating-rate payments, commonly used in interest rate swaps to manage interest rate risk. In cross-currency swaps, both principal and interest payments are exchanged in different currencies, combining currency risk management with fixed-for-floating interest rate swaps to hedge exposure across currencies.

FX reset date

The FX reset date in cross-currency swaps is a crucial point where exchanged notionals are adjusted to reflect current foreign exchange rates, mitigating currency risk, unlike interest rate swaps which do not involve currency exchanges or FX reset dates. Cross-currency swaps combine principal and interest payments in two currencies with periodic FX resets, whereas interest rate swaps focus solely on exchanging interest rate cash flows in a single currency without any FX rate adjustments.

Swap curve

The swap curve represents the relationship between swap rates and maturities, with cross-currency swaps incorporating exchange rate risk by exchanging principal and interest in different currencies, while interest rate swaps involve exchanging fixed and floating interest payments within the same currency to manage interest rate exposure.

Mark-to-market value

Mark-to-market value for cross-currency swaps incorporates both exchange rate fluctuations and interest rate differentials, reflecting the current net value of cash flows exchanged in distinct currencies. In contrast, interest rate swaps' mark-to-market valuation focuses solely on interest rate changes, as cash flows occur in the same currency, making currency risk irrelevant.

LIBOR vs EURIBOR

LIBOR (London Interbank Offered Rate) and EURIBOR (Euro Interbank Offered Rate) serve as benchmark interest rates in cross-currency swaps and interest rate swaps, with LIBOR primarily used in USD-denominated swaps and EURIBOR in EUR-denominated instruments. Cross-currency swaps typically involve exchanging principal and interest payments based on LIBOR and EURIBOR rates to hedge currency and interest rate risk, whereas interest rate swaps focus solely on exchanging fixed and floating interest payments referenced to either LIBOR or EURIBOR within a single currency framework.

Hedging efficiency

Cross-currency swaps offer superior hedging efficiency by simultaneously managing exposure to both foreign exchange risk and interest rate fluctuations, whereas interest rate swaps primarily address interest rate risk alone. Incorporating cross-currency swaps into risk management strategies enhances the ability to stabilize cash flows in multiple currencies, optimizing financial performance under volatile market conditions.

Cross-currency swap vs Interest rate swap Infographic

moneydif.com

moneydif.com