Order flow provides real-time data on market liquidity and price movements before transactions are executed, enabling traders to anticipate market trends. Trade confirmation, on the other hand, serves as an official record verifying the details of completed trades, ensuring accuracy and compliance. Understanding the distinction between these two concepts enhances decision-making and risk management in financial trading.

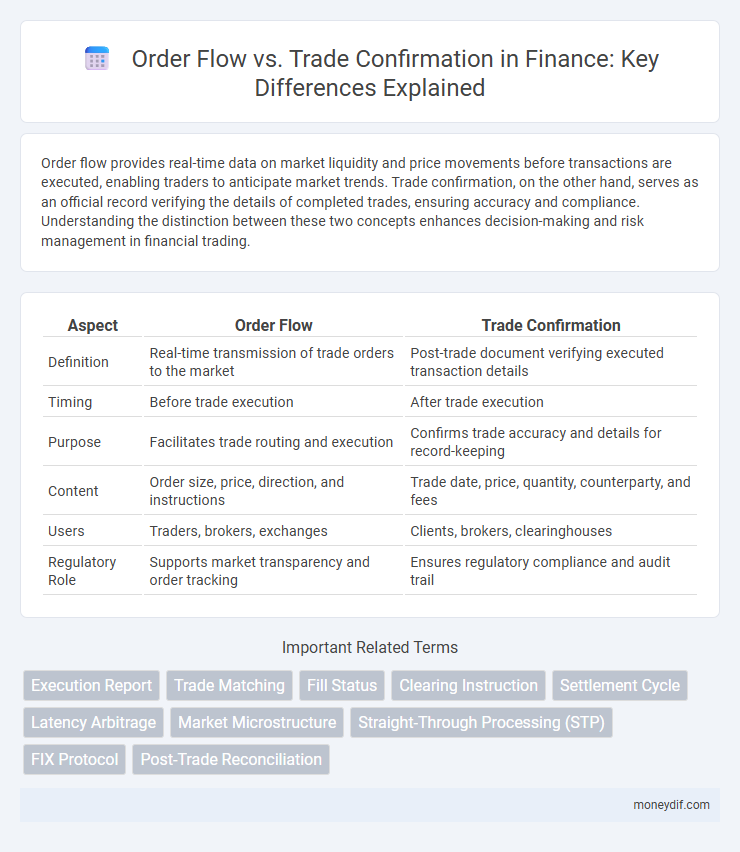

Table of Comparison

| Aspect | Order Flow | Trade Confirmation |

|---|---|---|

| Definition | Real-time transmission of trade orders to the market | Post-trade document verifying executed transaction details |

| Timing | Before trade execution | After trade execution |

| Purpose | Facilitates trade routing and execution | Confirms trade accuracy and details for record-keeping |

| Content | Order size, price, direction, and instructions | Trade date, price, quantity, counterparty, and fees |

| Users | Traders, brokers, exchanges | Clients, brokers, clearinghouses |

| Regulatory Role | Supports market transparency and order tracking | Ensures regulatory compliance and audit trail |

Understanding Order Flow in Financial Markets

Order flow in financial markets represents the real-time stream of buy and sell orders that drive price discovery and liquidity, providing critical insights into market sentiment and potential price movements. Trade confirmation, on the other hand, serves as the official verification of a completed transaction, detailing the execution price, quantity, and time. Analyzing order flow offers traders a predictive edge by revealing supply and demand dynamics before trades are finalized and confirmed.

What is Trade Confirmation?

Trade confirmation is a formal document or electronic notification that verifies the details of a completed securities transaction, including the asset traded, price, quantity, and settlement date. It serves as proof for both buyers and sellers, ensuring transparency and preventing discrepancies in trade execution. Timely trade confirmations are crucial for maintaining accurate records and complying with regulatory requirements in financial markets.

Key Differences Between Order Flow and Trade Confirmation

Order flow refers to the real-time stream of buy and sell orders submitted to financial markets, providing insights into market sentiment and liquidity. Trade confirmation is the post-execution document or message that verifies the details of a completed transaction, including price, quantity, and settlement instructions. Understanding the difference between order flow and trade confirmation is crucial for traders to analyze market behavior and ensure accuracy in trade settlements.

The Role of Order Flow in Price Discovery

Order flow plays a critical role in price discovery by providing real-time information on market participant demand and supply imbalances, which influence asset prices before trade confirmations are finalized. Analyzing order flow data allows traders and market makers to anticipate price movements and liquidity shifts, enhancing execution strategies and reducing adverse price impact. Unlike trade confirmation, which reports executed transactions, order flow captures intention and market sentiment, offering a proactive insight into evolving price dynamics.

How Trade Confirmations Ensure Transaction Accuracy

Trade confirmations provide detailed records of executed trades, including price, quantity, time, and counterparty information, ensuring transparency and accuracy in transaction reporting. By cross-verifying order flow data with trade confirmations, discrepancies or errors in trade execution are promptly identified and corrected. This rigorous validation process enhances investor confidence and regulatory compliance in financial markets.

Impact of Order Flow on Market Liquidity

Order flow, representing aggregated buy and sell orders, directly influences market liquidity by signaling supply and demand dynamics to market makers and liquidity providers. Efficient order flow enhances price discovery, narrows bid-ask spreads, and increases trade volume, fostering a more liquid and stable market environment. In contrast, delayed or inaccurate trade confirmations can disrupt liquidity by hindering the timely processing of orders and obscuring true market depth.

Compliance and Regulatory Aspects of Trade Confirmation

Trade confirmation is crucial for compliance as it provides a verified record of transaction details, ensuring transparency and adherence to regulatory requirements such as SEC Rule 10b-10. Order flow, while important for execution efficiency, lacks the formal documentation necessary for regulatory audits and dispute resolution. Financial institutions must prioritize accurate trade confirmation processes to maintain compliance and mitigate risks associated with trade settlement errors and fraud.

Order Flow Analysis for Trading Strategies

Order flow analysis provides real-time insight into market liquidity, revealing the intentions behind buy and sell orders that shape price movements. Unlike trade confirmation data, which validates completed transactions, order flow offers predictive value by identifying imbalances between buyer and seller pressure. Leveraging advanced order flow analytics enables traders to optimize entry and exit points, improve risk management, and enhance the profitability of trading strategies in dynamic markets.

Common Errors in Trade Confirmation and Their Consequences

Common errors in trade confirmation, such as incorrect trade details or mismatched order flow records, can lead to significant financial discrepancies and settlement delays. Inaccurate confirmations disrupt the reconciliation process, increasing the risk of failed trades and potential regulatory penalties. Ensuring precise alignment between order flow and trade confirmation data is crucial to maintain market integrity and operational efficiency.

Integrating Order Flow and Trade Confirmation in Modern Trading Systems

Integrating order flow and trade confirmation in modern trading systems enhances execution accuracy and reduces settlement risk by providing real-time transparency of transaction statuses. Advanced platforms leverage API connectivity and blockchain technology to synchronize order book data with trade confirmations, enabling seamless reconciliation and improved compliance reporting. This integration optimizes liquidity management, minimizes latency, and supports algorithmic trading strategies by ensuring immediate verification of trade executions.

Important Terms

Execution Report

Execution reports provide real-time data on order flow, capturing details such as order status, partial fills, and cancellations to ensure transparency in trade execution. Trade confirmations finalize these details by verifying executed prices, quantities, and timestamps, serving as official proof for both buyers and sellers in the transaction process.

Trade Matching

Trade matching ensures order flow accuracy by verifying buy and sell orders align precisely before execution. This process reduces errors in trade confirmation, enhancing settlement efficiency and market transparency.

Fill Status

Fill status indicates the completion level of an order within the order flow, reflecting whether trades have been fully or partially executed. Trade confirmation provides verification and details of these executed orders, ensuring accurate record-keeping and synchronization between trading parties.

Clearing Instruction

Clearing instructions specify the settlement details for order flow, ensuring accurate processing between brokers and clearinghouses, while trade confirmation provides verified details of executed trades to counterparties. Efficient clearing instruction management reduces settlement risks and discrepancies between order initiation and final trade confirmation.

Settlement Cycle

The settlement cycle defines the timeframe between order flow initiation and trade confirmation, ensuring accurate transfer of securities and funds.

Latency Arbitrage

Latency arbitrage exploits the time gap between order flow information and trade confirmation, allowing traders to react to market orders before they are fully executed. By leveraging faster access to order flow data, latency arbitrageurs gain a competitive edge in high-frequency trading environments, capturing price discrepancies that occur within milliseconds.

Market Microstructure

Market microstructure examines the impact of order flow--the sequence and size of buy and sell orders--on price formation and liquidity. Trade confirmation provides post-trade data that validates executed orders, enhancing transparency and reducing information asymmetry in trading environments.

Straight-Through Processing (STP)

Straight-Through Processing (STP) enables automated order flow by electronically transmitting trade instructions directly from the client to execution venues, reducing manual intervention and errors. Trade confirmation in STP systems occurs instantaneously upon execution, ensuring real-time verification and minimizing reconciliation delays.

FIX Protocol

FIX Protocol enables real-time electronic communication between order flow submissions and trade confirmations, enhancing market transparency and execution efficiency.

Post-Trade Reconciliation

Post-trade reconciliation involves verifying order flow against trade confirmations to identify discrepancies and ensure accuracy in transaction records. This process enhances operational efficiency by aligning executed trades with original orders, reducing settlement risks and regulatory compliance issues.

order flow vs trade confirmation Infographic

moneydif.com

moneydif.com