Dividend recapitalization involves a company taking on new debt to pay a special dividend to shareholders, enhancing immediate shareholder returns without changing ownership structure. Leveraged buyouts (LBOs) entail acquiring a company primarily through borrowed funds, often resulting in significant ownership and control shifts. Both strategies increase leverage but serve distinct financial and strategic objectives within corporate finance.

Table of Comparison

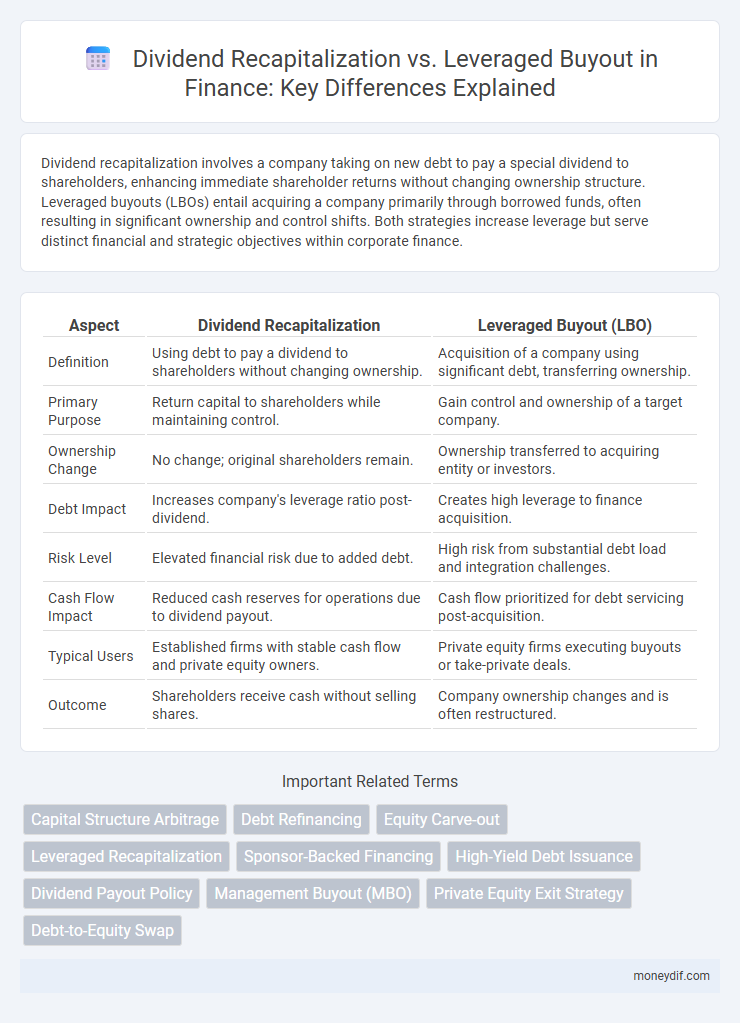

| Aspect | Dividend Recapitalization | Leveraged Buyout (LBO) |

|---|---|---|

| Definition | Using debt to pay a dividend to shareholders without changing ownership. | Acquisition of a company using significant debt, transferring ownership. |

| Primary Purpose | Return capital to shareholders while maintaining control. | Gain control and ownership of a target company. |

| Ownership Change | No change; original shareholders remain. | Ownership transferred to acquiring entity or investors. |

| Debt Impact | Increases company's leverage ratio post-dividend. | Creates high leverage to finance acquisition. |

| Risk Level | Elevated financial risk due to added debt. | High risk from substantial debt load and integration challenges. |

| Cash Flow Impact | Reduced cash reserves for operations due to dividend payout. | Cash flow prioritized for debt servicing post-acquisition. |

| Typical Users | Established firms with stable cash flow and private equity owners. | Private equity firms executing buyouts or take-private deals. |

| Outcome | Shareholders receive cash without selling shares. | Company ownership changes and is often restructured. |

Understanding Dividend Recapitalization

Dividend recapitalization involves a company taking on new debt to pay a special dividend to shareholders, often used by private equity firms to extract cash without selling the company. This strategy enables firms to realize returns while maintaining ownership control, contrasting with leveraged buyouts where debt is used to acquire a company outright. Understanding dividend recapitalization is critical for assessing its impact on company leverage and long-term financial stability.

What Is a Leveraged Buyout (LBO)?

A Leveraged Buyout (LBO) is a financial acquisition method where a company is purchased primarily using borrowed funds, with the acquired company's assets often serving as collateral for the debt. The objective of an LBO is to enable investors, typically private equity firms, to acquire controlling interest with minimal equity investment, aiming to improve operational efficiency and generate high returns through eventual resale or public offering. This strategy contrasts with dividend recapitalization, which involves issuing new debt to pay dividends to shareholders without changing ownership.

Key Differences Between Dividend Recap and LBO

Dividend recapitalization involves a company taking on new debt to pay a special dividend to shareholders, enhancing shareholder returns without transferring ownership. Leveraged buyout (LBO) refers to the acquisition of a company primarily funded through debt, resulting in a change of ownership where the equity investors gain control. The key differences lie in ownership transfer--dividend recap maintains existing ownership while LBO shifts control--and in purpose, with dividend recaps focused on returning capital to shareholders versus LBOs aimed at acquiring and restructuring companies.

Financial Structures in Dividend Recapitalization vs LBO

Dividend recapitalization involves a company taking on new debt to pay a dividend to shareholders, altering its financial structure by increasing leverage without changing ownership. Leveraged buyouts (LBOs) fundamentally restructure the company's capital by using significant borrowed funds to acquire controlling interest, shifting both debt levels and ownership. The key difference lies in dividend recaps maintaining existing equity holders while LBOs transfer control through heavy debt financing.

Impacts on Company Balance Sheets

Dividend recapitalization increases a company's debt load by issuing new debt to pay shareholders, which inflates liabilities and reduces equity on the balance sheet. Leveraged buyouts involve acquiring a company primarily with debt, significantly increasing leverage and altering asset ownership structure while typically resulting in a substantial rise in long-term liabilities. Both strategies intensify financial risk by heightening leverage ratios, impacting credit ratings and future financing flexibility.

Dividend Recap vs LBO: Risks and Rewards

Dividend recapitalization involves a company taking on new debt to pay a special dividend to shareholders, often increasing financial risk due to higher leverage and potential cash flow constraints. Leveraged buyouts (LBOs) acquire companies using significant debt, aiming to improve operational efficiency and generate returns, but they carry risks of debt overhang and execution challenges. Both strategies offer rewards like enhanced shareholder returns, but balancing debt levels and operational improvements is critical to mitigate risks inherent in high-leverage transactions.

Investor Perspectives: Dividend Recap vs Leveraged Buyout

Dividend recapitalization offers investors immediate liquidity by enabling companies to pay substantial dividends through new debt issuance, often enhancing returns without diluting ownership. Leveraged buyouts involve acquiring a target company primarily with debt, allowing investors to gain control and potentially realize significant capital appreciation over time, albeit with higher risk exposure. From an investor perspective, dividend recaps provide quicker cash flow benefits, while leveraged buyouts emphasize long-term value creation through operational improvements and strategic repositioning.

Regulatory and Tax Implications

Dividend recapitalization involves a company borrowing debt to pay a large dividend to shareholders, often triggering regulatory scrutiny regarding increased leverage ratios and financial stability under banking or securities laws. Leveraged buyouts (LBOs) typically entail acquiring a company primarily with borrowed funds, raising major tax considerations including interest deductibility and potential changes in tax basis affecting depreciation and amortization. Both transactions must navigate complex regulatory frameworks such as the SEC's reporting requirements and tax codes, with dividend recaps often impacting shareholder equity while LBOs influence ownership structure and corporate taxation strategies.

Case Studies: Real-World Examples

Dividend recapitalization in finance often involves companies raising debt to pay dividends to shareholders, as seen in the case of Dell's 2013 recapitalization, which allowed significant shareholder payouts without relinquishing control. In contrast, leveraged buyouts (LBOs), exemplified by the 2007 acquisition of TXU Energy by KKR and TPG Capital, utilize high debt levels to finance the complete acquisition of a company, typically restructuring operations post-transaction. These case studies highlight how dividend recapitalizations preserve equity ownership while LBOs enable full ownership transitions through debt leverage.

Choosing the Right Strategy: Factors to Consider

Dividend recapitalization involves a company taking on new debt to pay a dividend to shareholders, enhancing immediate shareholder returns without ownership change. Leveraged buyouts (LBOs) entail acquiring a company primarily with borrowed funds, transferring ownership and often triggering operational restructuring. Key factors in choosing between the two strategies include the company's cash flow stability, debt capacity, shareholder objectives, and long-term growth potential, with dividend recapitalization favoring mature businesses seeking liquidity and LBOs suited for firms where new ownership aims to drive value creation through strategic changes.

Important Terms

Capital Structure Arbitrage

Capital structure arbitrage exploits valuation inefficiencies between dividend recapitalization, where firms increase leverage to pay dividends, and leveraged buyouts, which involve acquiring companies primarily through debt financing to optimize capital structure.

Debt Refinancing

Dividend recapitalization involves refinancing debt to pay shareholders dividends without ownership change, whereas leveraged buyout uses significant debt refinancing to acquire and gain control of a company.

Equity Carve-out

An equity carve-out involves selling a minority stake to public investors to raise capital, which differs from dividend recapitalization that leverages debt to pay dividends and a leveraged buyout that uses significant debt to acquire a controlling interest.

Leveraged Recapitalization

A leveraged recapitalization restructures a company's equity and debt by issuing new debt to pay dividends or repurchase shares, distinguishing it from a dividend recapitalization, which specifically uses debt to pay dividends, and a leveraged buyout, where debt finances the acquisition of the entire company.

Sponsor-Backed Financing

Sponsor-backed financing in dividend recapitalization involves raising debt to pay dividends to equity holders without ownership change, whereas leveraged buyouts entail acquiring a company using significant debt, resulting in control transfer.

High-Yield Debt Issuance

High-yield debt issuance funds dividend recapitalizations by allowing companies to raise capital for shareholder payouts, whereas leveraged buyouts rely on such debt to finance the acquisition of target firms.

Dividend Payout Policy

Dividend payout policy influences corporate finance strategies by shaping decisions between dividend recapitalization, which involves borrowing to pay dividends, and leveraged buyouts, where acquired firms are financed through significant debt loads.

Management Buyout (MBO)

A Management Buyout (MBO) often involves Dividend Recapitalization to extract equity before or during the deal, whereas Leveraged Buyouts (LBOs) primarily use debt financing to acquire companies without necessarily distributing dividends.

Private Equity Exit Strategy

Dividend recapitalization provides private equity firms liquidity by issuing new debt to pay dividends, while leveraged buyouts focus on acquiring companies with significant debt to enhance returns upon exit.

Debt-to-Equity Swap

A Debt-to-Equity Swap restructures company liabilities by converting debt into equity, contrasting with Dividend Recapitalization which uses additional debt to pay shareholders, and Leveraged Buyouts that acquire firms primarily through significant debt financing.

Dividend Recapitalization vs Leveraged Buyout Infographic

moneydif.com

moneydif.com