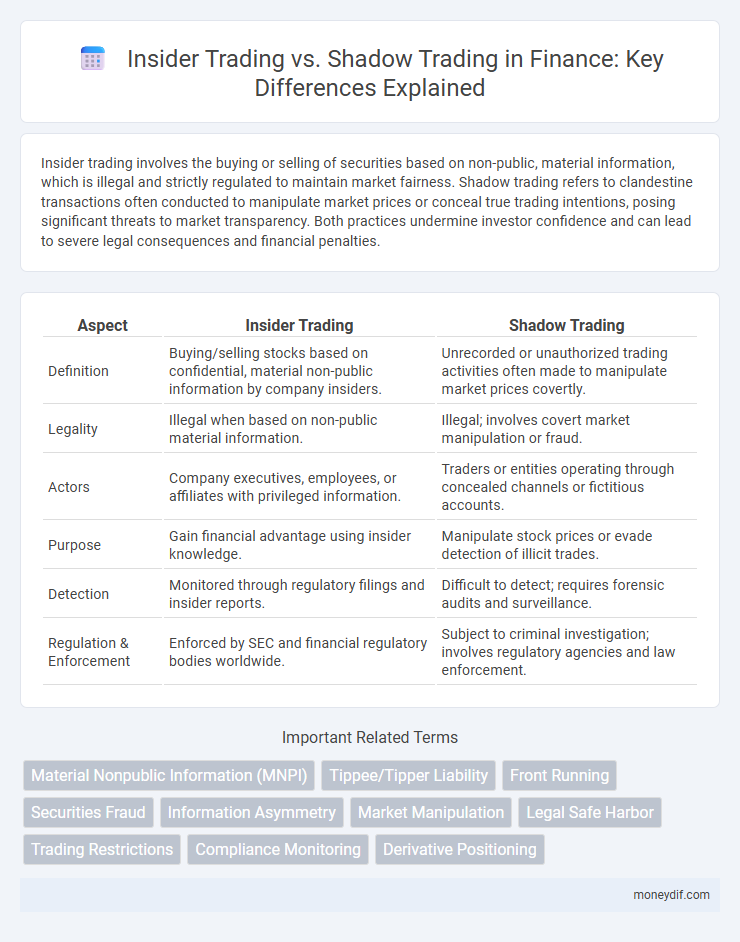

Insider trading involves the buying or selling of securities based on non-public, material information, which is illegal and strictly regulated to maintain market fairness. Shadow trading refers to clandestine transactions often conducted to manipulate market prices or conceal true trading intentions, posing significant threats to market transparency. Both practices undermine investor confidence and can lead to severe legal consequences and financial penalties.

Table of Comparison

| Aspect | Insider Trading | Shadow Trading |

|---|---|---|

| Definition | Buying/selling stocks based on confidential, material non-public information by company insiders. | Unrecorded or unauthorized trading activities often made to manipulate market prices covertly. |

| Legality | Illegal when based on non-public material information. | Illegal; involves covert market manipulation or fraud. |

| Actors | Company executives, employees, or affiliates with privileged information. | Traders or entities operating through concealed channels or fictitious accounts. |

| Purpose | Gain financial advantage using insider knowledge. | Manipulate stock prices or evade detection of illicit trades. |

| Detection | Monitored through regulatory filings and insider reports. | Difficult to detect; requires forensic audits and surveillance. |

| Regulation & Enforcement | Enforced by SEC and financial regulatory bodies worldwide. | Subject to criminal investigation; involves regulatory agencies and law enforcement. |

Definition of Insider Trading

Insider trading refers to the buying or selling of securities based on material, non-public information about a company, obtained by individuals such as executives, employees, or shareholders. This practice is illegal when the information used provides an unfair advantage and violates fiduciary duties or confidentiality agreements. Regulatory bodies like the SEC enforce laws to detect and prevent insider trading, aiming to maintain fair and transparent financial markets.

Understanding Shadow Trading

Shadow trading involves executing trades through indirect or covert methods to obscure the trader's identity and avoid regulatory scrutiny, contrasting with insider trading where illicit gains stem from non-public, material information. This practice complicates market transparency, making it challenging for regulators to detect manipulative activities hidden beneath complex layers of transactions or through affiliated entities. Understanding shadow trading is essential for enhancing surveillance systems and closing loopholes that allow market manipulation without relying on privileged information.

Key Differences Between Insider and Shadow Trading

Insider trading involves trading securities based on material, non-public information obtained by corporate insiders, while shadow trading refers to unauthorized trading activities executed by external parties mimicking or exploiting market movements without access to privileged information. Insider trading is regulated under securities law due to its impact on market fairness and transparency, whereas shadow trading often operates in unregulated or gray areas with potential for market manipulation. The key difference lies in the source of information and legal implications, with insider trading violating fiduciary duties and shadow trading exploiting market signals covertly.

Legal Implications of Insider Trading

Insider trading involves the illegal practice of trading a company's stock based on material, non-public information, leading to severe legal penalties including fines and imprisonment under securities laws such as the Securities Exchange Act of 1934. Shadow trading, while often less defined legally, refers to simulated or secretive trading activities that may skirt regulations but do not always meet the threshold of illegal insider trading. Regulatory bodies like the SEC prioritize detecting insider trading to maintain market integrity and protect investors from unfair advantages derived from confidential information.

Regulatory Challenges with Shadow Trading

Shadow trading presents complex regulatory challenges due to its opaque nature and the difficulty in tracing transactions through multiple intermediaries. Unlike insider trading, which involves illegal use of non-public information, shadow trading exploits gaps in market surveillance and involves activities that may skirt existing legal definitions. Regulators face hurdles in detecting, proving intent, and enforcing actions against shadow trades, necessitating enhanced transparency measures and advanced analytical tools.

High-Profile Insider Trading Cases

High-profile insider trading cases often involve corporate executives exploiting non-public information to gain financial advantages, exemplified by the Martha Stewart and Raj Rajaratnam scandals. Shadow trading, by contrast, refers to clandestine transactions that mimic insider trading but operate through complex networks to evade detection. Regulatory bodies like the SEC prioritize tracking these activities using advanced analytics to preserve market integrity and deter illicit trading.

Detection and Enforcement of Shadow Trading

Detection and enforcement of shadow trading rely heavily on advanced forensic analytics and real-time transaction monitoring to identify suspicious patterns that evade traditional insider trading controls. Regulatory bodies deploy AI-driven algorithms and cross-market surveillance systems to uncover concealed trades executed through proxy accounts or offshore entities. Strengthening international cooperation and enhancing legal frameworks improve the efficacy of penalties and preventive measures against shadow trading activities.

Impact on Financial Markets and Investors

Insider trading undermines market integrity by exploiting non-public, material information, leading to unfair advantages and eroding investor confidence. Shadow trading, involving opaque transactions often executed off-exchange, increases market volatility and obscures true asset values, complicating regulatory oversight. Both practices distort price discovery mechanisms, ultimately harming market efficiency and investor protection.

Prevention Strategies for Unlawful Trading

Implementing robust surveillance systems that analyze unusual trading patterns and integrating real-time transaction monitoring are critical prevention strategies against unlawful insider and shadow trading. Establishing strict compliance policies with mandatory insider trading disclosures, along with regular employee training on ethical practices and legal consequences, strengthens organizational defense. Leveraging advanced technologies like artificial intelligence and blockchain enhances transparency and detects illicit activities before market damage occurs.

Future Trends in Financial Market Manipulation

Future trends in financial market manipulation show a rise in sophisticated insider trading tactics leveraging artificial intelligence and big data analytics to predict market moves with high precision. Shadow trading schemes are evolving, utilizing decentralized finance (DeFi) platforms and obscure cryptocurrency transactions to mask illicit activities and evade regulatory detection. Enhanced blockchain forensics and real-time AI monitoring systems are becoming pivotal tools in combating these advanced manipulative practices in global markets.

Important Terms

Material Nonpublic Information (MNPI)

Material Nonpublic Information (MNPI) refers to confidential data about a company that can influence its stock price once made public. Insider trading involves buying or selling securities based on MNPI by individuals with privileged access, whereas shadow trading occurs when external parties exploit leaked MNPI indirectly through intermediaries or correlated market signals.

Tippee/Tipper Liability

Tippee and tipper liability in insider trading hinge on the tipper's breach of fiduciary duty by disclosing material nonpublic information and the tippee's subsequent use of that information for trading. Unlike insider trading, shadow trading involves clandestine transactions that mimic insider trading patterns but lack direct access to privileged information, raising complex challenges in proving liability.

Front Running

Front running involves executing trades based on non-public knowledge of upcoming large orders, distinguishing it from insider trading which uses confidential company information, while shadow trading manipulates market prices through secretly coordinated trades without direct insider information.

Securities Fraud

Securities fraud encompasses deceptive practices such as insider trading, where individuals exploit non-public information to gain unfair market advantages, and shadow trading, which involves unauthorized or disguised transactions that manipulate market prices or conceal true ownership. Both undermine market integrity by distorting price discovery and eroding investor confidence, necessitating stringent regulatory oversight and robust compliance measures.

Information Asymmetry

Information asymmetry occurs when insiders possess material, non-public information giving them an unfair advantage in trading, often leading to insider trading violations. Shadow trading exploits these imbalances covertly, where market participants execute trades based on inferred or leaked insider information, further obscuring transparency and market integrity.

Market Manipulation

Market manipulation involves deceptive practices such as insider trading, where privileged information is exploited for unfair advantage, and shadow trading, which covertly distorts market prices through hidden transactions.

Legal Safe Harbor

Legal Safe Harbor provisions protect corporate insiders by allowing them to trade company stock within pre-established windows or under Rule 10b5-1 trading plans, thus preventing allegations of insider trading. Shadow trading, often involving undisclosed or covert trades by insiders or affiliates, violates these safe harbor protections and can lead to significant legal penalties under securities laws enforced by the SEC.

Trading Restrictions

Trading restrictions designed to prevent insider trading impose strict limits on transactions involving non-public, material information, aiming to maintain market fairness and integrity. Shadow trading, often involving covert or indirect market manipulation, faces evolving regulatory scrutiny to close loopholes that exploit opaque trading practices and obscure beneficial ownership.

Compliance Monitoring

Compliance monitoring leverages advanced algorithms and AI to detect suspicious patterns indicative of insider trading and shadow trading, ensuring regulatory adherence and protecting market integrity. Continuous surveillance of trading activities and communication data enables early identification of illegal trades, reducing financial risks and enforcing stringent penalties.

Derivative Positioning

Derivative positioning involves holding options or futures contracts to speculate or hedge based on anticipated market movements, which can lead to insider trading if non-public, material information influences trades. Shadow trading, by contrast, manipulates derivative positions indirectly through undisclosed entities to mask true market intentions, complicating regulatory detection of illicit insider activities.

insider trading vs shadow trading Infographic

moneydif.com

moneydif.com