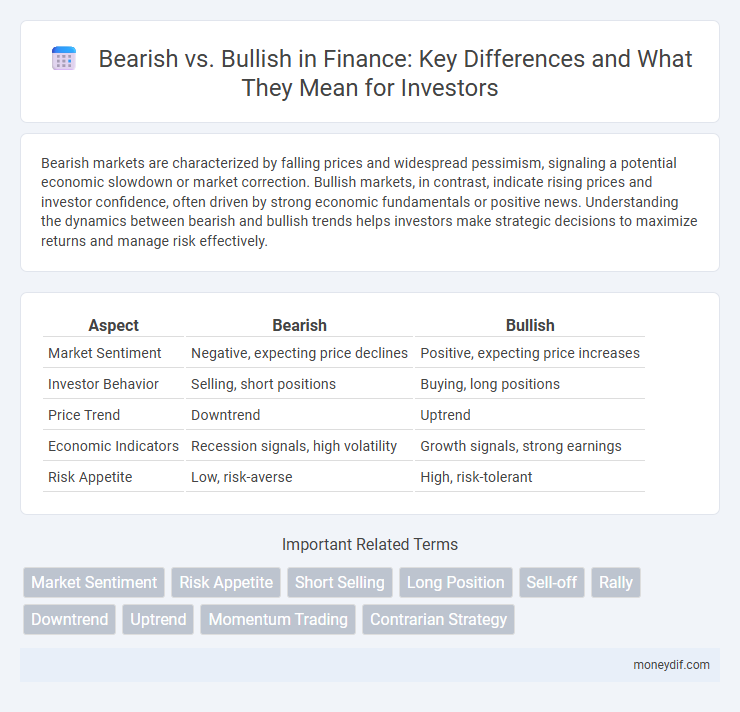

Bearish markets are characterized by falling prices and widespread pessimism, signaling a potential economic slowdown or market correction. Bullish markets, in contrast, indicate rising prices and investor confidence, often driven by strong economic fundamentals or positive news. Understanding the dynamics between bearish and bullish trends helps investors make strategic decisions to maximize returns and manage risk effectively.

Table of Comparison

| Aspect | Bearish | Bullish |

|---|---|---|

| Market Sentiment | Negative, expecting price declines | Positive, expecting price increases |

| Investor Behavior | Selling, short positions | Buying, long positions |

| Price Trend | Downtrend | Uptrend |

| Economic Indicators | Recession signals, high volatility | Growth signals, strong earnings |

| Risk Appetite | Low, risk-averse | High, risk-tolerant |

Understanding Bearish and Bullish Market Sentiments

Bearish market sentiment reflects investor pessimism, characterized by declining asset prices and increased selling pressure, often anticipating economic downturns or company underperformance. Bullish market sentiment embodies investor optimism, marked by rising asset prices and heightened buying activity, typically driven by positive economic data or strong corporate earnings. Recognizing these sentiments aids traders and investors in tailoring strategies to market trends and managing risk effectively.

Key Differences Between Bearish and Bullish Trends

Bearish trends are characterized by declining asset prices, increased selling pressure, and negative investor sentiment, often signaling economic slowdown or market corrections. Bullish trends exhibit rising asset prices, heightened buying activity, and positive investor confidence, typically indicating economic growth or market optimism. Key differences include the direction of price movement, volume patterns, and investor behavior, which directly impact trading strategies and portfolio management.

Identifying Signs of Bearish vs Bullish Markets

Bearish markets are characterized by declining stock prices, increasing market volatility, and negative investor sentiment often triggered by economic downturns or rising interest rates. Bullish markets exhibit rising stock prices, strong trading volume, and positive investor outlook fueled by economic growth and corporate earnings reports. Key indicators for identifying these trends include moving averages, Relative Strength Index (RSI), and market breadth analysis.

Market Indicators for Bearish and Bullish Conditions

Market indicators for bearish conditions often include declining moving averages, high volatility indices like the VIX, and negative momentum in relative strength index (RSI) readings below 30. Bullish conditions are typically signaled by rising moving averages, increasing trading volume, and RSI values above 70, indicating strong upward momentum. Analysts also monitor support and resistance levels, with breakouts above resistance confirming bullish trends and breaches below support levels signaling bearish sentiment.

Investment Strategies During Bearish vs Bullish Phases

Investment strategies during bearish phases prioritize capital preservation through defensive assets like bonds, dividend-paying stocks, and cash equivalents, while employing tactics such as short-selling and options hedging to mitigate losses. In bullish phases, investors emphasize growth-oriented assets, leveraging equities, sector rotation, and momentum investing to maximize returns amid rising markets. Adapting portfolio allocation dynamically between defensive and aggressive instruments enhances risk-adjusted performance across market cycles.

Psychological Factors Influencing Bearish and Bullish Behavior

Investor sentiment plays a crucial role in shaping bearish and bullish market trends, with fear often driving sell-offs in bearish phases and optimism fueling buying pressure during bullish periods. Cognitive biases such as herd behavior and confirmation bias amplify market movements, causing investors to either overreact to negative news or become overly confident in positive outlooks. Understanding these psychological drivers can help predict market volatility and improve timing strategies for entering or exiting positions.

Historical Examples of Bearish and Bullish Markets

Historical examples of bearish markets include the 1929 Great Depression crash, which led to a decade-long economic downturn, and the 2008 financial crisis triggered by the collapse of Lehman Brothers, resulting in widespread market panic. Bullish markets are exemplified by the 1990s tech boom, where rapid innovation and investor optimism drove the Nasdaq Composite to new highs, and the post-World War II economic expansion that saw sustained stock market growth fueled by industrial recovery and consumer demand. These periods illustrate the cyclical nature of financial markets influenced by economic conditions, investor sentiment, and global events.

Risk Management in Bearish vs Bullish Environments

Risk management strategies differ significantly between bearish and bullish markets, with bearish environments requiring heightened emphasis on capital preservation, stop-loss orders, and reduced exposure to volatile assets. In bullish markets, investors often implement more aggressive risk-taking through increased leverage and portfolio diversification to maximize returns. Understanding market sentiment and volatility metrics is crucial for adjusting risk tolerance and optimizing asset allocation across both market conditions.

Impact of Bearish and Bullish Sentiments on Asset Prices

Bearish sentiment often leads to declining asset prices as investors anticipate losses and sell off holdings, increasing market supply and driving prices down. Bullish sentiment drives asset prices higher by encouraging buying activity and increased demand, reflecting optimism about future growth and profits. Shifts between these sentiments create volatility, influencing market trends and investment strategies in both short and long-term horizons.

Bearish vs Bullish: Implications for Long-Term Investors

Bearish markets signal declining asset prices, prompting long-term investors to focus on risk management and potential value opportunities during downturns. Bullish markets reflect rising prices and growing investor confidence, encouraging increased investment and portfolio growth strategies. Understanding the cyclical nature of bearish and bullish trends helps long-term investors optimize asset allocation and achieve sustained financial growth.

Important Terms

Market Sentiment

Market sentiment reflects investor attitudes, with bearish sentiment indicating expectations of falling prices and bullish sentiment signaling confidence in rising markets.

Risk Appetite

Risk appetite varies significantly between bearish and bullish market conditions, with investors exhibiting lower risk tolerance during bearish trends and higher risk willingness during bullish trends.

Short Selling

Short selling involves betting against bullish markets by profiting from declining asset prices during bearish trends.

Long Position

A long position profits when bullish market trends drive asset prices up, contrasting with bearish trends that typically cause losses for long investors.

Sell-off

A sell-off typically indicates a bearish market sentiment where investors rapidly sell assets, contrasting with bullish conditions characterized by sustained buying and rising prices.

Rally

Rally in the stock market refers to a significant and sustained increase in stock prices, typically driven by bullish investor sentiment despite prior bearish trends.

Downtrend

A downtrend indicates a sustained period of declining prices where bearish sentiment dominates over bullish optimism, driving market values lower.

Uptrend

An uptrend signals sustained bullish momentum marked by higher highs and higher lows, contrasting with bearish trends characterized by lower highs and lower lows.

Momentum Trading

Momentum trading exploits bullish trends by buying assets with rising prices and capitalizes on bearish trends by short-selling declining assets to maximize returns.

Contrarian Strategy

The contrarian strategy involves investing against prevailing market trends by buying during bearish conditions and selling during bullish phases to capitalize on potential reversals.

Bearish vs Bullish Infographic

moneydif.com

moneydif.com