An expansionary gap occurs when actual economic output exceeds potential output, signaling an overheated economy with rising inflation risks. A contractionary gap happens when actual output falls below potential output, indicating underutilized resources and increased unemployment. Understanding these gaps helps policymakers adjust fiscal and monetary measures to stabilize economic growth and control inflation.

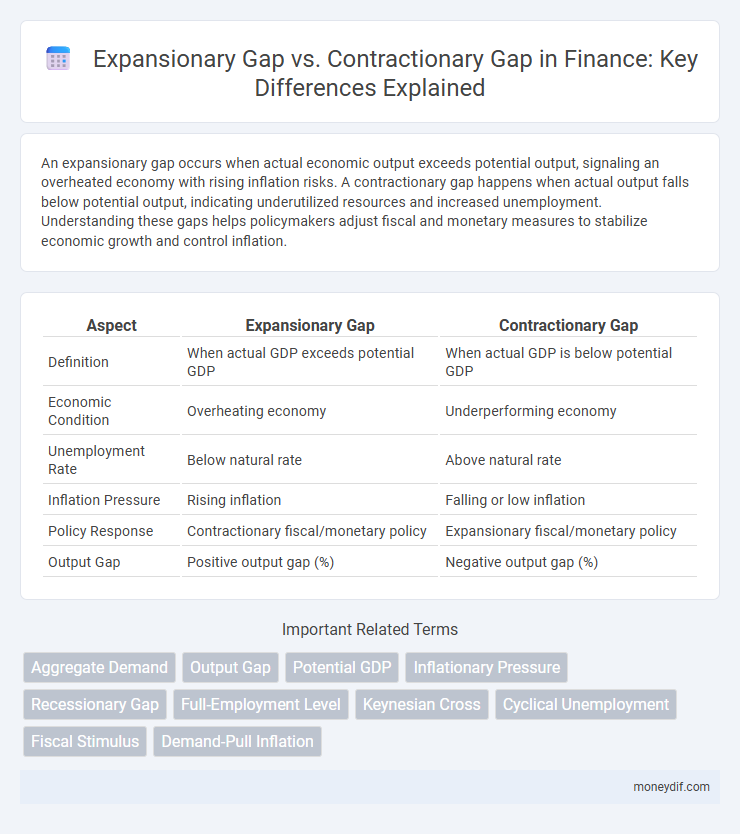

Table of Comparison

| Aspect | Expansionary Gap | Contractionary Gap |

|---|---|---|

| Definition | When actual GDP exceeds potential GDP | When actual GDP is below potential GDP |

| Economic Condition | Overheating economy | Underperforming economy |

| Unemployment Rate | Below natural rate | Above natural rate |

| Inflation Pressure | Rising inflation | Falling or low inflation |

| Policy Response | Contractionary fiscal/monetary policy | Expansionary fiscal/monetary policy |

| Output Gap | Positive output gap (%) | Negative output gap (%) |

Understanding Expansionary and Contractionary Gaps

Expansionary gaps occur when actual economic output exceeds potential output, leading to upward pressure on inflation and increased demand for resources. Contractionary gaps represent situations where actual output falls below potential output, resulting in unemployment and underutilized capacity. Recognizing these gaps is crucial for policymakers to adjust fiscal and monetary measures aimed at stabilizing economic fluctuations and promoting sustainable growth.

Causes of Expansionary Gaps in the Economy

Expansionary gaps occur when actual economic output exceeds potential output, driven primarily by increased aggregate demand from factors such as fiscal stimulus, lower interest rates, or consumer confidence boosts. Excessive government spending, tax cuts, and rapid credit expansion also contribute to demand-pull inflation and labor market tightness. These forces push output beyond the economy's sustainable capacity, causing upward pressure on wages and prices.

Triggers of Contractionary Gaps

Contractionary gaps occur when aggregate demand falls below the potential output of an economy, often triggered by reduced consumer spending due to declining confidence or rising interest rates that increase borrowing costs. Fiscal tightening through higher taxes or reduced government expenditure can also initiate contractionary gaps by decreasing overall demand. Additionally, external shocks like a sudden drop in exports or financial crises can significantly suppress aggregate demand, leading to a contractionary gap.

Key Differences: Expansionary vs. Contractionary Gap

An expansionary gap occurs when actual GDP exceeds potential GDP, indicating an overheating economy and upward pressure on inflation, while a contractionary gap arises when actual GDP is below potential GDP, signaling underutilized resources and higher unemployment. Expansionary gaps typically lead to inflationary pressures and demand-pull inflation, whereas contractionary gaps result in recessionary conditions and deflationary risks. Policymakers address expansionary gaps through contractionary fiscal or monetary measures and contractionary gaps with stimulative policies to restore economic equilibrium.

Impact on GDP and Economic Growth

An expansionary gap occurs when actual GDP exceeds potential GDP, leading to increased economic growth, higher inflation rates, and overheating of the economy. Conversely, a contractionary gap results when actual GDP falls below potential GDP, causing reduced economic growth, rising unemployment, and underutilized resources. Both gaps indicate deviations from full employment equilibrium, significantly impacting long-term economic stability and growth prospects.

Effects on Inflation and Unemployment

An expansionary gap occurs when actual output exceeds potential output, leading to upward pressure on inflation due to increased demand and reduced unemployment as firms hire to meet higher production needs. In contrast, a contractionary gap arises when actual output falls below potential output, causing downward pressure on inflation with weaker demand and higher unemployment driven by reduced production and layoffs. These gaps highlight the trade-off between inflation and unemployment, where expansionary gaps risk overheating the economy and contractionary gaps signal underutilized resources.

Fiscal Policy Responses: Bridging the Gaps

Fiscal policy responses to an expansionary gap typically involve contractionary measures such as increased taxes or reduced government spending to curb inflation and stabilize economic growth. In contrast, a contractionary gap prompts expansionary fiscal policies, including tax cuts and increased government expenditure, aimed at stimulating aggregate demand and reducing unemployment. Effective fiscal adjustments help bridge these output gaps, restoring equilibrium between actual and potential GDP.

Monetary Policy Tools for Gap Management

Expansionary gaps occur when actual output exceeds potential output, prompting central banks to implement contractionary monetary policies such as raising interest rates and selling government securities to curb inflation. Contractionary gaps arise when actual output falls below potential, leading to expansionary monetary measures like lowering interest rates and purchasing government securities to stimulate economic growth. Effective gap management relies on timely adjustments of the central bank's policy rate and open market operations to stabilize inflation and support employment.

Real-World Examples of Economic Gaps

The United States during the 2008 financial crisis experienced a contractionary gap, with actual GDP falling below potential GDP, leading to high unemployment and decreased consumer spending. Conversely, the late 1960s U.S. economy demonstrated an expansionary gap, where GDP exceeded its potential, triggering inflationary pressures as demand outpaced supply. Emerging markets like India in the early 2000s often show expansionary gaps during rapid growth phases, while countries such as Greece during the Eurozone debt crisis illustrate contractionary gaps with prolonged recessions and fiscal austerity.

Long-Term Implications for Financial Markets

Expansionary gaps typically signal increased economic output and rising inflation expectations, prompting central banks to consider tightening monetary policy, which can lead to higher bond yields and volatility in equity markets. Contractionary gaps indicate underutilized resources and slower growth, often resulting in lower interest rates to stimulate demand, supporting bond price appreciation but potentially signaling weakness in corporate earnings. Financial markets react over the long term by adjusting asset valuations and yield curves according to the persistent pressures of inflation and growth trends associated with each gap type.

Important Terms

Aggregate Demand

Aggregate demand represents the total spending on goods and services in an economy at a given overall price level and in a given period. An expansionary gap occurs when aggregate demand exceeds potential output, leading to inflationary pressures, while a contractionary gap arises when aggregate demand falls short of potential output, causing unemployment and underutilized resources.

Output Gap

The output gap measures the difference between actual and potential economic output, with an expansionary gap indicating actual GDP exceeds potential GDP, often causing inflationary pressures. A contractionary gap occurs when actual GDP falls below potential GDP, signaling underutilized resources and increased unemployment risk.

Potential GDP

Potential GDP represents the maximum sustainable output an economy can achieve without triggering inflationary pressures, serving as a benchmark for assessing economic performance. An expansionary gap occurs when actual GDP exceeds potential GDP, indicating overheating, while a contractionary gap arises when actual GDP falls below potential GDP, reflecting underutilized resources and economic slack.

Inflationary Pressure

Inflationary pressure intensifies during an expansionary gap when aggregate demand surpasses potential GDP, causing upward pressure on prices due to resource constraints. Conversely, a contractionary gap reflects deficient demand below potential GDP, leading to reduced inflationary pressure or deflation risks as excess capacity suppresses price increases.

Recessionary Gap

A recessionary gap occurs when actual output is below potential output, signaling underutilized resources and unemployment in the economy, contrasting with an expansionary gap where actual output exceeds potential output, causing inflationary pressures. Unlike a contractionary gap, which reflects a decrease in aggregate demand leading to lower production and employment, a recessionary gap highlights a persistent shortfall in demand that requires stimulative fiscal or monetary policies to restore economic equilibrium.

Full-Employment Level

The full-employment level represents the maximum sustainable output an economy can achieve without triggering inflation, serving as a benchmark to identify expansionary and contractionary gaps. An expansionary gap occurs when actual output surpasses full-employment output, causing upward pressure on wages and prices, while a contractionary gap arises when actual output falls below full employment, leading to unemployment and underutilized resources.

Keynesian Cross

The Keynesian Cross illustrates the equilibrium level of output where aggregate demand equals aggregate supply, highlighting the expansionary gap when actual output falls short of potential GDP, leading to unemployment and underutilized resources. Conversely, a contractionary gap occurs when aggregate demand exceeds potential output, causing inflationary pressures and an overheating economy.

Cyclical Unemployment

Cyclical unemployment rises during a contractionary gap when actual GDP falls below potential GDP, leading to reduced demand for labor, and declines during an expansionary gap as increased economic activity raises employment levels. This form of unemployment closely tracks fluctuations in the business cycle, reflecting the economy's deviations from full employment.

Fiscal Stimulus

Fiscal stimulus effectively reduces an expansionary gap by increasing aggregate demand and alleviates a contractionary gap by boosting economic output and employment.

Demand-Pull Inflation

Demand-pull inflation occurs when aggregate demand exceeds aggregate supply, creating an expansionary gap that drives up prices due to excessive spending in the economy. Conversely, a contractionary gap reflects insufficient demand relative to potential output, which typically restrains inflationary pressures by reducing spending and output.

expansionary gap vs contractionary gap Infographic

moneydif.com

moneydif.com