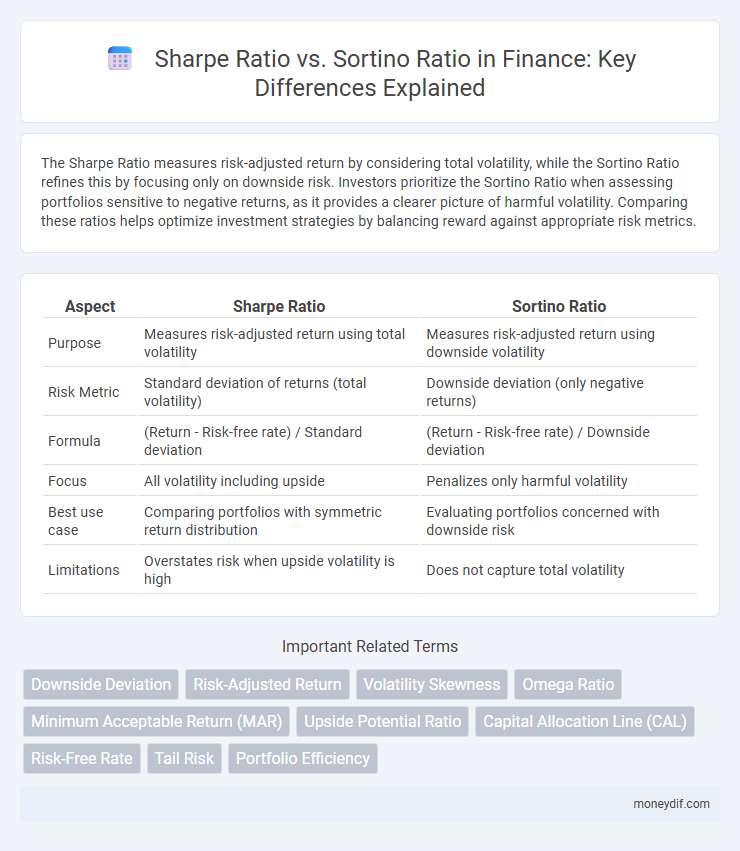

The Sharpe Ratio measures risk-adjusted return by considering total volatility, while the Sortino Ratio refines this by focusing only on downside risk. Investors prioritize the Sortino Ratio when assessing portfolios sensitive to negative returns, as it provides a clearer picture of harmful volatility. Comparing these ratios helps optimize investment strategies by balancing reward against appropriate risk metrics.

Table of Comparison

| Aspect | Sharpe Ratio | Sortino Ratio |

|---|---|---|

| Purpose | Measures risk-adjusted return using total volatility | Measures risk-adjusted return using downside volatility |

| Risk Metric | Standard deviation of returns (total volatility) | Downside deviation (only negative returns) |

| Formula | (Return - Risk-free rate) / Standard deviation | (Return - Risk-free rate) / Downside deviation |

| Focus | All volatility including upside | Penalizes only harmful volatility |

| Best use case | Comparing portfolios with symmetric return distribution | Evaluating portfolios concerned with downside risk |

| Limitations | Overstates risk when upside volatility is high | Does not capture total volatility |

Understanding the Sharpe Ratio: Definition and Calculation

The Sharpe Ratio measures risk-adjusted return by comparing portfolio excess return to its standard deviation, providing insight into investment performance relative to total volatility. It is calculated by subtracting the risk-free rate from the portfolio return and dividing the result by the standard deviation of the portfolio's excess returns. This metric is essential for investors assessing overall risk-adjusted profitability, though it treats upside and downside volatility equally.

Introduction to the Sortino Ratio: A Risk-Adjusted Return Metric

The Sortino Ratio measures risk-adjusted return by focusing exclusively on downside volatility, differentiating it from the Sharpe Ratio which accounts for total volatility. By penalizing only negative deviations from a target return, the Sortino Ratio offers a more precise evaluation of investment performance under adverse conditions. This metric is particularly valuable for investors seeking to understand downside risk without misrepresenting upside variability.

Key Differences Between Sharpe and Sortino Ratios

The Sharpe Ratio measures risk-adjusted return using total volatility, capturing both upside and downside deviations, while the Sortino Ratio focuses exclusively on downside risk by assessing negative volatility against a target or risk-free rate. Unlike the Sharpe Ratio, which treats all volatility equally, the Sortino Ratio provides a clearer view of downside risk, making it more suitable for investors sensitive to losses. Both ratios are essential for evaluating investment performance, but the Sortino Ratio offers enhanced precision in assessing downside risk-adjusted returns.

Pros and Cons of Using the Sharpe Ratio

The Sharpe Ratio measures risk-adjusted return by comparing portfolio excess return to total volatility, providing a straightforward and widely accepted metric for performance evaluation. However, it treats all volatility as risk, failing to distinguish between upside and downside fluctuations, which can misrepresent an investment's true risk profile. Its reliance on standard deviation makes it less effective for assets with non-normal return distributions or skewed risks, where downside-focused measures like the Sortino Ratio may offer better insight.

Advantages of the Sortino Ratio in Portfolio Analysis

The Sortino Ratio offers a significant advantage in portfolio analysis by focusing exclusively on downside volatility, providing a more accurate assessment of risk-adjusted returns for investors concerned with negative fluctuations. Unlike the Sharpe Ratio, which treats all volatility equally, the Sortino Ratio distinguishes harmful downside risk from total volatility, enabling better risk management and portfolio optimization. This targeted approach allows portfolio managers to identify investments that deliver superior returns relative to their downside risk, enhancing decision-making in constructing resilient portfolios.

When to Use Sharpe Ratio vs. Sortino Ratio

Use the Sharpe Ratio to evaluate the risk-adjusted return of an investment by considering total volatility, making it suitable when both upside and downside risks matter. The Sortino Ratio is preferred when assessing investments where downside risk is a primary concern, as it only penalizes negative volatility. For portfolios with asymmetric risk profiles or when measuring downside risk helps optimize investment decisions, relying on the Sortino Ratio provides a more accurate risk-adjusted performance metric.

Real-World Examples: Comparing Sharpe and Sortino Ratios

The Sharpe Ratio evaluates risk-adjusted returns by considering total volatility, making it ideal for portfolios with symmetric risk profiles, such as large-cap equity funds. In contrast, the Sortino Ratio isolates downside risk by penalizing only negative deviations, which suits hedge funds or strategies targeting downside protection. For example, during the 2008 financial crisis, portfolios with higher Sortino Ratios demonstrated better risk management by minimizing losses, while Sharpe Ratios often underestimated downside exposure.

Interpreting Results: What the Ratios Tell Investors

The Sharpe Ratio measures risk-adjusted return by comparing portfolio excess return to total volatility, helping investors understand overall return per unit of risk. The Sortino Ratio refines this by focusing only on downside deviation, highlighting how well a portfolio compensates for harmful volatility below a target return. Together, these ratios guide investors in assessing performance, with the Sortino Ratio offering a more precise measure of downside risk management.

Limitations and Common Misconceptions

The Sharpe Ratio often faces criticism for treating all volatility as risk, disregarding the difference between upside and downside fluctuations, which leads to misleading assessments of risk-adjusted returns. In contrast, the Sortino Ratio improves risk measurement by focusing solely on downside deviation, yet it may underestimate total risk by ignoring positive volatility that could signal potential instabilities. Common misconceptions include overreliance on the Sharpe Ratio for evaluating performance during volatile markets and the belief that the Sortino Ratio is universally superior, overlooking the context-specific nature of risk metrics in portfolio management.

Choosing the Right Risk Metric for Your Investment Strategy

The Sharpe Ratio measures risk-adjusted return by evaluating total volatility, making it suitable for strategies where both upside and downside risks are relevant. The Sortino Ratio focuses exclusively on downside volatility, providing a more accurate assessment for investors prioritizing downside protection. Selecting between these metrics depends on whether an investment strategy values overall risk exposure or specifically targets downside risk management.

Important Terms

Downside Deviation

Downside Deviation measures the volatility of negative returns and is used in the Sortino Ratio to provide a more accurate risk-adjusted return comparison than the Sharpe Ratio, which considers total volatility.

Risk-Adjusted Return

The Sharpe Ratio measures risk-adjusted return using total volatility including downside and upside risk, whereas the Sortino Ratio focuses exclusively on downside deviation, providing a more precise evaluation of downside risk for portfolio performance.

Volatility Skewness

Volatility skewness influences risk assessment by causing discrepancies in the Sharpe Ratio's sensitivity to total volatility compared to the Sortino Ratio's focus on downside volatility, impacting portfolio performance evaluation.

Omega Ratio

The Omega Ratio provides a comprehensive risk-adjusted performance measure by capturing all moments of return distribution, offering advantages over the Sharpe Ratio's symmetric risk assessment and the Sortino Ratio's focus on downside volatility.

Minimum Acceptable Return (MAR)

Minimum Acceptable Return (MAR) defines the benchmark in Sortino Ratio calculations by focusing on downside risk relative to returns below MAR, whereas the Sharpe Ratio evaluates total volatility against returns without distinguishing harmful volatility.

Upside Potential Ratio

Upside Potential Ratio evaluates investment returns by focusing on positive deviations, providing a complementary risk-return measure to the Sharpe Ratio, which considers total volatility, and the Sortino Ratio, which emphasizes downside risk.

Capital Allocation Line (CAL)

The Capital Allocation Line (CAL) represents portfolios combining a risk-free asset with a risky asset optimized by the Sharpe Ratio measuring total volatility, while the Sortino Ratio adjusts CAL decisions by focusing only on downside risk for more targeted risk-return assessment.

Risk-Free Rate

The Risk-Free Rate, representing the return of a zero-risk investment, is critical for calculating the Sharpe Ratio by measuring excess return volatility, while the Sortino Ratio refines this by focusing exclusively on downside risk relative to the Risk-Free Rate.

Tail Risk

Tail risk significantly impacts investment performance evaluation by highlighting downside volatility that the Sharpe Ratio overlooks, while the Sortino Ratio provides a more accurate risk-adjusted return measurement by focusing solely on negative returns.

Portfolio Efficiency

Portfolio efficiency is enhanced by evaluating risk-adjusted returns using the Sharpe Ratio, which considers total volatility, versus the Sortino Ratio, which focuses solely on downside risk.

Sharpe Ratio vs Sortino Ratio Infographic

moneydif.com

moneydif.com