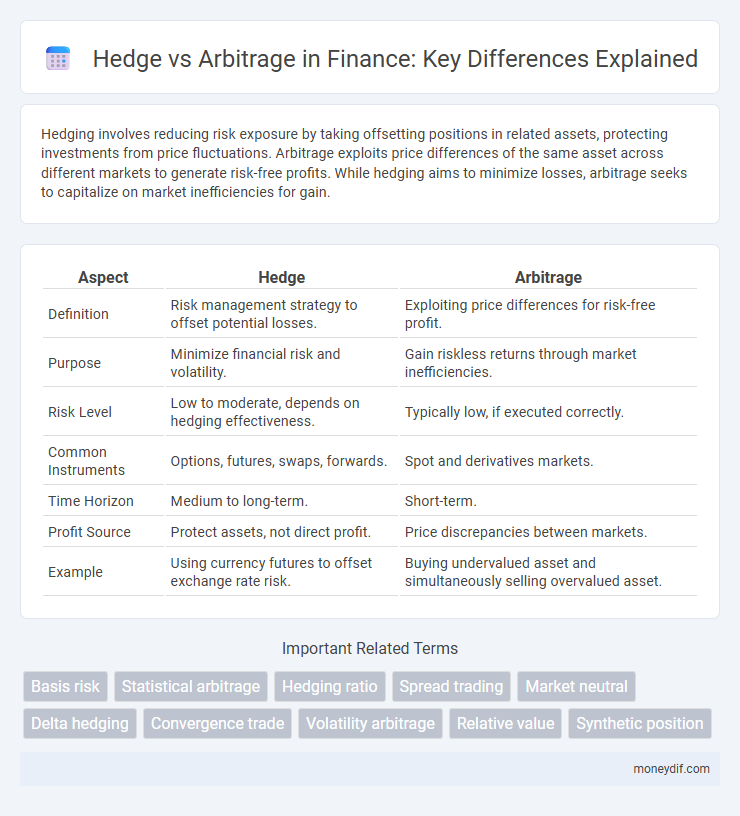

Hedging involves reducing risk exposure by taking offsetting positions in related assets, protecting investments from price fluctuations. Arbitrage exploits price differences of the same asset across different markets to generate risk-free profits. While hedging aims to minimize losses, arbitrage seeks to capitalize on market inefficiencies for gain.

Table of Comparison

| Aspect | Hedge | Arbitrage |

|---|---|---|

| Definition | Risk management strategy to offset potential losses. | Exploiting price differences for risk-free profit. |

| Purpose | Minimize financial risk and volatility. | Gain riskless returns through market inefficiencies. |

| Risk Level | Low to moderate, depends on hedging effectiveness. | Typically low, if executed correctly. |

| Common Instruments | Options, futures, swaps, forwards. | Spot and derivatives markets. |

| Time Horizon | Medium to long-term. | Short-term. |

| Profit Source | Protect assets, not direct profit. | Price discrepancies between markets. |

| Example | Using currency futures to offset exchange rate risk. | Buying undervalued asset and simultaneously selling overvalued asset. |

Understanding Hedge and Arbitrage: Key Financial Concepts

Hedge and arbitrage represent fundamental strategies in risk management and profit maximization within finance. Hedging involves the use of financial instruments or market strategies to offset potential losses in investments, thereby reducing exposure to price fluctuations. Arbitrage exploits price discrepancies of identical or similar assets across different markets to achieve risk-free profits, relying on the simultaneous buying and selling of these assets.

Core Differences Between Hedging and Arbitrage

Hedging involves mitigating potential losses by taking offsetting positions to reduce risk exposure in financial markets. Arbitrage exploits price inefficiencies across different markets or instruments to generate risk-free profits. The core difference lies in hedging's focus on risk reduction versus arbitrage's aim of capitalizing on price discrepancies.

Objectives: Risk Management vs Profit Generation

Hedging aims to minimize financial risk by offsetting potential losses in investments through strategies like options, futures, or swaps. Arbitrage focuses on exploiting price inefficiencies across markets to generate risk-free profits by simultaneously buying low and selling high. The primary objective of hedging is risk management, while arbitrage targets profit generation through market discrepancies.

Types of Hedging Strategies in Finance

Types of hedging strategies in finance primarily include forward contracts, futures contracts, options, and swaps, each designed to mitigate specific risks such as currency fluctuations, interest rate changes, or commodity price volatility. Forward contracts lock in prices for future transactions, while futures contracts are standardized and traded on exchanges, providing liquidity and price transparency. Options grant the right, but not the obligation, to buy or sell assets, offering more flexibility, whereas swaps involve exchanging cash flows or liabilities to manage exposure to variables like interest rates or foreign exchange rates.

Main Arbitrage Techniques Used by Investors

Investors primarily use statistical arbitrage, merger arbitrage, and convertible arbitrage to capitalize on price discrepancies across markets. Statistical arbitrage relies on quantitative models to identify temporary mispricings, while merger arbitrage involves trading securities of companies undergoing mergers or acquisitions. Convertible arbitrage focuses on exploiting inefficiencies between convertible bonds and the underlying stock, providing balanced risk and return opportunities.

Market Conditions Favoring Hedging or Arbitrage

Market conditions favor hedging when there is high volatility and uncertainty, prompting investors to minimize risk exposure through derivative instruments like options and futures. Arbitrage opportunities arise in less efficient markets where price discrepancies between different exchanges or related securities exist, allowing traders to exploit temporary inefficiencies for risk-free profits. Understanding liquidity, transaction costs, and regulatory frameworks is crucial in determining whether hedging or arbitrage strategies are more effective under specific financial market environments.

Tools and Instruments for Hedging and Arbitrage

Hedging primarily utilizes derivatives such as options, futures, and swaps to mitigate financial risks and protect asset values against market fluctuations. Arbitrage employs strategies involving spot transactions, forward contracts, and algorithmic trading platforms to exploit price discrepancies across different markets or instruments for risk-free profit. Both approaches rely heavily on financial tools like volatility indices, interest rate swaps, and cross-border settlement systems to optimize their effectiveness in dynamic trading environments.

Real-World Examples: Hedging Versus Arbitrage

Hedging involves mitigating risk by taking offsetting positions, such as a farmer using futures contracts to lock in crop prices, whereas arbitrage exploits price discrepancies, like traders simultaneously buying gold in one market and selling it in another for profit. In currency markets, companies hedge foreign exchange risk by entering forward contracts, while arbitrageurs capitalize on mispricings between spot and futures prices. Real-world cases include portfolio managers reducing volatility through hedging strategies, contrasted with hedge funds employing high-frequency arbitrage to generate riskless returns.

Risks and Limitations: Hedge vs Arbitrage

Hedge strategies primarily aim to mitigate risks by offsetting potential losses in an asset through opposing positions, yet they are limited by basis risk and imperfect correlations. Arbitrage exploits price discrepancies across markets for risk-free profit, but faces risks including execution risk, transaction costs, and market inefficiencies that can reduce expected gains. Both approaches require precise timing and market access, with hedging focused on loss reduction and arbitrage reliant on rapid, accurate trade execution to capitalize on fleeting opportunities.

Choosing the Right Strategy: Factors to Consider

Choosing the right strategy between hedge and arbitrage depends on risk tolerance, market conditions, and investment goals. Hedge strategies primarily reduce exposure to price volatility, while arbitrage focuses on exploiting price inefficiencies for profit. Evaluating liquidity, transaction costs, and regulatory constraints is essential for optimizing returns and managing financial risk effectively.

Important Terms

Basis risk

Basis risk arises when the price difference between a hedged asset and its related derivative fluctuates, causing imperfect hedge effectiveness. This risk contrasts with arbitrage opportunities, which rely on price discrepancies without such uncertainty, aiming for risk-free profits through simultaneous buying and selling in different markets.

Statistical arbitrage

Statistical arbitrage leverages quantitative models to exploit pricing inefficiencies between related securities, often employing hedge strategies to minimize market risk exposure while maximizing profit potential. Unlike pure arbitrage, which aims for riskless gains, statistical arbitrage involves probabilistic predictions and dynamic hedging to manage risk in volatile markets.

Hedging ratio

The hedging ratio quantifies the proportion of a portfolio's exposure offset through derivatives to minimize risk, contrasting with arbitrage strategies that exploit price differentials for risk-free profit.

Spread trading

Spread trading involves simultaneously buying and selling related securities to profit from the price difference, effectively hedging risk by offsetting potential losses in one position with gains in another. Unlike arbitrage, which exploits price inefficiencies for risk-free profit, spread trading manages exposure between correlated assets to minimize market volatility impact.

Market neutral

Market neutral strategies aim to eliminate market risk by balancing long and short positions, distinguishing them from arbitrage which exploits price discrepancies for risk-free profits.

Delta hedging

Delta hedging involves adjusting a portfolio to maintain a delta-neutral position, reducing risk from price movements in the underlying asset, a technique primarily used for hedging rather than arbitrage. Unlike arbitrage, which seeks risk-free profits from price discrepancies, delta hedging focuses on minimizing directional risk in options trading by dynamically balancing long and short positions.

Convergence trade

Convergence trade exploits price discrepancies between related financial instruments, aiming to profit when prices converge, often involving hedging to manage risk rather than pure arbitrage which seeks risk-free gains from price differences. Unlike strict arbitrage, convergence trades carry market risk and require sophisticated modeling to predict when and how prices will align.

Volatility arbitrage

Volatility arbitrage involves exploiting discrepancies between the implied volatility of options and the expected future volatility of the underlying asset, distinct from traditional hedge strategies that primarily focus on risk reduction by offsetting positions. Hedge funds employing volatility arbitrage use sophisticated models to identify mispriced options, aiming to generate returns by capturing volatility spreads rather than simply protecting portfolios against adverse price movements.

Relative value

Relative value strategies exploit pricing inefficiencies between related assets, using hedging to manage risk while arbitrage seeks risk-free profit by simultaneously buying and selling mispriced securities.

Synthetic position

Synthetic positions replicate the payoff of an underlying asset through a combination of options or futures contracts, enabling strategic hedging or arbitrage opportunities. Traders use synthetic positions to manage risk exposure efficiently or exploit price discrepancies between related instruments for arbitrage profits.

hedge vs arbitrage Infographic

moneydif.com

moneydif.com