A thin market is characterized by low trading volume and limited liquidity, often leading to higher price volatility and wider bid-ask spreads. In contrast, a thick market features high trading activity and abundant liquidity, resulting in more stable prices and tighter spreads. Investors typically prefer thick markets for greater ease of entry and exit, reducing transaction costs and risk.

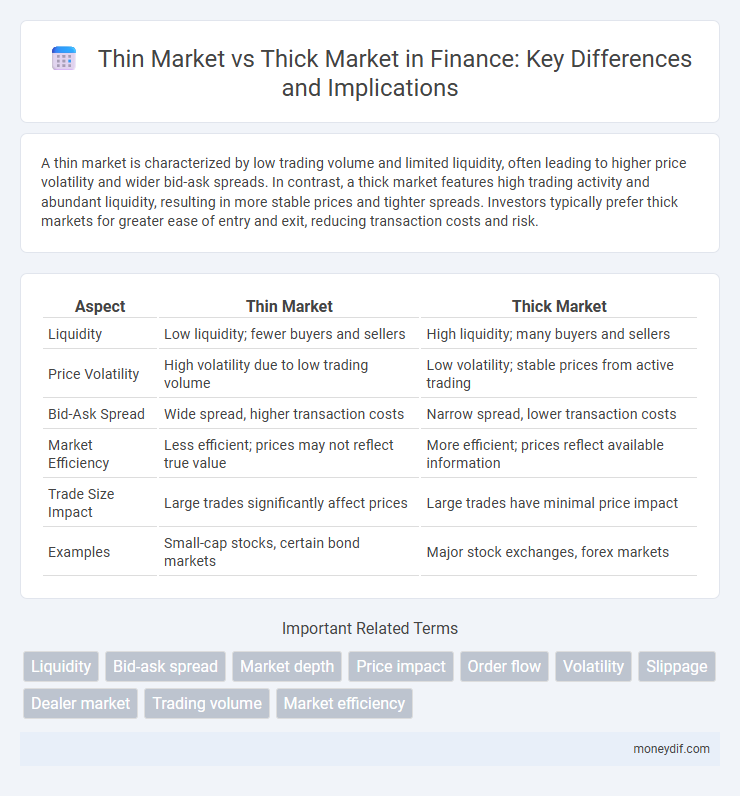

Table of Comparison

| Aspect | Thin Market | Thick Market |

|---|---|---|

| Liquidity | Low liquidity; fewer buyers and sellers | High liquidity; many buyers and sellers |

| Price Volatility | High volatility due to low trading volume | Low volatility; stable prices from active trading |

| Bid-Ask Spread | Wide spread, higher transaction costs | Narrow spread, lower transaction costs |

| Market Efficiency | Less efficient; prices may not reflect true value | More efficient; prices reflect available information |

| Trade Size Impact | Large trades significantly affect prices | Large trades have minimal price impact |

| Examples | Small-cap stocks, certain bond markets | Major stock exchanges, forex markets |

Understanding Thin and Thick Markets in Finance

Thin markets in finance are characterized by low liquidity and fewer participants, leading to higher volatility and wider bid-ask spreads. Thick markets exhibit high trading volume, abundant buyers and sellers, and tighter spreads, facilitating price efficiency and stability. Understanding the differences between thin and thick markets is crucial for investors to manage risk and optimize trade execution strategies.

Key Characteristics of Thin Markets

Thin markets exhibit low trading volume and limited liquidity, resulting in wider bid-ask spreads and higher price volatility. These markets often feature fewer participants, leading to less price transparency and increased risks of price manipulation. Thin markets typically appear in specialized assets or during periods of economic uncertainty, affecting efficient price discovery and investor confidence.

Defining Features of Thick Markets

Thick markets are characterized by high liquidity, with numerous buyers and sellers actively engaging in transactions, resulting in tighter bid-ask spreads and reduced price volatility. This increased activity facilitates efficient price discovery and allows for large trades to be executed without significantly impacting market prices. Thick markets typically exhibit greater transparency and lower transaction costs, making them more attractive for investors seeking quick and stable execution of trades.

Liquidity Differences: Thin vs. Thick Markets

Thin markets exhibit lower liquidity characterized by fewer buyers and sellers, resulting in wider bid-ask spreads and greater price volatility. Thick markets feature higher liquidity with numerous participants, enabling tighter spreads and more stable prices. The liquidity differences significantly impact transaction costs, market efficiency, and the ease of executing large orders without substantial price changes.

Price Volatility and Market Depth

Price volatility in thin markets is significantly higher due to low trading volume and limited market depth, causing larger price fluctuations from relatively small trades. In contrast, thick markets exhibit greater market depth with abundant buy and sell orders, leading to reduced volatility and more stable pricing. Enhanced liquidity in thick markets facilitates smoother price discovery and limits the impact of individual transactions on overall market prices.

Impact on Bid-Ask Spreads

Thin markets exhibit wider bid-ask spreads due to lower trading volume and reduced liquidity, resulting in higher transaction costs for investors. Thick markets, characterized by high trading activity and abundant market participants, typically have narrow bid-ask spreads that enhance price efficiency and facilitate smoother trade execution. Market depth and order flow significantly influence the spread width, impacting overall market stability and investor confidence.

Trading Strategies for Thin and Thick Markets

Trading strategies in thin markets emphasize caution, leveraging limit orders and wider bid-ask spreads to mitigate price impact and liquidity risks. In contrast, thick markets support high-frequency trading and market orders due to abundant liquidity and tighter spreads, enabling rapid execution and minimal slippage. Adapting strategies to these market conditions enhances portfolio efficiency and risk management in varied trading environments.

Risks and Opportunities in Thin Markets

Thin markets carry higher risks due to low liquidity, resulting in wider bid-ask spreads and increased price volatility that can lead to significant trading costs and difficulties in executing large orders. However, thin markets also offer opportunities for knowledgeable investors to identify mispriced assets and capitalize on less competitive trading environments. Understanding the balance between liquidity constraints and potential arbitrage can enhance risk management and strategic decision-making in thin market scenarios.

Case Studies: Real-World Examples

Thin markets, such as the early stages of cryptocurrency trading, often exhibit high volatility and limited liquidity, exemplified by Bitcoin's price fluctuations before widespread adoption. Thick markets like the New York Stock Exchange demonstrate stable pricing and deep liquidity, enabling efficient capital flow and robust trader participation. Case studies reveal that thin markets increase transaction costs and risk, while thick markets support price discovery and market resilience.

Implications for Investors and Policy Makers

Thin markets, characterized by low trading volumes and limited liquidity, increase the risk of price volatility and reduced market efficiency, challenging investors' ability to execute trades at fair prices. Thick markets, with high liquidity and active participation, enable more accurate price discovery and lower transaction costs, benefiting investor confidence and portfolio management. Policy makers must design regulations that enhance market transparency and liquidity to ensure stable, efficient markets that protect investors and foster economic growth.

Important Terms

Liquidity

Liquidity in financial markets refers to the ease with which assets can be bought or sold without significantly affecting their price; thick markets feature high liquidity with numerous buyers and sellers, leading to tight bid-ask spreads and stable prices. In contrast, thin markets have low liquidity characterized by fewer participants, wider bid-ask spreads, and greater price volatility, increasing transaction costs and market risk.

Bid-ask spread

The bid-ask spread in a thin market tends to be wider due to lower liquidity and fewer market participants, causing greater price volatility and higher transaction costs. In contrast, a thick market features a narrower bid-ask spread driven by high trading volume and abundant buyers and sellers, enabling more efficient price discovery and reduced trading expenses.

Market depth

Market depth refers to the ability of a market to absorb large orders without significant impact on price, indicating liquidity levels; a thick market exhibits high market depth with numerous buy and sell orders closely priced, while a thin market shows low market depth marked by sparse orders and greater price volatility. Thick markets facilitate smoother price discovery and lower transaction costs, whereas thin markets often face price distortions and increased bid-ask spreads.

Price impact

Price impact measures how much a trade affects an asset's price, with thin markets showing higher price impact due to lower liquidity and fewer participants, causing larger price swings. Thick markets feature greater liquidity and trading volume, resulting in smaller price impact and more stable prices during transactions.

Order flow

Order flow analysis reveals the intensity and direction of trades, significantly impacting price movements in both thin and thick markets. In thin markets, limited liquidity causes order flow to create larger price swings, while thick markets with abundant liquidity result in smoother and more stable price changes due to balanced order flow.

Volatility

Volatility tends to be higher in thin markets due to lower liquidity and fewer participants, causing larger price fluctuations from relatively small trades. In contrast, thick markets with high trading volume and liquidity usually exhibit lower volatility, reflecting more stable price movements.

Slippage

Slippage occurs when market orders execute at prices different from expected, often due to low liquidity in thin markets where bid-ask spreads are wide and order books lack depth. In contrast, thick markets with high trading volumes and narrow spreads minimize slippage by providing ample liquidity and tighter price continuity.

Dealer market

A dealer market features a network of dealers who hold inventories of securities and facilitate trades, often leading to higher liquidity in thick markets where numerous buyers and sellers create tighter bid-ask spreads. Thin markets, characterized by fewer participants and lower trading volumes, result in wider spreads and increased price volatility due to limited dealer competition and inventory holdings.

Trading volume

Trading volume serves as a key indicator distinguishing thin markets with low transaction activity and wide bid-ask spreads from thick markets characterized by high liquidity and narrow spreads. In thick markets, elevated trading volume supports price stability and efficient price discovery, whereas thin markets often experience higher volatility and limited price transparency due to sparse trading.

Market efficiency

Market efficiency is significantly influenced by the liquidity of the trading environment, where thick markets with high trading volumes facilitate rapid information dissemination and price adjustments, enhancing allocative efficiency. Thin markets, characterized by low trading activity, often suffer from higher transaction costs, greater price volatility, and slower incorporation of information, leading to reduced market efficiency.

thin market vs thick market Infographic

moneydif.com

moneydif.com