Wash sales occur when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days, disallowing the tax deduction. Tax-loss harvesting strategically involves selling securities at a loss to offset taxable gains while avoiding wash sale rules by waiting the required period or buying different assets. Properly navigating these rules maximizes tax benefits and enhances portfolio efficiency.

Table of Comparison

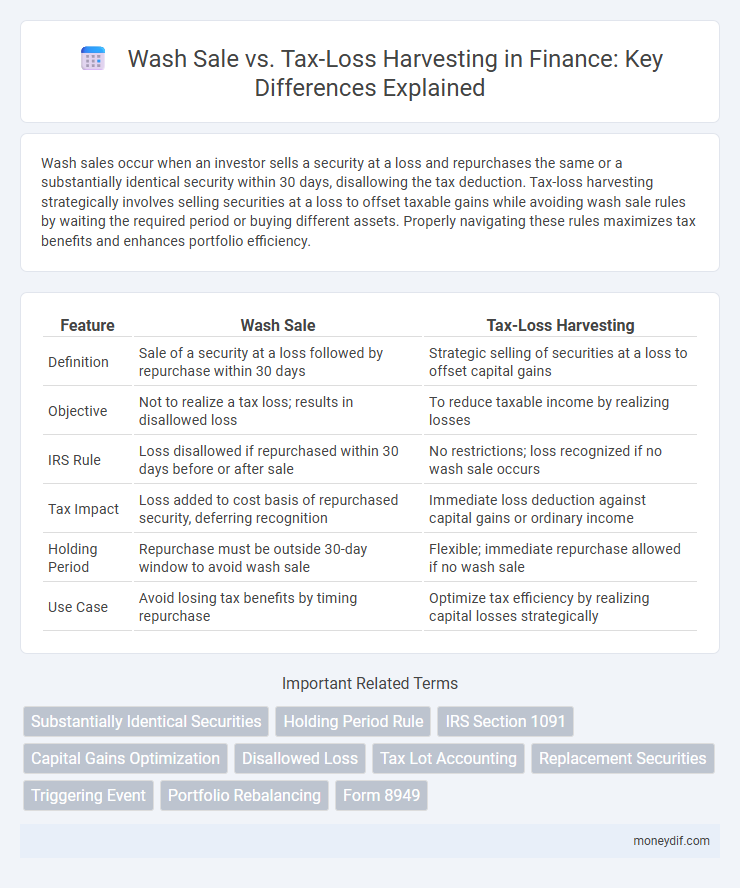

| Feature | Wash Sale | Tax-Loss Harvesting |

|---|---|---|

| Definition | Sale of a security at a loss followed by repurchase within 30 days | Strategic selling of securities at a loss to offset capital gains |

| Objective | Not to realize a tax loss; results in disallowed loss | To reduce taxable income by realizing losses |

| IRS Rule | Loss disallowed if repurchased within 30 days before or after sale | No restrictions; loss recognized if no wash sale occurs |

| Tax Impact | Loss added to cost basis of repurchased security, deferring recognition | Immediate loss deduction against capital gains or ordinary income |

| Holding Period | Repurchase must be outside 30-day window to avoid wash sale | Flexible; immediate repurchase allowed if no wash sale |

| Use Case | Avoid losing tax benefits by timing repurchase | Optimize tax efficiency by realizing capital losses strategically |

Understanding Wash Sales: Key Definitions

Wash sales occur when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days before or after the sale, disallowing the loss deduction for tax purposes. Tax-loss harvesting involves strategically selling securities at a loss to offset capital gains, but wash sale rules prevent these losses from being claimed if the repurchase happens too soon. Understanding the IRS criteria for wash sales is crucial to properly implementing tax-loss harvesting strategies and optimizing tax benefits in investment portfolios.

What Is Tax-Loss Harvesting?

Tax-loss harvesting involves selling securities at a loss to offset capital gains taxes, thereby reducing overall tax liability. This strategy requires careful management to avoid triggering wash sale rules, which disallow claiming a loss if a substantially identical security is repurchased within 30 days. Effective tax-loss harvesting can optimize investment portfolios by enhancing after-tax returns through strategic loss realization.

IRS Rules: Wash Sale Provisions Explained

The IRS wash sale rule disallows a tax deduction for a loss on a security sold if the same or a substantially identical security is purchased within 30 days before or after the sale, preventing investors from claiming artificial losses. Tax-loss harvesting involves intentionally selling securities at a loss to offset capital gains, but must navigate wash sale provisions to be effective and compliant. Understanding these IRS rules is crucial for optimizing tax strategies without triggering disallowed losses.

Differences Between Wash Sale and Tax-Loss Harvesting

Wash sale rules prohibit claiming a tax loss if you repurchase the same or substantially identical security within 30 days, effectively deferring the deduction, while tax-loss harvesting strategically sells depreciated assets to offset capital gains and reduce taxable income. Unlike wash sales, tax-loss harvesting requires careful timing and asset selection to comply with IRS regulations and maximize tax benefits without triggering disallowed losses. Understanding the distinction is crucial for investors aiming to optimize portfolio tax efficiency and adherence to tax compliance standards.

Recognizing Disallowed Losses Under Wash Sale Rule

The wash sale rule disallows claiming a tax loss if a substantially identical security is purchased within 30 days before or after the sale date, effectively preventing taxpayers from recognizing artificial losses. Tax-loss harvesting requires careful tracking to avoid triggering this rule, as disallowed losses must be added to the cost basis of the repurchased securities, deferring the tax benefit. Understanding the timing and identification of wash sales is critical for optimizing tax strategies and maintaining compliance with IRS regulations.

Strategies to Avoid Wash Sale Violations

Implement strict tracking systems to monitor transactions and identify repurchases of substantially identical securities within 30 days before or after a sale to prevent wash sale violations. Utilize tax-loss harvesting by strategically selling losing investments while avoiding repurchase of the same or substantially identical assets within the wash sale window. Employ substitution with similar but not identical securities, such as different ETFs or mutual funds in the same sector, to maintain market exposure without triggering wash sale rules.

Tax-Loss Harvesting Best Practices

Tax-loss harvesting involves strategically selling securities at a loss to offset capital gains tax liability while adhering to IRS rules to maximize tax benefits. Best practices include avoiding wash sales by not repurchasing the same or substantially identical securities within 30 days before or after the sale date to ensure losses are deductible. Investors should maintain a diversified portfolio, carefully document transactions, and consult tax professionals to optimize harvest timing and comply with tax regulations.

Impact of Wash Sale on Portfolio Performance

Wash sales can significantly affect portfolio performance by disallowing the immediate deduction of losses, thereby deferring tax benefits and reducing the effectiveness of tax-loss harvesting strategies. This deferral can lead to higher short-term tax liabilities and diminished cash flow, limiting reinvestment opportunities and compounding returns over time. Investors must carefully navigate wash sale rules to optimize after-tax returns and preserve portfolio growth.

Record-Keeping for Wash Sales and Tax-Loss Events

Accurate record-keeping is crucial for managing wash sales and tax-loss harvesting to ensure compliance with IRS rules and maximize tax benefits. Investors must track purchase and sale dates, security identifiers, and transaction amounts to identify wash sales accurately and adjust cost bases accordingly. Detailed documentation supports precise tax reporting and prevents disallowed losses under Section 1091 of the Internal Revenue Code.

Common Mistakes and How to Maximize Tax Benefits

Investors often confuse wash sales with tax-loss harvesting, leading to disallowed losses and missed tax benefits. A common mistake is repurchasing the same or substantially identical security within 30 days before or after the sale, triggering the IRS wash sale rule and invalidating the deduction. To maximize tax benefits, investors should wait beyond the 30-day window or invest in different securities with similar risk profiles to maintain market exposure while realizing losses.

Important Terms

Substantially Identical Securities

Substantially identical securities refer to stocks or securities that are so similar that a sale of one and repurchase of the other within 30 days triggers the wash sale rule, disallowing the recognition of a tax loss for that transaction. Tax-loss harvesting strategies must avoid repurchasing substantially identical securities within the wash sale window to ensure realized losses can be used to offset taxable gains effectively.

Holding Period Rule

The Holding Period Rule requires investors to hold a security for more than 30 days before repurchasing a substantially identical asset to avoid a wash sale, which disallows claiming a tax deduction on a loss. This rule plays a critical role in tax-loss harvesting strategies, as investors must time their transactions carefully to realize tax benefits without triggering wash sale penalties.

IRS Section 1091

IRS Section 1091 prohibits claiming a tax deduction from a loss on a security if the same or substantially identical security is purchased within 30 days before or after the sale, defining the basis for wash sale rules. Tax-loss harvesting strategies must navigate Section 1091 to avoid wash sale disallowance, ensuring that realized losses are eligible for tax deductions by timing repurchases outside the 61-day window.

Capital Gains Optimization

Capital Gains Optimization strategies often involve navigating the complexities of wash sale rules, which disallow claiming a tax loss if a substantially identical security is purchased within 30 days before or after the sale. Tax-loss harvesting leverages these rules by selling securities at a loss to offset gains, while carefully avoiding wash sales to ensure the loss is deductible for reducing taxable capital gains.

Disallowed Loss

Disallowed loss occurs in a wash sale when a security is sold at a loss and repurchased within 30 days, preventing the recognition of the tax loss, whereas tax-loss harvesting involves strategically selling investments to realize losses and offset capital gains or reduce taxable income. Understanding wash sale rules is crucial in tax-loss harvesting to ensure losses are valid for tax deduction and avoid disallowed losses that can defer tax benefits.

Tax Lot Accounting

Tax lot accounting enables precise identification of shares affected by wash sales, optimizing tax-loss harvesting strategies by accurately tracking purchase dates and cost bases.

Replacement Securities

Replacement securities are key in tax-loss harvesting strategies, allowing investors to realize losses without violating wash sale rules by purchasing similar but not substantially identical securities within 30 days before or after the sale. Understanding IRS guidelines on wash sales ensures that tax-deductible losses from sold securities are preserved while maintaining market exposure through careful selection of replacement securities.

Triggering Event

A triggering event in tax-loss harvesting occurs when a substantially identical security is repurchased within 30 days, causing a wash sale that disallows the immediate tax deduction on losses.

Portfolio Rebalancing

Portfolio rebalancing strategically integrates tax-loss harvesting by avoiding wash sale rules to optimize tax efficiency and maintain desired asset allocation.

Form 8949

Form 8949 is used to report capital gains and losses from the sale or exchange of securities, including adjustments for wash sales, which occur when a security is repurchased within 30 days before or after a sale at a loss. Tax-loss harvesting strategically realizes losses to offset gains and reduce taxable income, but wash sale rules disallow loss claims if substantially identical securities are bought in the wash sale period, requiring adjustments on Form 8949.

wash sale vs tax-loss harvesting Infographic

moneydif.com

moneydif.com