Arbitrage involves exploiting price discrepancies of identical or similar financial instruments across different markets to generate risk-free profits. Hedging aims to reduce or eliminate potential losses by taking offsetting positions in related assets, enhancing portfolio stability. Both strategies are essential for managing risk and optimizing returns in dynamic financial environments.

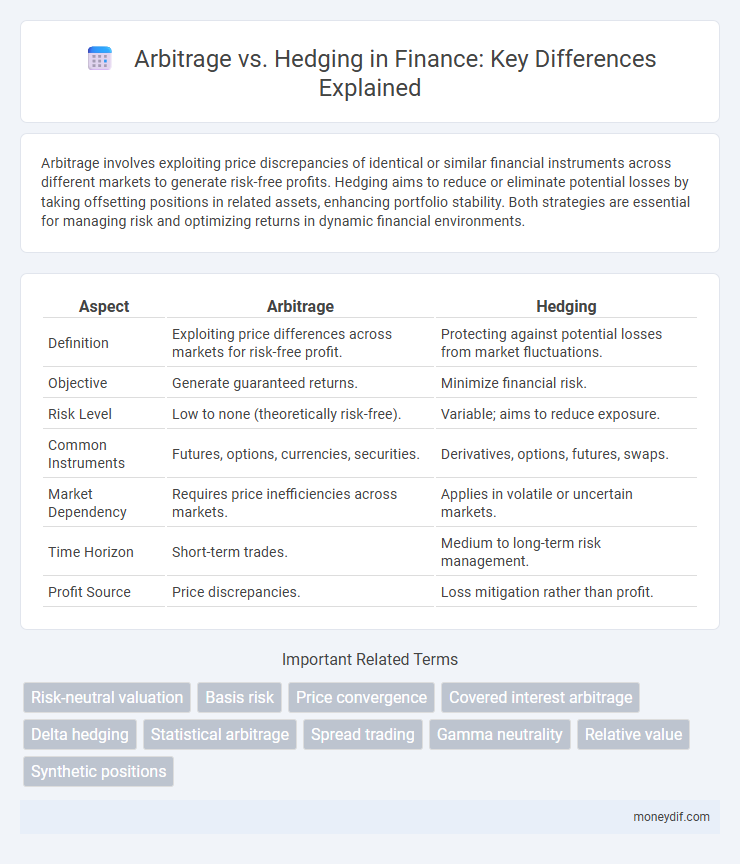

Table of Comparison

| Aspect | Arbitrage | Hedging |

|---|---|---|

| Definition | Exploiting price differences across markets for risk-free profit. | Protecting against potential losses from market fluctuations. |

| Objective | Generate guaranteed returns. | Minimize financial risk. |

| Risk Level | Low to none (theoretically risk-free). | Variable; aims to reduce exposure. |

| Common Instruments | Futures, options, currencies, securities. | Derivatives, options, futures, swaps. |

| Market Dependency | Requires price inefficiencies across markets. | Applies in volatile or uncertain markets. |

| Time Horizon | Short-term trades. | Medium to long-term risk management. |

| Profit Source | Price discrepancies. | Loss mitigation rather than profit. |

Introduction to Arbitrage and Hedging

Arbitrage involves exploiting price differences of the same asset across different markets to secure risk-free profits, leveraging market inefficiencies. Hedging, in contrast, aims to reduce risk exposure by taking offsetting positions in related assets, protecting against adverse price movements. Both strategies play critical roles in financial risk management but differ fundamentally in purpose and execution.

Defining Arbitrage in Financial Markets

Arbitrage in financial markets involves simultaneously buying and selling assets in different markets to exploit price discrepancies for a risk-free profit. This strategy leverages market inefficiencies by capitalizing on price differences without exposure to market risk. Effective arbitrage requires real-time information and rapid execution across various financial instruments and exchanges.

Understanding Hedging Strategies

Hedging strategies in finance involve using financial instruments like options, futures, and swaps to minimize potential losses from price fluctuations in assets or commodities. Unlike arbitrage, which exploits price differences for risk-free profit, hedging aims to reduce risk exposure by offsetting potential negative impacts in investment portfolios. Effective hedging requires careful assessment of market conditions, correlation between assets, and cost-benefit analysis to ensure protection without significantly diminishing returns.

Key Differences Between Arbitrage and Hedging

Arbitrage involves exploiting price discrepancies in different markets to secure risk-free profits, whereas hedging aims to reduce potential losses by taking offsetting positions against existing risks. Arbitrage requires simultaneous buying and selling of assets, while hedging typically involves derivative instruments like options or futures to protect against market fluctuations. The primary distinction lies in arbitrage seeking profit without exposure to risk, whereas hedging prioritizes risk management over immediate gain.

Risk Profiles: Arbitrage vs Hedging

Arbitrage involves exploiting price discrepancies across markets to achieve riskless profit, typically exhibiting a low-risk profile due to simultaneous buying and selling of related assets. Hedging aims to reduce potential losses from adverse price movements by taking offsetting positions, resulting in a risk profile that mitigates market volatility but does not eliminate risk entirely. While arbitrage seeks to capitalize on inefficiencies with minimal exposure, hedging focuses on managing and controlling existing financial risks.

Real-World Examples of Arbitrage

Arbitrage involves exploiting price differences of identical or similar financial instruments across different markets to earn risk-free profits, as seen in the 1987 stock index arbitrage where traders capitalized on discrepancies between futures and spot prices. Currency arbitrage is another example, where investors simultaneously buy and sell currency pairs in different forex markets to benefit from exchange rate inefficiencies. These real-world arbitrage opportunities are distinct from hedging strategies, which primarily aim to reduce risk exposure rather than generate guaranteed profits.

Practical Applications of Hedging

Hedging in finance involves using derivative instruments such as options, futures, and swaps to reduce exposure to price fluctuations in assets, commodities, or currencies. Corporations employ hedging strategies to lock in costs or revenues, stabilizing cash flows and minimizing the risk of adverse market movements. Practical applications include airlines hedging fuel prices, exporters and importers managing currency risk, and investors protecting stock portfolios against market volatility.

Benefits and Limitations of Arbitrage

Arbitrage exploits price discrepancies across different markets to generate risk-free profits, enhancing market efficiency and liquidity. It benefits traders by providing opportunities for immediate gains without exposure to market risk; however, it requires significant capital, rapid execution, and access to multiple markets. Limitations include the risk of execution delays, transaction costs, and potential regulatory restrictions that may reduce profitability.

Advantages and Drawbacks of Hedging

Hedging in finance offers the advantage of risk reduction by protecting investments from adverse price movements and ensuring more predictable cash flows, which enhances financial stability. However, it may limit profit potential since gains can be offset by the costs of hedging instruments, such as options or futures contracts. The main drawback involves transaction costs and the complexity of implementing effective hedging strategies, which require constant monitoring and adjustment to changing market conditions.

Choosing the Right Strategy: Arbitrage or Hedging?

Choosing the right strategy between arbitrage and hedging depends on an investor's risk tolerance and market outlook. Arbitrage exploits price discrepancies across markets for risk-free profits, ideal in highly liquid environments with minimal risk exposure. Hedging mitigates potential losses by offsetting exposures, suitable for protecting portfolios against market volatility and adverse price movements.

Important Terms

Risk-neutral valuation

Risk-neutral valuation uses the assumption of no-arbitrage opportunities to price derivatives by replicating payoffs through hedging strategies in a risk-neutral probability measure.

Basis risk

Basis risk arises from imperfect correlation between the spot price and the futures price, creating potential losses when using arbitrage or hedging strategies.

Price convergence

Price convergence occurs when arbitrageurs exploit price discrepancies between markets, driving prices closer, while hedgers use derivatives to manage risk without directly causing convergence.

Covered interest arbitrage

Covered interest arbitrage exploits interest rate differentials between countries while eliminating exchange rate risk, distinguishing it from hedging which solely aims to minimize currency exposure without profiting from interest rate gaps.

Delta hedging

Delta hedging minimizes risk exposure by adjusting option positions to maintain a neutral portfolio, contrasting arbitrage which seeks profit from price inefficiencies without market risk.

Statistical arbitrage

Statistical arbitrage exploits pricing inefficiencies through quantitative models by simultaneously buying undervalued and selling overvalued assets, whereas hedging aims to reduce risk exposure by offsetting potential losses in investment portfolios.

Spread trading

Spread trading exploits price differences between related assets, combining arbitrage's risk-free profit strategy with hedging's risk mitigation to optimize portfolio performance.

Gamma neutrality

Gamma neutrality involves maintaining a portfolio balanced against changes in the underlying asset's price, minimizing arbitrage opportunities by effectively hedging option positions.

Relative value

Relative value strategies exploit price discrepancies between correlated assets, while arbitrage seeks risk-free profits from market inefficiencies, and hedging aims to reduce exposure to adverse price movements.

Synthetic positions

Synthetic positions combine options and underlying assets to replicate arbitrage opportunities or hedge risks by mimicking the payoff of actual securities.

Arbitrage vs Hedging Infographic

moneydif.com

moneydif.com