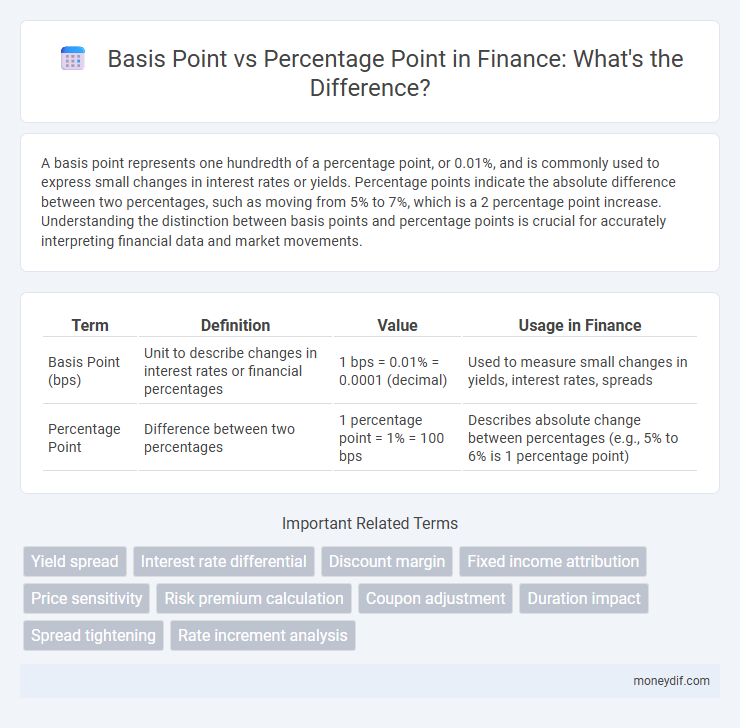

A basis point represents one hundredth of a percentage point, or 0.01%, and is commonly used to express small changes in interest rates or yields. Percentage points indicate the absolute difference between two percentages, such as moving from 5% to 7%, which is a 2 percentage point increase. Understanding the distinction between basis points and percentage points is crucial for accurately interpreting financial data and market movements.

Table of Comparison

| Term | Definition | Value | Usage in Finance |

|---|---|---|---|

| Basis Point (bps) | Unit to describe changes in interest rates or financial percentages | 1 bps = 0.01% = 0.0001 (decimal) | Used to measure small changes in yields, interest rates, spreads |

| Percentage Point | Difference between two percentages | 1 percentage point = 1% = 100 bps | Describes absolute change between percentages (e.g., 5% to 6% is 1 percentage point) |

Understanding Basis Points and Percentage Points

Basis points and percentage points are key units for measuring changes in interest rates and financial metrics, with one basis point equal to 0.01% or 1/100th of a percentage point. Understanding basis points allows investors and analysts to quantify small changes accurately, such as a 25 basis point increase representing a 0.25% rise in rates. Percentage points measure absolute differences between percentages, crucial for comparing financial performance or rate changes without confusion from relative percentage changes.

Key Differences Between Basis Points and Percentage Points

Basis points represent one-hundredth of a percentage point (0.01%), making them crucial for precise interest rate and financial metric changes. Percentage points measure the absolute difference between percentages, often illustrating broader changes such as shifts in unemployment rates or return on investment. Distinguishing between these units ensures accurate communication in financial analysis, risk assessment, and investment performance reporting.

Why Precision Matters in Financial Communication

In finance, a basis point equals 0.01%, making it crucial for conveying small changes in interest rates or yields with exactness. Misunderstanding basis points versus percentage points can lead to significant misinterpretation of investment performance or risk assessments. Precise financial communication ensures accurate decision-making and maintains investor confidence.

Calculating Changes: Basis Points Explained

Calculating changes in interest rates or financial metrics often requires understanding the difference between basis points and percentage points. A basis point equals 0.01%, so a change of 100 basis points corresponds to a 1% change, providing precise granularity in measuring small fluctuations. This precision is critical in financial markets for accurately assessing yield changes, bond spreads, and investment returns.

Percentage Points: How They Impact Financial Metrics

Percentage points measure the absolute difference between two percentages, crucial for accurately assessing changes in financial metrics such as interest rates, profit margins, and investment yields. An increase from 5% to 7% translates to a 2 percentage point rise, providing a clear and precise understanding of performance shifts. This metric eliminates confusion present in percentage change calculations, making it essential for investors and analysts when evaluating financial growth or risk.

Common Mistakes in Using Basis Points vs. Percentage Points

Common mistakes in using basis points versus percentage points often involve confusing their scale and impact on financial metrics, leading to inaccurate interpretations. A basis point equals 0.01%, meaning a change of 100 basis points corresponds precisely to a 1 percentage point change, a distinction critical in interest rate adjustments and bond yield calculations. Misapplication of these units can distort reporting and decision-making in portfolio management, risk assessment, and investor communication.

Real-World Examples in Finance

In finance, a basis point equals 0.01% and is crucial for expressing small interest rate changes, such as a 25 basis point increase marking a Federal Reserve rate hike from 3.00% to 3.25%. Percentage points represent absolute differences between percentages, such as a bond yield rising from 5% to 7%, a 2 percentage point increase that equals 200 basis points. Real-world applications include tracking stock dividend yield shifts, mortgage rate adjustments, and credit spread movements, where precision between basis points and percentage points affects investment decisions and risk assessments.

When to Use Basis Points vs. Percentage Points

Basis points are used to measure small changes in interest rates, yields, or other percentages in finance, where precision is crucial--for example, a 25 basis point increase in a bond yield signifies a 0.25% change. Percentage points are employed when comparing absolute differences between percentages, such as an increase from 5% to 7%, which corresponds to a 2 percentage point rise. Use basis points to avoid ambiguity in financial data and percentage points to express straightforward changes in rate values.

Importance in Interest Rates and Yield Calculations

Basis points and percentage points are crucial in finance for precisely measuring changes in interest rates and yields, where one basis point equals 0.01% and one percentage point equals 1%. Using basis points avoids ambiguity in communicating small fluctuations, essential for bond yields, loan rates, and investment returns. Accurate interpretation of these units impacts risk assessment, portfolio management, and financial decision-making in markets sensitive to even minor rate shifts.

Best Practices for Reporting Financial Data

When reporting financial data, clarity between basis points and percentage points is essential to avoid misinterpretation of changes in rates or returns. A basis point equals one-hundredth of a percentage point (0.01%), commonly used to describe interest rate movements and yield changes with greater precision. Best practices include explicitly stating the unit of measurement to enhance transparency and accuracy in financial communication.

Important Terms

Yield spread

Yield spread represents the difference between two interest rates or bond yields, commonly expressed in basis points, where one basis point equals 0.01%, while a percentage point equals 1%. Using basis points provides greater precision in measuring yield spread changes, especially in fixed income markets where small variations significantly impact investment decisions.

Interest rate differential

Interest rate differential represents the difference between two interest rates, often expressed in basis points where 1 basis point equals 0.01%, providing a more precise measure than percentage points. A change of 100 basis points corresponds to a full 1% difference, critical for forex trading, bond markets, and evaluating investment returns.

Discount margin

Discount margin measures the yield spread of a bond over the reference rate, expressed in basis points, where one basis point equals 0.01%, providing a finer resolution than percentage points. This precision allows investors to assess small yield differentials accurately, crucial for fixed-income securities analysis and pricing.

Fixed income attribution

Fixed income attribution quantifies portfolio performance by decomposing returns into various factors, with basis points (bps) offering a precise measure where 1 bps equals 0.01%, enabling detailed analysis of small yield changes. Using basis points instead of percentage points enhances granularity in performance evaluation, critical for accurate attribution of interest rate movements, credit spread changes, and yield curve shifts.

Price sensitivity

Price sensitivity measures how a change in price affects demand, often analyzed using basis points (1 basis point = 0.01%) for finer granularity in financial contexts, whereas percentage points represent whole percentage changes. Understanding the distinction is crucial for accurately interpreting the impact of small price fluctuations on market behavior and investment decisions.

Risk premium calculation

Risk premium calculation often requires careful attention to the difference between basis points and percentage points, where one basis point equals 0.01% or 0.0001 in decimal form. Accurately converting basis points into percentage points ensures precise measurement of the excess return expected from an investment relative to a risk-free rate.

Coupon adjustment

Coupon adjustment involves modifying the interest rate on a bond or loan, often expressed in basis points, where 100 basis points equal 1 percentage point. This precise measurement facilitates accurate comparisons and adjustments in financial instruments' yields, enhancing investment decision-making.

Duration impact

Duration impact measures a bond's price sensitivity to interest rate changes, where a one basis point move (0.01%) causes an approximate price change equal to the duration multiplied by 0.0001. In contrast, a percentage point change (1%) results in a price adjustment roughly equal to the duration times 0.01, illustrating that percentage point variations have a significantly larger effect on bond valuations than basis point shifts.

Spread tightening

Spread tightening refers to the reduction in the difference between yields on two financial instruments, typically measured in basis points, where one basis point equals 0.01% or 0.0001 in decimal form. This metric is preferred over percentage points in fixed income markets because it provides a more precise and granular view of yield changes, essential for assessing credit risk and investment performance.

Rate increment analysis

Rate increment analysis involves evaluating changes in interest rates or returns expressed in basis points, where one basis point equals 0.01%, compared to percentage points, which denote full percentage changes. Understanding the distinction between basis points and percentage points is critical for accurately interpreting rate fluctuations, as a 50 basis point increase translates to a 0.50% change, whereas a 1 percentage point increase equals a 1% change.

basis point vs percentage point Infographic

moneydif.com

moneydif.com