Gross exposure represents the total value of all positions held in a portfolio without offsetting short positions, reflecting the overall market risk. Net exposure measures the difference between long and short positions, indicating the portfolio's directional market risk. Understanding the distinction between gross and net exposure is crucial for effective risk management and portfolio optimization.

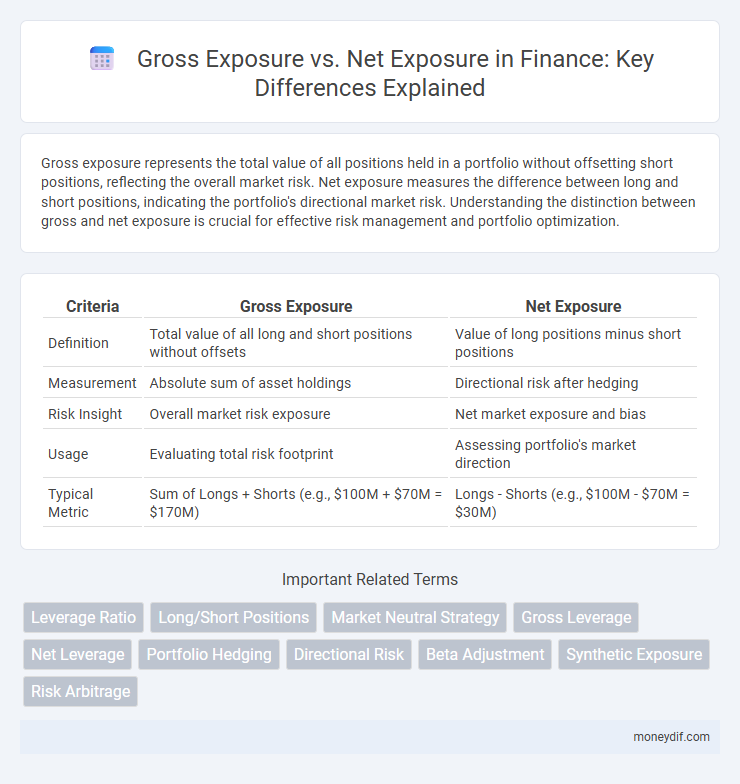

Table of Comparison

| Criteria | Gross Exposure | Net Exposure |

|---|---|---|

| Definition | Total value of all long and short positions without offsets | Value of long positions minus short positions |

| Measurement | Absolute sum of asset holdings | Directional risk after hedging |

| Risk Insight | Overall market risk exposure | Net market exposure and bias |

| Usage | Evaluating total risk footprint | Assessing portfolio's market direction |

| Typical Metric | Sum of Longs + Shorts (e.g., $100M + $70M = $170M) | Longs - Shorts (e.g., $100M - $70M = $30M) |

Understanding Gross Exposure in Finance

Gross exposure in finance represents the total value of all long and short positions in a portfolio without offsetting positions. It measures the absolute market risk by aggregating the sum of asset values, offering insight into potential maximum exposure to market movements. Understanding gross exposure helps investors assess the scale of their investments and risk before considering hedging or netting strategies that adjust net exposure.

Defining Net Exposure: Key Concepts

Net exposure represents the total value of an investor's positions after offsetting long and short holdings, providing a clearer risk assessment than gross exposure. While gross exposure sums absolute long and short positions without considering their directional offset, net exposure calculates the difference, reflecting true market exposure. Understanding net exposure helps investors measure actual risk and potential profit or loss more accurately during market fluctuations.

Gross vs. Net Exposure: Core Differences

Gross exposure represents the total value of all positions held in a portfolio, including both long and short positions, without offsetting them against each other. Net exposure calculates the difference between long and short positions, reflecting the portfolio's actual market risk and directional bias. Understanding the distinction between gross and net exposure helps investors assess risk levels and leverage more accurately in financial strategies.

Importance of Exposure Analysis in Portfolio Management

Exposure analysis in portfolio management is crucial for assessing both gross exposure and net exposure to understand total risk and market sensitivity effectively. Gross exposure reflects the total investment across assets without offsetting positions, highlighting potential maximum risk levels, while net exposure accounts for hedges and neutralizes opposing positions, providing a clearer picture of market directional risk. Accurate measurement of these exposures enables portfolio managers to optimize risk-adjusted returns, maintain regulatory compliance, and ensure alignment with investment objectives.

How Gross Exposure Impacts Risk Assessment

Gross exposure represents the total value of all long and short positions in an investment portfolio, providing a comprehensive measure of the portfolio's total market risk before netting positions. High gross exposure magnifies potential losses and gains, increasing portfolio volatility and affecting risk-adjusted performance metrics such as Value at Risk (VaR) and Sharpe Ratio. Unlike net exposure, which reflects directional market risk, gross exposure highlights the aggregate exposure to market movements, making it critical for accurately assessing leverage and potential liquidity risks in risk management frameworks.

Measuring Net Exposure: Methods and Metrics

Measuring net exposure involves calculating the difference between total long and short positions to assess an investor's actual risk in the market. Common methods include using Value at Risk (VaR) metrics, beta-adjusted exposure, and exposure-weighted averages to quantify net market sensitivity. These metrics help in understanding leverage, potential loss limits, and overall portfolio risk beyond gross exposure figures.

Practical Examples: Gross and Net Exposure in Action

In portfolio management, gross exposure represents the total value of all long and short positions, while net exposure is the difference between these positions, indicating market direction risk. For example, a hedge fund with $100 million long and $60 million short positions has a gross exposure of $160 million but a net exposure of $40 million long. This distinction helps investors assess total market commitment versus directional risk, enabling more precise risk management strategies.

Gross and Net Exposure in Hedge Funds

Gross exposure in hedge funds represents the total value of all long and short positions combined, reflecting the overall level of market risk taken by the fund. Net exposure measures the difference between long and short positions, indicating the fund's directional market risk or market sensitivity. Understanding the distinction between gross and net exposure is critical for assessing a hedge fund's risk management strategy and potential volatility.

Managing Portfolio Volatility through Exposure Adjustment

Gross exposure measures the total value of all long and short positions in a portfolio, providing insight into potential market risk before hedging. Net exposure calculates the difference between long and short positions, reflecting the portfolio's directional risk and sensitivity to market movements. Adjusting gross and net exposures strategically helps manage portfolio volatility by balancing risk and return in dynamic market environments.

Regulatory Considerations for Exposure Reporting

Regulatory frameworks mandate precise reporting of both gross exposure and net exposure to ensure transparency and risk management in financial institutions. Gross exposure represents the total unhedged risk or position size, while net exposure accounts for hedges, offsets, or collateral mitigating the overall risk. Accurate differentiation and disclosure of these exposures enable regulators to assess systemic risk, enforce capital adequacy requirements under Basel III, and monitor compliance with limits on leverage and counterparty risk.

Important Terms

Leverage Ratio

The Leverage Ratio measures the proportion of a financial institution's gross exposure to its net exposure, reflecting the total risk taken relative to available capital. A higher Leverage Ratio indicates increased use of borrowed funds or derivatives, amplifying both potential gains and risks in the balance sheet.

Long/Short Positions

Long/Short positions involve simultaneously holding long assets to benefit from price increases and short assets to profit from price declines, with gross exposure representing the total value of both long and short holdings. Net exposure measures the difference between long and short positions, indicating the portfolio's overall market direction bias and risk level.

Market Neutral Strategy

Market neutral strategies aim to balance long and short positions to achieve low net exposure, often targeting a net exposure close to zero while maintaining high gross exposure to maximize alpha generation and risk diversification. Gross exposure measures the total value invested long and short, whereas net exposure represents the difference between long and short positions, reflecting the strategy's directional market risk.

Gross Leverage

Gross leverage measures the total risk exposure by comparing gross exposure, which is the sum of all long and short positions, against net exposure, representing the difference between those positions; higher gross leverage indicates greater total market exposure relative to the portfolio's net directional stance. Investors use gross leverage to assess potential risk amplification from both sides of a portfolio, emphasizing total exposure rather than just net market direction.

Net Leverage

Net leverage measures a fund's total debt relative to its net asset value, reflecting true financial risk by accounting for both gross exposure and hedging positions. Unlike gross exposure, which sums all long and short positions without offsetting, net exposure subtracts short positions from long ones, offering a clearer picture of effective leverage and potential market sensitivity.

Portfolio Hedging

Portfolio hedging involves managing gross exposure, which is the total value of all long and short positions, to reduce risk from market fluctuations, while net exposure represents the difference between these positions and indicates the portfolio's actual market risk. Effective hedging strategies aim to minimize net exposure, thereby limiting potential losses without necessarily reducing gross exposure or overall portfolio size.

Directional Risk

Directional risk measures potential loss from market movements by comparing gross exposure, which sums all long and short positions without netting, to net exposure that accounts for hedging by offsetting positions; gross exposure typically indicates higher risk due to unhedged positions, whereas net exposure reflects the actual market risk after offsetting trades reduce directional bias. Understanding the difference between these exposures helps investors manage portfolio risk by balancing total invested capital against market directional sensitivity.

Beta Adjustment

Beta adjustment refines portfolio risk by aligning gross exposure, which measures total market value of long and short positions, to net exposure, the difference between these positions, ensuring accurate sensitivity to market movements. This technique accurately calibrates beta to reflect true market risk, accounting for leverage and hedging effects inherent in gross exposure without overstating net exposure influence.

Synthetic Exposure

Synthetic exposure refers to investment risk created through derivatives, allowing traders to simulate gross exposure levels without directly holding the underlying assets, while net exposure considers the overall directional risk after accounting for hedges and offsets. Managing synthetic exposure helps in optimizing portfolio leverage and risk-return profiles by balancing gross exposure, which measures total long and short positions, against net exposure, reflecting the true market exposure.

Risk Arbitrage

Risk arbitrage strategies typically involve taking positions with significant gross exposure to capitalize on merger spreads while maintaining a lower net exposure to limit market risk. By balancing long and short positions, investors manage gross exposure to enhance potential returns and use net exposure to control portfolio risk and reduce sensitivity to overall market movements.

gross exposure vs net exposure Infographic

moneydif.com

moneydif.com