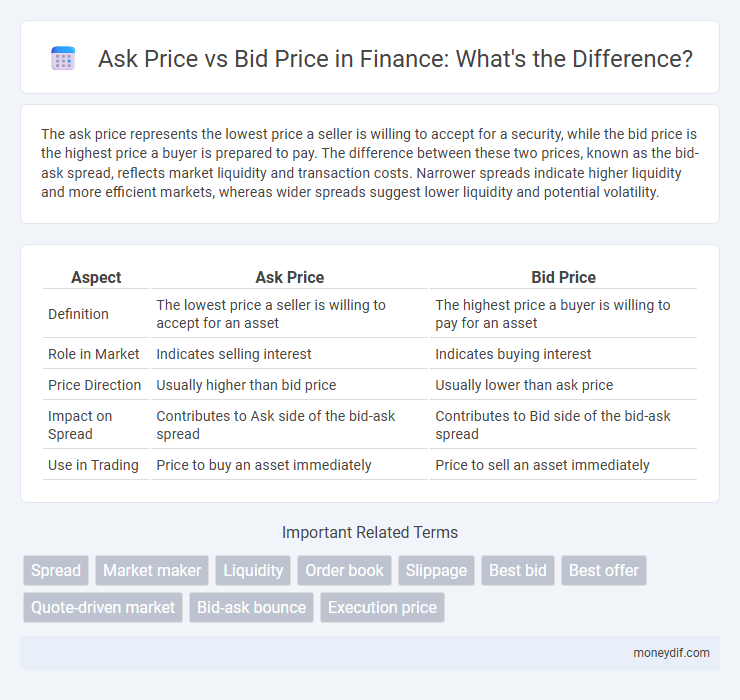

The ask price represents the lowest price a seller is willing to accept for a security, while the bid price is the highest price a buyer is prepared to pay. The difference between these two prices, known as the bid-ask spread, reflects market liquidity and transaction costs. Narrower spreads indicate higher liquidity and more efficient markets, whereas wider spreads suggest lower liquidity and potential volatility.

Table of Comparison

| Aspect | Ask Price | Bid Price |

|---|---|---|

| Definition | The lowest price a seller is willing to accept for an asset | The highest price a buyer is willing to pay for an asset |

| Role in Market | Indicates selling interest | Indicates buying interest |

| Price Direction | Usually higher than bid price | Usually lower than ask price |

| Impact on Spread | Contributes to Ask side of the bid-ask spread | Contributes to Bid side of the bid-ask spread |

| Use in Trading | Price to buy an asset immediately | Price to sell an asset immediately |

Understanding Bid Price and Ask Price

Bid price represents the highest price a buyer is willing to pay for a financial asset, while the ask price is the lowest price a seller is willing to accept. The difference between these two prices is known as the bid-ask spread, which reflects market liquidity and transaction costs. Traders analyze this spread to assess market efficiency and to execute buy and sell orders effectively.

Key Differences Between Bid and Ask Price

The bid price represents the highest price a buyer is willing to pay for a security, while the ask price is the lowest price a seller is willing to accept. The difference between these two prices is known as the bid-ask spread, which serves as a key indicator of market liquidity and transaction costs. Understanding the bid-ask spread is essential for traders to evaluate the cost of entering or exiting a position in financial markets.

How Bid-Ask Spread Impacts Trading

The bid-ask spread directly affects trading costs by representing the difference between the highest price buyers are willing to pay and the lowest price sellers will accept. A wider bid-ask spread increases transaction costs and reduces market liquidity, making it more expensive for traders to enter or exit positions. Tight spreads are typically found in highly liquid markets, facilitating faster execution and lower cost for both retail and institutional investors.

Factors Influencing Bid and Ask Prices

Bid and ask prices are influenced by market liquidity, with higher liquidity typically leading to narrower spreads. Supply and demand dynamics for the security significantly affect these prices, as increased demand raises bid prices while abundant supply lowers ask prices. Other factors include market volatility, transaction costs, and the presence of informed traders, which collectively contribute to the price gap between bids and asks.

Role of Market Makers in Bid-Ask Pricing

Market makers play a crucial role in determining the bid and ask prices by continuously quoting buy (bid) and sell (ask) prices for financial instruments, ensuring market liquidity. They profit from the spread between the ask price and bid price while providing immediate execution for traders. This bid-ask spread reflects supply and demand dynamics, transaction costs, and market volatility, all managed by market makers to maintain orderly trading.

Bid vs. Ask: Effects on Trade Execution

Bid price represents the highest price a buyer is willing to pay for a security, while the ask price is the lowest price a seller is willing to accept. The spread between bid and ask prices affects trade execution by influencing transaction costs and liquidity, with narrow spreads generally indicating efficient markets and lower costs. Traders must consider bid-ask spreads to optimize entry and exit points, as wider spreads can lead to higher slippage and reduced profitability.

Strategies to Navigate Bid-Ask Spread

Effective strategies to navigate the bid-ask spread include placing limit orders to control entry and exit prices, thus avoiding unfavorable market prices. Traders should analyze historical spread data to identify periods of lower volatility when tighter spreads occur, reducing transaction costs. Utilizing algorithmic trading tools can also optimize order execution by dynamically adjusting bids and offers based on real-time market conditions.

Bid-Ask Spread and Market Liquidity

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid price) and the lowest price a seller is willing to accept (ask price), serving as a key indicator of market liquidity. Narrow spreads typically indicate highly liquid markets with active trading and lower transaction costs, while wider spreads suggest lower liquidity and higher trading costs. Market makers and traders closely monitor the bid-ask spread to assess the cost of entering and exiting positions, impacting overall market efficiency and price discovery.

Importance of Bid and Ask in Stock Trading

The bid price represents the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept. The difference between these prices, known as the bid-ask spread, is crucial for liquidity and transaction costs in stock trading. Narrow spreads typically indicate a highly liquid market, enabling traders to execute orders more efficiently and at better prices.

Real-World Examples of Bid and Ask Price

In the stock market, Amazon's ask price might be $3,500 per share while the bid price hovers around $3,495, reflecting active buyer-seller dynamics and liquidity. Forex trading often shows the EUR/USD pair with an ask price of 1.1050 and a bid price at 1.1048, illustrating narrow spreads in high-volume currency pairs. Real estate auctions also demonstrate this concept, where sellers set an ask price of $500,000 on a property, while buyers offer a bid price of $490,000, highlighting market negotiation processes.

Important Terms

Spread

Spread represents the difference between the ask price and the bid price of a financial instrument, reflecting market liquidity and transaction costs. A narrower spread indicates higher liquidity and lower trading costs, while a wider spread suggests lower liquidity and higher costs for traders.

Market maker

Market makers continuously provide liquidity by quoting both bid and ask prices, where the bid price represents the highest price they are willing to pay, and the ask price reflects the lowest price at which they sell; the spread between these prices is crucial for profitability and market efficiency. This bid-ask spread fluctuates based on market volatility, trading volume, and the asset's liquidity, directly impacting transaction costs for traders and the overall price discovery process.

Liquidity

Liquidity in financial markets is reflected by the narrow spread between the ask price and bid price, indicating a high volume of buyers and sellers actively trading an asset. A tighter spread enhances market efficiency by reducing transaction costs and allowing quicker execution of orders at prices closer to the true market value.

Order book

The order book displays real-time lists of buy orders (bids) and sell orders (asks), where the bid price represents the highest price buyers are willing to pay, and the ask price indicates the lowest price sellers are willing to accept. The spread between the ask price and bid price reflects market liquidity and trading activity, influencing price discovery and potential arbitrage opportunities.

Slippage

Slippage occurs when the executed trade price differs from the expected ask or bid price, often due to market volatility or low liquidity. It typically causes buyers to pay more than the ask price and sellers to receive less than the bid price, impacting trade execution cost and order fulfillment.

Best bid

The best bid represents the highest price a buyer is willing to pay for an asset, closely related to the ask price, which is the lowest price a seller is willing to accept, creating the bid-ask spread that indicates market liquidity. Narrow bid-ask spreads often signal high trading volume and efficient price discovery, while wider spreads can reflect lower liquidity and greater volatility.

Best offer

The best offer in trading represents the lowest ask price sellers are willing to accept, while the bid price indicates the highest price buyers are ready to pay. The spread between the ask and bid prices reflects market liquidity and transaction costs, influencing trading decisions and potential profits.

Quote-driven market

A quote-driven market features dealers who post bid prices to buy and ask prices to sell financial instruments, creating continuous two-sided quotes that facilitate liquidity and price discovery. The spread between the ask price and bid price reflects transaction costs and market maker compensation, influencing trading volume and market efficiency.

Bid-ask bounce

Bid-ask bounce refers to the short-term price fluctuations caused by the difference between the ask price and the bid price, where trades alternate between the higher ask and lower bid prices. This phenomenon can create misleading volatility in asset prices despite no fundamental changes in market value.

Execution price

Execution price is the actual price at which a trade is completed, often influenced by the bid-ask spread, where the bid price represents the highest price a buyer is willing to pay and the ask price is the lowest price a seller is willing to accept. Transactions typically occur at the ask price when buying and at the bid price when selling, with execution price reflecting real-time market liquidity and order flow.

ask price vs bid price Infographic

moneydif.com

moneydif.com