The Greenshoe option and the over-allotment option are often used interchangeably in finance to stabilize stock prices after an initial public offering (IPO). The Greenshoe option allows underwriters to sell additional shares, typically up to 15% more than the original offering, to cover excess demand. This mechanism helps maintain price stability by enabling the purchase of shares in the open market if the stock price falls below the offering price.

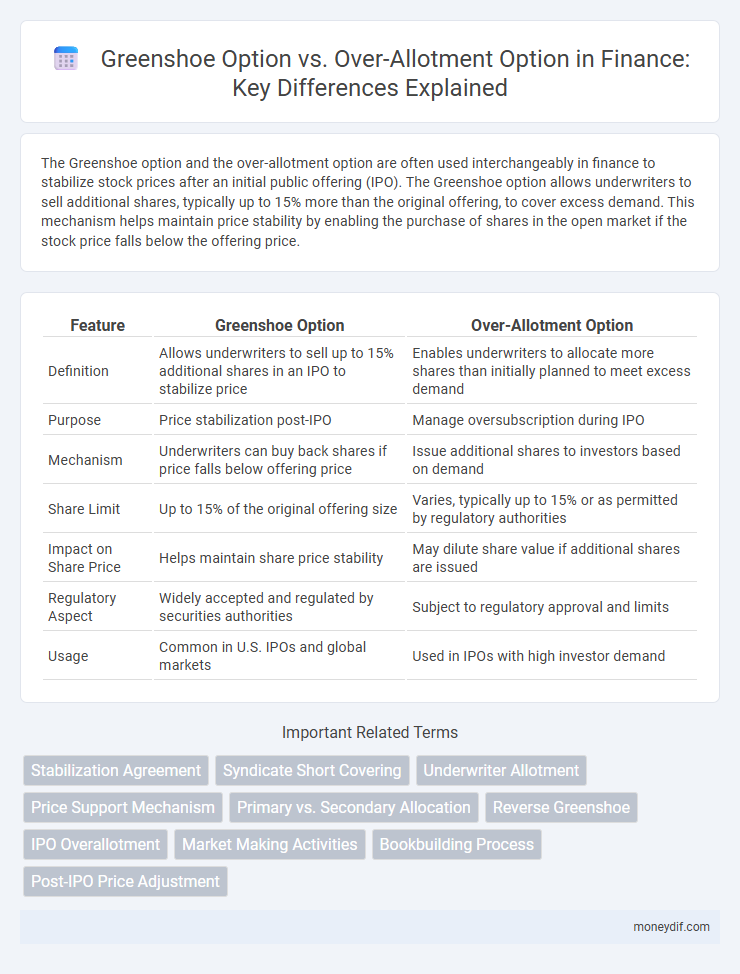

Table of Comparison

| Feature | Greenshoe Option | Over-Allotment Option |

|---|---|---|

| Definition | Allows underwriters to sell up to 15% additional shares in an IPO to stabilize price | Enables underwriters to allocate more shares than initially planned to meet excess demand |

| Purpose | Price stabilization post-IPO | Manage oversubscription during IPO |

| Mechanism | Underwriters can buy back shares if price falls below offering price | Issue additional shares to investors based on demand |

| Share Limit | Up to 15% of the original offering size | Varies, typically up to 15% or as permitted by regulatory authorities |

| Impact on Share Price | Helps maintain share price stability | May dilute share value if additional shares are issued |

| Regulatory Aspect | Widely accepted and regulated by securities authorities | Subject to regulatory approval and limits |

| Usage | Common in U.S. IPOs and global markets | Used in IPOs with high investor demand |

Understanding the Greenshoe Option

The Greenshoe Option is a provision in an initial public offering (IPO) that allows underwriters to purchase up to an additional 15% of shares from the issuer to stabilize the stock price after the offering. This option helps mitigate market volatility by enabling underwriters to support the share price if demand exceeds supply. Often confused with the broader Over-Allotment Option, the Greenshoe specifically refers to this price stabilization mechanism within the equity offering process.

What Is an Over-Allotment Option?

An Over-Allotment Option, commonly known as a greenshoe option, allows underwriters to sell additional shares, typically up to 15% more than the original number offered, to stabilize the stock price after an initial public offering (IPO). This mechanism helps manage excess demand, reduce volatility, and maintain market stability by enabling underwriters to buy back shares if necessary. The option's strategic use mitigates risk for both issuers and investors, supporting a smoother market introduction of new stock.

Key Differences between Greenshoe and Over-Allotment Options

The Greenshoe option refers specifically to the issuer's right to sell additional shares, up to 15% more than the original offering, to stabilize the stock price after an IPO. The over-allotment option is a broader term encompassing any overallocation of shares beyond the initial offering, which may be exercised by underwriters but does not always involve price stabilization mechanisms. Key differences include the Greenshoe's explicit price support goal and regulated cap on share quantity versus the more flexible and varied use of over-allotment options in capital markets.

The Role of Greenshoe in IPO Stabilization

The Greenshoe option serves as a critical mechanism for stabilizing IPO prices by allowing underwriters to sell additional shares, typically up to 15%, beyond the original offering size to meet excess demand. This over-allotment provision helps mitigate price volatility by enabling underwriters to buy back shares if the stock price falls below the offering price, thereby supporting market price stability. The effective use of the Greenshoe option enhances investor confidence and smooths price fluctuations during the initial trading period.

Over-Allotment Option: Mechanism and Purpose

The Over-Allotment Option allows underwriters to sell additional shares, typically up to 15% of the original offering, to stabilize the stock price post-IPO by meeting excess demand. This mechanism helps prevent price volatility by enabling the purchase of more shares from the company if the stock price rises above the offering price. Its primary purpose is to provide price support and investor confidence during the initial trading period.

Benefits of Greenshoe Options for Issuers and Investors

The Greenshoe option provides issuers with price stabilization by allowing the sale of additional shares, reducing volatility during initial public offerings (IPOs). Investors benefit from increased liquidity and confidence as the option helps prevent sharp price drops by enabling underwriters to buy shares in case of excess demand. This mechanism ultimately supports a more balanced market and can lead to improved post-IPO performance.

Risks Associated with Over-Allotment and Greenshoe Options

Over-allotment and Greenshoe options involve issuing more shares than initially planned, potentially leading to market price volatility if demand is overestimated. Risks include dilution of shareholder value and price decline if the overallotment shares are sold aggressively or if market conditions deteriorate. Mispricing or mismanagement of these options can result in reputational damage and increased regulatory scrutiny.

Real-World Examples of Greenshoe and Over-Allotment Options

The Greenshoe option, famously utilized in Alibaba's 2014 IPO, allowed underwriters to purchase up to 15% additional shares to stabilize the stock price post-offering, exemplifying effective demand management. In contrast, Facebook's 2012 IPO employed an over-allotment option that enabled underwriters to sell extra shares beyond the original allotment, aiding liquidity and price stabilization in volatile markets. Both mechanisms serve to mitigate price volatility but differ in execution, with Greenshoe emphasizing price support and over-allotment focusing on supply flexibility.

Regulatory Framework Governing Greenshoe vs Over-Allotment Options

The regulatory framework governing greenshoe and over-allotment options primarily centers on the U.S. Securities and Exchange Commission (SEC) rules, which allow underwriters to stabilize the post-offering price by purchasing additional shares within a specified period, typically 30 days. The greenshoe option specifically refers to an overallotment provision permitting up to 15% extra shares to be sold, aimed at price stabilization and liquidity enhancement. Regulations mandate strict disclosure requirements and time-limited exercise periods to prevent market manipulation and ensure transparency in both greenshoe and general over-allotment offerings.

Which Option Is Right for Your IPO: A Comparative Analysis

The Greenshoe Option and Over-Allotment Option both allow underwriters to stabilize IPO prices by selling additional shares, but the Greenshoe Option typically grants up to 15% extra shares to cover over-allotments. Selecting the right option depends on factors such as market volatility, investor demand, and regulatory approval, with the Greenshoe Option offering more flexibility for price stabilization. Understanding the mechanics and implications of each can optimize capital raising and reduce post-IPO price fluctuations.

Important Terms

Stabilization Agreement

The Stabilization Agreement governs the Greenshoe Option, which allows underwriters to purchase additional shares up to 15% to stabilize post-IPO price, whereas the Over-Allotment Option specifically refers to this contractual right enabling share overallotment and price support.

Syndicate Short Covering

Syndicate short covering occurs when underwriters buy back shares to cover overallotments in the greenshoe option, stabilizing the stock price after an IPO.

Underwriter Allotment

Underwriter Allotment refers to the initial allocation of shares given to underwriters who may exercise the Greenshoe Option, allowing them to buy additional shares up to 15% more than the original issue, whereas the Over-Allotment Option specifically enables underwriters to sell more shares than initially planned to stabilize the stock price.

Price Support Mechanism

The Price Support Mechanism stabilizes the stock price by allowing underwriters to exercise the Greenshoe Option, an over-allotment option that enables them to purchase additional shares up to 15% to cover short positions and prevent price declines post-IPO.

Primary vs. Secondary Allocation

Primary allocation refers to the initial distribution of shares during an IPO, while secondary allocation involves the sale of existing shares by insiders, and the Greenshoe option enables underwriters to sell additional shares to stabilize price post-IPO, contrasting with the over-allotment option which specifically addresses extra shares sold beyond the initial offering amount.

Reverse Greenshoe

Reverse Greenshoe is a mechanism allowing underwriters to sell shares back to the issuer to stabilize stock price after an over-allotment option increases share supply beyond the original offering.

IPO Overallotment

The IPO overallotment process utilizes the Greenshoe option to stabilize share prices by allowing underwriters to sell additional shares up to 15%, whereas the over-allotment option refers more broadly to any issuance of extra shares beyond the initial offering to meet excess demand.

Market Making Activities

Market making activities utilize the Greenshoe option as a specific type of over-allotment option allowing underwriters to stabilize share prices by purchasing additional shares up to typically 15% of the offering size.

Bookbuilding Process

The Bookbuilding Process often incorporates the Greenshoe Option, a specific type of Over-Allotment Option allowing underwriters to purchase additional shares, stabilizing the stock price post-IPO.

Post-IPO Price Adjustment

The post-IPO price adjustment is influenced by the Greenshoe option, which allows underwriters to stabilize share prices by purchasing up to 15% additional shares, whereas the over-allotment option specifically refers to this mechanism enabling the sale of extra shares beyond the original offering size to manage market demand.

Greenshoe Option vs Over-Allotment Option Infographic

moneydif.com

moneydif.com