Securitization involves pooling various financial assets and issuing new securities backed by these assets, transferring risk to investors and improving liquidity. Syndication, on the other hand, refers to multiple lenders jointly funding a large loan, sharing risk and capital requirements without creating new securities. Both methods optimize capital allocation but differ in structure, risk distribution, and regulatory treatment.

Table of Comparison

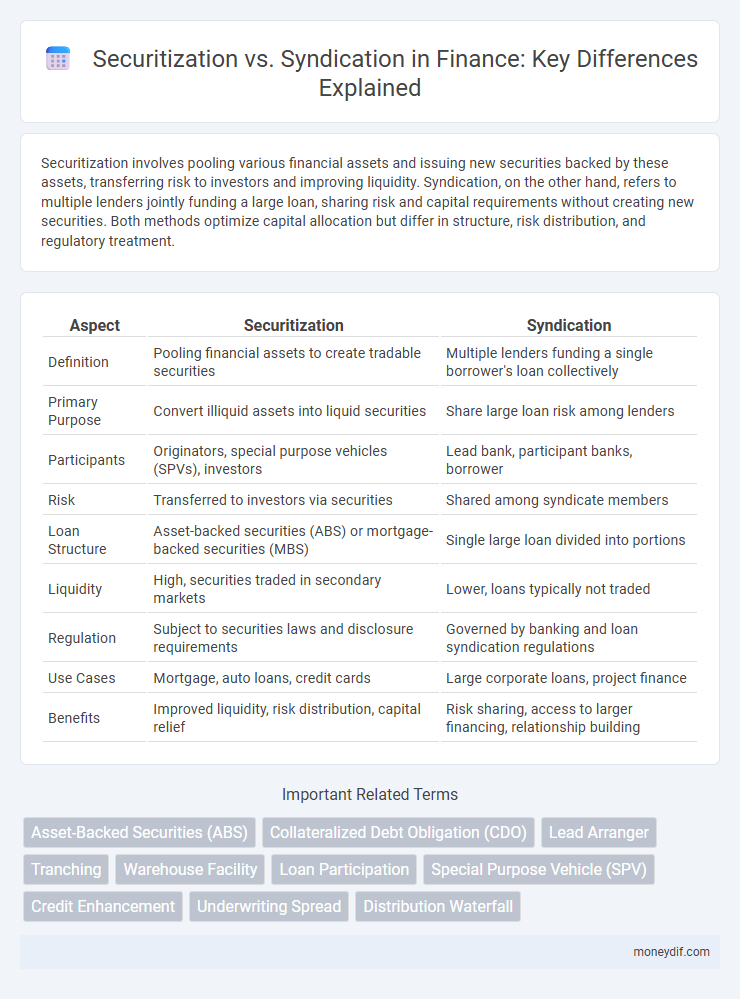

| Aspect | Securitization | Syndication |

|---|---|---|

| Definition | Pooling financial assets to create tradable securities | Multiple lenders funding a single borrower's loan collectively |

| Primary Purpose | Convert illiquid assets into liquid securities | Share large loan risk among lenders |

| Participants | Originators, special purpose vehicles (SPVs), investors | Lead bank, participant banks, borrower |

| Risk | Transferred to investors via securities | Shared among syndicate members |

| Loan Structure | Asset-backed securities (ABS) or mortgage-backed securities (MBS) | Single large loan divided into portions |

| Liquidity | High, securities traded in secondary markets | Lower, loans typically not traded |

| Regulation | Subject to securities laws and disclosure requirements | Governed by banking and loan syndication regulations |

| Use Cases | Mortgage, auto loans, credit cards | Large corporate loans, project finance |

| Benefits | Improved liquidity, risk distribution, capital relief | Risk sharing, access to larger financing, relationship building |

Introduction to Securitization and Syndication

Securitization involves pooling various financial assets such as mortgages or loans and transforming them into tradable securities, enabling issuers to access capital markets and improve liquidity. Syndication refers to multiple lenders or investors jointly funding a single large loan or financing arrangement, distributing risk and resources among participants. Both methods are critical in modern finance for managing risk exposure and optimizing capital allocation.

Key Definitions and Core Concepts

Securitization involves pooling various financial assets, such as loans or receivables, and converting them into tradable securities to diversify risk and improve liquidity. Syndication refers to multiple lenders or investors jointly providing a large loan or financing to a single borrower, sharing the credit risk and capital exposure. Both methods optimize capital allocation but differ in structure: securitization transforms assets into marketable securities, while syndication splits direct lending responsibilities among participants.

Structural Differences Between Securitization and Syndication

Securitization involves pooling financial assets like loans or receivables and issuing securities backed by these assets, separating them from the originator's balance sheet, creating multiple tranches with varying risk levels. Syndication entails multiple lenders jointly providing portions of a single loan to a borrower, sharing the credit risk without creating new financial instruments or removing the loan from the originator's balance sheet. The structural difference lies in securitization transforming assets into tradable securities with defined cash flow priorities, while syndication is a collaborative loan arrangement maintaining the original loan structure and risk distribution among lenders.

Process Overview: How Securitization Works

Securitization involves pooling various financial assets such as mortgages or loans and converting them into marketable securities that investors can purchase. The process begins with the originator transferring assets to a special purpose vehicle (SPV), which isolates the assets from the originator's balance sheet and issues asset-backed securities (ABS) to investors. Cash flows generated by the underlying assets are used to pay interest and principal to security holders, creating liquidity and risk distribution within financial markets.

Process Overview: How Syndication Works

Syndication in finance involves multiple lenders jointly funding a large loan, with one lead arranger coordinating the process, structuring the deal, and negotiating terms. The lead arranger manages communication between the borrower and syndicate members, allocates loan portions, and monitors repayments. This collaborative approach diversifies risk among lenders while enabling access to sizable capital amounts.

Risk Distribution and Investor Exposure

Securitization distributes risk by pooling various financial assets and issuing securities backed by these pools, thus transferring credit risk from the originator to a broad base of investors. Syndication spreads risk among multiple lenders by sharing a large loan, limiting individual investor exposure to default by dividing loan amounts and repayments. In securitization, investors have exposure linked to specific tranches with varying risk levels, whereas syndication involves more homogeneous risk exposure based on the loan agreement terms shared among participants.

Advantages and Disadvantages of Securitization

Securitization offers enhanced liquidity by converting illiquid assets into tradable securities, enabling issuers to access diversified funding sources and reduce credit risk through asset pooling. However, it involves complex structuring and high transaction costs, which can limit its feasibility for smaller entities. Additionally, securitization's reliance on market conditions exposes issuers to pricing volatility and potential adverse regulatory impacts.

Pros and Cons of Syndication

Syndication in finance allows multiple lenders to share the risk and pool resources for large loans, improving capital distribution and mitigating individual exposure. It offers borrowers access to larger financing amounts and diverse expertise but can lead to slower decision-making and complex coordination among participants. The downside includes potential conflicts of interest and reduced flexibility due to the need to satisfy multiple stakeholders.

Regulatory and Compliance Considerations

Securitization involves pooling financial assets and issuing securities backed by those assets, subject to strict regulatory frameworks such as Basel III and Dodd-Frank Act to ensure transparency and risk retention requirements. Syndication, which entails multiple lenders jointly providing a single loan, requires adherence to lending regulations and borrower protection laws governed by entities like the Federal Reserve and the OCC. Both processes demand rigorous compliance with disclosure mandates, anti-money laundering (AML) standards, and ongoing reporting obligations to mitigate systemic risk and protect investors.

Suitability and Use Cases in Modern Finance

Securitization is suitable for institutions seeking to transform illiquid assets into marketable securities, thereby enhancing liquidity and risk distribution, commonly used in mortgage-backed securities and asset-backed securities markets. Syndication is ideal for large-scale financing requiring risk sharing among multiple lenders, frequently applied in corporate loans, infrastructure projects, and leveraged buyouts. Both methods optimize capital allocation but differ in complexity, risk exposure, and regulatory treatment within modern financial ecosystems.

Important Terms

Asset-Backed Securities (ABS)

Asset-Backed Securities (ABS) involve securitization by pooling financial assets into tradable securities, contrasting with syndication where loans are distributed among multiple lenders to share risk.

Collateralized Debt Obligation (CDO)

Collateralized Debt Obligations (CDOs) are complex securitized financial instruments that pool various debt assets, enabling risk distribution unlike syndication, which involves multiple lenders jointly providing a loan without creating tradable securities.

Lead Arranger

Lead Arrangers coordinate syndicated loans by structuring, syndicating, and managing credit risk, while in securitization they pool assets to issue securities backed by those assets for investor distribution.

Tranching

Tranching in securitization segments pooled assets into different risk and return classes, whereas syndication involves multiple lenders sharing portions of a single loan without structuring asset-backed tranches.

Warehouse Facility

Warehouse facility structures in securitization provide short-term funding with asset-backed collateral, whereas syndication involves multiple lenders jointly financing a loan to diversify risk and increase capital availability.

Loan Participation

Loan participation involves multiple lenders sharing portions of a single loan, differing from securitization, which pools loans into marketable securities, and syndication, where lenders collaboratively fund and manage a large loan.

Special Purpose Vehicle (SPV)

A Special Purpose Vehicle (SPV) facilitates securitization by isolating financial assets to issue securities, whereas syndication involves multiple lenders sharing a loan without creating a separate legal entity.

Credit Enhancement

Credit enhancement in securitization improves asset-backed security ratings by reducing investor risk, whereas syndication spreads loan risk among multiple lenders without altering underlying credit quality.

Underwriting Spread

Underwriting spread in securitization is typically narrower than in syndication due to reduced risk exposure and standardized asset pools.

Distribution Waterfall

The distribution waterfall in securitization prioritizes structured tranche payments through predefined cash flow tiers, while syndication involves proportional distribution of loan repayments among participating lenders based on their share.

Securitization vs Syndication Infographic

moneydif.com

moneydif.com