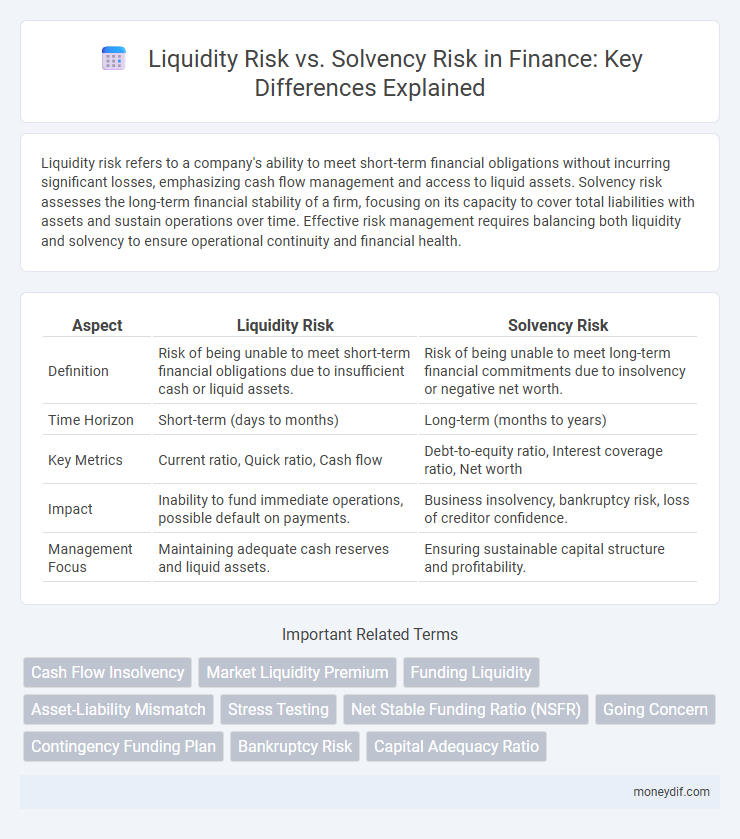

Liquidity risk refers to a company's ability to meet short-term financial obligations without incurring significant losses, emphasizing cash flow management and access to liquid assets. Solvency risk assesses the long-term financial stability of a firm, focusing on its capacity to cover total liabilities with assets and sustain operations over time. Effective risk management requires balancing both liquidity and solvency to ensure operational continuity and financial health.

Table of Comparison

| Aspect | Liquidity Risk | Solvency Risk |

|---|---|---|

| Definition | Risk of being unable to meet short-term financial obligations due to insufficient cash or liquid assets. | Risk of being unable to meet long-term financial commitments due to insolvency or negative net worth. |

| Time Horizon | Short-term (days to months) | Long-term (months to years) |

| Key Metrics | Current ratio, Quick ratio, Cash flow | Debt-to-equity ratio, Interest coverage ratio, Net worth |

| Impact | Inability to fund immediate operations, possible default on payments. | Business insolvency, bankruptcy risk, loss of creditor confidence. |

| Management Focus | Maintaining adequate cash reserves and liquid assets. | Ensuring sustainable capital structure and profitability. |

Understanding Liquidity Risk: Definition and Key Concepts

Liquidity risk refers to the potential inability of a firm or individual to meet short-term financial obligations due to the lack of liquid assets or insufficient cash flow. Key concepts include the cash conversion cycle, market liquidity, and the impact of asset liquidity on the ease of converting holdings into cash without significant loss. Effective liquidity risk management involves maintaining adequate cash reserves, access to credit lines, and continuous monitoring of cash inflows and outflows to prevent insolvency or forced asset sales.

What is Solvency Risk? Core Principles Explained

Solvency risk refers to a company's ability to meet its long-term financial obligations and sustain operations over time. It is assessed by analyzing debt-to-equity ratios, interest coverage ratios, and cash flow stability to ensure liabilities do not exceed assets. Understanding solvency risk helps investors and creditors evaluate the financial health and long-term viability of a business.

Liquidity vs. Solvency: Fundamental Differences

Liquidity risk refers to a firm's inability to meet short-term financial obligations due to insufficient cash flow or liquid assets, while solvency risk concerns the long-term viability of a business based on its total assets versus liabilities. Liquidity focuses on immediate cash availability and operational continuity, whereas solvency assesses the overall financial health and capital structure sustainability. Understanding the fundamental differences between liquidity and solvency risks is crucial for effective financial risk management and maintaining investor confidence.

Common Triggers of Liquidity Risk in Finance

Common triggers of liquidity risk in finance include sudden declines in market confidence, deterioration of asset quality, and unexpected large withdrawals by depositors. These events strain a firm's ability to meet short-term obligations without incurring substantial losses. Market volatility and credit rating downgrades further exacerbate liquidity pressures by limiting access to funding sources.

Main Causes of Solvency Risk in Organizations

Solvency risk in organizations primarily stems from prolonged negative cash flows, excessive debt accumulation, and inadequate asset management. Poor profitability combined with high fixed costs often erodes equity, increasing the likelihood of insolvency. Ineffective financial planning and adverse market conditions further exacerbate an organization's inability to meet long-term obligations.

Impact of Liquidity Risk on Financial Health

Liquidity risk significantly affects a company's financial health by limiting its ability to meet short-term obligations, potentially leading to increased borrowing costs or forced asset sales at unfavorable prices. Insufficient liquidity disrupts cash flow management, undermining operational stability and investor confidence. Persistent liquidity risk can escalate into solvency issues if the firm fails to restructure debts or secure adequate financing timely.

How Solvency Risk Affects Long-Term Sustainability

Solvency risk directly impacts a company's long-term sustainability by threatening its ability to meet long-term obligations and maintain positive shareholder equity. Prolonged insolvency can erode investor confidence, leading to reduced access to capital markets and increased borrowing costs. Firms facing high solvency risk often struggle to invest in growth opportunities, undermining their competitive position and future profitability.

Measuring Liquidity and Solvency: Key Ratios and Metrics

Liquidity risk is measured using ratios like the current ratio and quick ratio, which assess a firm's ability to meet short-term obligations with liquid assets. Solvency risk relies on metrics such as the debt-to-equity ratio and interest coverage ratio, indicating long-term financial stability and capacity to cover debt expenses. Accurate measurement of both liquidity and solvency risks is crucial for effective financial risk management and ensuring sustainable business operations.

Managing Liquidity and Solvency Risks: Best Practices

Effective management of liquidity and solvency risks involves maintaining adequate cash reserves and ensuring access to diverse funding sources to meet short-term obligations. Implementing robust financial forecasting and stress testing allows firms to anticipate potential liquidity crunches and solvency challenges, enabling proactive measures. Regularly monitoring key financial ratios such as the current ratio, quick ratio, and debt-to-equity ratio enhances early detection of financial distress and supports informed decision-making.

Real-World Case Studies: Liquidity and Solvency Risks in Action

Liquidity risk manifests prominently in the 2008 Lehman Brothers collapse, where the firm's inability to meet short-term obligations triggered a systemic shock. Solvency risk surfaced during the Greek debt crisis, as prolonged fiscal deficits and unsustainable debt levels threatened the nation's capacity to honor long-term liabilities. These real-world cases underscore the critical distinction between immediate cash flow shortages and foundational financial instability in risk management strategies.

Important Terms

Cash Flow Insolvency

Cash flow insolvency occurs when a company lacks sufficient liquidity to meet short-term obligations despite having solvency, highlighting the critical distinction between liquidity risk--the inability to cover immediate liabilities--and solvency risk, which involves the overall inability to meet long-term debts.

Market Liquidity Premium

Market liquidity premium compensates investors for bearing liquidity risk, which arises from difficulties in quickly buying or selling assets without significant price impact, distinct from solvency risk related to a firm's ability to meet long-term obligations.

Funding Liquidity

Funding liquidity measures a firm's ability to meet short-term cash demands and differs from solvency risk, which assesses long-term financial stability amid liquidity risk's potential to trigger funding shortfalls.

Asset-Liability Mismatch

Asset-liability mismatch significantly increases liquidity risk by impairing an institution's ability to meet short-term obligations while simultaneously heightening solvency risk through potential long-term capital inadequacy.

Stress Testing

Stress testing evaluates liquidity risk by simulating cash flow disruptions and solvency risk by assessing capital adequacy under adverse economic scenarios.

Net Stable Funding Ratio (NSFR)

The Net Stable Funding Ratio (NSFR) measures a bank's liquidity risk by ensuring it maintains sufficient stable funding over a one-year horizon to cover long-term assets, thereby indirectly supporting solvency by reducing funding mismatches.

Going Concern

Going concern risk arises when liquidity risk impairs a company's ability to meet short-term obligations, potentially escalating into solvency risk if long-term liabilities exceed asset values.

Contingency Funding Plan

A Contingency Funding Plan minimizes liquidity risk by ensuring access to emergency funds while maintaining solvency risk management through capital adequacy and long-term financial stability.

Bankruptcy Risk

Bankruptcy risk increases significantly when liquidity risk limits a firm's ability to meet short-term obligations and solvency risk reflects its insufficient long-term asset coverage against liabilities.

Capital Adequacy Ratio

The Capital Adequacy Ratio (CAR) measures a bank's capital relative to its risk-weighted assets, crucial for solvency risk assessment, while liquidity risk focuses on a bank's ability to meet short-term obligations without impacting CAR directly.

Liquidity Risk vs Solvency Risk Infographic

moneydif.com

moneydif.com