Treasury stripping involves separating a Treasury bond into its individual principal and interest components, creating zero-coupon securities that trade independently. Coupon stripping specifically refers to detaching just the coupon payments from the bond, offering investors tailored exposure to periodic interest streams. Both strategies enhance portfolio diversification by providing varied risk and duration profiles, but Treasury stripping provides a more comprehensive breakdown than coupon stripping alone.

Table of Comparison

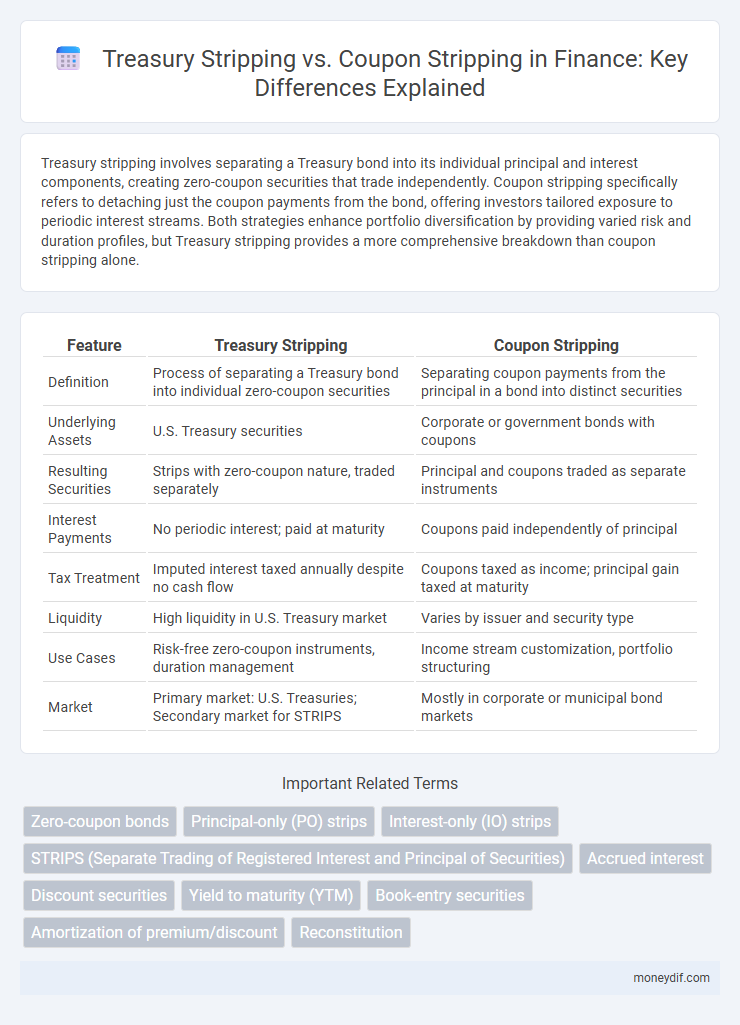

| Feature | Treasury Stripping | Coupon Stripping |

|---|---|---|

| Definition | Process of separating a Treasury bond into individual zero-coupon securities | Separating coupon payments from the principal in a bond into distinct securities |

| Underlying Assets | U.S. Treasury securities | Corporate or government bonds with coupons |

| Resulting Securities | Strips with zero-coupon nature, traded separately | Principal and coupons traded as separate instruments |

| Interest Payments | No periodic interest; paid at maturity | Coupons paid independently of principal |

| Tax Treatment | Imputed interest taxed annually despite no cash flow | Coupons taxed as income; principal gain taxed at maturity |

| Liquidity | High liquidity in U.S. Treasury market | Varies by issuer and security type |

| Use Cases | Risk-free zero-coupon instruments, duration management | Income stream customization, portfolio structuring |

| Market | Primary market: U.S. Treasuries; Secondary market for STRIPS | Mostly in corporate or municipal bond markets |

Introduction to Treasury Stripping and Coupon Stripping

Treasury stripping involves separating a Treasury bond into its individual interest and principal components, creating zero-coupon securities known as STRIPS, each with distinct maturities and cash flows. Coupon stripping refers specifically to detaching the periodic interest payments, or coupons, from the bond's principal, enabling investors to trade these components separately. Both methods enhance liquidity and investor flexibility by allowing tailored exposure to fixed income cash flows and interest rate risks.

Key Definitions: Treasury Strips vs Coupon Strips

Treasury Strips refer to securities created by separating the principal and interest payments of U.S. Treasury bonds, transforming each into individual zero-coupon securities. Coupon Strips specifically isolate the interest (coupon) payments from the principal, allowing investors to purchase interest-only components separately. Both Treasury Strips and Coupon Strips enable investors to target distinct cash flows, optimizing portfolio strategies for duration and income preferences.

The Mechanics of Treasury Stripping

Treasury stripping involves separating a U.S. Treasury bond or note into its principal and interest components, creating zero-coupon securities from each coupon payment and the final principal repayment. The mechanics include physically removing coupons from the bond certificate or using book-entry procedures where each coupon is assigned a separate CUSIP, allowing investors to trade individual interest payments independently. This process enables investors to tailor cash flows based on timing preferences and manage interest rate risk more precisely compared to holding the full bond.

How Coupon Stripping Works

Coupon stripping involves separating the periodic interest payments (coupons) from the principal amount of a bond, creating distinct securities that trade independently. Each coupon payment becomes a zero-coupon bond maturing on the coupon payment date, allowing investors to target specific cash flows. This process enhances liquidity and price discovery for both the principal and individual coupon components in the fixed income market.

Differences Between Treasury and Coupon Stripping

Treasury stripping involves separating a Treasury bond into its individual principal and interest components, creating zero-coupon securities without periodic interest payments. Coupon stripping, on the other hand, focuses solely on isolating the coupon payments from a bond, allowing investors to trade interest payments independently of the principal. Treasury stripping typically results in two types of strips--principal and coupon--while coupon stripping only produces the interest cash flows for separate trading.

Advantages of Treasury Stripping

Treasury stripping offers notable advantages such as enhanced liquidity due to the active market for stripped Treasury securities and precise valuation from distinct principal and interest components. This method allows investors to tailor portfolios by isolating zero-coupon bonds, reducing reinvestment risk compared to coupon stripping. Furthermore, Treasury stripping typically benefits from lower credit risk inherent in U.S. government securities, providing greater security and stability for long-term investment strategies.

Benefits of Coupon Stripping

Coupon stripping offers investors enhanced flexibility by allowing the separation of interest payments from the principal, enabling targeted investment strategies and tailored cash flow management. This method increases market liquidity by broadening access to fixed-income securities for investors seeking specific durations or income patterns. Furthermore, coupon stripping facilitates more precise tax planning opportunities, as investors can manage income recognition based on their individual tax situations.

Risks and Considerations for Investors

Treasury stripping involves separating a Treasury security into its principal and interest components, which exposes investors to reinvestment risk and liquidity risk due to potential market volatility and limited secondary market demand. Coupon stripping creates zero-coupon securities from coupon payments, presenting interest rate risk and valuation fluctuations, especially in rising rate environments. Investors must carefully assess credit risk, tax implications, and market liquidity to optimize portfolio outcomes and manage potential losses effectively.

Tax Implications of Stripped Securities

Treasury stripping creates separate principal and interest components from a Treasury bond, where the interest portion is taxed annually as income despite no coupon payments received. Coupon stripping involves separating coupon payments from the bond's principal, generating zero-coupon securities with accrued interest taxed as imputed income each year. Investors must carefully consider tax implications, as stripped securities often trigger phantom income taxes on accrued amounts without corresponding cash flow.

Treasury Stripping vs Coupon Stripping: Which Is Right for You?

Treasury stripping involves separating a U.S. Treasury bond into its principal and interest components, creating zero-coupon securities that enable investors to target specific cash flows and manage interest rate risk efficiently. Coupon stripping, on the other hand, focuses on splitting only the periodic interest payments from bonds, suitable for investors seeking steady income streams without exposure to principal repayment timing. Choosing between Treasury stripping and coupon stripping depends on your investment goals, risk tolerance, and cash flow preferences, with Treasury stripping favored for long-term, zero-coupon strategies and coupon stripping ideal for income-focused portfolios.

Important Terms

Zero-coupon bonds

Zero-coupon bonds created through Treasury stripping separate principal payments from interest coupons, enabling investors to trade and value each component independently based on discounted cash flows.

Principal-only (PO) strips

Principal-only (PO) strips represent securities derived from separating the principal component of Treasury bonds in the Treasury stripping process, while coupon stripping involves isolating the interest payments as separate securities. PO strips provide investors pure exposure to the bond's principal repayment, eliminating reinvestment risk present in coupon strips, which pay interest periodically.

Interest-only (IO) strips

Interest-only (IO) strips derived from Treasury stripping focus on receiving payments solely from the interest component of Treasury securities, whereas coupon stripping isolates periodic interest payments, allowing investors to hold and trade interest cash flows independently from principal repayments.

STRIPS (Separate Trading of Registered Interest and Principal of Securities)

STRIPS (Separate Trading of Registered Interest and Principal of Securities) enables Treasury securities to be separated into individual interest and principal components, allowing investors to trade these cash flows independently. Treasury stripping refers specifically to this process of breaking down Treasury bonds into principal and coupon units, whereas coupon stripping isolates only the periodic interest payments, enhancing flexibility for portfolio management and yield customization.

Accrued interest

Accrued interest represents the interest accumulated on Treasury securities between coupon payments, impacting Treasury stripping by separating principal and interest components for zero-coupon securities, while coupon stripping isolates only the periodic coupon payments as separate zero-coupon instruments.

Discount securities

Discount securities are zero-coupon instruments issued at a price below face value, reflecting the present value of future payments, while Treasury stripping involves separating Treasury coupon bonds into individual interest and principal components for separate trading. Coupon stripping specifically targets the removal of coupon payments from a bond, converting them into distinct zero-coupon securities, contrasting with Treasury stripping which may include principal and coupon separation.

Yield to maturity (YTM)

Yield to maturity (YTM) for Treasury stripping involves calculating the return on zero-coupon securities created by separating principal and interest payments, reflecting the present value of future cash flows without periodic coupon payments. Coupon stripping focuses on isolating individual interest payments, with YTM representing the discount rate that equates the sum of these coupon payments' present values to the bond's price.

Book-entry securities

Book-entry securities streamline Treasury stripping by electronically separating principal and interest components, while coupon stripping traditionally involves physical certificate processing to isolate coupon payments. This digital approach enhances accuracy, reduces settlement risks, and improves liquidity in Treasury markets compared to manual coupon stripping methods.

Amortization of premium/discount

Amortization of premium or discount adjusts the bond's book value over time, reflecting the gradual recognition of cost differences between purchase price and face value. Treasury stripping separates a bond into principal and coupon components for individual trading, while coupon stripping isolates periodic interest payments, both requiring precise amortization to accurately value each stripped security.

Reconstitution

Reconstitution involves recombining separate Treasury STRIPS, comprising principal-only and interest-only components, back into their original coupon-bearing Treasury securities. Treasury stripping separates bonds into zero-coupon instruments, while coupon stripping isolates periodic interest payments, enabling distinct trading and valuation of each cash flow.

Treasury stripping vs Coupon stripping Infographic

moneydif.com

moneydif.com