Cost of carry represents the total expenses incurred to hold a financial asset, including storage fees, interest, and insurance, while roll yield refers to the profit or loss realized when rolling over futures contracts as they near expiration. Understanding the interplay between cost of carry and roll yield is essential for investors seeking to manage futures positions effectively and optimize returns. Accurately assessing both factors helps in identifying arbitrage opportunities and in predicting the behavior of prices in contango and backwardation markets.

Table of Comparison

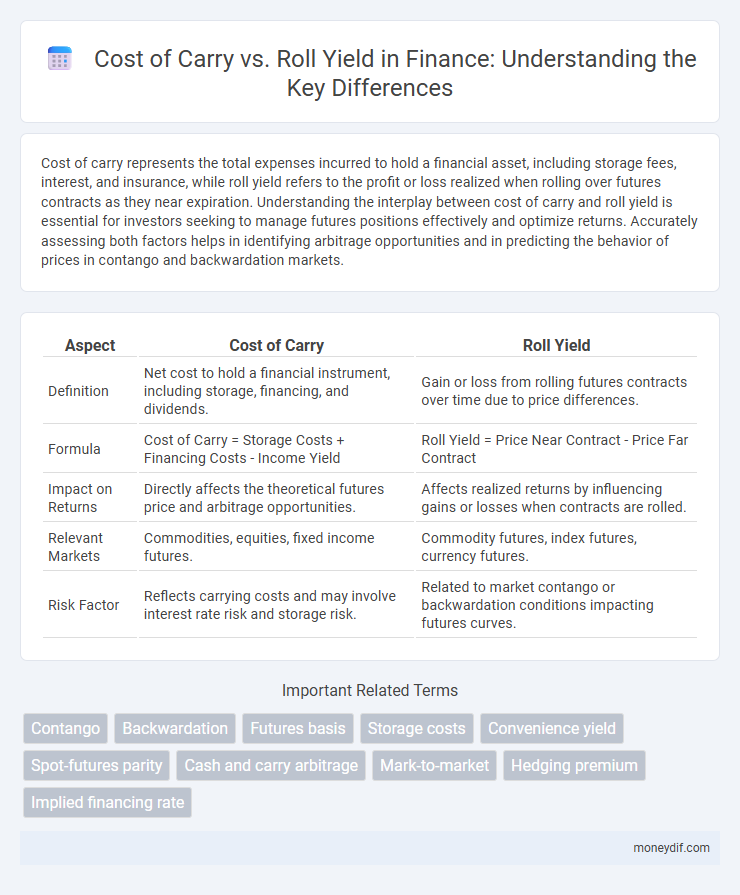

| Aspect | Cost of Carry | Roll Yield |

|---|---|---|

| Definition | Net cost to hold a financial instrument, including storage, financing, and dividends. | Gain or loss from rolling futures contracts over time due to price differences. |

| Formula | Cost of Carry = Storage Costs + Financing Costs - Income Yield | Roll Yield = Price Near Contract - Price Far Contract |

| Impact on Returns | Directly affects the theoretical futures price and arbitrage opportunities. | Affects realized returns by influencing gains or losses when contracts are rolled. |

| Relevant Markets | Commodities, equities, fixed income futures. | Commodity futures, index futures, currency futures. |

| Risk Factor | Reflects carrying costs and may involve interest rate risk and storage risk. | Related to market contango or backwardation conditions impacting futures curves. |

Introduction to Cost of Carry and Roll Yield

Cost of carry represents the total expenses incurred to hold a financial asset over a period, including interest, storage, and insurance costs, which directly affect futures pricing. Roll yield emerges from the strategy of rolling contracts forward in the futures market, reflecting gains or losses due to the difference between expiring and new contract prices. Understanding the interaction between cost of carry and roll yield is essential for accurately assessing futures returns and managing investment risks.

Defining Cost of Carry in Financial Markets

Cost of carry in financial markets represents the total expenses involved in holding a position in an asset, including interest, storage, insurance, and dividends. It directly impacts futures pricing by reflecting the net cost of maintaining the underlying asset until contract maturity. Understanding cost of carry is essential for traders to accurately assess the profitability of arbitrage opportunities and to distinguish it from roll yield, which arises from rolling over futures contracts.

Understanding Roll Yield in Derivative Trading

Roll yield in derivative trading represents the profit or loss derived from the difference between the futures price and the spot price as a contract approaches expiration. This yield is influenced by the cost of carry, which includes storage, interest rates, and convenience yield, affecting the futures price relative to the spot price. Understanding roll yield helps traders optimize strategies by recognizing when futures contracts are in contango (negative roll yield) or backwardation (positive roll yield), directly impacting returns in commodity or financial instrument futures markets.

Key Differences Between Cost of Carry and Roll Yield

Cost of carry refers to the total expenses incurred in holding a financial asset, including storage, financing, and insurance costs, while roll yield represents the gains or losses realized when rolling over futures contracts due to differences between spot and futures prices. Cost of carry primarily influences the futures price by accounting for all holding costs, whereas roll yield depends on the shape of the futures curve--contango or backwardation--and market expectations. Understanding these distinctions is crucial for investors managing futures portfolios, as cost of carry affects pricing fundamentals and roll yield impacts returns through contract expirations.

How Cost of Carry Affects Futures Pricing

Cost of carry directly impacts futures pricing by incorporating storage costs, interest rates, and dividends into the contract value, reflecting the net cost of holding the underlying asset until contract maturity. This adjustment ensures futures prices converge with the spot price as the delivery date approaches, influencing arbitrage opportunities and market efficiency. Understanding cost of carry helps traders evaluate roll yield, which represents gains or losses realized when rolling futures contracts forward.

The Role of Roll Yield in Commodity Investments

Roll yield plays a crucial role in commodity investments by influencing overall returns through the price differentials encountered when rolling futures contracts forward. Unlike the cost of carry, which accounts for storage, insurance, and financing expenses, roll yield arises from changes in the shape of the futures curve, either contango or backwardation. Investors can enhance performance when markets are in backwardation, capturing positive roll yield, whereas contango typically results in negative roll yield, eroding returns despite the underlying spot price movements.

Factors Influencing Cost of Carry and Roll Yield

Cost of carry is influenced by interest rates, storage costs, and convenience yield, which represent the expenses and benefits of holding an asset over time. Roll yield depends on the shape of the futures curve, particularly contango and backwardation, affecting the profit or loss when rolling contracts forward. Market liquidity and volatility also impact roll yield by altering the ease and cost of contract rollover.

Practical Examples: Calculating Cost of Carry vs Roll Yield

Calculating cost of carry involves assessing the total expenses of holding a position, including interest rates, storage fees, and dividends, which directly impact futures pricing. Roll yield arises when investors roll over futures contracts, capturing gains or losses from the difference between expiring and new contract prices, influenced by market contango or backwardation. For example, in oil futures, if storage costs and interest exceed the price decline from one contract to the next, cost of carry dominates, whereas positive roll yield occurs in backwardated markets when the new contract is cheaper than the expiring one.

Impact on Portfolio Returns: Strategy Insights

Cost of carry and roll yield are critical factors influencing portfolio returns, particularly in futures and commodity trading strategies. The cost of carry, encompassing storage, financing, and insurance expenses, directly affects the holding cost of an asset, while roll yield arises from the price difference between expiring and new contract maturities. Understanding their interplay helps investors optimize strategy selection, manage risks, and enhance long-term portfolio performance by capitalizing on favorable market conditions and minimizing negative carry effects.

Conclusion: Optimizing Strategies with Cost of Carry and Roll Yield

Optimizing investment strategies requires a deep understanding of both cost of carry and roll yield, as these factors significantly influence futures pricing and returns. Managing cost of carry involves assessing storage, interest, and financing expenses to minimize negative impacts on portfolio performance. Maximizing roll yield entails strategically timing contract rolls to capture favorable price convergence, ultimately enhancing overall investment efficiency in commodity and financial futures markets.

Important Terms

Contango

Contango occurs when the futures price exceeds the spot price due to a positive cost of carry that outweighs the negative roll yield during contract rollover.

Backwardation

Backwardation occurs when the futures price is below the spot price, often reflecting a negative cost of carry where storage, financing, and other holding expenses are outweighed by convenience yield or immediate availability benefits. This situation results in a positive roll yield for investors who roll over contracts, as they can purchase cheaper futures contracts to replace expiring ones.

Futures basis

Futures basis reflects the difference between the futures price and the spot price, influenced by the cost of carry, which includes storage, financing, and convenience yield. When cost of carry exceeds roll yield, the basis tends to be positive (contango), while a negative basis (backwardation) often indicates that roll yield outweighs cost of carry.

Storage costs

Storage costs increase the cost of carry by adding expenses to holding inventory, which can diminish roll yield by reducing the net return from rolling futures contracts.

Convenience yield

Convenience yield represents the non-monetary benefits of holding a physical commodity, impacting the cost of carry by reducing the effective cost of storing and financing the asset. This yield influences the roll yield, as a higher convenience yield often leads to backwardation in futures markets, resulting in positive roll returns for investors.

Spot-futures parity

Spot-futures parity explains the relationship between the spot price and futures price of an asset, where the cost of carry includes storage, financing, and convenience yield, influencing the futures price relative to the spot. Roll yield arises when futures contracts are rolled over as they approach expiration and can either add to or detract from returns depending on the shape of the futures curve, highlighting the practical deviations from theoretical cost of carry.

Cash and carry arbitrage

Cash and carry arbitrage exploits price discrepancies between spot and futures markets by purchasing the underlying asset and simultaneously selling a futures contract, profiting when the cost of carry--which includes storage, financing, and convenience yield--is lower than the futures premium, while roll yield impacts arbitrage returns when futures prices differ across contract expirations.

Mark-to-market

Mark-to-market accounting directly impacts the cost of carry by reflecting daily gains or losses based on current market prices, which influences the effective financing cost embedded in futures contracts. Roll yield arises when investors roll over expiring contracts to maintain positions, creating returns or losses depending on the futures curve's contango or backwardation relative to the spot price and cost of carry.

Hedging premium

The hedging premium quantifies the difference between the cost of carry and roll yield, reflecting the net cost or benefit of maintaining futures positions over time.

Implied financing rate

The implied financing rate reflects the cost of carry minus the roll yield in futures trading, representing the effective interest rate implied by the price difference between the futures and spot markets. This rate helps traders assess the true cost of holding an asset over time by separating financing costs from gains earned through rolling contracts.

Cost of carry vs Roll yield Infographic

moneydif.com

moneydif.com