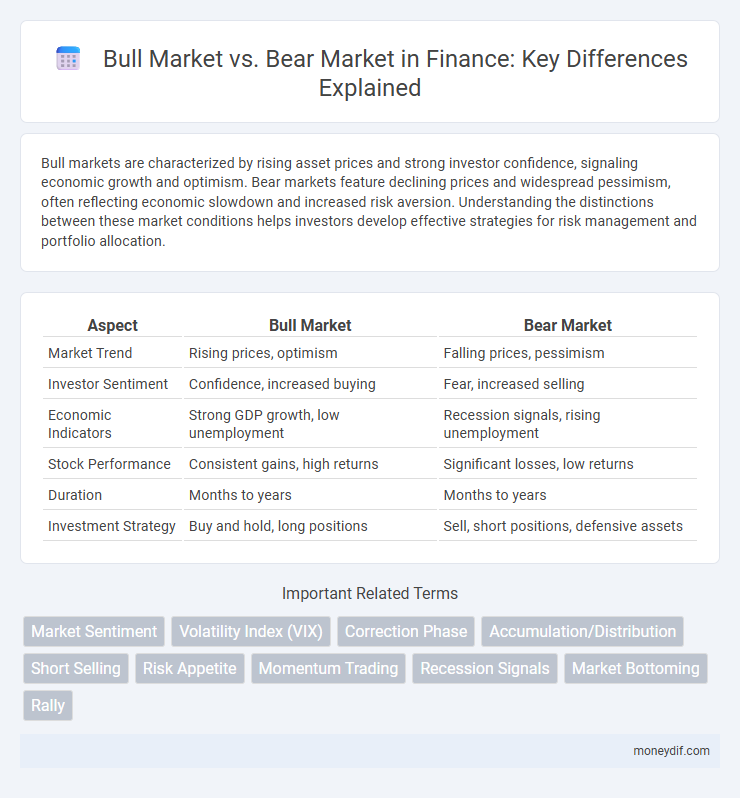

Bull markets are characterized by rising asset prices and strong investor confidence, signaling economic growth and optimism. Bear markets feature declining prices and widespread pessimism, often reflecting economic slowdown and increased risk aversion. Understanding the distinctions between these market conditions helps investors develop effective strategies for risk management and portfolio allocation.

Table of Comparison

| Aspect | Bull Market | Bear Market |

|---|---|---|

| Market Trend | Rising prices, optimism | Falling prices, pessimism |

| Investor Sentiment | Confidence, increased buying | Fear, increased selling |

| Economic Indicators | Strong GDP growth, low unemployment | Recession signals, rising unemployment |

| Stock Performance | Consistent gains, high returns | Significant losses, low returns |

| Duration | Months to years | Months to years |

| Investment Strategy | Buy and hold, long positions | Sell, short positions, defensive assets |

Understanding Bull and Bear Markets

Bull markets signify prolonged periods of rising stock prices, characterized by investor confidence and economic growth indicators such as increased GDP and low unemployment rates. Bear markets involve sustained declines in stock prices, often triggered by economic downturns, higher unemployment, and reduced corporate earnings. Understanding these market trends helps investors make informed decisions by analyzing market sentiment, economic data, and risk factors.

Key Characteristics of Bull Markets

Bull markets are characterized by sustained price increases across major stock indices, often exceeding 20% from previous lows, driven by strong investor confidence and robust economic indicators such as rising GDP and low unemployment rates. High trading volumes, increased corporate earnings, and a general optimism about future growth propel stock valuations higher during these periods. Investor sentiment typically shifts toward risk-taking, with sectors such as technology, consumer discretionary, and financials leading gains in bullish phases.

Defining Features of Bear Markets

Bear markets are characterized by a sustained decline of 20% or more in major stock indexes over a prolonged period, often accompanied by widespread investor pessimism and reduced trading volumes. These markets typically reflect deteriorating economic conditions, such as rising unemployment rates and declining corporate earnings, leading to lower consumer confidence. Unlike bull markets, bear markets signal a contraction phase where asset prices fall and risk aversion increases among investors seeking to preserve capital.

Economic Indicators Influencing Market Trends

Economic indicators such as GDP growth rate, unemployment figures, and consumer confidence indexes significantly influence bull and bear market trends. Rising GDP and low unemployment often stimulate bullish sentiment by signaling economic strength, while declines in these indicators typically trigger bearish markets due to anticipated economic slowdown. Inflation rates and interest rate policies by central banks also play crucial roles by affecting investor confidence and capital flow within financial markets.

Investor Behavior in Bull vs Bear Markets

Investors exhibit increased risk appetite during bull markets, often driven by optimism and rising asset prices, leading to higher trading volumes and greater market participation. In contrast, bear markets trigger risk aversion, fear-driven sell-offs, and a flight to safer assets such as bonds or cash equivalents. Behavioral biases like herd mentality and loss aversion significantly influence decision-making, intensifying market volatility in both phases.

Strategies for Navigating Bull Markets

During bull markets, investors should prioritize growth-focused strategies such as increasing equity exposure and targeting high-performing sectors like technology and consumer discretionary. Employing momentum investing techniques and reinvesting dividends can amplify returns amid rising asset prices. Risk management remains crucial by setting stop-loss orders and regularly reviewing portfolio allocations to protect gains.

Risk Management During Bear Markets

Risk management during bear markets requires proactive strategies to protect capital from significant losses caused by declining asset prices and increased market volatility. Investors should diversify portfolios across asset classes, employ stop-loss orders, and consider hedging techniques such as options or inverse ETFs to mitigate downside risk. Maintaining liquidity and reassessing risk tolerance are critical to preserve capital and capitalize on market recovery opportunities.

Historical Examples of Bull and Bear Markets

The 1920s bull market in the United States saw rapid economic expansion and soaring stock prices before the 1929 crash triggered the Great Depression bear market, which lasted over three years with significant losses. The dot-com bubble of the late 1990s exemplified a tech-driven bull market, ending in the early 2000s with a bear market characterized by substantial declines in technology stocks. More recently, the 2008 financial crisis caused a severe bear market, while the recovery post-2009 initiated one of the longest bull markets in history, driven by sustained corporate earnings growth and accommodative monetary policies.

Impact of Market Cycles on Portfolio Performance

Bull markets typically drive significant portfolio growth through rising asset values and increased investor confidence, often resulting in higher returns for diversified equities and growth-oriented investments. Bear markets can lead to portfolio contractions due to declining stock prices and heightened volatility, emphasizing the importance of risk management strategies such as diversification and asset allocation adjustments. Understanding market cycles enables investors to optimize portfolio performance by rebalancing assets and deploying defensive investments during downturns to mitigate losses.

Tips for Investing in Volatile Market Conditions

In volatile market conditions, investors should diversify portfolios across asset classes like stocks, bonds, and commodities to mitigate risk during both bull and bear markets. Employing dollar-cost averaging helps reduce the impact of price fluctuations by spreading out investment purchases over time. Staying informed on market trends and maintaining a long-term investment strategy enhances resilience against sudden market downturns or rallies.

Important Terms

Market Sentiment

Market sentiment significantly influences investor behavior, driving bullish sentiment during sustained price increases in a bull market and bearish sentiment amid prolonged declines in a bear market. These collective investor emotions, often measured by indicators like the Fear & Greed Index, directly impact trading volume, volatility, and asset price trends across financial markets.

Volatility Index (VIX)

The Volatility Index (VIX), often referred to as the "fear gauge," typically spikes during bear markets as investors anticipate higher market uncertainty and risk. Conversely, the VIX usually declines during bull markets, reflecting investor confidence and reduced expected volatility in stock prices.

Correction Phase

The Correction Phase in a bull market typically involves a temporary price decline of 10% to 20%, reflecting profit-taking and market revaluation without signaling a full bear market reversal. In contrast, during a bear market, corrections often lead to deeper and more prolonged declines, indicating sustained investor pessimism and economic uncertainty.

Accumulation/Distribution

The Accumulation/Distribution (A/D) indicator measures buying and selling pressure by analyzing volume flow in relation to price movements, often signaling potential trend reversals between bull and bear markets. High A/D values during rising prices confirm strong accumulation in bull markets, while declining A/D during falling prices indicates distribution in bear markets.

Short Selling

Short selling thrives in bear markets as investors profit from declining stock prices by borrowing and selling shares, anticipating a drop to repurchase them at lower prices. In contrast, bull markets often limit short selling's effectiveness due to rising stock prices and increased risk of losses for short sellers.

Risk Appetite

Risk appetite reflects an investor's willingness to accept potential losses in pursuit of gains, often increasing during bull markets characterized by rising asset prices and optimistic sentiment. In contrast, risk appetite typically decreases in bear markets due to heightened uncertainty and declining asset values, leading to more conservative investment strategies.

Momentum Trading

Momentum trading exploits price trends by buying assets showing strong upward momentum during bull markets and selling or shorting assets exhibiting downward momentum in bear markets. This strategy leverages relative strength indicators and volume analysis to capitalize on continued price movement in trending markets.

Recession Signals

Recession signals often include inverted yield curves, rising unemployment rates, and declining consumer confidence, which commonly precede a transition from a bull market characterized by rising stock prices to a bear market marked by widespread declines. Monitoring economic indicators such as GDP contraction, reduced corporate earnings, and falling industrial production provides critical insights into potential market downturns associated with recessions.

Market Bottoming

Market bottoming occurs when asset prices reach their lowest point after a prolonged bear market, signaling a potential shift toward a bull market characterized by rising prices and increased investor confidence. Identifying key indicators such as declining volatility, improved economic data, and stabilized trading volumes helps investors anticipate the transition from bearish to bullish trends.

Rally

Rally refers to a rapid increase in asset prices within a bull market, signaling strong investor confidence and upward momentum. In contrast, a bear market rally is a temporary price increase during a prolonged market decline, often followed by further losses.

bull market vs bear market Infographic

moneydif.com

moneydif.com